Emerging market (EM) economies are not what they used to be. They evolved away from cyclical, commodity-oriented, and state-owned companies towards developing intellectual property, pioneering technology-based companies, and building new business models driving greater earnings sustainability. We see three sub-themes of innovation powering EM: disruption, transformation, and digitalisation.

- Disruption: New technologies and business models are creating tectonic shifts.

- China leads solar glass production globally and generally utilises natural gas instead of carbon-heavy production methods.1 Solar electricity costs and production are now competitive with coal, yet with fewer carbon emissions.

- Transformation: Agile EM companies are adapting to a changing world, creating disruption, or responding to it. Investment opportunities may include banks and “old economy” stocks utilising innovative technology to pivot to new products.

- For example, the South Korean companies that spearheaded the development of electric vehicle (EV) batteries are now the top-producing EV battery manufacturers and lead EV battery penetration worldwide.

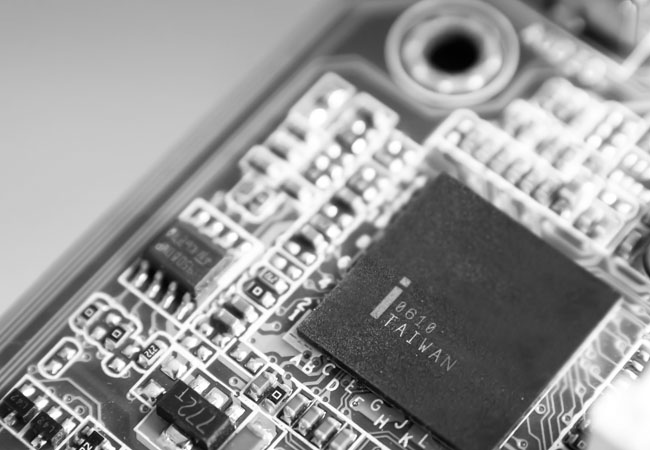

- Digitalisation: The companies that enable our data-driven world provide essential online and offline infrastructure, including semiconductors, cloud computing, data centres, internet-of-things, artificial intelligence (AI), and 5th generation (5G) technology.

- Semiconductor manufacturing companies in Taiwan and South Korea, for example, dominate globally due to their strong manufacturing capabilities, clout, and cash generation that widen their competitive advantages amid booming chip demand for computing, cryptocurrency mining, autos, appliances, and other businesses.

- The Consumer Discretionary, Consumer Staples, IT & Communication Services, and Health Care sectors now constitute the majority of the MSCI EM Index, displacing the “old economy” sectors of Materials, Energy, and Industrials that peaked in 2008.2

- Digital transformation and its multitrillion-dollar opportunities are still in their early days. Digitising consumer experiences accelerated further due to the pandemic.

As investors look for innovation, they should consider EM. We foresee a multitude of potential investment opportunities in the years ahead. For more, please read “Emerging Markets: The Post-Pandemic Promise” by Chief Investment Officer Manraj Sekhon, Franklin Templeton Emerging Markets Equity. And Jonathan Curtis, Portfolio Manager, Franklin Equity Group, focuses on the information technology (IT) sector in “Tech Opportunities Abound Amid Economic Reopening.”

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stocks historically have outperformed other asset classes over the long term but tend to fluctuate more dramatically over the short term. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. Investments in fast-growing industries like the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. Small- and mid-capitalisation companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies.

Past performance does not guarantee future results.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date (or specific date in some cases) and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton Institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_____________________________

1. Source: NikkeiAsia, “China’s solar panel makers top global field but challenges loom”, by Yukinori Hanada, 31 July 2019.

2. Source: MSCI Emerging Market Index Sector Exposure, from FactSet and MSCI. Starting January 2010 to December 2020, “Old Economy”: Materials, Energy, and Industrials; “New Economy”: Consumer Discretionary, Consumer Staples, IT & Communication Services, and Health Care. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses, or sales charges.