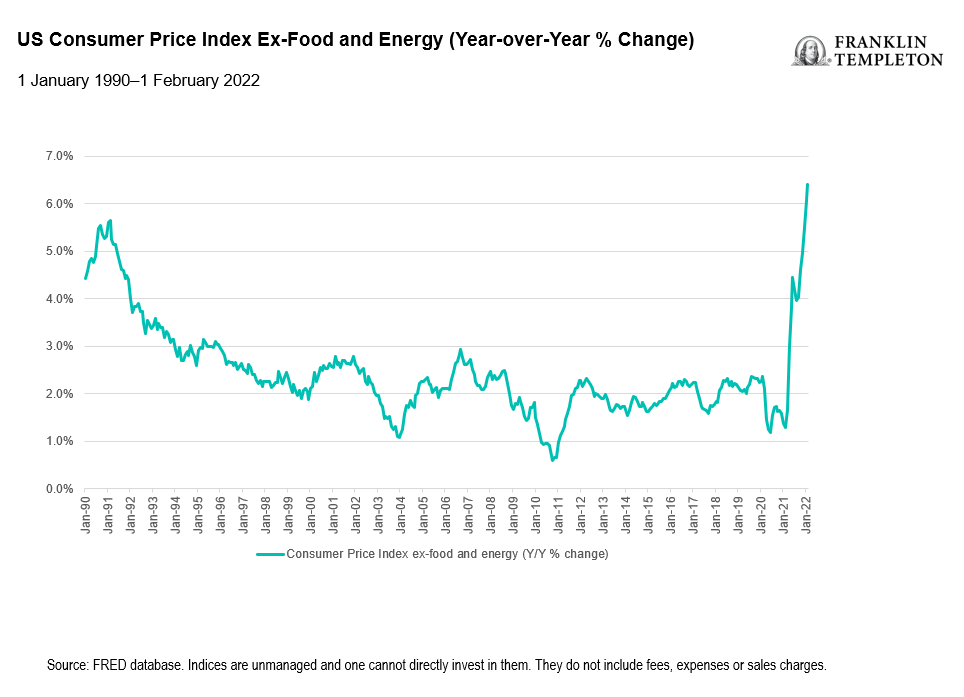

Second Quarter (Q2) 2022 Outlook: Summary

Last year’s headlines (COVID-19 and China) have been replaced with new concerns (Invasions and Inflation). Central bankers are pivoting from stabilising growth to limiting inflation. Traditional bond and equity markets have come under pressure as they adjust to this new regime. Hedge fund managers are once again excited by the long vs. short investment opportunities. While the beta uptrend in stock and bond markets may have stalled, dispersion has improved the outlook for alpha-driven performance.

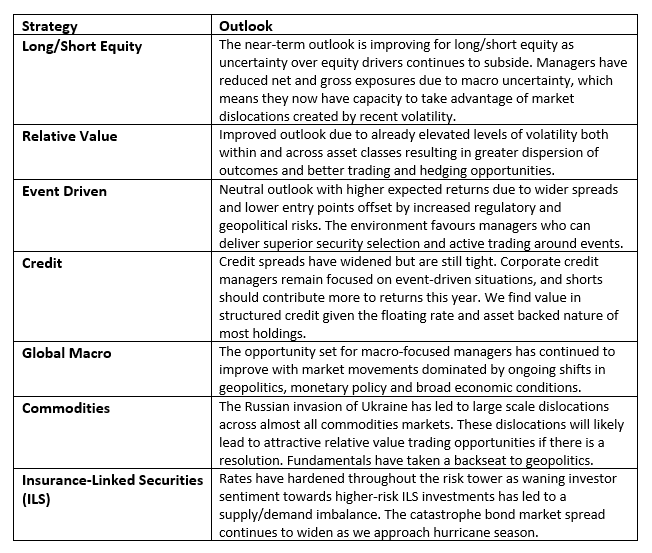

Strategy Highlights

- Commodities: The Russian invasion has led to tremendously elevated commodity volatility and dislocations across most markets. Historically, higher levels of volatility have led to a richer opportunity set across both directional and relative value trading strategies.

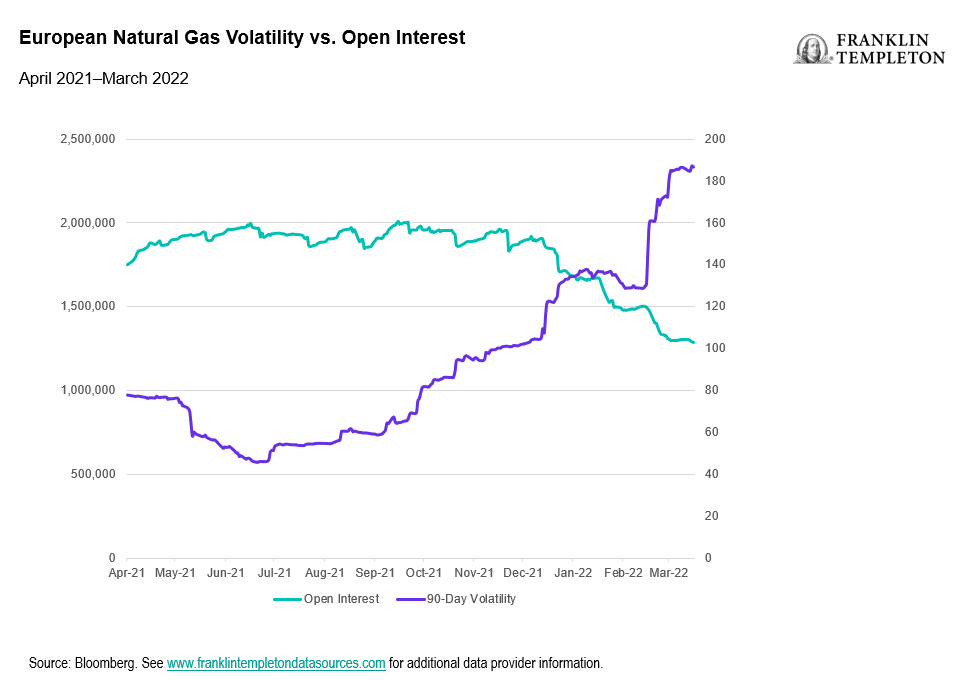

- Relative Value: Elevated levels of volatility across and within asset classes are offering improved trading opportunities.

- Global Macro: Managers focusing on macro factors like changing economic data, central bank policy shifts, and geopolitical developments may face a rich opportunity set for both medium-term themes and short-term trading over the next several months.

Macro Themes We Are Discussing

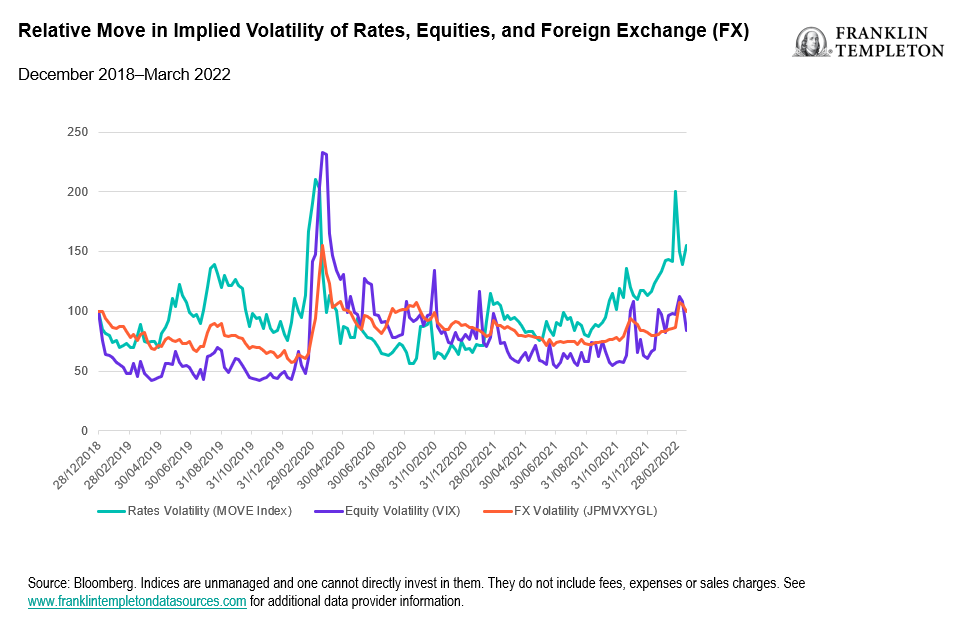

In the past, some of the largest causes of market cycle regime shifts have been due to dislocations caused by a change in interest-rate policies, elevated levels of inflation, and/or some type of military conflict. As we draft this overview of second quarter themes, we note that all three of these macro events are capturing headlines today. In short, the Russian invasion of Ukraine has added pressure to the inflationary cycle that began in late 2020. In response to these inflationary pressures, many central banks have indicated that policy interest rates will shift upwards.

For many years, we have heard central bankers wondering how to best promote economic growth while avoiding deflationary pressures. Ironically, many of our hedge fund managers and market strategists are now worried about the possibility of inflation spiralling upwards alongside muted global growth. On the bright side, there are some indications the COVID-19 situation is improving, and a slight easing is being seen in the supply chain blockages.

Going forward, we are monitoring various themes driving markets and especially their impact on active management alpha over the next 9-12 months. Dislocations such as we saw in the first quarter tend to offer opportunities both on the long and short side of the equity, bond, commodity, and foreign exchange markets. The trick is trying to understand what catalysts or events will stabilise investor sentiment so macro- and micro-fundamentals can drive both relative value and directional investment opportunities.

For example, how long will the war between Russia and Ukraine last? How fast and how far are central bankers looking to raise policy interest rates? Has the recent correction in growth stocks reset valuations to opportunistic levels? Will the supply/demand imbalances involving energy products be resolved? And finally, how long will this inflation cycle last? Given the fluid nature of headlines driving these themes, general market volatility may remain above average until we gain some clarity. That said, our investment committee discussions and comments from our managers lean towards the views outlined below as most likely.

Regarding the Russia-Ukraine war, there is the belief (or hope) that the length of the conflict will be short-lived and that further escalation is unlikely. Furthermore, some of our hedge fund managers made the point that the equity markets are handling the geopolitical uncertainty with a relatively low degree of panic. Macro managers/commodity trading advisors (CTAs) are on watch for opportunities that would benefit from any positive headlines involving Eastern European and Asian geopolitical issues.

For example, they are looking for further signs of stabilisation in Chinese real estate and the broader economic environment. They feel that some currencies are undervalued, and some emerging market bond yields have reached attractive levels. For those that trade commodities, both directionally and on a spread basis, any signs of stalling in energy prices alongside signs of a post-COVID global growth cycle presents some strong arbitrage opportunities and new technical trends.

We now know inflation was not transitory. Now what? Even if inflation trends slow in 2022, will price pressures remain high and limit the global economic growth cycle? We subscribe to the view that inflation will move lower but will remain above historical long-term average levels. We also believe that growth will be modest barring any military escalation. In this environment, security selection in the equity and corporate bond markets will be paramount.

Beta-driven trends may be noisy, but alpha-driven spread trades should contribute to performance in 2022. Those sectors that benefit from above average inflation will attract investor inflows while others may experience limited earnings growth due to reduced profit margins. Equity long/short and bond relative value managers are expecting increased dispersion as a result. Positioning correctly for these divergences has typically been a good source of alpha-driven performance.

Further, the level and trend of inflation and the associated interest-rate environment tends to be a key driver of currency market trading. After years of low inflation, low or negative interest rates, and below-average volatility, macro CTA traders are excited to generate performance once again through foreign exchange trading.

To summarise, market stress events are never pleasant to experience in the short term, but the dislocations created during volatile times help to reset long/short and relative value alpha opportunities.

Q2 2022 Outlook: Strategy Highlights

Commodities

Russia’s decision to invade the Ukraine in late February will likely have long lasting ramifications across the commodities complex. Russia has been a large energy supplier to the rest of Europe, and following the advent of the war, the European Union has accelerated plans to become less reliant on Russian energy. Whipsawing commodity prices and increasing margin calls have forced traders to reduce their activity, driving liquidity out of markets, and exacerbating price swings. We have seen this across commodity markets including European natural gas after Russian President Vladimir Putin began demanding ruble payments for gas to nickel, which led the London Metal Exchange to suspend trading for days following a 250% price increase over two days, and in wheat where futures jumped by the exchange limit for consecutive sessions in early March. The combination of elevated volatility, significantly increased margin requirements and pockets where market liquidity drops has led to funds needing to take a much more conservative approach to risk management.

Relative Value

Volatility has picked up across a wide range of asset classes but is particularly pronounced in rates. The dramatic increase in inflation expectations and a hawkish central bank reaction has led investors to bid up implied volatility to levels last seen during the March 2020 COVID-19 dislocation. Gradual withdrawal of liquidity from the markets due to rising interest rates and reduced central bank purchases is likely to support elevated rates of volatility, which should be positive for strategies built around active trading and liquidity provision to the markets.

Global Macro

Macro factors have continued to dominate recent market moves. With central banks shifting towards policy tightening in response to surging inflation, we expect this factor dominance may continue. Many discretionary and systematic macro managers had positioned their portfolios to benefit from this trend, including through longs in commodities or shorts in fixed income. As the macro picture and policy responses evolve, managers focused on these developments may find an attractive opportunity set for active trading.

What Are the Risks?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at 7 April 2022, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Investments are not FDIC insured; may lose value; and are not bank guaranteed.

English

English