While metaverse-related stocks have struggled amid the recently beaten down technology sector environment, innovation from companies and content producers has hardly slowed. Take the recent interest in artificial intelligence (AI), for example. Mentions of AI in earnings calls are up 75%1 so far this year, with such discussions increasingly global and spanning more industries. The new wave of generative AI systems, like ChatGPT and DALL-E, use deep learning networks for innovation in creating content and automating workflows. They’ve also captivated investor attention, imagination and funding.

Last year, just over 100 generative AI-focused US startups fetched US$2.6 billion in investments and estimates for the funding outlook this year are comparable.2 Not only is AI technology key to the buildout and powering of the metaverse, but it’s also an area that appears to be expanding in tandem with that of immersive technology. Both themes boast a growing array of industrial use cases such as data augmentation, chip design, drug design and material science.

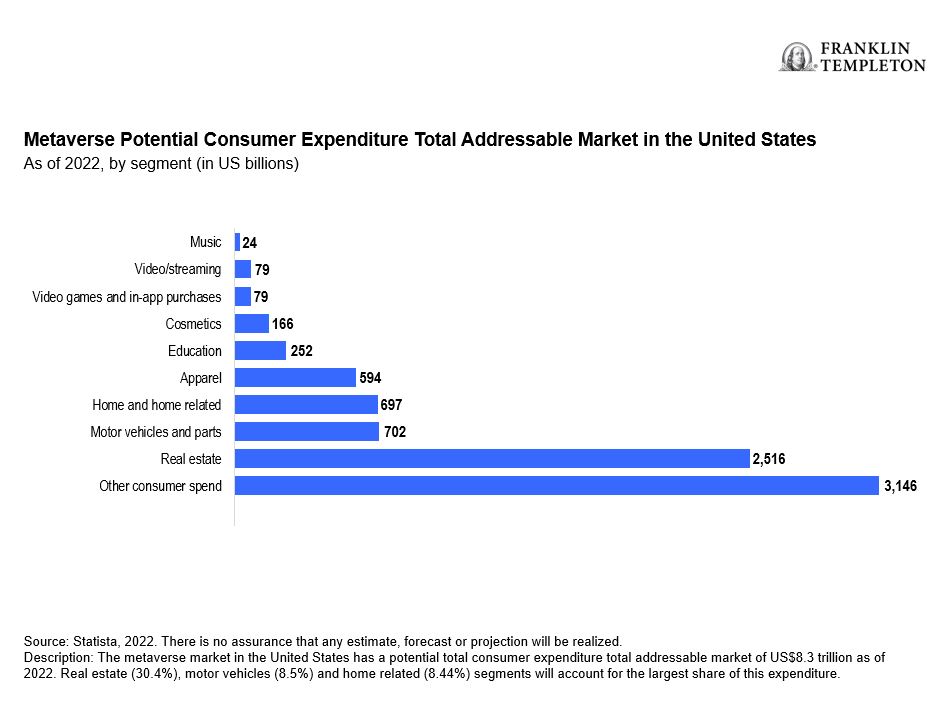

To take a step back, for the unindoctrinated, we typically define the metaverse as the next iteration of the internet—the successor to today’s global connectivity and communication methods via shared virtual and mixed reality spaces that are 3D, decentralized and interactive. As the hottest thematic concept for exchange-traded funds in 2022, the metaverse is a multi-trillion-dollar, multi-decade opportunity.

Mimicking internet growth

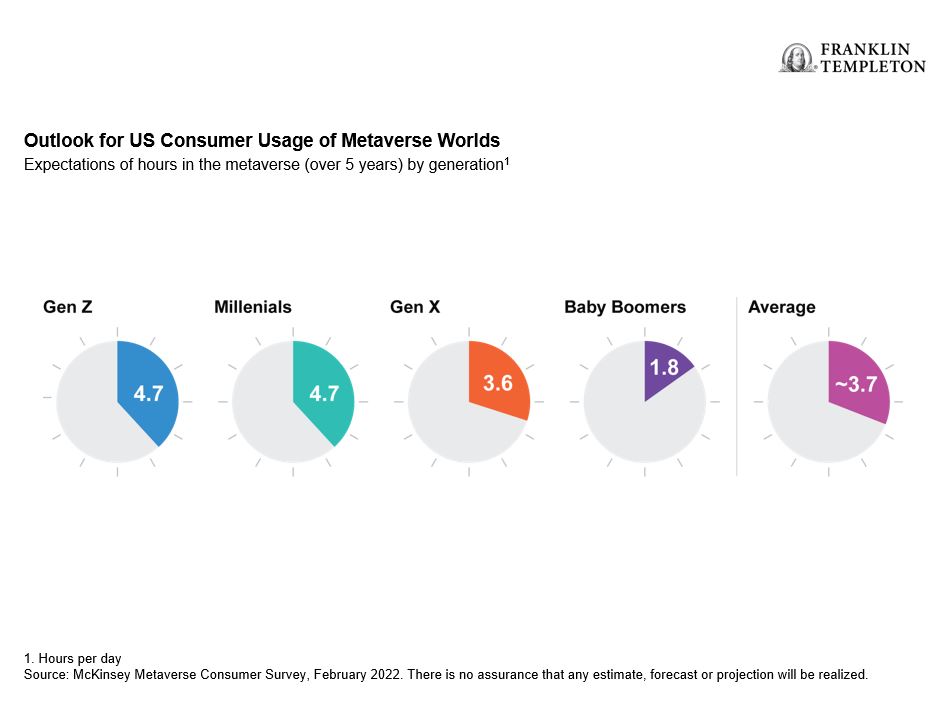

While metaverse development is still in its early stages and quite fragmented, change could come quickly. The total addressable metaverse market could reach up to an estimated five billion users—or nearly 63% of the global population—and generate revenues of between US$8 trillion and US$13 trillion by 2030, according to Citi.3 But even before then, 25% of people will spend at least one hour a day in the metaverse, predicts research firm Gartner.4 To put this growth and potential in context, nearly 64% of the world uses the internet now, with most users (three billion) residing in Asia as of last year.5

Of course, the metaverse continuum is not without its skeptics, who fear that there’s currently more buzz than adoption. Granted, the “metaverse” term itself may make it feel surreal. Nevertheless, even in this realm of infancy, the competitive business landscape has changed. Companies are clamoring for the metaverse edge and enterprise investment into the space is growing. We are also already seeing and experiencing a morphing of real and digital worlds (i.e., cycling through the Pyrenees from a stationary bike in your basement).

While entertainment (gaming and socializing) in metaverse worlds is well-known, the technology’s further potential lies in how it can aid industries. A company planning to manufacture a new product can now use more advanced forms of virtual reality (VR) to perfect fabrication plans more efficiently and collaboratively.

The possibilities are immense

Just within the auto industry alone, applications for the metaverse are already proliferating. German vehicle maker BMW is utilizing “digital twin” factories for new design customizations, which allows different manufacturing locations to sync up and learn from each other. And just like Meta’s slogan (“The metaverse may be virtual but the impact will be real”), the significant savings in time and production cost has real value to investors.

Several other new use cases were promoted and unveiled at this year’s CES (the Computer Technology Association’s annual trade show). This included VR experiences for rear-seat passengers; virtual showrooms like that of Fiat and Kia Germany—which allow for customizations and “in-world” purchasing; the use of ChatGPT for sales and feature tutorials; mixed reality technician servicing and haptic devices that simulate touch. The benefits range from futuristic entertainment to efficiencies in inventory management.

In other new use cases, Johns Hopkins University neurosurgeons are already using augmented reality to perform spinal surgery. Last year, the National Aeronautics and Space Administration (NASA) launched a metaverse coding challenge, and the US Army and local law enforcement have also ramped up virtual world efforts for recruitment and instruction. As a global innovation hub, South Korea has several government and corporate initiatives well under way, including Metaverse Seoul, which will give users access to public services, such as permitting avatars to visit tax offices.

While a chatbot didn’t write this particular commentary, the global financial services industry is also tapping into the innovation. Investors looking to add metaverse exposure to portfolios can themselves leverage the potential benefits of AI’s role in index methodology. This is accomplished via tools using natural language processing algorithms to parse large volumes of data that guide portfolio selection.

The Solactive Global Metaverse Innovation Index, for example, employs such a proprietary tool to select, vet and rebalance technology companies that offer metaverse products, including blockchain applications.6 Each stock is screened for sustainability and governance compliance and assigned a relevancy score and ranking. Will Google lose the AI war to ChatGPT? Does the metaverse’s brightest future tilt more toward consumer or industrial sectors? Rules-based ETF strategies tracking such indexes can offer an advantage in that they automatically adjust portfolios to capture optimal metaverse exposure.

While the environment for businesses and end users to move seamlessly between various worlds is still nascent, new networks are already forming. Enterprise use cases in coming years will likely span internal collaboration, client contact, sales and marketing, advertising, events, engineering and design, and workforce training and recruitment. The enhancement of progressive technology and rising computation power has paved the way for a growing number of global firms to develop new ways to profoundly impact societies and global economic growth. We expect that enthusiasm for immersive technology and virtual marketplaces will persist and that the secular growth of digitalization and the opportunity set for driving long-term investor returns will be too big to be ignored.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.

Investments in fast-growing industries like the technology sector (which historically has been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security.

Buying and using blockchain-enabled digital currency carries risks, including the loss of principal. Speculative trading in bitcoins and other forms of cryptocurrencies, many of which have exhibited extreme price volatility, carries significant risk. Among other risks, interactions with companies claiming to offer cryptocurrency payment platforms or other cryptocurrency-related products and services may expose users to fraud. Blockchain technology is a new and relatively untested technology and may never be implemented to a scale that provides identifiable benefits.

For actively managed ETFs, there is no guarantee that the manager’s investment decisions will produce the desired results.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: MarketWatch. “Tech execs didn’t just start talking about AI, but they are talking about it a lot more,” March 7, 2023.

2. Source: CB Insights. January 25, 2023.

3. Source: Citi GPS: Global Perspectives and Solutions, March 2022. There is no assurance that any estimate, forecast or projection will be realized.

4. Source: Gartner press release. “Gartner Predicts 25% of People Will Spend At Least One Hour Per Day in the Metaverse by 2026,” February 7, 2023. There is no assurance that any estimate, forecast or projection will be realized.

5. Source: Statista, February 2023.

6. The Solactive Global Metaverse Innovation Index represents companies that provide or use innovative technologies to offer products and services around the metaverse and supporting blockchain technologies. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges.