Key takeaways:

- An uncertain global economic environment has led to significant market declines worldwide. However, positive factors exist.

- Although UK small- and mid-capitalisation (cap) stocks underperformed large-cap stocks over the past year, we believe small- and mid-cap stocks should outperform once again.

- With the recent declines in small- and mid-cap stocks, we see excellent valuation opportunities emerging.

- We’re finding what we consider to be long-term opportunities in UK small-cap stocks within four strategic themes: digital economy, decarbonisation, consumer brands, and content and intellectual property (IP) creation.

- Within UK mid-cap stocks, we see potential opportunities in companies with strong balance sheets that can continue to invest and grow their competitive position.

Cloudy outlook with some silver linings

Many economies worldwide are facing multiple headwinds, with global markets experiencing significant declines because of all the uncertainty. Investors are wondering when inflation will peak, how central banks will respond to gain control over inflation, and how deep and long the slowdown will be. In addition to raising interest rates, central banks are also withdrawing monetary stimulus, reducing their balance sheets, and switching from quantitative easing to quantitative tightening. There are clearly geopolitical tensions, including the ongoing war in Ukraine. How China will emerge from its ongoing COVID-driven slowdown is still unknown.

The only thing that’s clear to us is that the world has changed, and we’re on a new road that will likely be bumpy. We also know that we’re in a period where the pendulum has swung in the direction of macro concerns driving markets. Investors seem focused on data points and top-down newsflow. Company-specific fundamentals seem to have taken a backseat. However, we believe the pendulum will swing back at some point—we just don’t know when. A whole host of overriding concerns are currently obscuring the outlook, and there are a wide range of possible outcomes.

Investor concerns accelerated during the first half of 2022, with sentiment swinging between a stagflationary and recessionary environment. While there are undoubtedly huge inflationary cost pressures for many households and businesses, not all businesses are the same and not all consumers are the same. Additionally, there are still a lot of excess savings built up over the past few years, which provides a big cushion for UK consumers to call upon if needed. Strong demand and limited supply continue to underpin the UK housing market, along with a healthy job market with low unemployment and a record 1.3 million in job vacancies, making the length and depth of an economic slowdown difficult to forecast.

Potential rotation back into UK small- and mid-cap equities

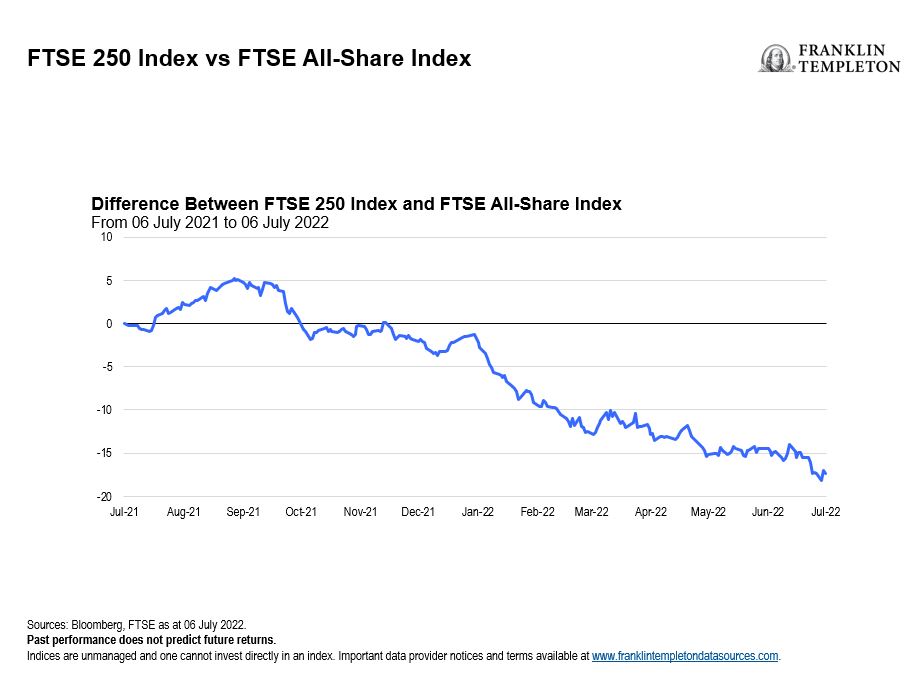

The complicated nature of the current environment has negatively impacted small- and mid-cap stocks more than larger listed businesses. From July 2021 through July 2022, the mid-cap stocks represented by the FTSE 250 Index had nine months of underperformance versus the FTSE All-Share Index.1 The spread between these two indices shows a dramatic style rotation—an increasing demand for more defensive areas of the market and a reducing of perceived riskier areas, such as mid-cap stocks.

Large-cap stocks also fared better than mid-cap stocks over the same period due to differences in sector weightings. The FTSE 100, which comprises large-cap stocks, has higher weightings in oil and gas, mining and health care stocks (which have been appreciating) as well as generally more defensive stocks. In contrast, the FTSE 250 has higher weightings in consumer and industrial stocks (which have been poor performers) as well as other more economically sensitive businesses.

We don’t know how long this current volatile period will last, but at some point we believe small- and mid-cap stocks will outperform once again. During risk-off periods when investors are fleeing to defensive stocks, the mid-cap stocks are usually the first to be sold, but they’re also usually the first ones to reverse course. Small caps tend to follow.

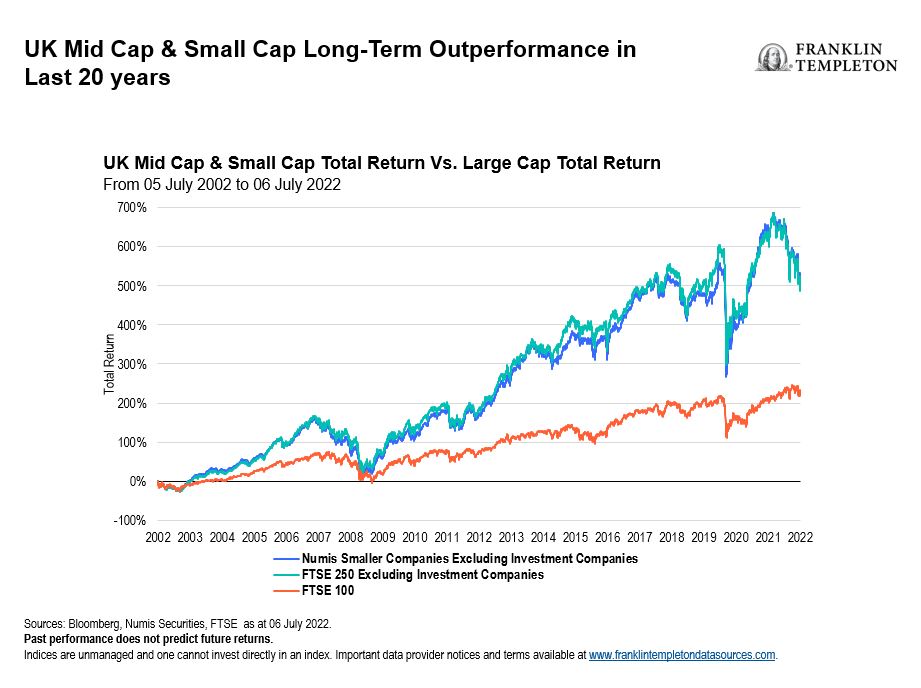

Additionally, looking back over the past roughly 20 years from July 2002 through July 2022, small-cap stocks in the Numis Smaller Companies Index as well as the FTSE 250 Index outperformed the FTSE 100 Index.2 Small- and mid-cap stocks also produced returns that were around 500% greater than the original investment over the same period.3 This time frame included some tough periods with significant drawdowns, such as the global financial crisis of 2007–2008, the Brexit referendum in 2016 and the global pandemic that started in 2020.

Potential valuation opportunities are emerging

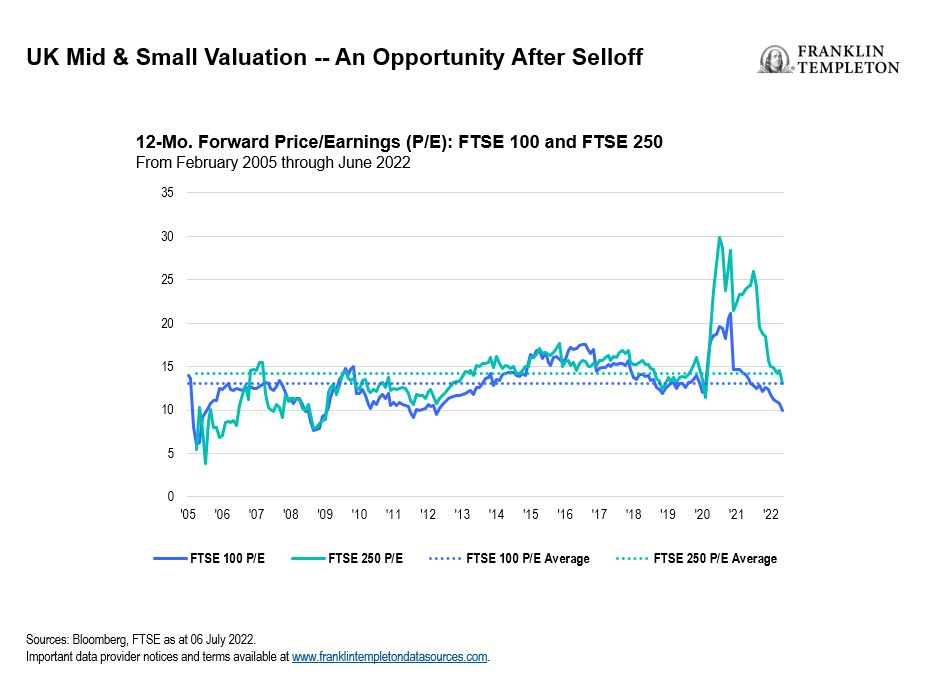

With market movements being more top-down and macro-data driven, and many investors overlooking company fundamentals right now, we’re starting to see many interesting opportunities emergewhere we believe the risk/reward is being tilted in our favour. The FTSE 250 has been trading below its long-term average, with its 12-month forward price/earnings (P/E) ratio currently estimated at 13 times, which is below its long-term average of around 14.4

We acknowledge that profit growth, margins and earnings momentum will be challenged as we head into the second half of 2022 and into 2023. However, some companies will fare better than others. There are opportunities in companies that have skilled and experienced management teams, are dealing with current challenges well, and have reasonably strong balance sheets.

Four strategic themes within UK small-cap stocks

In our analysis, UK small-cap stocks are currently pricing in a lot of downgrades. Investor sentiment seems to have swung too far into pessimism. We are looking beyond any short-term macroeconomic forecasts and we believe exposure to the following four strategic themes within UK small-cap stocks can drive long-term returns and provide resilience during a possible slowdown in economic activity.

- Digital economy: The pandemic has proven to be a catalyst for technology adoption and has accelerated underlying trends. We’re seeing growth in the digital economy in different end markets, such as electronic tagging for offenders, cyber security, online auction platforms, language translation and digital marketing, as well as companies in the ecommerce logistics supply chain.

- Decarbonisation: Businesses benefitting from decarbonisation efforts include those that manufacture more energy efficient ventilation products for residential homes and electronic components for customers in renewable energy as well as alternative asset managers that invest in sustainably led companies.

- Consumer brands: Although businesses within consumer brands will likely experience short-term pressure on earnings due to a decline in discretionary spending, we believe brands with stronger market and competitive positions will come through tougher economic conditions with enhanced market share.

- Content and IP creation: Audiences are demanding more and more new content through digital channels such as video games, TV subscription services and social media. We believe the structural growth here will endure for the long term, particularly benefiting businesses that either produce and own content or manufacture equipment used for creating content.

Balance sheet strength is paramount

In this tough market environment, we believe that for small and mid-cap stocks in particular, balance sheet strength is paramount, and valuations matter. We avoid overleveraged and cash-hungry businesses as well as high-risk or speculative investment areas of the markets. Instead, we focus on companies that can take advantage of opportunities and use their balance sheet strength to grow their competitive position, allowingthem to take advantage of any acquisition opportunities or capital returns like stock buybacks. Recently, we have seen a large increase in the number of companies using their strong balance sheets to buy back stock.

Additionally, many companies have emerged from a challenging two-year pandemic period much stronger, with improved market positions and more efficient operations. Many will use their financial and competitive strength to make the most of any volatile periods and we believe they will emerge in an even better position once the economic cycle starts to improve.

In the current uncertain environment, we also aim to use volatility to our advantage by focusing on individual company fundamentals. In times of challenging economic forecasts, we heed the advice of Sir John Templeton: ‘The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell’.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

__________

1. Sources: Bloomberg, FTSE as at 06 July 2022. The FTSE All-Share Index represents 98%–99% of UK market capitalisation, and is the aggregation of the FTSE 100, FTSE 250 and FTSE Small Cap Indices. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is no guarantee of future results. See www.franklintempletondatasources.com for additional data provider information.

2. Sources: Bloomberg, Numis Securities, FTSE as at 06 July 2022. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is no guarantee of future results. See www.franklintempletondatasources.com for additional data provider information.

3. Ibid.

4. Sources: Bloomberg, FTSE as at 06 July 2022. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is no guarantee of future results. See www.franklintempletondatasources.com for additional data provider information.