Introduction

I am in the process of completing a three-part series of papers about technology megatrends impacting society and what to expect with the Web3 revolution. This article recaps the innovation cycles that gave rise to these megatrends featured in my first paper—“Evolution of commercial technologies and impact on business delivery.” It also offers a preview of the five megatrends that I will discuss in more detail in my second paper coming out in the first quarter of 2023.

Tech-driven innovation cycles create new business approaches

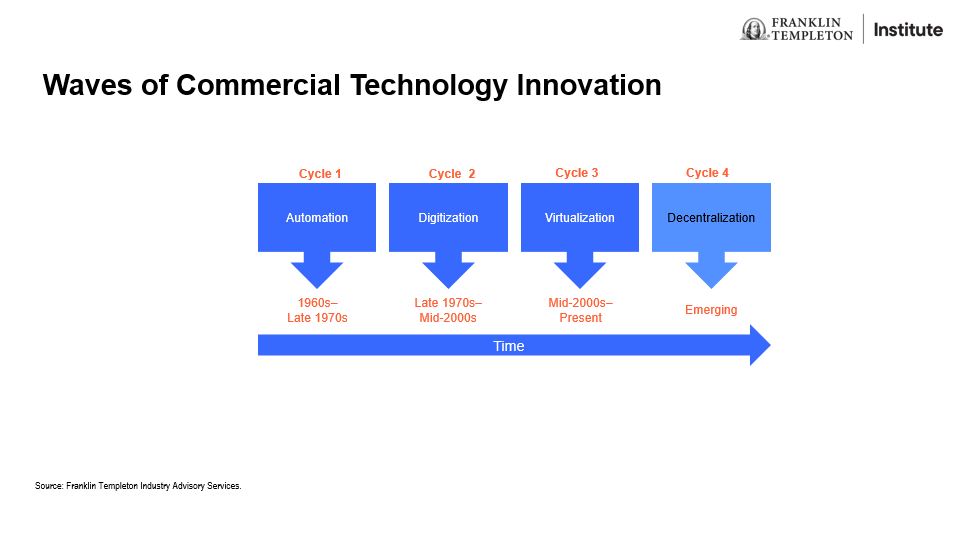

Since the 1960s, commercial enterprises have benefited from a rapid evolution in the technologies available to them—adapting many innovations originally designed for the military and previously deployed only to large universities. As these new commercial technologies have emerged, they alter what is possible for businesses and their customers. The push to adopt new capabilities requires enterprises to rebuild their delivery infrastructure. This cycle of new technology changing business abilities, and thus prompting upgrades to an organization’s platform, has now happened three times since the 1960s, and we are on the verge of a fourth innovation cycle.

The first cycle, automation, was when computers became more compact, resulting in more efficient business tasks and more centralized data processing. In the 1970s, the second cycle of digitization began with the emergence of personal computers as well as commercial off-the-shelf software. Networking also progressed, with the internet becoming publicly available in the late 1980s and websites exploding by the early 2000s. We are currently finishing up the third cycle, virtualization, that features the introduction of cloud computing, APIs and big data. These new technologies have allowed for the embedding of our social interactions into digital networks and have fostered new commercial platforms that allow individuals and businesses to interact at-will across a range of business activities.

The fourth cycle on the horizon is decentralization, where peer-to-peer interactions shift away from intermediated platforms to commercial protocols where users and resource providers are incentivized to share in the ownership of the networks they use most frequently and participate in the financial rewards those networks generate. For more in-depth information on these four cycles, please explore our recent in-depth report “Evolution of commercial technologies and impact on business delivery.”

Megatrends being enabled by tech-driven innovation

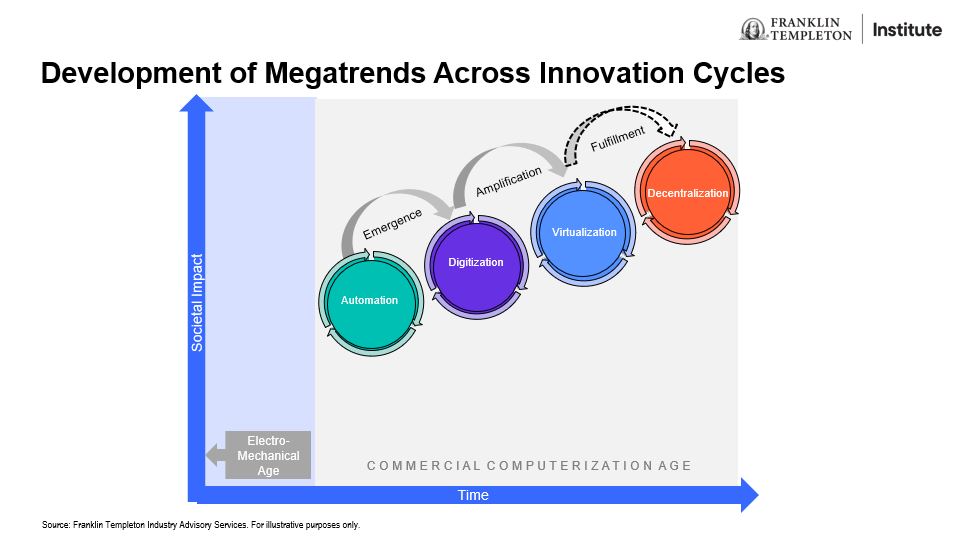

As these tech innovation cycles unfold, the impacts of continual innovation are becoming more cumulative—resulting in the emergence of five megatrends that reflect broader changes about how society operates. An introduction to these megatrends is provided here, and a more in-depth exploration of these trends and how they are likely to alter society will be forthcoming in our new report due out in first quarter (Q1) 2023.

These megatrends have already profoundly changed the power that individuals wield in society and the value drivers of commerce. The emerging fourth cycle of innovation might witness the culmination of these changes and prove to be the most disruptive yet. Indeed, society may be on the cusp of an even more dramatic evolution than the advent of the internet.

Megatrend #1: Democratization of access

The first megatrend relates to how the rails of commerce are becoming increasingly democratized. Commerce has become more open, offering individuals and enterprises unprecedented access and control over their buying and selling channels.

- During the age of automation, proprietary computer systems were built to enhance the efficiency of commerce—increasing the velocity at which transactions could take place and allowing for economies of scale in terms of pricing.

- The digitization era began to open these proprietary systems, exposing processes and data that had only been available to employees and allowing individuals to access and arrange their own commercial transactions via the web. For example, buying airplane tickets directly instead of using a travel agent.

- With virtualization, processes have moved beyond the company perimeter and are becoming distributed via platforms and networks that allow individuals and businesses to not only access and initiate transactions, but to contribute and leverage their own resources. For example, allowing others to rent your home on Airbnb.

- As the decentralization cycle takes hold, these commercial platforms are evolving into commercial protocols. Just as individuals can call up a website using web protocols, such as HTTP, new offerings will allow individuals to access process-focused protocols via the web that allow them to initiate their own contracts, create and collateralize their own assets and earn financial incentives that position them to be owners of the networks they use most frequently.

Megatrend #2: Decomposition of business value

The second megatrend shows how the drivers of business value are changing, moving from the in-house manufacture and distribution of tangible goods that can be measured by capital expenditures to a more intangible set of differentiators that increasingly rely on a broader ecosystem to fulfill key processes.

- Automation placed the focus on enhanced manufacturing abilities, with enterprises able to quantify how much they were investing to improve their throughput and scale.

- A shift away from tangible to intangible enterprise value began in the digitization cycle as automation shifted from the manufacturing plant to the front office. This allowed for a surge in the creation of innovation and intellectual property—the delivery of which became a differentiator—thus positioning knowledge-based services as a new value driver.

- In the current age of virtualization, business value is increasingly tied to powerful platforms that drive network effects. Successful businesses either foster or rely on these network effects by connecting into the ecosystems they enable, allowing the platform provider to fulfill key parts of their business process.

- As the coming decentralization cycle unfolds, affiliations with a network are likely to evolve with processes from diverse providers becoming embedded into the network, as enterprises distribute their business value by turning their processes into open-source code that can be accessed by developers and inserted into any relevant transaction flow.

Megatrend #3: Expanding power of the crowd

The third megatrend focuses on evolution in the communication channels that individuals utilize to share their experiences around commercial transactions and how use of these channels has given them a voice that allows them to impact, and perhaps ultimately shape, business offerings and messaging.

- Interactive voice technologies and call centers emerged to support consumers in the automation cycle, allowing them to report feedback and concerns, but in a one-on-one manner that left consumers uncertain about the impact of such engagement.

- The emergence of bulletin boards, online forums and blogs during the digitization cycle provided consumers asynchronous feedback mechanisms that could be viewed and shared among many potential and actual buyers, as well as viewed by targeted enterprises. This marked the first steps toward the emergence of a crowd voice.

- Social media—the hallmark of the virtualization cycle—has created a synchronous feedback loop between consumers and commercial enterprises, elevating in many instances the views and opinions of individuals over the official brand messaging and advertising of the company itself and encouraging the engagement of a new class of influencers to shape opinions.

- The coming decentralization cycle marks the emergence of a peer-to-peer economy and directly involves consumers via new governance processes that incentivize the most active participants of a network to become owners and a part of the community that sets the business strategy for the commercial protocol.

Megatrend #4: Institutionalization of the individual

Institutions use their organizational resources to pursue long-term goals for their underlying members, accessing many financial and social opportunities to achieve their success. The fourth megatrend explores how individuals have been gaining access to these same levers to optimize the use of their personal resources to meet their own long-term goals.

- The automation cycle supported a massive improvement in record-keeping that allowed for the creation of the credit card that could be issued at scale—allowing individuals to purchase items on credit and extend their buying power, just like institutions.

- Digitization provided individuals a powerful new tool—the personal computer—and created new channels for individuals via the internet, allowing them to access and engage experts and transact directly with suppliers via their online websites, giving individuals more abilities that were previously reserved solely for institutions.

- Virtualization has allowed individuals to become part of far-reaching online communities and commercial platforms, which in turn has allowed them to shape their own personal brand via social media, connect to allied networks, and utilize their personal assets to earn revenues—all activities that institutions have traditionally pursued.

- Decentralization should close any remaining gaps between individuals and institutions as participants in commercial protocols will be able to raise capital directly by issuing NFTs that encapsulate their personal assets and by using their broader set of digital holdings as collateral to borrow against, loan or stake without needing the approval or facilitation of an intermediary.

Megatrend #5: Quantification of behavior

The final megatrend explores how each tech-driven innovation cycle has resulted in the creation and storage of a growing set of transactional and process-related data and how the mining of these data have helped to enhance commercial outcomes and become increasingly targeted and personalized.

- Executive information systems emerged in the automation cycle, pulling together information from all the various branches and departments of an enterprise to give the C-suite insights into their business activities to enhance their decision-making.

- Growing use of specialized systems in the digitalization cycle—such as customer relationship management, enterprise resource management and point-of-sale transaction processing—allowed information to be gathered at a process level and analyzed to enhance service delivery and improve outcomes.

- Powerful new data processing techniques and artificial intelligence have been deployed in the virtualization cycle to target how individuals behave at each stage of a process and compare their activity to actions taken by similar cohorts with the goal of tailoring a user’s experience and increasing the likelihood that the user will engage or transact.

- The decentralization cycle is likely to see algorithms extend beyond how individuals engage in a process to modeling the individual themselves across multiple processes and tying together insights about their activities and behavior to build customized offerings that are based on the individual’s unique profile.

Impact on society

Collectively, the megatrends previewed in this piece have been gaining ground as each new tech-driven innovation cycle unfolds. The megatrends emerged as the impacts of automation were being fully understood and transitioning to digitization. They became amplified as digitization progressed through the 1980s into the early 2000s and virtualization took hold, and they are likely to find their fulfillment in the coming cycle of decentralization.

If the megatrends progress as we anticipate, in the space of 60 or so years, consumers will have gained tremendous agency and become powerful drivers of commercial activity able to use their resources collectively or as individuals to direct and manage their own lives and livelihoods; while at the same time, commercial enterprises will have shifted from being powerful monoliths that manufactured and distributed their own goods and services to become increasingly enmeshed in a broad networked ecosystem that brings together vast resources and efficiencies in a manner increasingly designed to appeal to the end-user’s experience.

These concepts will be explored in more depth in our upcoming piece due to be released in Q1 2023.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in fast-growing industries like the technology sector (which historically has been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.