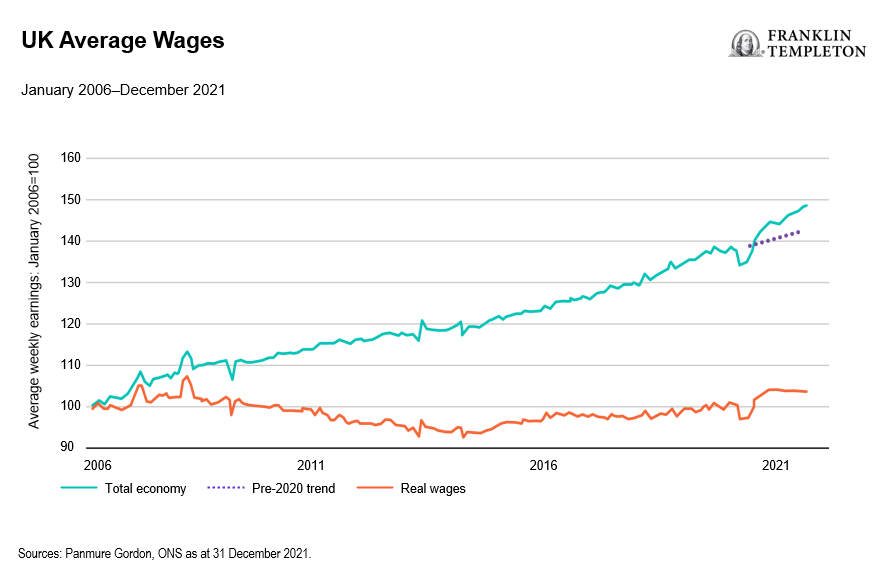

Any discussion on the macro outlook for the UK economy and the equity market needs to start with the topic of inflation. Early last year, the market was panicking about the prospect of inflation—but largely thinking it would likely be “transitory”. Those fears materialised with some stronger-than-expected inflation figures throughout 2021. The Consumer Price Index rose to a 30-year high in December of 2021 of 5.4%, year-on-year, so we are really stretching the definition of transitory to its limit now. Rising inflation continues to affect us all, and how policymakers will respond is top of mind today. But it is important to remember that in order to generate a sustained inflationary spiral akin to the 1970s, we would need to see further, ever-higher price increases as compared against the prior year’s numbers. As the mathematics gets a little bit tougher, we think the inflation numbers should moderate over the course of the year and beyond.

…and Interest Rates

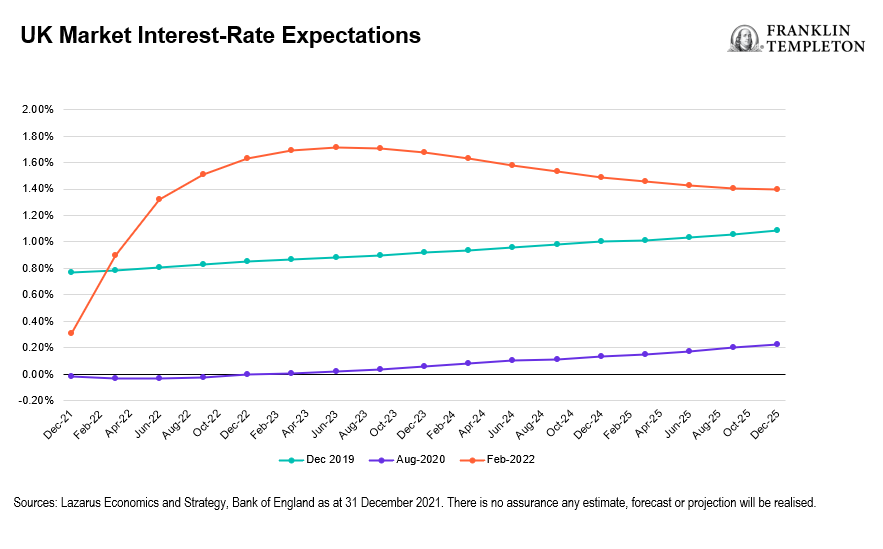

Tackling Inflation is certainly on the minds of central bankers across the globe. Before COVID-19, market expectations were for UK interest rates to take several years to reach 1%. In the depths of the pandemic, this expectation collapsed to price in rates barely budging above the zero bound. But those expectations have markedly changed. On 3 February 2022, the Bank of England increased its base rate from 0.25% to 0.50%, and the market expects three further rate hikes this year, moving the rate up to the 1% level and beyond. Whilst these forecasts seem aggressive relative to the recent rate environment, we mustn’t forget that base rates of 5% and above were commonplace before the 2008 global financial crisis.

But What Impact Does This Have on the UK Market?

It is important to understand the composition of equity indices before assessing the relative impact of inflation and rising interest rates. Drilling down into the UK equity market, we encounter dominant sectors such as banks, life assurance, specialist financials and resources, all of which are beneficiaries of inflation and rising interest rates. Regulatory price rises and the ability to pass through increasing input costs to the end consumer are key to inflation protection, and considering the UK economy also has significant exposure to utilities, tobacco, pharmaceuticals and food retail, we believe the UK market has a strong foundation from which to “weather the storm”.

The UK equity market has lagged the United States for some time, most recently due to the paucity of high-growth (often zero-profit) stocks where the terminal value is discounted from earnings projected many years into the future. With rising interest rates also increasing the discount rate for equity valuations, these high-growth stocks are disproportionately sensitive to inflation and the consequent central bank response. It is such considerations that suggest to us that market conditions are becoming more favourable for the UK market on both an absolute and relative basis, as intimated by the strong relative performance of the United Kingdom market thus far in 2022.

…And the UK Consumer?

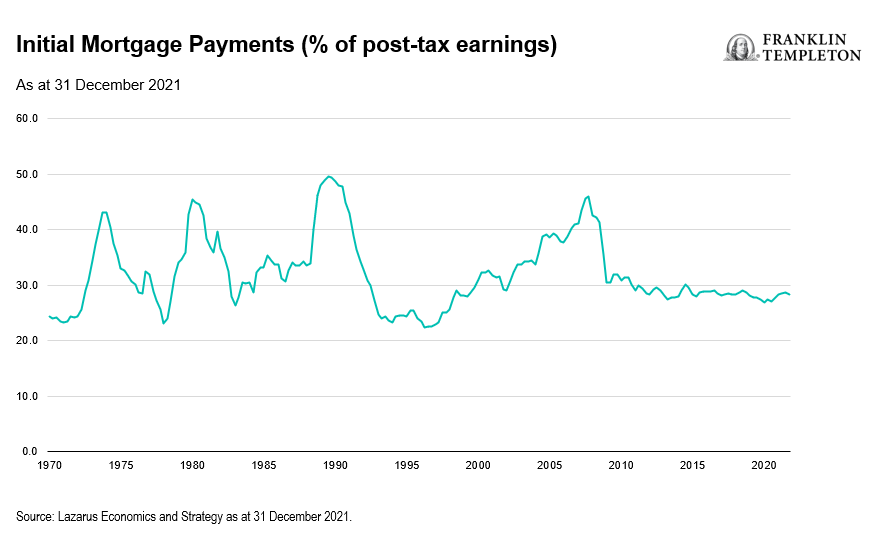

There are undoubted pressures on the UK consumer in 2022 as rising National Insurance, energy bills and general inflation eat into discretionary spending. Despite the shift in interest rate expectations, it is important to consider the mechanisms through which that feeds onto the economy. We are starting from a position where mortgage payments are at historically low proportion percentage of post-tax earnings, providing a cushion against rising rates. What is more, with 80% of mortgages currently on fixed-rate deals (indeed the majority on five-year deals),1 any direct impact through this mechanism to consumer spending is likely to be lagged. The great imponderable through all this is the likely usage or otherwise of the excess saving that has compounded throughout the pandemic, some £200bn of additional firepower being reported.2 Moreover, when you consider strong employment data in the form of record job vacancies and business confidence to grow human capital, there are still plenty of signs of life in the UK economy.

Where Are UK Valuations?

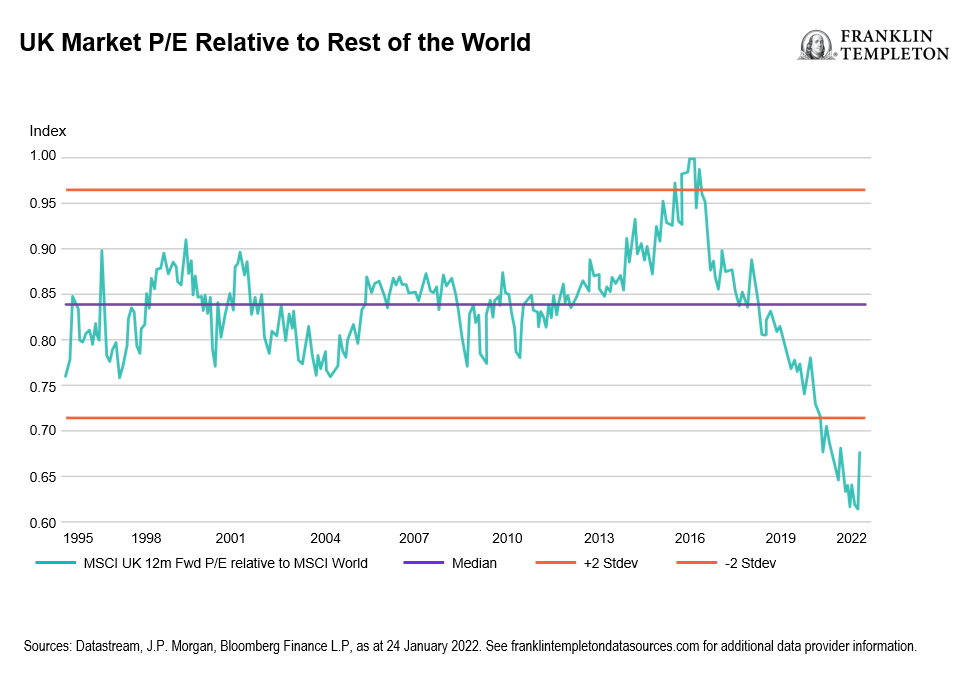

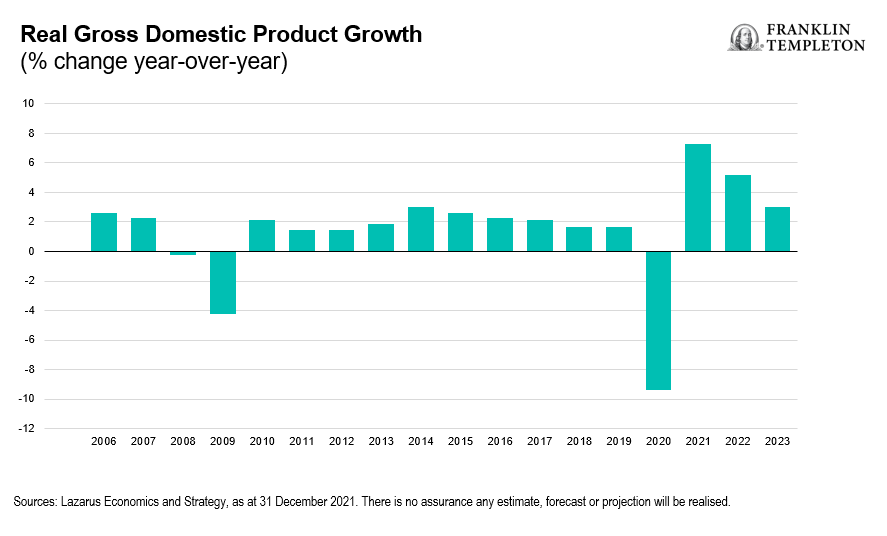

Comparing the UK market to those overseas, relative valuations peaked in 2016 ahead of the Brexit referendum, and have been falling ever since. Looking at forward price/earnings (P/E) ratios, UK stocks look very inexpensive on a global basis, with a P/E of 12.5x versus around 20x for the MSCI World Index.3 Much of this is due to the under-exposure to expensive growth stocks that have performed so well in recent years. However, we remain confident that the United Kingdom offers reasonable growth at very reasonable prices—forecast gross domestic product remains at around 5% and on an upward trajectory to pre-pandemic levels.

Enhanced merger & acquisition activity remains supportive to UK valuations, and we are also noticing a reversal in a long-term decreasing trend of new initial public offering (IPO) listings, all indicative of attractively valued equity capital. We believe the UK market is adequately protected against further de-ratings and becomes increasingly attractive when considered alongside the prospect of a healthy 4% dividend yield.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

_____________________________________________

1. Sources: Datastream, J.P. Morgan, Bloomberg Finance L.P, as at 24 January 2022. See franklintempletondatasources.com for additional data provider information.

2. Source: Lazarus Economics and Strategy as at 31 December 2021.

3. Sources: Lazarus Economics and Strategy, ONS as at 31 December 2021.