In this first of a series of country-specific perspectives, we offer our views on inflationary drivers and factors such as policy responses, wage growth, pricing power and sector exposure for context on how global investor returns may fare. What follows is an excerpt from a longer topic paper, which is available for download here.

The late Nobel Prize-winning economist Simon Kuznets once purportedly said there are “four types of countries in the world: developed, undeveloped, Argentina and Japan.”

Think what you will of that quip. But those two economies continue to mystify. Despite efforts by policymakers, Argentina remains mired in chronic hyperinflation and Japan is still contending with the stubbornly low inflation that leaves it an outlier amid trending record high rates.

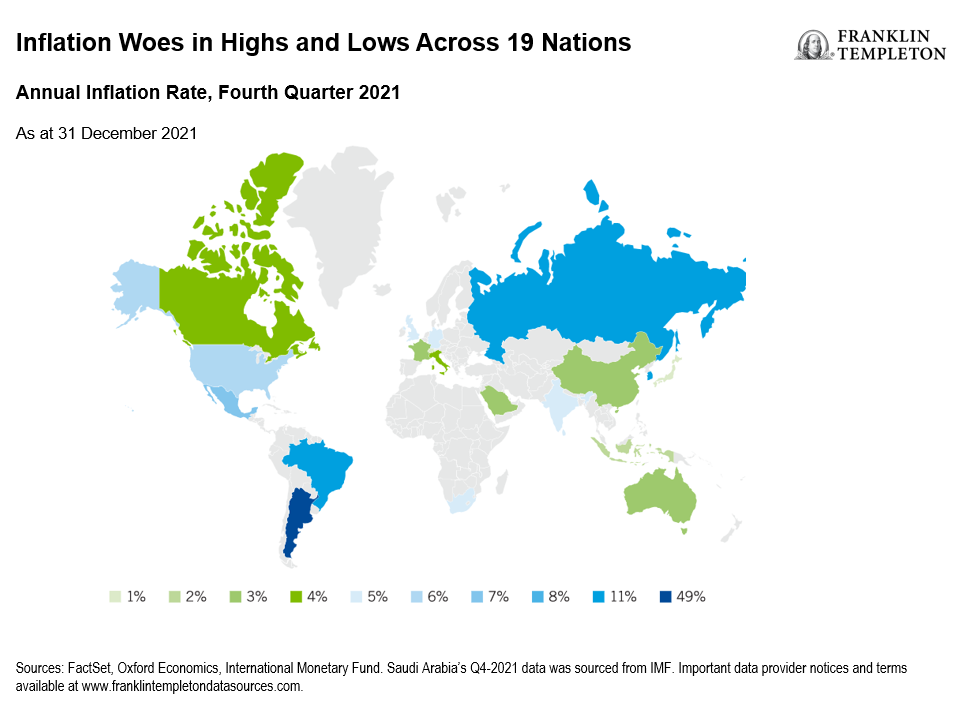

These may be extreme examples, but they’re a good reminder that inflation levels across different nations span broadly even now. So, for investors weighing tactical tilts to global asset allocation targeted by country, it’s worth looking into such macroeconomic forces.

Resurgent inflation has become nearly as prevalent across the globe as the coronavirus itself, but not all nations are rushing into a tightening cycle. In addition to differing policy responses, we also saw a wide dispersion in 2021 returns among regional equity markets.

While China, Japan, South Korea and Taiwan are all key Asian manufacturing centres that have faced recent supply chain problems, they produced very different returns last year. Chinese equities, impacted by significant government policy changes, fell by more than 21% for the year while Taiwanese stocks rose more than 27%.1 Japan was mostly flat. And South Korean markets, which had a banner year in 2020, ended 2021 down slightly. For the year prior, the FTSE South Korea RIC Capped Net Tax Index had outperformed not just the Asia region but most developed and emerging world markets when it returned more than 40% at the end of 2020.2

The difference between the returns of benchmark indices tracked by our best-performing and worst-performing passive single-country ETFs for 2021 eclipsed 50% (in USD). Boosted by financial sector gains, Saudi Arabia’s market was the top performer, returning more than 36% for the year.3

Given the wide range of macroeconomic environments, investors seeking to boost their international exposure may do well to consider targeted single-country allocation to potentially capture higher gains.

Few places have found inflation to be quite as vexing as it is in Brazil, where the woes are compounded by the worst drought in decades. Its central bank has signalled an understandably aggressive tightening cycle to try to tame its double-digit inflation of more than 10%.4

The Bank of England is also a standout. It led the charge in mid-December, becoming the world’s first major central bank to raise interest rates since the onset of the pandemic.

And the US Federal Reserve Bank (Fed) is attempting to keep inflation in check by considering dialing back bond purchases before raising interest rates for the first time since 2018. Meanwhile, on the other end of the spectrum, policymakers in China are attempting to deflate its property bubble as Japan’s especially accommodative central bank shuns monetary tightening.

Markets are expected to continue clawing their way back to a broad recovery this year, albeit unevenly across regions and in fits and starts. This makes the ability to have targeted investment exposure with single-country strategies even more compelling, in our view.

Japan—Will Inflation Rise with the Sun?

Inflation in Japan has remained persistently tame, and the Bank of Japan (BoJ) is expected to continue its 10th consecutive year of an ultra-easy policy stance. For the current fiscal year ending in March 2022, the bank estimates that prices should remain flat, and Japan is expected to fall short of its 2% inflation target over the near term.5

While government stimulus checks sent to every resident in the spring couldn’t get inflation to budge, Prime Minister Fumio Kishida enjoys a high approval rating and has pledged bold measures to move towards carbon neutrality, narrow income gaps and digitalise the economy. Such moves, especially those efforts towards greater digitalisation, may benefit Japan’s information technology sector, which comprises one of the largest weightings in the FTSE Japan Capped Index. Overall, 2022 seems promising for Japanese stocks considering the renewed calm of political stability that has emerged since Kishida was elected. He has promised to up corporate tax incentives for firms that raise long-stagnant wages (average wages have risen just 4% in more than three decades).6 And in his first major policy announcement, the prime minister unveiled a record US$490 billion stimulus package.

In a Fed rate-hike environment, the yen’s depreciation against the US dollar should also drive the appeal of undervalued Japanese equities and ETFs as the export heavyweight’s goods become more competitive and boost profits overseas.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Generally, those offering potential for higher returns are accompanied by a higher degree of risk. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For actively managed ETFs, there is no guarantee that the manager’s investment decisions will produce the desired results. ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with developing markets are magnified in frontier markets. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager(s) and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________________________________

1. Source: Bloomberg as at 31 December 2021. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

2. Ibid.

3. Ibid.

4. Source: Central Bank of Brazil, January 2022.

5. There is no assurance that any estimate, forecast or projection will be realised.

6. Source: Nikkei Asia, “Japan’s 30-year wage slump hangs over distribution debate,” October 16, 2021.