The investment landscape heading into 2023 is very different to 12 months ago, when there really was no alternative to equities, and investors were locked into a desperate search for yield across all asset classes. The US Federal Reserve’s (Fed’s) singular focus on controlling inflation during 2022 resulted in an aggressive cycle of rate rises, which in turn tightened financial conditions, leading to a sharp rise in yields and spreads on fixed income assets.

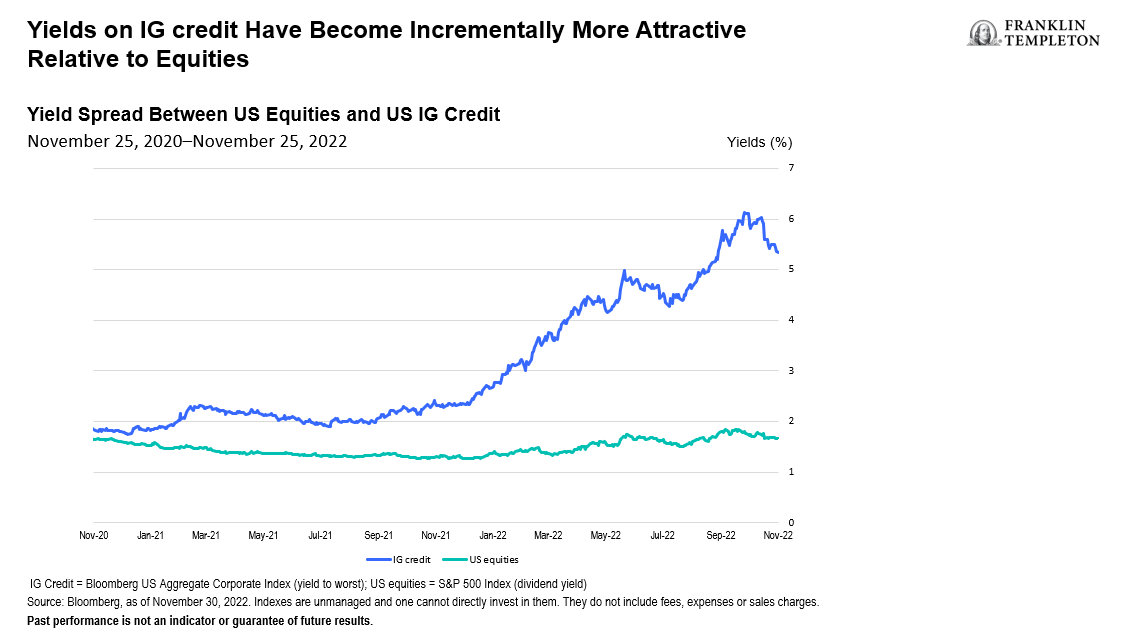

A year ago, yields on high-quality credit did not seem attractive to us, prospects for total returns were poor, and bonds were not acting as a diversifier. Today, we believe the same assets offer better total return potential than equities, while the positive correlation with stocks is also breaking down, allowing fixed income to offset equity market volatility (See chart below).1

As a result, Franklin Income Investors (FII) continues to invest with a preference for fixed income, moving closer to a 60/40 split in favor of bonds over equities. Moving forward, our allocation decisions will be driven by what happens with interest rates and inflation during 2023. We believe the move higher in rates is likely almost done, but we expect a long pause from the Fed before any pivot, meaning our attention will be focused on the effect rate hikes have on the economy and inflation. The uncertainty lies in whether the lagged effect of tightening financial conditions and a more challenging growth environment results in a real pullback in fundamentals.

Improved total return potential within fixed income

Allocation within the fixed income asset class will also depend upon where markets go, although investment-grade (IG) credit is currently our preferred asset class in terms of total return, income and risk management. In a positive economic scenario, we believe these assets have the potential to make double-digit returns as rates move lower and spreads narrow, while they should also outperform other risk assets should fundamentals deteriorate. If IG corporate bond yields move back toward 6%, then, in our view, investors should consider increasing holdings in that sector at a faster pace, taken from either equities, high-yield (HY) bonds or US Treasuries.2

However, our assessment of US Treasuries has also improved as interest rates have risen, given they currently offer attractive yields and downside protection should a recession increase equity market volatility. When 10-year Treasury yields were around 2% they were unattractive to us, but extending duration to lock in yields at 4% is much more compelling from an income perspective. This means US Treasuries will form a core part of FII’s ongoing strategy into 2023.

Elsewhere, the HY bond sector is, in our view, more resilient than many investors believe, absent a significant negative impact on corporate earnings. Most HY issues won’t need to be refinanced in the next few years, and therefore a recession in 2023 with a modest pullback doesn’t overly concern us. As a result, while the investment community focuses on whether spreads are wide enough to justify a move into credit, we see opportunities at current yields, which have shot up to levels not seen for 15 years.

We don’t think spreads are likely to rise significantly, which means we are very comfortable being in the credit space, particularly at such low prices. Against this background, we believe it is a relatively straightforward call to add selectively to HY credit at the expense of higher volatility equity holdings that, in a recessionary scenario, should underperform credit.

In a worst-case scenario, a prolonged period of higher rates or further tightening would eventually put pressure on over-levered companies that need to refinance their debt. Under those circumstances, it is possible to engage with public companies to help them refinance their debt on a private basis, however, we believe the opportunities for healthy returns in the public markets are currently so attractive that private investments would likely not be adequately compensated for the additional illiquidity premium.

Managing equity uncertainty

We still see opportunities for selective investment in equities to maximize yield and total return while navigating increased volatility. For equities to rally, we believe it would take a favorable trajectory around inflation and economic growth, while earnings would also need to remain relatively robust. We would also want to see the Fed pause rate hikes, move into a position to normalize rates, and get back to a neutral setting. Alternatively, there could be further downside for equities if the economy feels the impact of tightening in 2023 and earnings suffer.

In our opinion, equity-linked notes (ELNs) offer a way to manage this uncertainty, while expanding the universe of stocks available for investment. ELNs enable investors to derive income from exposure to equities that offer little or no dividend and can be used in conjunction with common stocks to access both yield and price upside potential. These instruments can also be used to smooth volatility and hedge exposure.

The power of duration

In summary, we believe the investment environment during 2023 promises to provide much greater potential for yield and total return than we saw at the turn of 2022. In our analysis, locking in attractive yields through duration is the best way to achieve income goals, while investing in fixed income assets at attractive prices should deliver robust returns if rates fall and spreads narrow due to looser Fed policy. Additionally, we think higher-quality bonds offer significant downside protection should any recession prove deeper than expected. Elsewhere, in our opinion, broad equity exposure remains important should an improvement in economic sentiment trigger an equity market rally.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. In general, an investor is paid a higher yield to assume a greater degree of credit risk. The risks associated with higher-yielding, lower-rated debt securities include higher risk of default and loss of principal. Treasuries, if held to maturity, offer a fixed rate of return and fixed principal value; their interest payments and principal are guaranteed.

Investments in equity-linked notes (ELNs) often have risks similar to their underlying securities, which could include management, market, and, as applicable, foreign securities and currency risks. In addition, ELNs are subject to certain debt securities risks, such as interest rate and credit risks, as well as counterparty and liquidity risk. Investments in equity index-linked notes (ILNs) often have risks similar to securities in the underlying index, which could include management risk, market risk and, as applicable, foreign securities and currency risks.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________________

1. IG Credit = Bloomberg US Aggregate Corporate Index (yield to worst); US equities = S&P 500 Index (dividend yield). Source: Bloomberg, as of November 25, 2022. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

2. Ibid.