Key takeways:

- Rising inflation and rising interest rates have led to concerns about reduced economic growth and a selloff in cyclical stocks. Additional concerns include a derating of long-duration equities and a drawdown in growth stocks.

- The UK consumer is facing a cost-of-living crisis, fuelled by surging energy prices and rising taxes.

- Positive underlying factors are supporting the UK economy, including excess disposable income, mortgage affordability and robust employment.

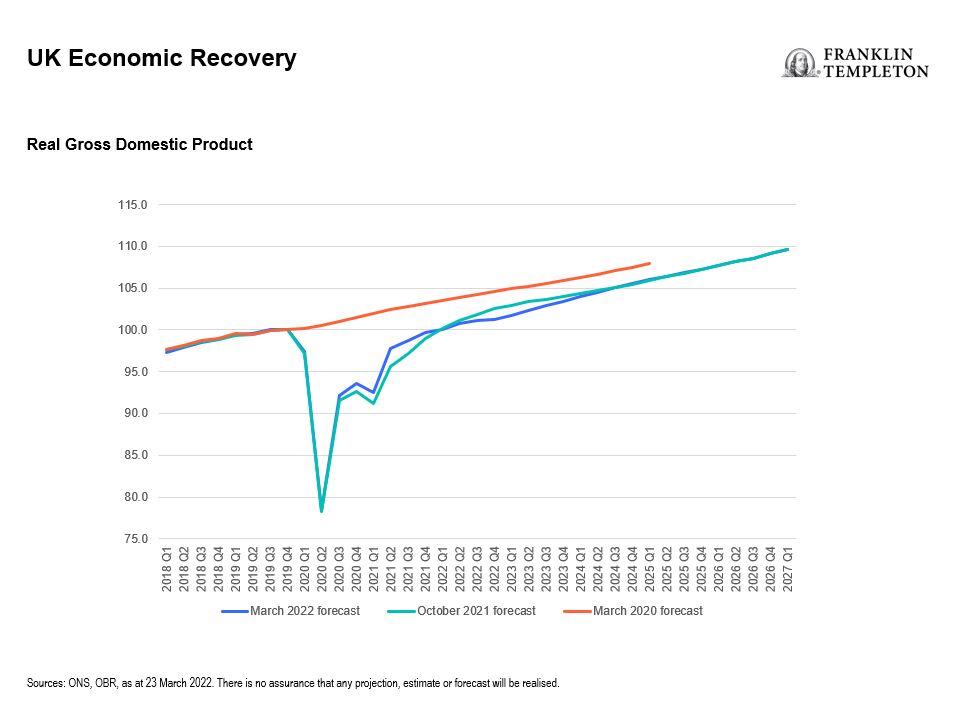

- Despite rising inflation and interest rates, we believe the United Kingdom is coming from a position of strength that will help its economy ride out these bumps and return to its growth trajectory prior to the pandemic.

- We believe the UK stock market offers good opportunities. It has significant exposure to commodities and consumer staples, which exhibit inflation-resistant tendencies, and has been benefitting from a weak sterling relative to the US dollar.

Rising interest rates and reduced growth leads to equity drawdowns for cyclical and growth stocks

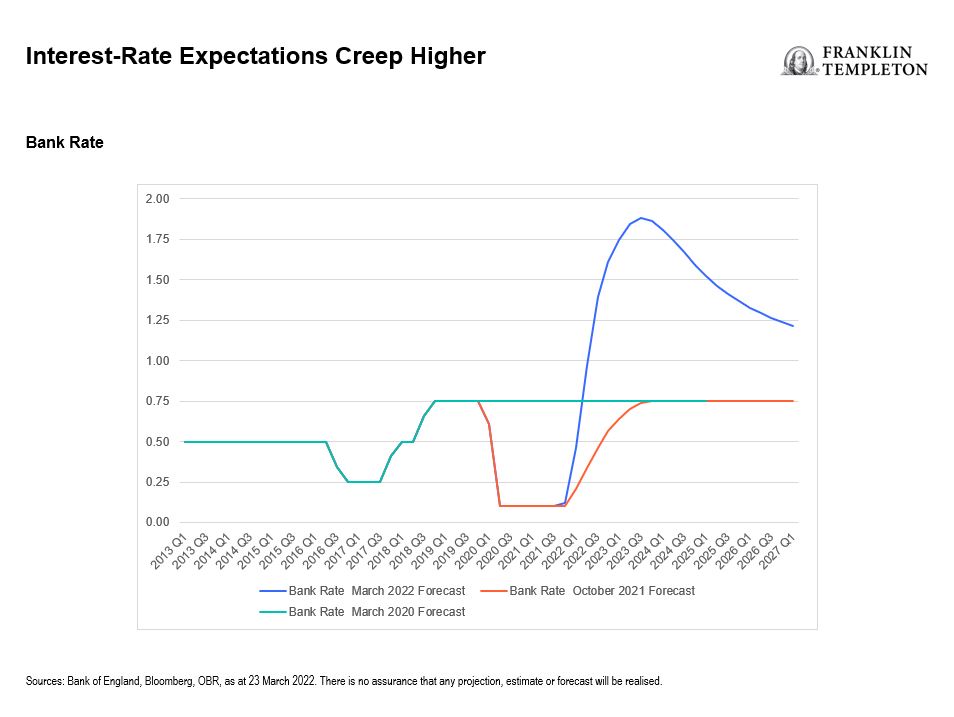

Since the beginning of the year, the UK equity market has been struggling to digest two trends—the persistent and elevated levels of inflation and the implications for interest rates and central bank actions. Investors seem to be expecting reduced growth this year and are concerned that the Bank of England may go too far in raising interest rates, triggering a recession. Thus, cyclical areas of the market—such as retail, travel and leisure, and industrials—have seen their share prices sell off recently as the market has been trying to price in a possible slowdown.

Furthermore, with discount rates being very sensitive to interest rates, increasing interest rates resulted in a derating (investors reducing the multiple that they are prepared to apply to a company’s earnings to value the equity) of long-duration equities. This scenario has caused a drawdown in growth stocks year-to-date, as witnessed in the US NASDAQ Composite Index, as well as further down the market-capitalisation (cap) scale, such as those companies represented in the FTSE 250 Index.1

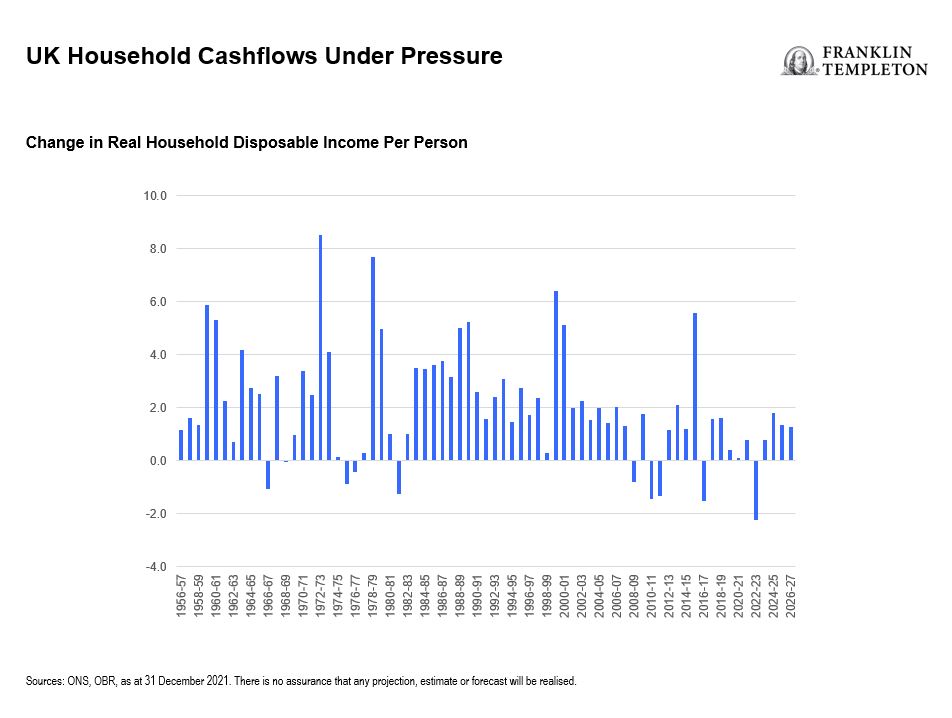

Rising prices and lower household disposable income leads to cost-of-living crisis

Another core issue facing the UK domestic economy is that the UK consumer is facing a cost-of-living crisis. The Office for National Statistics (ONS) projects that real household disposable income will likely drop significantly in 2022. Rising energy prices, national insurance increases and rising mortgage rates are some of the factors that are putting a squeeze on disposable income.

Excess disposable income, mortgage affordability and robust employment support UK economy

We believe there are opportunities in UK equities where the market has been too pessimistic. Counteracting the negativity are some underlying positive fundamentals, such as the buildup of excess disposable income that occurred during the COVID-19 pandemic. Other than consumption of physical goods that fuelled inflation, around £250 billion worth of excess savings was built up in 2020-2021 when people could not spend their money on meals out, weekends away or foreign holidays.2 The lockdowns prevented people from spending on services or experiences, and that money is still sitting on the sidelines. Analysts are debating whether these savings will come back into the economy or not, which is causing differences in UK growth forecasts. Nonetheless, that money is there, and we believe it will eventually make its way back into the economy in some shape or form.

Despite rising interest rates, mortgages remain affordable across the United Kingdom. Average mortgage payments as a proportion of disposable income are at the lower end of their historical ranges. Housing price corrections occurred after the 1991 and 2007 peak periods when mortgage payments became a significant chunk of people’s disposable incomes.3 In our opinion, that is not the case today. Additionally, most mortgages are fixed either for two or five years, so it will take time for changes in mortgage rates to impact spending power.

UK consumer confidence is predicated on the value of people’s homes—their largest assets—and how secure they feel in their employment. Recent data show unemployment at record lows and job vacancies at record highs.4 There are currently more job vacancies than there are job seekers. Thus, we believe that even if the economic waters get a bit choppy, at least the United Kingdom is starting the journey from a position of relative economic strength, given the robust nature of the UK employment market. Strong long-term wage growth is another factor counteracting the cost-of-living crisis. Thus, nominal wage increases will help consumers keep pace with rapidly rising prices.

Where do we go from here?

As the UK economy bounces back from the pandemic, analysts disagree on the prospects for UK economic growth in 2022 and beyond. The Office for Budget Responsibility (OBR) forecasts around 3.8% growth5, albeit with a weakening trajectory into the second half. The United Kingdom is still trying to get back to the economic growth trajectory that was in place prior to the pandemic. Given what is happening with inflation and rising interest rates, there will likely be some bumps in the road, but we believe the economy is coming from a position of strength that will help it ride out these bumps.

Regarding the UK equity market, the FTSE 100 Index, composed of UK large-cap stocks, has been relatively strong compared to global equities year-to-date.6 The UK stock market has a lot of exposure to commodities (such as oil and industrial minerals), as well as the pharmaceuticals, utilities and consumer staples sectors, which tend to be more defensive than cyclicals in an inflationary environment. In contrast, it does not have the same exposure to growth stocks that are vulnerable to a derating as compared with other markets.

The overall valuation of UK equities is low as compared with historical, and indeed international standards, in our analysis. The UK market did not see a big rerating during the pandemic, and therefore is far less exposed to the risk of a derating. Additionally, sterling has been weak relative to the US dollar, which supports the UK market given that a large proportion of FTSE 100 companies’ earnings come from overseas.

Overall, we hold an optimistic view of the UK equity market relative to overseas markets and believe that UK large-cap stocks offer good opportunities for investors.

What are the risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Important legal information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

__________

1. Bloomberg, as at 17 May 2022. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator of future results. See www.franklintempletondatasources.com for additional data provider information.

2. Source: Lazarus Economics and Strategy, as at 31 December 2021.

3. Ibid.

4. Ibid.

5. Forecast as of 31 March 2022. There is no assurance that any estimate, forecast or projection will be realised.

6. Source: Bloomberg., as at 17 May 2022.