Key takeaways:

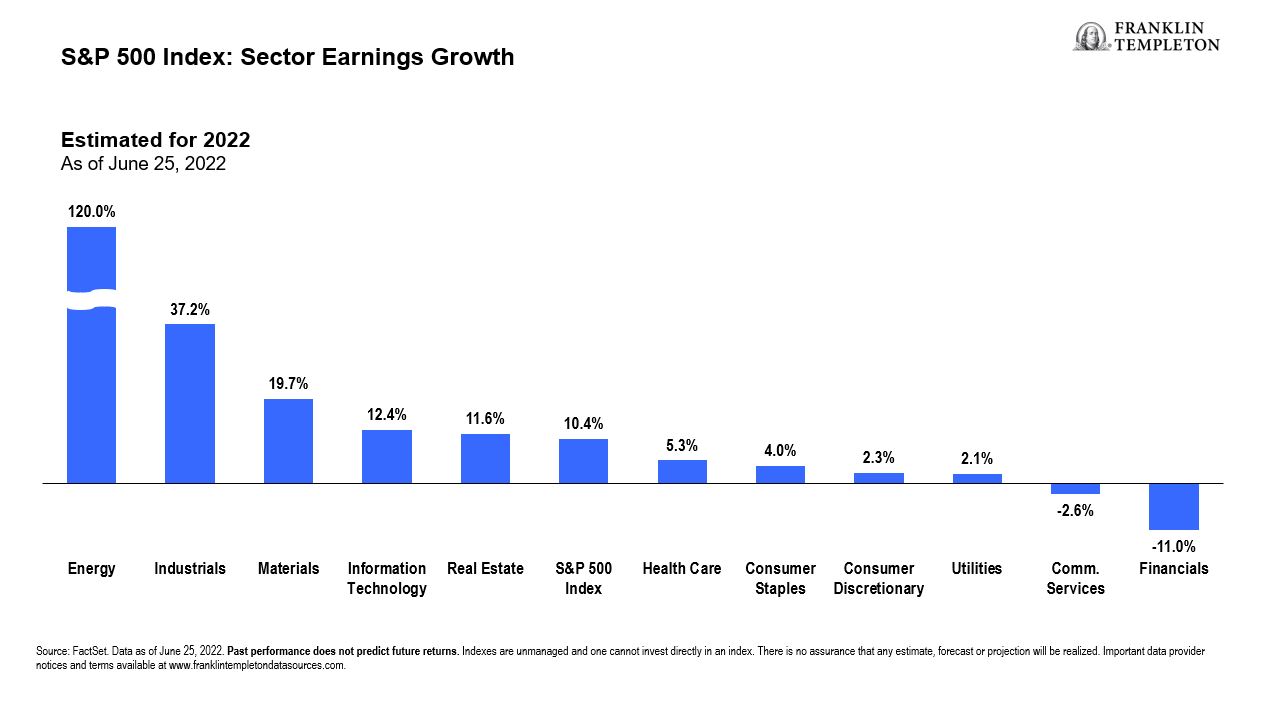

- We believe S&P 500 earnings growth will likely face pressure in the second half of the year but should remain positive in 2022.

- In our analysis, US stocks continue to trade at a premium versus other markets. We believe these higher relative valuations reflect stronger corporate profitability, better return on equity, and more robust growth in comparison to equity markets in other parts of the world.

- Long-term secular growth trends, such as health care innovation, digital transformation and the rise of fintech, remain deeply relevant even as economic growth moderates. We believe they will likely create productivity and profitability tailwinds for companies operating in these integral sectors.

- We believe businesses with robust competitive positions, strong pricing power and healthy financials should perform well in any market environment.

- We believe outperformance is generated by identifying long-term winners rather than timing short-term trades in the market. As such, we view the current volatility as a compelling buying opportunity.

The short video below talks more about these same themes:

Current US economic outlook

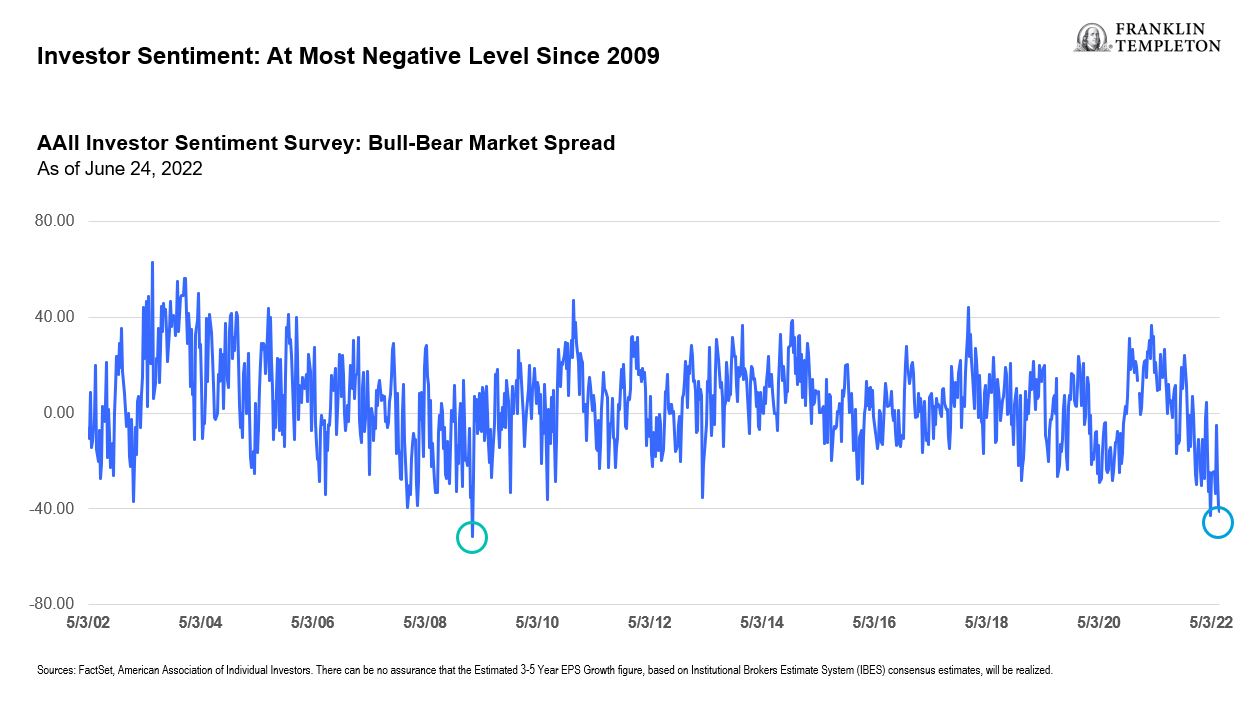

Global markets are at a crossroads, reflecting deep concerns around inflation, interest rates, moderating economic growth, and elevated geopolitical uncertainty in Europe as it pertains to the Russia-Ukraine war and its potential ripple effects. Market sentiment has swung dramatically, from bullish peaks in 2021 to extremely bearish levels in recent weeks. Indeed, sentiment indicators are close to the lows of 2009. This is notable considering that the state of the economy today is certainly stronger than 2009, when the US economy was reeling from the impact of significant financial imbalances and an imploding housing market.

In our view, the sentiment indicators reflect anticipated economic headwinds ahead and an expectation that consensus earnings estimates could be revised lower in the coming quarters. In aggregate, we believe S&P 500 earnings growth will face pressure in the second half of the year, but should remain positive in 2022.

Valuations have rapidly contracted over the last six months; the forward price-to-earnings (P/E) ratio of the S&P 500 Index has returned to pre-COVID-19 levels and is trading about one standard deviation below its past five-year average. Stock price pressure has largely been driven by multiple compression as interest-rate increases have impacted discount rates and, in turn, reduced what investors are willing to pay for future earnings. While this is appropriate to some degree, it is notable that the profitability and earnings power of many companies remain intact and earnings reports have been resilient across many sectors. In our opinion, recent volatility has created interesting opportunities in the market for long-term investors who are able to look through the near-term turbulence and focus on the growth opportunity of future years.

In our analysis, US stocks continue to trade at a premium versus other markets. In our view, these higher relative valuations reflect stronger corporate profitability, better return on equity, and more robust growth in comparison to equity markets in other parts of the world.

While interest-rate increases can slow the economy and lead to recessionary downturns, equity markets have historically performed well in rising interest-rate environments. Over the last eight rate hike cycles dating back to the early 1990s, the S&P 500 has typically declined ahead of and going into the first interest-rate increase, but as the pace of policy tightening becomes more transparent and predictable, equity markets have tended to perform well. Looking at the last few months, the market has followed its historical pattern, but with a higher degree of downside volatility.

Long-term secular growth trends, such as health care innovation, digital transformation and the rise of fintech, remain intact. These trends were clear beneficiaries of the COVID environment but remain deeply relevant even as economic growth moderates. We believe they will likely create productivity and profitability tailwinds for companies operating in these integral sectors.

Outlook for inflation: some pressures may moderate

We think the United States has probably seen the inflationary peak, but core levels of inflation may remain stubbornly high for a while. However, we believe this should moderate as supply challenges abate and pent-up demand normalizes. As it stands, we’ve already seen some moderate pullback in commodity prices including oil, lumber and copper from very elevated levels, which should ease inflationary pressure somewhat.

It is important to note that measures of inflation, such as the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE), are lagging indicators, with substantial backward-looking components. The more forward-looking components of inflation seem to point to some moderation. Home prices have moderated in the United States and home sales have slowed meaningfully. Wage inflation has slowed, and we have started to observe layoffs across some companies—early indications that the labor market is rightsizing. The auto backlog, which was primarily driven by supply chain problems, has started to recede and auto deliveries have increased. Energy prices have also receded from recent highs. Taken together, we believe these should create an environment for moderating inflationary pressure, although the effects will only be seen in headline and core inflation gauges after a lag.

Directionally, in our opinion, inflation should continue to improve in the second half of the year and may moderate faster than market participants anticipate. This could be a net positive for risk assets as it means the US Federal Reserve (Fed) may not have to move as aggressively as it had intended in the face of slowing economic momentum. While we think inflation will moderate, there is a strong likelihood that it will not hit the Fed’s 2% core PCE inflation target. Instead, inflation may hover around a 2%–3% range for some time, reflecting the stickier aspects of inflation that may not dissipate quickly. This will keep pressure on the Fed, in that they may keep policy settings tighter for longer.

As it stands, we’re already seeing the effects of higher interest rates ripple through mortgage rates, auto lending rates and other consumer credit rates, which is likely to dampen aggregate demand further in the face of already moderating growth. The challenge for the Fed will be to calibrate monetary policy settings, such that it is tight enough to curtail inflation, yet not too tight that it triggers a deep and long recession. Engineering a soft landing is a tall order.

Probability of severe recession appears low

We believe the probability of a severe recession in 2022 is low. Underlying economic conditions in the United States, while weaker than last year, remain healthy, in our view. Two pillars of the US economy appear resilient: corporate earnings have remained relatively robust, while consumer balance sheets are solid, and debt-servicing ratios remain low. That said, earnings growth could slow and we’re likely to see a moderation of gross domestic product (GDP) growth from a fairly elevated base on a year-on-year basis.

As long as the labor market remains healthy, where unemployment hovers around 3%–4%, it is difficult to fathom a case where we enter a recession that is anything but shallow. A technical recession—two quarters of negative GDP growth—in the next year or so is certainly possible, but ultimately it is likely to be a shallow and short-lived one, in our opinion.

Sector opportunities

We have a quality basis and primarily focus on businesses with robust competitive positions, strong pricing power and healthy financials as we believe these are the companies that perform well in any market environment. Our focus on major secular themes, like digital transformation and health care innovation, invariably leads us to both established and emerging growth players in various sectors.

Companies across the globe are focused on improving productivity, lowering costs and finding ways to widen their reach and deepen relationships with customers. These often require investments in digital technologies, digital applications, software and hardware. We continue to see robust demand for technology enablers from enterprises across various sectors. The outlook for digital spending remains bright as investing in digital capabilities has moved up the needs ladder for many businesses post-COVID.

We do think that some technology players have been unfairly penalized in the recent rates-driven market correction. Many of these tech businesses are unprofitable and are likely to remain so in the near term. Being in the early stages of growth, they’re understandably focused on spending to engage the huge addressable market opportunity for their products as they grow their business. As active and fundamental investors who focus on the bottom-up, we continue to see healthy fundamentals among some of these businesses. They’re growing at a rapid clip and continue to acquire customers at a rapid pace. There are certain viral aspects to their businesses and existing customers are also spending more on their platforms.

That said, we remain discerning on our exposure, focusing on software over hardware given their resilience to supply chain snarls, and favoring enterprises over consumers given that the former is a reliable source of demand and is likely to spend more on tech. We also pay close attention to unit economics in terms of the cost to acquire a customer and the return they earn on that investment. These are the businesses we believe will shine with time and grow to be the next-generation leaders in their respective sectors.

Striking a balance

We seek a good balance of consistent, high-quality, name brand, best-in-class, established businesses along with exposure to next-generation leaders. To do this, we rely a great deal on our bottom-up, fundamental research capabilities and leverage our in-house team of analysts to uncover promising companies that have the potential to become market leaders. Having a constant dialogue with the companies we hold also helps us discern potential winners that may emerge in different sectors.

As long-term investors, we typically take a three-to-five-year view when assessing opportunities. Ultimately, we believe outperformance can be generated by identifying these long-term winners rather than timing short-term trades in the market. As such, we view the current volatility as a compelling buying opportunity.

The dramatic performance of mega-cap (companies with market capitalizations in excess of $200 billion) technology stocks, specifically Apple, Alphabet and Microsoft, relative to the broader S&P 500 Index has been a defining feature of the market environment since the onset of the COVID-19 pandemic. These three names continue to account for roughly one-sixth of the S&P 500 based on market capitalization.

While these are very good companies, in our view there are many opportunities outside of these names that offer compelling potential for alpha generation. We believe the opportunity set outside these mega-cap names is large and robust and the real opportunity for active equity investors is to find uncovered gems that have the potential to be the next generation of market leaders.

Gauging the market bottom

We do not focus or rely on any one particular indicator to divine or predict where the market is headed next. We typically observe a range of indicators to better understand the market environment.

Historically, overly bearish sentiment tends to signal good buying opportunities. Incrementally shallower selloffs in the stock market in response to adverse new information often tells us that a great deal of bad news is already baked in the price. We are starting to see this in sectors like tech. Over the next quarter, any negative earnings revisions could test this hypothesis. The reaction to companies missing earnings estimates or providing negative forward guidance on top-line earnings, costs and growth may offer insights into what outcomes the market has already priced in.

On a macro level, seeing a sustained moderation in forward-looking inflation indicators will be crucial to pinpoint the potential top-end for interest rates, as it provides some scope for the Fed to temper the pace of monetary policy tightening. Directionally, this means less headwinds and more tailwinds for risk assets like stocks.

For now, we think it is too early to call a market bottom, although we do think we’re close. Valuations are very supportive for many companies, and the outlook for growth and earnings has been significantly reset over the last six months, not just in equities, but also across many asset classes.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The technology industry can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants as well as general economic conditions. Investments in fast-growing industries, including the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

English

English 简体中文

简体中文