Key Points

- What happened? Russia invaded Ukraine, Western sanctions are escalated and geopolitical uncertainty increases.

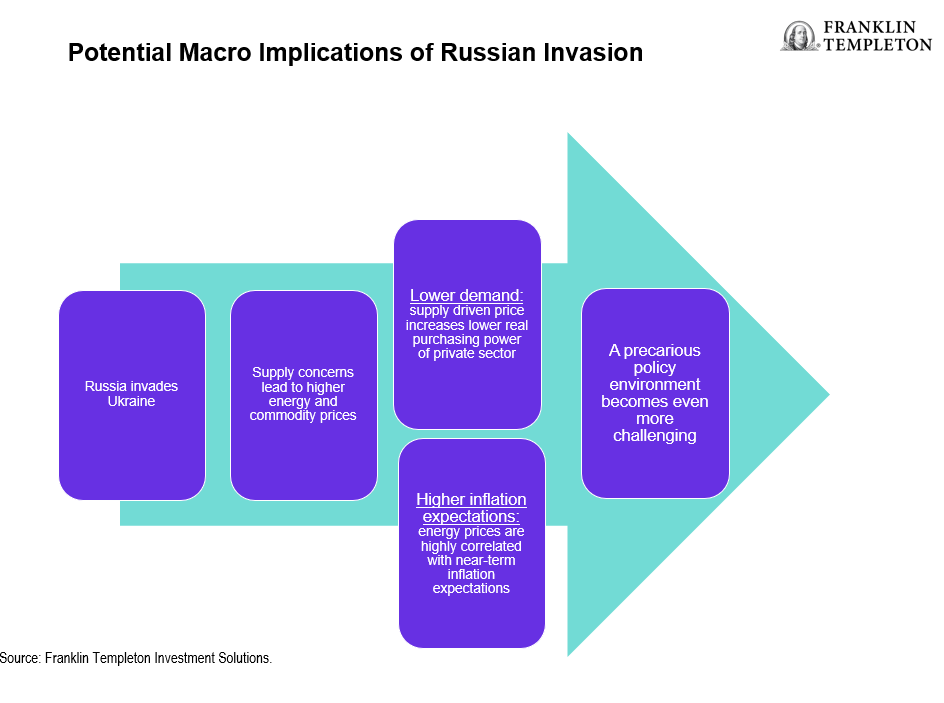

- Macro Implications: Lower demand as energy prices increase, and higher inflation expectations. Both pose challenges for policymakers as interest rate tightening cycles appear imminent.

- Multi-Asset Implications: Geopolitical outcomes have varied over history. The risk is that we move into a higher inflation/lower growth environment, which can be challenging for risk assets.

What Happened?

On 24 February Russia invaded Ukraine and shelled military installations across the country after weeks of diplomatic and military escalation. Our initial thoughts are to reflect on the human tragedy and suffering that is unfolding. The human toll is not lost on us as we analyse the economic and market ramifications of this conflict.

The invasion follows a precedent—Russia invaded the Georgian province of Ossetia in 2008 and, in 2014, annexed the (formerly Ukrainian) Crimean Peninsula. This is consistent with Russian President Vladimir Putin’s intentions to reverse Russia’s waning power.

In response, Western countries imposed sanctions on affiliates of the Russia government. Also, troops were moved to forward positions as military tension escalated. Importantly, policymakers have been reluctant to directly target any additional Russian energy companies or bar Russia from the SWIFT payment system.

At this point, there are a lot of unknowns, including the scope and duration of the military campaign; Putin’s ultimate ambitions in Ukraine and Eastern Europe; the range and severity of Western sanctions; and the implications for geopolitical alliances. All these issues will have economic and financial implications.

Macroeconomic Implications

Russia represents a small portion of global gross domestic product (2%) and capital markets (0.2%) but is a large commodity producer. Russia is responsible for 17% of global natural gas production, 12% of oil production, and is a major exporter of agricultural commodities (48% of global fertiliser exports), industrial, and precious metals.1 Notably, it’s responsible for 41% of Europe’s natural gas imports.2 Sanctions and supply related disruptions, including suspended certification of the Nordstream 2 pipeline connecting Russia and Germany, has driven commodity prices higher.

A supply driven rise in commodity prices has two key macro implications. First, demand is weakened as real spending power diminishes for households and businesses. Second, short-term inflation expectations are correlated with energy prices and may be pressured higher. The combination of weaker demand and elevated inflation expectations pose a problem for policymakers, as the policy environment was already tenuous before the increased geopolitical tension.

It remains unclear how policymakers will respond to this shock. The Federal Reserve’s initial comments suggest it’s staying the course of quantitative tightening and rate hikes this year. But the immediate and second/third-order impacts of the conflict remain undetermined. This suggests greater risk of a policy error and sustained volatility across major markets, given the uncertainty overhang.

Multi-Asset Implications

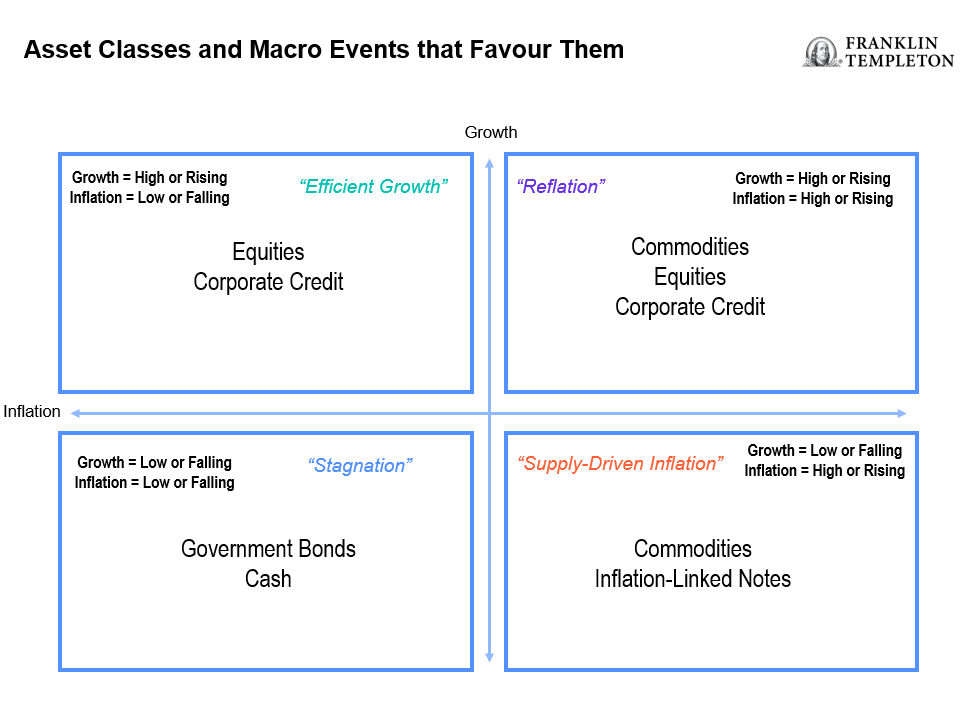

Given the amount of uncertainty, we find it important to have a roadmap to navigate our portfolio asset allocation. Our analysis suggests that certain asset classes perform well in particular economic environments due to their characteristics and economic rationale (and calibrated with their historical behaviour). As we gain more clarity on the evolving situation, our roadmap can help guide asset allocation decisions. As outlined earlier, if the conflict remains protracted, it may produce a “low growth, high inflation” environment, as highlighted in the bottom-right quadrant below, while a brief conflict may have a negligible impact.

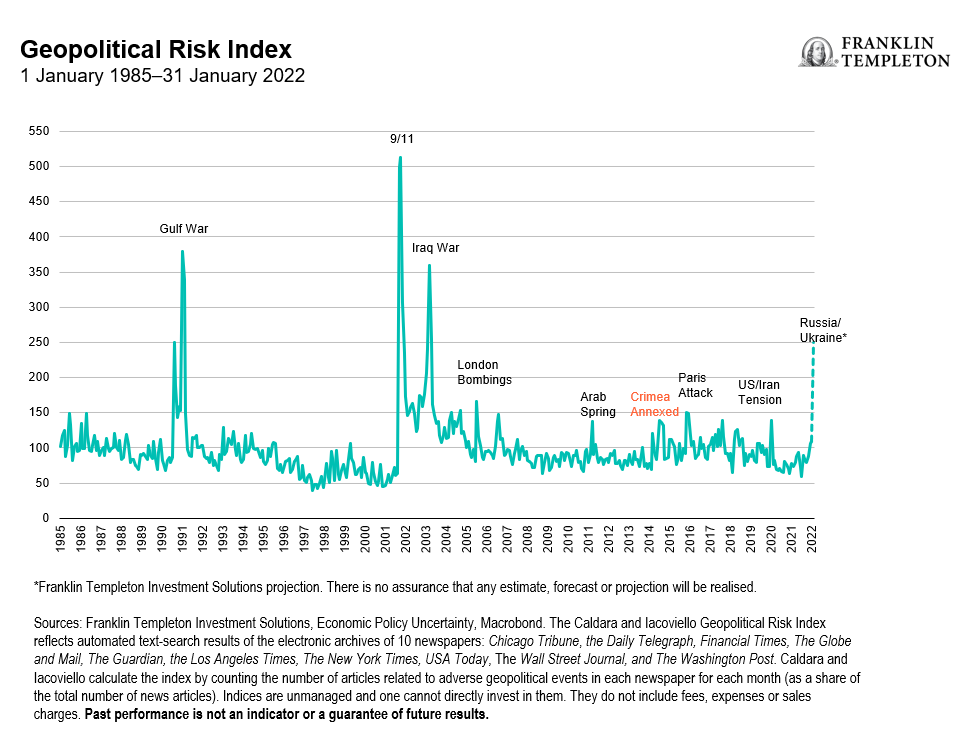

More broadly, there is potential for this event to tighten financial conditions across many markets. That would be consistent with several previous geopolitical shocks, e.g., the 1973 Yom Kippur War and OPEC embargo; 1979 Iran-Iraq War; 1990 Gulf War; 9/11 and ensuing wars in Afghanistan/Iraq. However, in other instances, like the more recent Russian invasion of Crimea in 2014, financial markets were barely impacted. Geopolitical events can have very different outcomes.

From a regional and sectoral perspective, commodity inflation is transferring income from commodity importers to exporters—for example, benefiting Canada’s economy at Japan’s expense. Firms in the energy and materials sectors may benefit versus consumer sectors. Europe’s economy and markets will likely be hit worst from the conflict, given its proximity and trade relations.

As we navigate these volatile events, we are increasingly looking to be nimble, and prudent, in making asset allocation tradeoffs over the coming months.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________________________________

1. Sources: Federal Service of State Statistics, US Food & Agriculture Organization, US Department of Energy, as at 2020.

2. Source: European Central Bank, as at 2019.