Note: the video below was recorded in December 2021. References to “next year” thus refer to 2022.

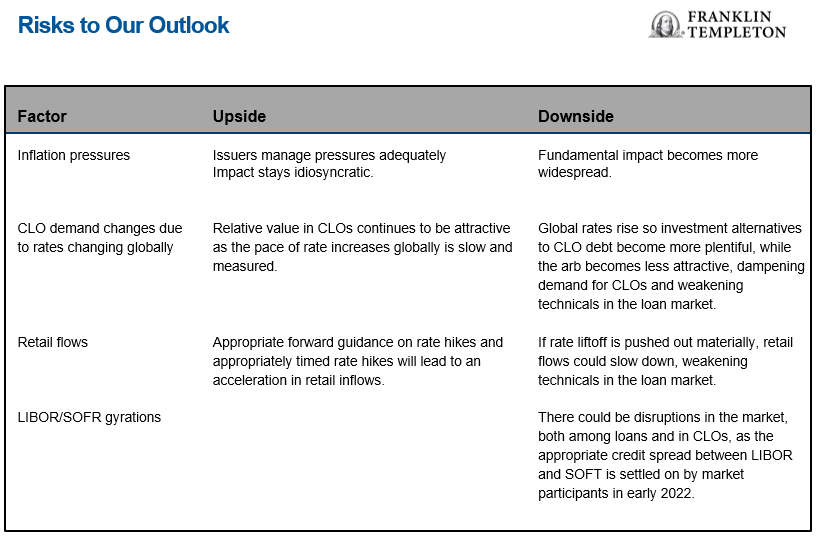

Except for a brief pause around the COVID-19 Omicron variant discovery, loan spreads have continued their steady march tighter, more so since mid-September, when expectations around US Federal Reserve tapering and rate hikes started to increase, which has provided tailwinds to the floating-rate bank loan sector.

Technical conditions remain healthy—record collateralised loan obligation (CLO) issuance and retail demand have supported loan prices. While there may be a lull in loan market activity in the early part of 2022 as market participants absorb the implications of the transition from London Interbank Offered Rate (LIBOR) to Secured Overnight Financing Rate (SOFR), we believe CLOs will continue to be an attractive option for investors, which supports loan valuations and provides a floor on loan prices.

In general, retail flows have been consistently positive in 2021, driven by an expectation that interest rates will rise.1 We believe current loan spreads are attractive, and technical conditions remain in favour of a tightening trajectory. We also believe expectations around the timing of an interest rate liftoff will be a key determinant of credit market sentiment.

As expected, the path to full recovery has been uneven across industries and issuers as economies fully reopen, depending on trends in office vs. remote work, safety restrictions on indoor and outdoor capacity in various sectors and ultimate demand for activities and services that have been reopening. Office supply businesses have been slow to recover as have certain aerospace issuers and leisure issuers such as gyms and movie theaters. Supply-chain disruptions and labour and input cost inflation have been headwinds in certain cases as well. Demand for chemicals, packaging, and building materials has been strong, but margins have been negatively impacted by higher resin and other input costs and/or higher container rates. Many issuers have been able to push through price increases to offset a portion or all of the higher costs, albeit with a lag. Consumer, retail and food issuers have also faced higher input costs and labour inflation, with varying abilities to pass on price increases.

On the other hand, some issuers are benefitting. Commodity issuers are clearly benefitting from inflation, and loan prices have been lifted most in these sectors in 2021, although we would note that these industries represent just 5% of the loan market. We are mindful of cyclical upswings that might be winding down for certain sectors that had thrived during the pandemic. At the same time, we are on the lookout for loan issuers with business models that will likely benefit the most from permanent changes in consumption patterns/behaviours and work habits in a post-COVID-19 world.

If we observe volatility on account of supply-chain issues and cost inflation, changing expectations on the timing of rate hikes or potential macroeconomic challenges posed by the Omicron variant, on a selective basis we would consider such periods as buying opportunities, as we believe corporate fundamentals are still healthy.

In general, we favour B-rated loans, especially those with LIBOR floors. As the likelihood of rising prices and interest rates is higher than it has been in the last several years, we maintain our view that industries with challenged fundamentals could be more adversely affected than others, especially those with ongoing supply-chain woes. Amid idiosyncratic issuer risk, prudent security selection remains paramount, in our view.

Despite the potential headwinds that persistent inflationary pressures could bring, we continue to believe that supply-chain disruptions and inflation have the potential to delay, but not derail, full recovery. We also do not expect a high probability of large-scale fundamental weakness in the loan market over the next year, especially to such a degree that it eclipses the significant technical tailwinds for floating rate assets. We maintain our constructive outlook for the bank loan sector—over the next 12 months, technical conditions should remain strong and fundamentals broadly constructive with subdued default rates, against the backdrop of a rising interest-rate environment.

What Are the Risks?

All investments involve risks, including possible loss of principal. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. Floating-rate loans and debt securities tend to be rated below investment grade. Investing in higher-yielding, lower-rated, floating-rate loans and debt securities involves greater risk of default, which could result in loss of principal—a risk that may be heightened in a slowing economy. Interest earned on floating-rate loans varies with changes in prevailing interest rates. Therefore, while floating-rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_____________________

1. Sources: Franklin Templeton Fixed Income Research, JP Morgan. As of October 2021. There is no assurance that any estimate, forecast or projection will be realised.

English

English