Value stocks spent over a decade in the wilderness. But after a rebound in 2022, we believe the style is on track for a multi-year resurgence. In our analysis, valuations remain cheap, earnings are growing, and the inflation and interest-rate environments may be supportive. Greater investment in the traditional industrial economy should be another positive support. Growth stocks may manage to do well in fits and starts, but the trend looks to us to be in value’s favor.

Value grows

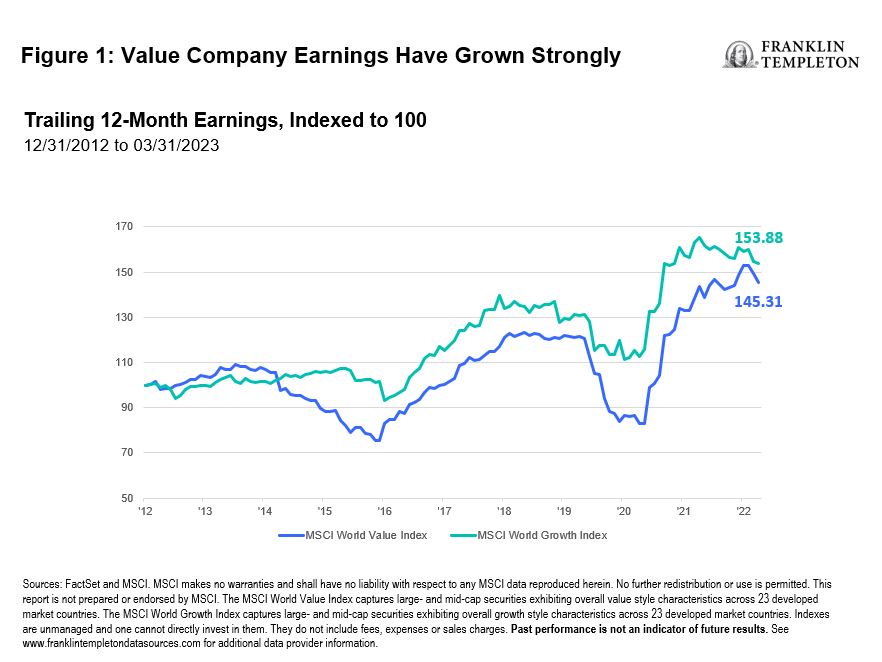

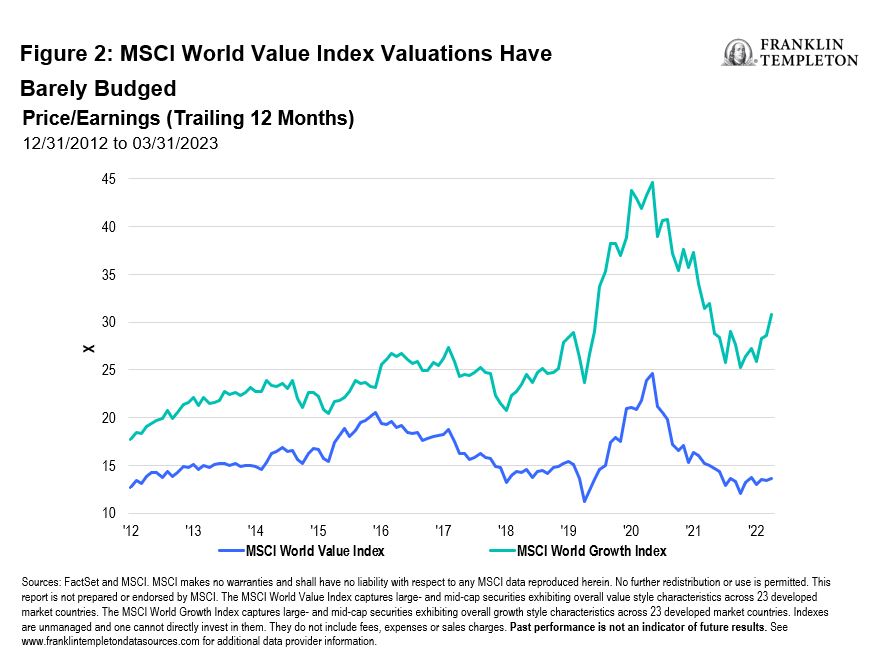

Valuations look attractive to us even after the value style’s outperformance in 2022. At the end of March 2023, the trailing price-to-earnings ratio for the MSCI World Value Index was about 13.5 times, compared with 31 times for the MSCI World Growth Index.1 This gaping disparity exists even though earnings growth for the two styles is nearly similar. Trailing earnings per share for the MSCI World Growth Index have expanded about 54% over the past decade. This performance is not too far ahead of the 45% rise in earnings of MSCI World Value companies.2 (See Figure 1). That means an investor who invests in the growth index is paying more per unit of earnings growth than an investor who chooses value.

The growth index has seen its multiple expand dramatically over the past decade, while the multiple for value stocks has barely budged (See Figure 2), leaving the premium over value at levels higher than the tech bubble of the early 2000s.3 This gap is unlikely to remain, in our view. Value company earnings have been strong, which we think may cause multiples to start to converge as the year continues.

A bullish backdrop

And after years of near-zero interest rates and low inflation, modestly higher rates and moderate inflation should provide value stocks with an additional lift. Value companies, which tend to be in areas of the market such as energy and financials, generally make their money in the near term. As a result, earnings are discounted less than growth company earnings, like at tech firms, whose profits and cash flows are booked at some distant date.

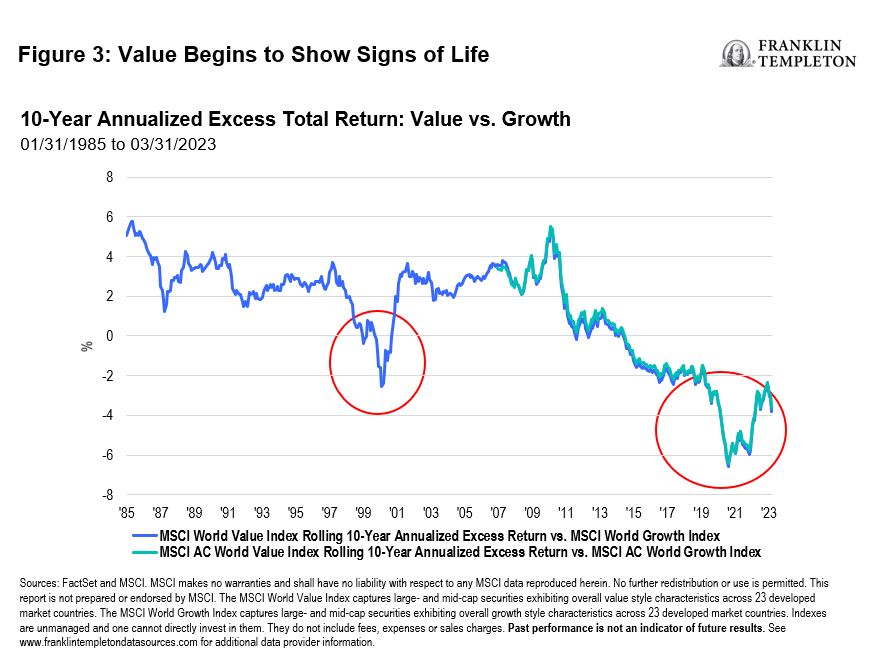

With interest rates having increased sharply in 2022, growth company earnings are now discounted at a higher rate, lowering their present value. Historically, we have seen value stocks outperform growth stocks once the US Federal Reserve begins to raise interest rates. These rate hikes are occurring all around the developed world, potentially giving value stocks a global boost. And value stocks have responded, with the style outperforming recently, but leaving plenty of room for continued strength, in our opinion. (See Figure 3).

Moreover, moderate inflation can be good for value stocks. These companies may be in a better position to pass along higher prices to customers. Increased cash flows can then be reinvested and used to grow the business. If that is not an attractive option for the cash, the company can pay shareholders dividends or buy back stock.

Go west and east

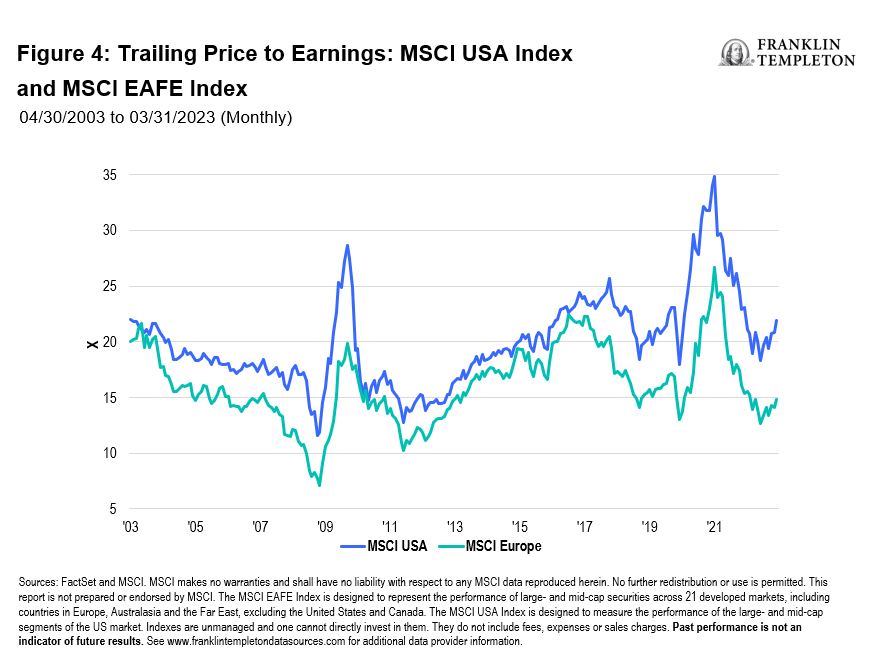

Globally, the spread between value and growth valuations may bode well for future outperformance of companies domiciled outside the United States. The US market is more richly valued than its European and Asian counterparts, making it more important for value investors to also be active stock pickers. This approach is necessary given the US market’s high overweight in global indexes. The yawning valuation gaps between the MSCI EAFE Index and the MSCI USA Index suggests that there is greater room for non-US company valuations to improve over time.4 (See Figure 4).

The makeup of the European market is also more heavily skewed toward value stocks, creating a richer hunting ground for opportunities. Financials, materials and energy stocks comprise most of the market, compared to the United States, which tilts heavily toward information technology firms.

Additionally, we believe that the developed world will be investing more in physical infrastructure over the coming decade. From clean energy initiatives to locating supply chains closer to home, the increased spending should generate greater investment in the more traditional industrial economy, made up largely of value companies, over time.

In energy, both the impact of the Russia-Ukraine war and US legislation aimed at spending more on climate change mitigation and energy security are likely to result in greater investment opportunities in those companies focused on cleaner energy and renewable power initiatives. And efforts to bring manufacturing closer to home and fortify supply chains should continue, given rising political uncertainties globally. The growing need for improved defense capabilities, liquified natural gas plants, windmills and semiconductor factories are all positive for value stocks, in our view.

We believe that active management in the value space is crucial, since understanding the companies, their businesses and the potential catalysts for their share price takes deep fundamental analysis. These stocks can be simply misunderstood, broken growth companies, turnaround candidates or value traps.5 Knowing the nuances of why a stock is undervalued is important. Value stocks can also be complementary to existing portfolios regardless of the market environment, providing greater balance and diversity, and the potential for better long-term returns.

Given the attractive valuations and earnings growth, potential for relative stability in the face of a moderate downturn, inflation and interest-rate trends and a push to local onshoring, we expect value stocks to shine in the years ahead. With the style no longer out of fashion, we believe value is truly resurgent.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested.

Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions.

Value securities may not increase in price as anticipated or may decline further in value. Investments in foreign securities involve special risks including currency fluctuations, economic instability, and political developments.

Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity.

Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Sources: Factset and MSCI. The MSCI World Value Index captures large- and mid-cap securities exhibiting overall value style characteristics across 23 developed market countries. The MSCI World Growth Index captures large- and mid-cap securities exhibiting overall growth style characteristics across 23 developed market countries. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator of future results. See www.franklintempletondatasources.com for additional data provider information.

2. Ibid.

3. Ibid.

4. Sources: Factset and MSCI. The MSCI EAFE Index is designed to represent the performance of large- and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the United States and Canada. The MSCI USA Index is designed to measure the performance of the large- and mid-cap segments of the US market. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator of future results. See www.franklintempletondatasources.com for additional data provider information.

5. A value trap occurs when an investor looks at the fundamentals and market price of a stock, and it appears the stock is valued at a discount (cheap to own), but it ends up not being the case.