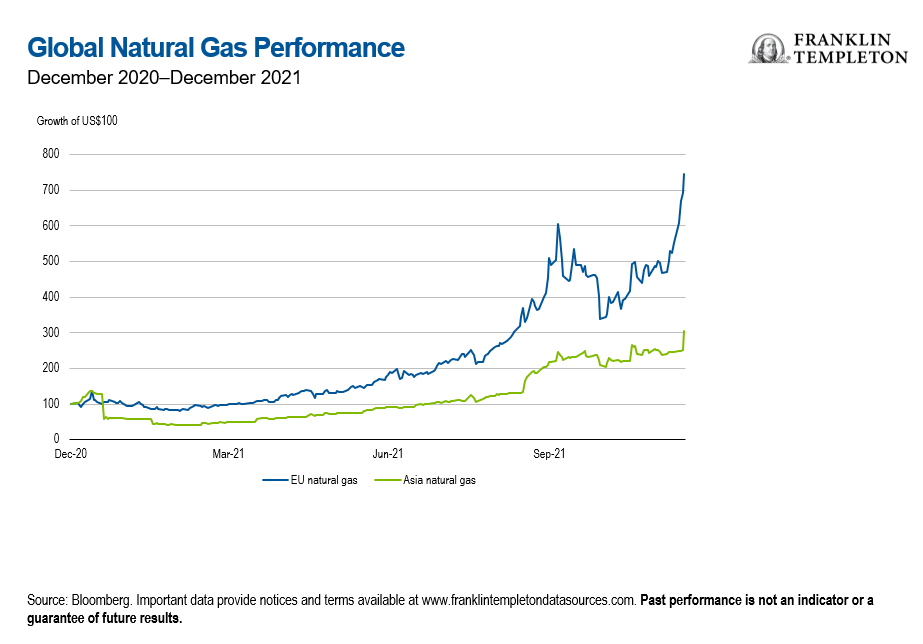

First Quarter (Q1) 2022 Outlook: Summary

As we commence 2022, the prospect of a reduction of global liquidity provided by major central banks has increased volatility in the traditional equity and fixed income markets. To complicate matters, inflationary pressures have been building and may not prove to be as “transitory” as once thought. Investors are looking to hedge funds to reduce volatility and increase flexibility in their overall portfolio, giving them optionality as markets transition to a new regime.

Strategy Highlights

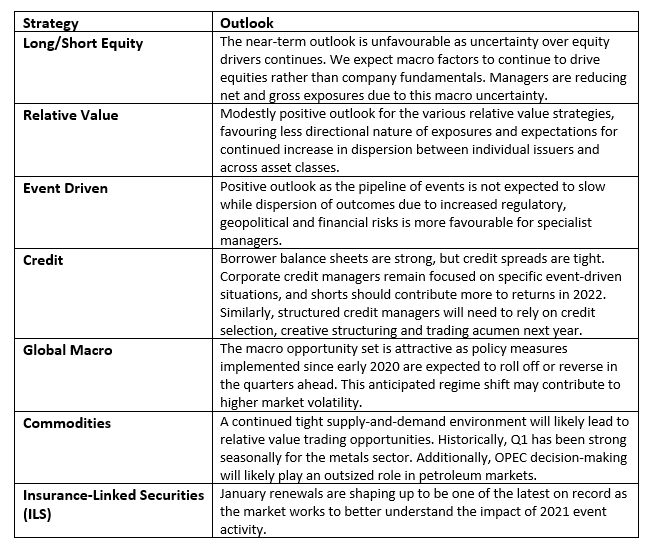

- Relative Value: Observed continuing increase in dispersion within and across asset classes indicative of a potential increase in fundamental and macro risks and is favourable for less directional relative value strategies.

- Global Macro: A shift in policy regime may create market opportunities for managers focused on macro factors. Managers with a tactical trading approach may benefit from higher realised volatility across asset classes.

- Commodities: The major unknown is the Omicron variant and the subsequent impact on demand going forward, particularly in the energy sector. This should provide a rich opportunity set on both the long and short sides for active commodity traders.

Macro Themes We Are Discussing

As market volatility has increased, we have correspondingly seen a rise in dispersion among hedge fund managers. Event-driven strategies have been outperforming due to the number of deals, easy lending conditions, strong earnings, and companies’ strategic focus on future growth. Commodities mangers have also been consistently strong year to date (YTD), as not only have there been many large directional moves, but also rich relative value opportunities in the energy and grains markets. Global macro hedge funds have been challenged, as some common themes at the start of the year have not played out as planned, such as the steepening yield curve theme and weakness in the US dollar. Managers with more of a focus on developed markets have fared better than managers focused on non-developed markets. As expected, managers with an exposure to the energy, decarbonisation and commodity markets have fared better. Credit managers have faced a challenge of extremely tight spreads but have been more focused on fundamentals and corporate specific events to generate solid returns so far. Long/short equity managers found the ability to generate alpha very challenging, particularly early in the year, but have shown recent signs of alpha generation as fundamentals are becoming more important than the global liquidity flows.

Going forward, our hedge fund managers and the K2 Investment Committee are discussing some key themes that we believe will drive market sentiment and performance in 2022.

Is inflation transitory?

As the world normalises, global supply-chain disruption and demand surges have increased inflationary pressures in many parts of the global economy. The thinking had been that this would be “transitory”, but even the Federal Reserve (Fed) has dropped the adjective “transitory”, signalling that it may think this could be a sustainable inflationary shock. Global bond markets have in general flattened, indicating that the market believes inflation is under control, but what if it is not? There is risk of the risk-free rate moving considerably higher, having a consequential repricing effect on all securities.

How will central banks shift to a less accommodative interest rate and liquidity policy?

The Fed and other central banks have indicated a taper of bond purchases, but this is not rate hiking. Clearly, central banks are stepping on the liquidity brake; the key going forward is how fast and effective is that tapping on the brakes? On one hand, if they are too slow and the economies strong, they will be behind the curve and risk that the bond markets move dramatically lower in price to reflect a central bank acting too slow. Conversely, if the economies are not able to sustain growth and/or a COVID-19 variant slows the economy, then central banks will have to change tack and turn on the liquidity valves. We expect the markets to be hyper focused on this, creating a higher volatility regime.

How strong can corporate earnings be, and how long can that strength persist?

The corporate earnings cycle is peaking just as central banks are reducing liquidity in the system. In general, third-quarter 2021 reported earnings were very strong, fourth-quarter 2021 is expected to follow on, also being very strong, and forward revisions continue to be notched up even higher. But is this sustainable? For how long? How much stronger? Is the market getting set up for a disappointment? Corporate fundamentals will be the center of attention for hedge fund managers, making the environment very rich for active long-short investing.

How will global decarbonisation effect sectors and companies?

Global decarbonisation will continue to be on the forefront for investors, governments, consumers and corporations. How will this play out? Clearly the energy markets are in transition, but so is the industrial sector and every aspect of one’s life is being evaluated from a green perspective. The opportunity to invest in market leaders and new technologies is very compelling in our view, and should likely drive outsized returns. Governments are working on policies, consumers are voting with their wallets and investors are demanding better standards. We expect this theme to garner even more attention and investment.

Q1 2022 Outlook: Strategy Highlights

Relative Value

After declining for almost a year, we have recently seen a gradual pickup in dispersion in equities (and other asset classes). Increasing dispersion is driven by greater uncertainty across both fundamental and macro factors, and we expect this trend to continue. Dispersion within and across asset classes is favourable for relative value strategies that are better positioned to capitalise in dislocations across instruments in a less-directional fashion.

Global Macro

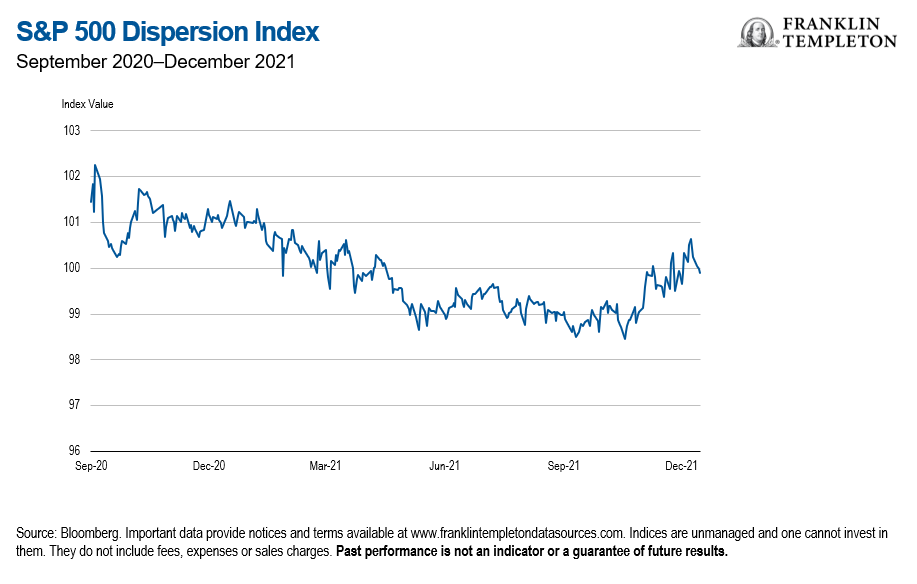

Expectations for tighter monetary policy and the removal of fiscal support may create headwinds for financial conditions in the year ahead. As emergency policy measures roll off or are removed, uncertainty and volatility are likely to return in a more meaningful way to markets. We think forward-looking managers focused on these macro factors may be well suited to find trading opportunities as this regime shift, which is already under way in many parts of the world, accelerates during 2022.

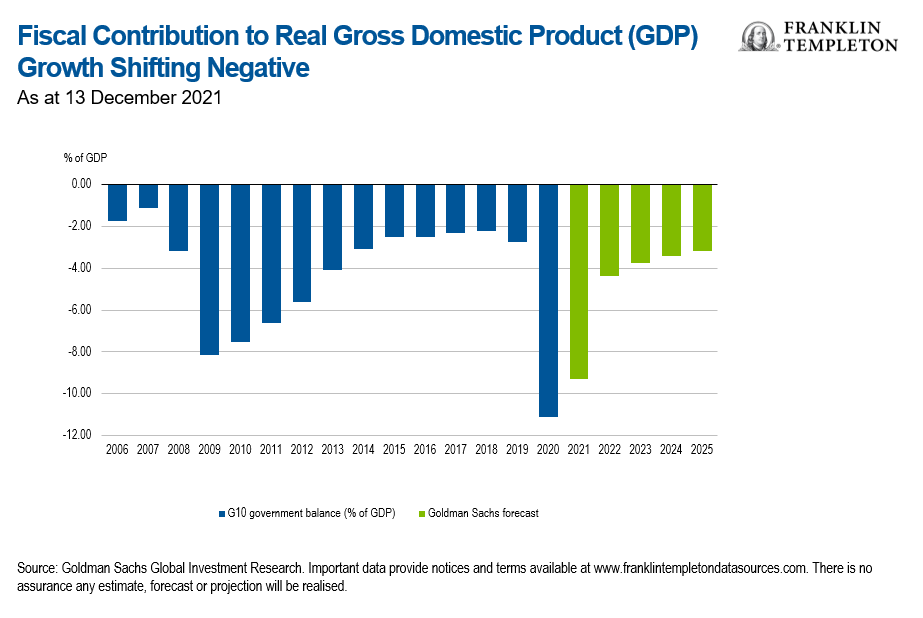

Commodities

Global natural gas markets have had a volatile fourth-quarter 2021, which shows no signs of reversing as we move into the first quarter of 2022. A myriad of factors has been impacting European natural gas markets including weather and geopolitical headlines from Russia and Ukraine. Russia’s Nordstream 2 pipeline is a large source of supply across Europe, and ongoing inventory tightness in Northwestern European gas balances disincentivises Europe from restricting Russian gas exports to the region. One factor that may lead to a price correction during the winter months is the prevalence of the Omicron variant. As the variant spreads globally, demand could be negatively impacted, which would likely help balance supply and demand globally.

What Are the Risks?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at 5 January 2022, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Investments are not FDIC insured; may lose value; and are not bank guaranteed.