The Russian invasion of Ukraine has shaken up the world across several dimensions. Between the loss of life and destruction of Ukrainian infrastructure, it has been extremely unsettling for us to watch and absorb. Beyond Ukraine, the Russian invasion has affected many parts of the global economy, in particular the global supply chain of key commodities. Our team takes a deep dive into what this war could mean for global supply chains and potential problems surrounding the supply and export of key commodities including gas and oil, autos, semiconductors, food and fertiliser.

Key Points

- Global Supply Chain Woes: Inflation pressures were already elevated heading into 2022, and the Russia/Ukraine war is creating additional concerns. Energy pressures are well documented, but other areas such as autos, semiconductors, food and fertilisers will also be deeply impacted by the Russian/Ukraine war.

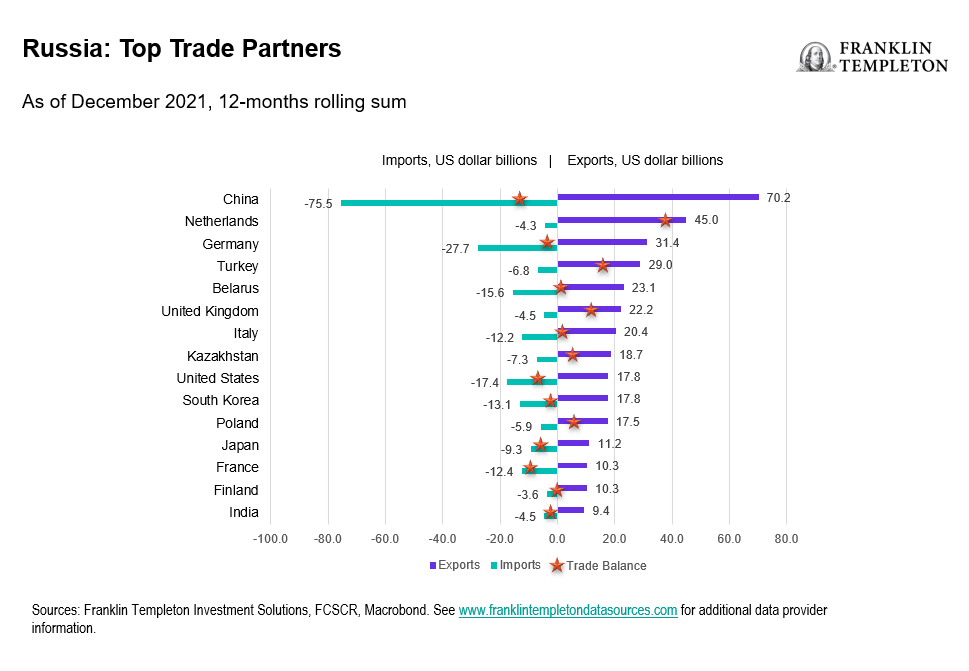

- Global Macro Implications: We are facing rising inflation, slowing demand and a precarious policy environment. Inflation and growth impacts are expected to be felt more acutely in the European region, given stronger trade ties to Russia.

- Multi-Asset Considerations: We are less constructive on equities and have a bearish view on eurozone equities. We continue to prefer inflation-linked bonds and remain cautious regarding duration exposure.

Global Supply Chain Woes

Energy: Many countries are attempting to move away from Russian energy imports despite such high global exposure. The United States has enacted a total ban on Russian energy imports, while the United Kingdom and European Union (EU) have announced plans to significantly decrease Russian energy imports by year-end. This will take time given how large of a customer the EU-27 is for Russian energy. Energy commodity curves have moved into steep backwardation as a result.

Key Facts

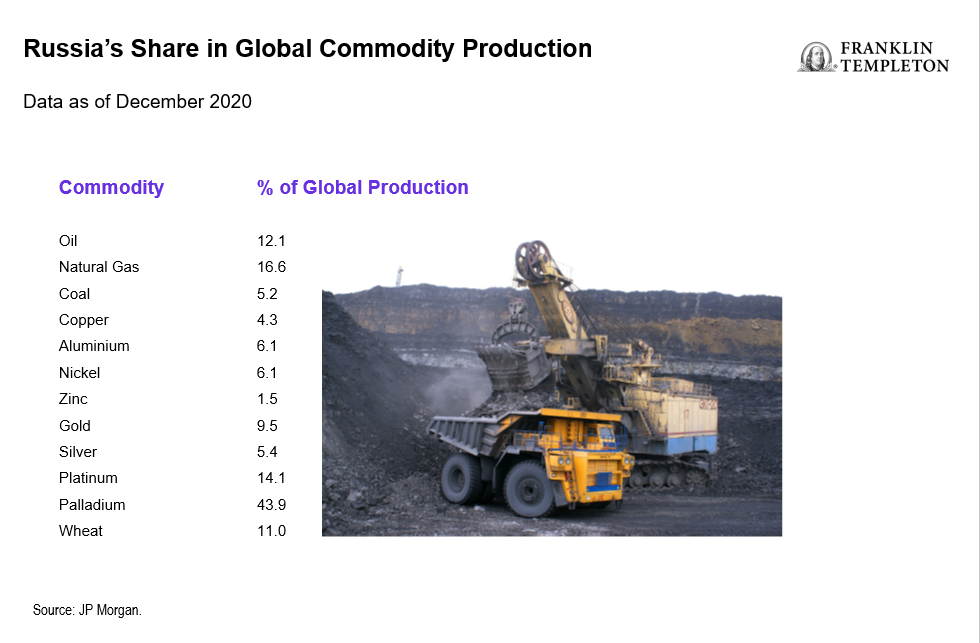

- Russia accounts for 2% of global gross domestic product (GDP), but accounts for 12% and 17% of global oil and natural gas production, respectively.1

- The EU depends on Russia for 40% of its natural gas. Russia also supplies 27% of the 27-country bloc’s oil imports, and 46% of its coal imports.2

- The first European move away from Russian oil resulted from Germany suspending the certification process of the Nord Stream 2 Baltic Sea gas pipeline, which finished construction in September and would have nearly doubled the flow of Russian gas into Germany.

- Ahead of Russia’s invasion of Ukraine, European spot gas prices had risen 400%3 over the previous year (as at 23 February) due to the global reopening and significantly cold winter across Europe.

Autos: The war in Ukraine has created a parts shortage that has now forced automakers to shut down key European plants. This takes place as the auto industry faces the potential for longer-term disruption in metals and chips supplies due to significant Russia and Ukraine exposure.

Key facts

- Russia is the world’s biggest exporter of palladium (40%) and second-biggest exporter of platinum, both of which are used in the construction of autocatalytic converters for vehicles.4

- Ukraine is a key supplier of wiring harnesses that are needed to organise a car’s wiring and connect its various components.

- Difficulties in receiving wiring harnesses from Ukraine has forced both German-based Volkswagen (VW) and BMW to idle certain plants in Germany while acknowledging that other plants will begin to slowdown as well.

- Ukraine produces 70% of the world’s neon gas—most of which is used to produce semiconductors and automotive chips. This exposes automakers and electric vehicle (EV) producers to greater challenges with replenishing already-depleted chip inventories should the war in Ukraine effect neon gas production and transportation.5

Semiconductors: Neon gas—one of the key materials needed for semiconductor production—predominantly comes from Ukraine. While the longer-term concerns center around Ukraine’s neon gas production, the current issues revolve around the closure of the Black Sea ports that transport the existing stock of neon gas to the rest of the world.

Key Facts:

- Russia and Ukraine produce 40%-50% of semiconductor-grade neon. Largely derived from Russian steel manufacturing, neon gas is purified in Ukraine so it can be used in lasers that help in the design of semiconductors. 6

- Up to 75% of the world’s neon supply is used to make semiconductors.7

- Semiconductor production could also be impacted longer term given the high exposure to Russia’s production of palladium, a metal that is used in sensor chips and certain types of computing memory.

- Large chip companies such as Intel have said they expected limited supply chain disruption for now from the Russia-Ukraine war, thanks to raw material stockpiling and diversified procurement. This is a positive acknowledgement given the White House warned the semiconductor companies to diversify their supply if Russia retaliates against current sanctions by blocking access to key materials such as neon gas.

Food: Ukraine’s predominant trade partners for food are the Middle East and North Africa; these regions will be impacted the most from any war-related food disruptions. Ukraine and Russia combined account for 29% of global wheat exports, with the Black Sea region effectively regarded as the “breadbasket of the world”.8 However, this will now strictly be the breadbasket of Ukraine since the Ukrainian government has banned exports of wheat and other food staples to prevent a humanitarian crisis in the region.

Key facts

- Ukraine supplies about 15% of the global corn supply.9 Major customers include China and the EU.

- Russia and Ukraine together represent almost 30% of the world’s barley supply.10

- In addition, Ukraine is the global leader in sunflower oil and together with Russia accounts for 75% of global sunflower oil exports, which represent about 10% of all cooking oil.11

- Planting for corn, barley and sunflower seeds will start in April and occur directly in areas where the Russian military is currently bearing down. Ukraine’s next wheat harvest is also set to begin during the upcoming summer.

Fertilisers: Russia is a major producer of potash, phosphate and nitrogen-containing fertilisers which represent roughly 13% of global fertiliser exports.12 Following a Russian ban on ammonium nitrate fertiliser, the Russian Ministry of Industry and Trade has now called for a broad suspension of fertiliser exports. The potential for a persistent fertiliser shortage could increase farming costs and lower crop yields, producing global food shortages and inflation.

Key facts

- A significant development comes from Russia banning the export of ammonium nitrate, a key fertiliser for which Russia accounts for two-thirds of the global market.13

- This ban comes at a crucial time, as the world has already faced fertiliser disruptions leading up to the war in Ukraine.

- Brazil is the most affected country given its status as the largest producer of coffee, soybeans, and sugar. It is enormously dependent on fertiliser imports: 85% of its fertilisers are imported annually, with 20% coming from Russia which will be impacted by the ban.14

- Inventory levels suggest that Brazil’s local fertiliser stocks will only last for the next three months as Julia Meehan, head of fertilisers for the commodity price agency ICIS, highlights that “All everybody is talking about is availability. There are huge concerns”.15

Global Macro Implications and Multi-Asset Considerations

Inflation was high as we headed into 2022. There were some promising signs of supply chain woes starting to ease—supplier delivery times were starting to improve, prices paid by businesses were starting to fall, and the slow fading of durable goods demand were all giving signs that inflation may ease in the new year. As the Russia-Ukraine war has escalated, the rise in energy prices has derailed much of the optimism we had entering 2022.

The current macro outlook has darkened. Our inflation expectations have risen dramatically. Importantly, we view the current rise in inflation as being supply-driven, and consequently expect the rise in prices to negatively affect household and business demand. We were already seeing the negative impacts of high inflation on consumer confidence, and now expect additional headwinds to real consumer spending, even as most private sector balance sheets remain healthy. Lastly, the mixture of higher inflation and lower demand adds to an already precarious policy environment. Central banks in most major regions are expected to hike this year, in some cases significantly. It will be difficult for policymakers to engineer a soft landing in this volatile macro environment; the risk of a policy error has risen.

In multi-asset portfolios, we are less bullish on equities as our expectation of inflation has risen against weaker demand. We do not expect policymakers to come to the rescue if risky assets stumble from here, particularly as inflation remains well above most central bank targets. We have also turned bearish on Eurozone equities, where supply-chain effects are greatest. We continue to favour inflation-linked bonds over nominal bonds and remain underweight duration.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Past performance is not an indicator or guarantee of future performance. There is no assurance that any estimate, forecast or projection will be realised.

Companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by the CFA Institute.

_____________________________________

1. Source: Bloomberg. As of 2020.

2. Source: M. Thompson. “Europe plans to slash Russian gas imports by 66% this year,” CNN Business, 8 March 2022.

3. Source: ICE UK Natural Gas Futures.

4. Source: HSBC Global Research, Russia-Ukraine escalation, February 2022.

5. Source, P. Wadhwa. “Russia – Ukraine war: Brace for chip shortage, warns Moody’s Analytics”, Business Standard, 5 March 2022.

6. Source: S. Bhattacharyya. “Russian Attack on Ukraine Could Dent Chip-Maker Supply Lines”, The Wall Street Journal, 25 February 2022.

7. Ibid.

8. Ibid.

9. Source: N. Aizenman. “Russia’s war on Ukraine is dire for world hunger. But there are solutions”, NPR, 6 March 2022.

10. Ibid.

11. Source: J. Wilson. “Russian war in world’s “breadbasket” threatens food supply”, AP News, 6 March 2022.

12. Source: HSBC Global Research, Russia-Ukraine escalation, February 2022.

13. Source: L. Magalhaes, S. Pearson. “Ukraine War Hits Farmers as Russia Cuts Fertilizer Supplies, Hurting Brazil”, The Wall Street Journal, 5 March 2022.

14. Ibid.

15. Source: S. Butler. “Surge in fertiliser prices from Russia-Ukraine war adds to pressure on UK farmers,” The Guardian, 8 March 2022.

English

English