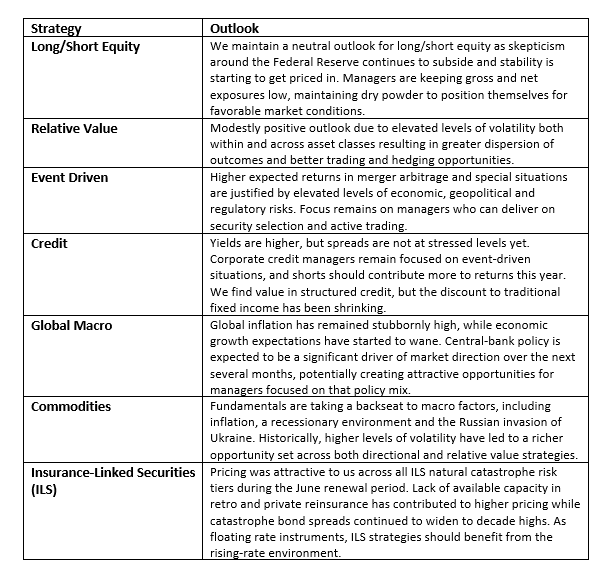

Third quarter (Q3) outlook: Summary

We are monitoring economic growth, earnings, supply chains and inflation for clues as to whether central banks can achieve the elusive “soft landing.” The implications for markets and different hedge fund strategies are significant. We expect volatility, correlations and dispersion to remain elevated and have shifted to a lower beta profile in favor of diversifying strategies and ones that can possibly benefit from rising rates and inflation accordingly.

Strategy highlights

- Commodities: A potential recessionary environment and high levels of inflation have led to increased volatility across commodity markets and thereby a richer opportunity set across both directional and relative value trading strategies.

- Global Macro – Discretionary: Central-bank policy paths are a clear focal point for markets as policymakers seek to navigate above-target inflation and slowing growth. Discretionary macro managers focused on these factors may find compelling directional and relative value opportunities.

- Long/Short Equity – Europe: The rising cost of capital—through rising rates in Europe for the first time in over a decade—will fuel more dispersion in European equities, creating opportunities for long/short equity managers.

Macro themes we are discussing

As we noted last quarter, in the past, some of the largest causes of market cycle regime shifts have been due to dislocations caused by a change in interest-rate policies, elevated levels of inflation and/or some type of military conflict. As we enter the third quarter (Q3), it is becoming more evident that inflation has a duration longer than “transitory,” the global interest-rate hiking/normalization cycle is now in full gear, and markets are showing signs of stress, most notably in crypto. Ironically, central banks are comfortable having some firms go down so long as the traditional financial system is not at risk. Rather, Federal Reserve (Fed) Chair Jerome Powell and other G7 central bankers have become “highly attentive to inflation risks,” which could unfortunately come against a backdrop of declining growth.

We have been transitioning to a new investment regime since the start of 2022. This year is quickly becoming one where investors have very few areas to preserve capital. Fixed income is no longer a hedge for equities, correlations are rising quickly, and the traditional 60/40 portfolio is down approximately 13% for the first half. In addition, those investments that typically provide diversification to the 60/40 mix, benefit from the prospect of inflation, and withstand a rise in interest rates are now highly valued by asset allocation.

Going forward, we are monitoring measures of economic growth, earnings, supply chain links and measures of projected inflation for clues as to whether central banks can stick the landing of taming inflation without outright stifling growth. As we write, the Fed’s own nowcast model is registering near-zero gross domestic product (GDP) growth and Powell has acknowledge that a soft landing is going to be very difficult to achieve. The broad implications for markets and different hedge fund strategies are significant. We have shifted to a lower beta profile in favor of diversifying strategies and ones that can possibly benefit from rising rates and inflation. We expect volatility, correlations and dispersion to remain elevated, although we are surprised that volatility has not moved higher already (volatility sellers have been capping the market spikes).

We are big believers that markets trade based on expectations, positioning and investor flows. During the second half of this year, we will be particularly keen for shifts in expectations of inflation, growth/earnings and positioning. We expect that these key elements will vacillate, creating a rich environment for active management. Hedge funds are multi-dimensional active management strategies in that there is both a long and short book as well as the ability to scale up or down the overall risk of the portfolio as the market cycle shifts.

In short, while the recent “risk reset” has created performance challenges for many asset and product classes (including some hedge funds), the resulting price dislocations have improved the performance outlook for long vs. short opportunities. Additional clarity regarding central bank plans, economic growth outlooks and year-over-year inflation trends should create convergence opportunities between related investments that have disconnected over the past six months.

Q3 2022 outlook: Strategy highlights

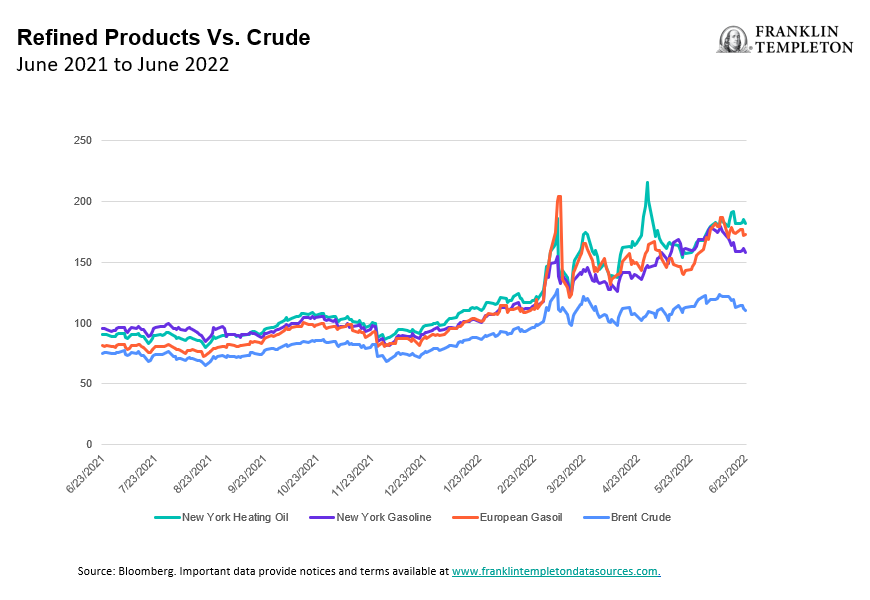

Commodities

A variety of fuel subsidies have kept consumption afloat, and together with limited refining capacity, has powered rallies that have outstripped crude prices. US gasoline at $5 per gallon has caught political attention, which could trigger policy action ahead of the November midterm elections. Oil market backwardation, a bullish pattern in which near-term prices trade above longer-dated ones, has grown in recent days. A surging structure is a reminder to traders of a robust physical market. High refined product prices also pointed to a continued demand pull. Most of the cargoes recently purchased by Asian customers are for August loading, signaling confidence in demand over the next few months. Buyers are paying the biggest premiums for crude oil that yields more diesel or gasoline, as tight supplies underpin higher fuel prices.

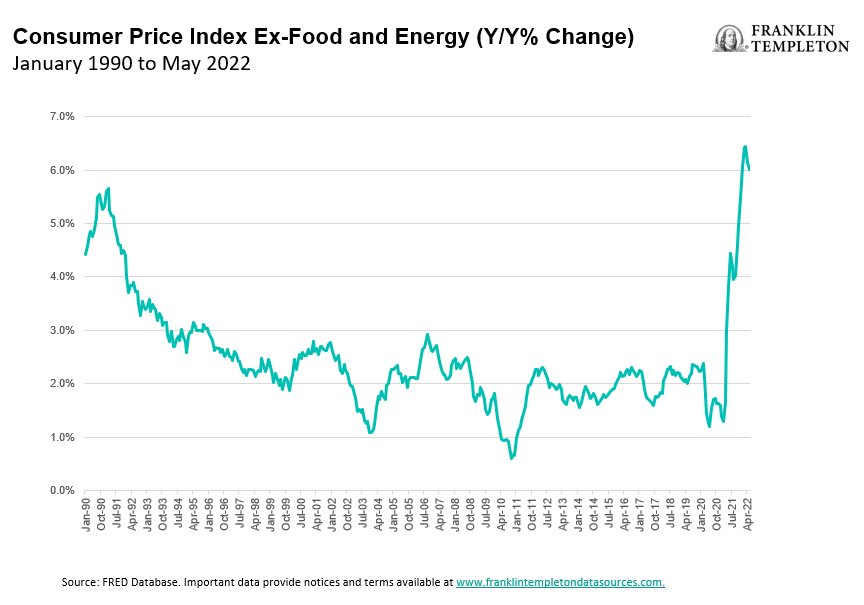

Global macro – discretionary

Inflation and economic growth are the key factors driving the macro policy mix and market direction. With significant moves in major asset classes over the last several months, managers are now focusing on the incremental data for suggestions of where policy may shift next. Many central banks have clearly stated their intentions to bring inflation back down to policy targets, but they now must also consider what appears to be slowing economic growth trends that could push policy in a less hawkish direction. Market volatility may remain high, and macro-driven managers may find ample opportunities as these two major conflicting factors develop over the next several months.

Inflation Remains Significantly Above Policy Targets

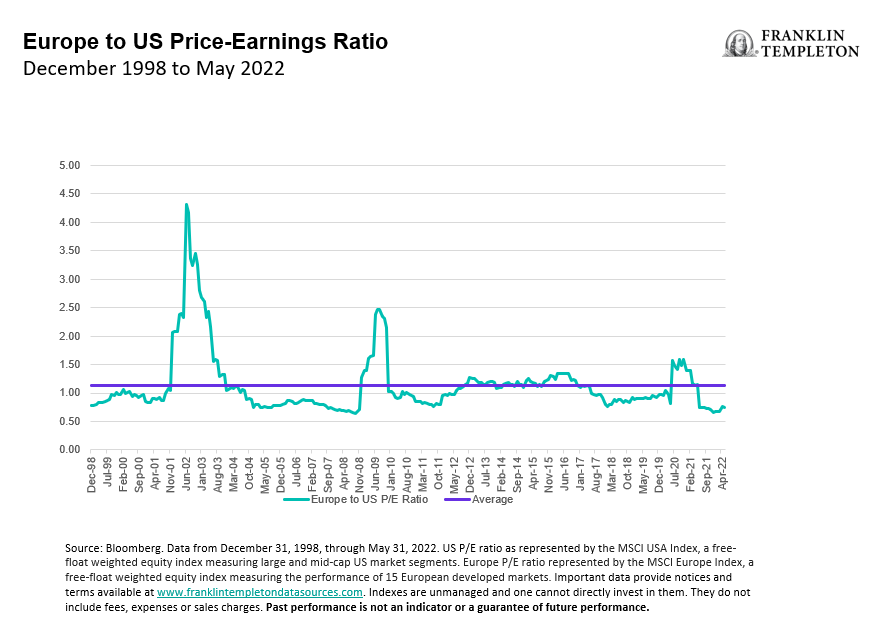

Long/short equity – Europe

High volatility in Europe, coupled with a rising rate environment and recession concerns may continue to create opportunities in European equities. The rising cost of capital in Europe should create more dispersion in European equities. Price-to-earnings (P/E) multiples have exhibited close to negative correlations to both central-bank policy rates and credit spreads. Entities that are most levered or need access to funding will be affected by higher borrowing costs. We expect this setup to expose idiosyncratic issues in the coming months. The chart below shows how P/E valuations in Europe are now lower than the United States on average, signaling a relative attractiveness in European equities. Valuations across the eurozone are the most compelling among advanced economies with 12-month forward P/E multiples for the European Monetary Union (EMU) at 11.3x and the United Kingdom at 9.8x vs. 16.3x for the United States. Across Europe, managers have reduced gross and net exposures, creating sufficient dry powder to take advantage of upcoming opportunities, which may arise from these dislocations.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss or principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of April 7, 2022, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Investments are not FDIC insured; may lose value; and are not bank guaranteed.