The importance of environmental, social and governance (ESG) and sustainable investing has been growing in recent years. In 2021, 39% of investors globally were invested in ESG products—an increase from 33% in 2020.1

Our Canadian ESG survey, conducted by Directions Research, reveals that ESG is fundamentally important to investors, even those just learning what it is. We share findings from the survey, as well as data from surveys in other regions, along with our analysis and possible action items for financial advisors.

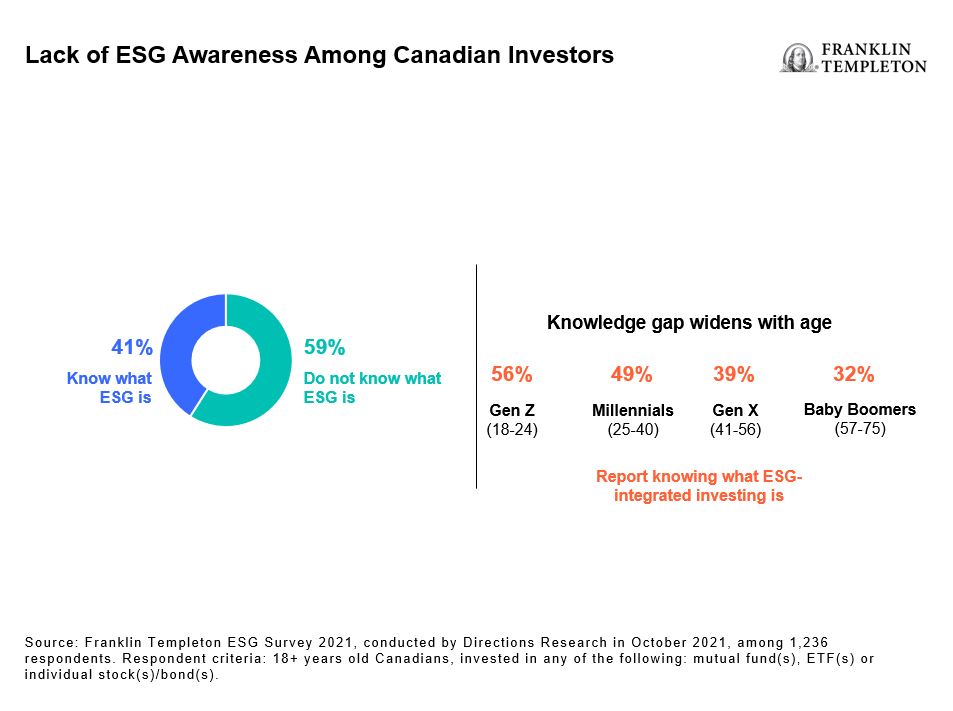

Investors lack ESG awareness

While it’s clear the world at large has a heightened awareness of environmental and social issues these days, there seems to be a general lack of ESG awareness among investors. Only 25% of investors in the United States2 and 41% in Canada profess to know what ESG is,3 and those who have never worked with an advisor are less likely to know about it.4

Investors want ESG-integrated options

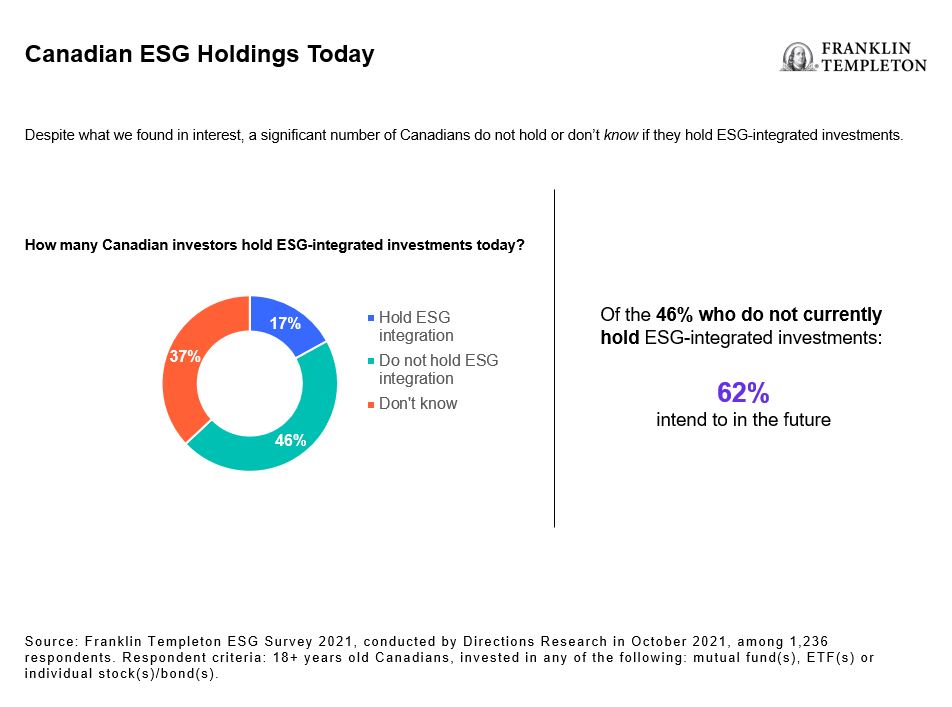

According to our survey, once a definition was provided, 61% of Canadian investors said it is important that their investment options include ESG—even those who didn’t previously know what it was. Additionally, ESG considerations are more important to women (65% for women vs. 58% for men) and younger generations (76% for Gen Z and 69% for millennials vs. 58% for Gen X and 53% for Baby Boomers). Despite this interest, a significant majority of these Canadians don’t hold or don’t know if they hold ESG-integrated investments.

In comparison, according to a Deutsche Bank survey, the worldwide percentage of investors who have completely integrated ESG into their overall process is 30%, with Europe higher at 37% and the Americas lower at 16%.5

Obstacles to ESG investing

It appears that the greatest obstacles to ESG investing are the lack of awareness and education. For Canadians who do not hold ESG-integrated investments, the top three reasons among those we surveyed are: “I don’t know enough about them,” “I’ve never thought about it,” and “My investment advisor has never discussed ESG with me.”

Analysis and possible action items for financial advisors

Financial advisors can play a key role in bolstering investors’ knowledge of ESG and ESG-integrated investment solutions. In doing so, advisors can reinforce their value to current and future clients. For example, because younger investors are more aware of and interested in ESG, advisors can use these conversations to build trusted relationships with those who will eventually inherit wealth.

Franklin Templeton ESG Survey 2021, conducted by Directions Research in October 2021, among 1,236 respondents. Respondent criteria: 18+ years old Canadians, invested in any of the following: mutual fund(s), ETF(s) or individual stock(s)/bond(s).

Franklin Templeton is not affiliated with Directions Research.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Franklin Templeton and our Specialist Investment Managers have certain environmental, sustainability and governance (ESG) goals or capabilities; however, not all strategies are managed to “ESG” oriented objectives.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Franklin Templeton Canada is a business name used by Franklin Templeton Investments Corp.

__________

1. Source: EY, “Can the difference of one year move you years ahead?” November 22, 2021.

2. Source: Gallup, “Where US investors stand on ESG investing,” February 23, 2022.

3. Source: Franklin Templeton ESG Survey 2021, conducted by Directions Research in October 2021, among 1,236 respondents. Respondent criteria: 18+ years old Canadians, invested in any of the following: mutual fund(s), ETF(s) or individual stock(s)/bond(s).

Franklin Templeton is not affiliated with Directions Research.

4. Ibid.

5. Source: Deutsche Bank Research, “ESG Survey — What corporates and investors think,” November 2021.