We remain defensive in our market outlook and beta positioning. The focus of our investment team continues to be on capturing alpha opportunities until valuations, earnings growth, inflation and central bank policy clarity improves. Then, we will likely look to increase directional market risk.

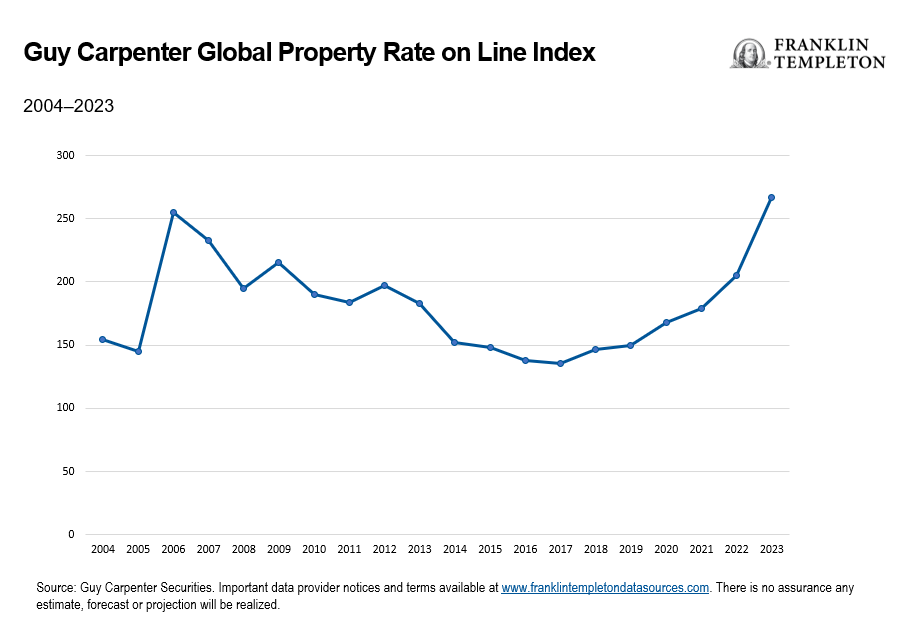

Strategy highlights

- Discretionary global macro: While many managers experienced losses around recent rates volatility, the opportunity set may become clearer as policymakers grapple with the conflicting forces of high inflation and slowing credit creation.

- Commodities: The large macro impact within energy markets has continued, with OPEC’s surprise production cut highlighting concerns over recessionary risks and subsequent demand destruction.

- Insurance-linked securities (ILS): The current market is one of the most attractive for ILS investors since asset class inception. Total yields remain elevated following January 2023 renewals, which saw tighter reinsurance capital and higher money market rates.

Macro themes we are discussing

We began the year thinking the most important factor for the markets over the next 12 months would unequivocally be inflation and inflation expectations. As we enter the second quarter, we still very much believe this is the driving force in markets. We are now approaching a fork in the road; either the US economy will have a soft economic landing, or this will be the beginning of more rate hikes to tame a stronger-than-previously-expected inflation backdrop. Both forward paths are highly uncertain given that they are the aggregate result of many disparate inputs, some of which have substantial lag effects. We are focused on upcoming earnings and the narrative around the future earnings outlook, inflation reports, credit growth, employment and consumer spending. The resulting market environment, which we believe will persist for the foreseeable future, is one of high uncertainty as the market prices forward expectations of when and how inflation will be tamed. Major price and liquidity dislocations typically accompany such regimes.

Given the complexities of aggregate inflation inputs, we continue to find it highly unlikely that central banks will accomplish their goal. The most likely scenario is a policy error; the question is how and to what degree. We continue to expect market events that cause rapid re-pricings and liquidity dislocations, such as we witnessed with the banking crisis last quarter. These “risk resets” are happening more quickly than they have historically, and they are accompanied by fast-paced re-risking as well.

We continue to prioritize capital preservation, with a strong preference toward managers that can capture long versus short alpha in shifting environments via nimble portfolios. Our high-conviction area in hedge funds continues to be discretionary global macro managers given the opportunity set for directional and relative value themes. We favor market neutral alpha-driven managers in equity long/short and fixed income. Rising cash rates in the fixed income markets could provide a ballast to strategies.

Overall, we remain defensive in our outlook and beta positioning. The focus of our investment team continues to be on capturing alpha opportunities until valuations, earnings growth and central bank policy clarity improves.

Q2 2023 outlook: Strategy highlights

Discretionary global macro

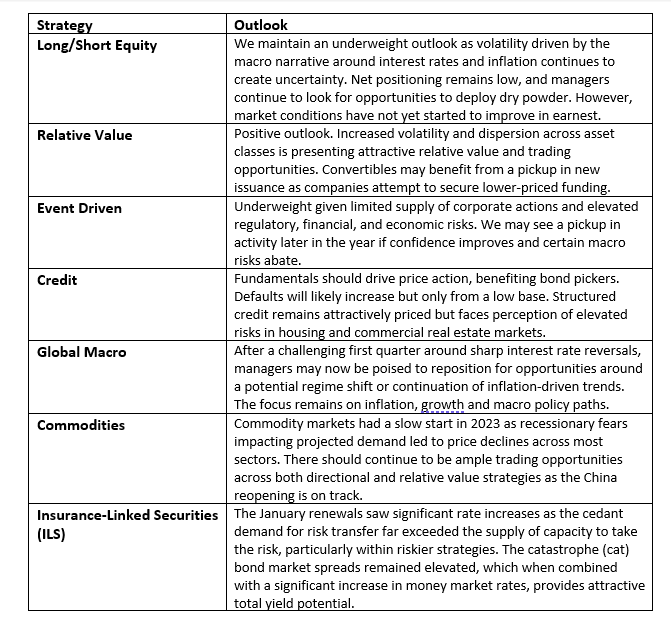

Investors have been recalibrating their expectations for macro policy paths for several months, which can have a meaningful impact on all markets, even outside of interest rates. Moves in these market-implied expectations were relatively violent around recent concerns of contagion spreading from the US regional banking sector. A spike in interest-rate volatility and a rapid reversal of market expectations (from clearly hawkish to clearly dovish within days) can have a positive or negative impact on manager performance depending on their positioning on that day; in the case of March, many macro managers were on the wrong side and lost money. However, dislocations like this recent event can create short-term trading opportunities and can potentially mark the beginning of a regime shift or establishment of a new trend. In either case, discretionary macro managers focused on the data driving these policy decisions may be well-placed to capture this opportunity set.

Exhibit 1: Market-Implied Fed Funds Hikes/Cuts

Commodities

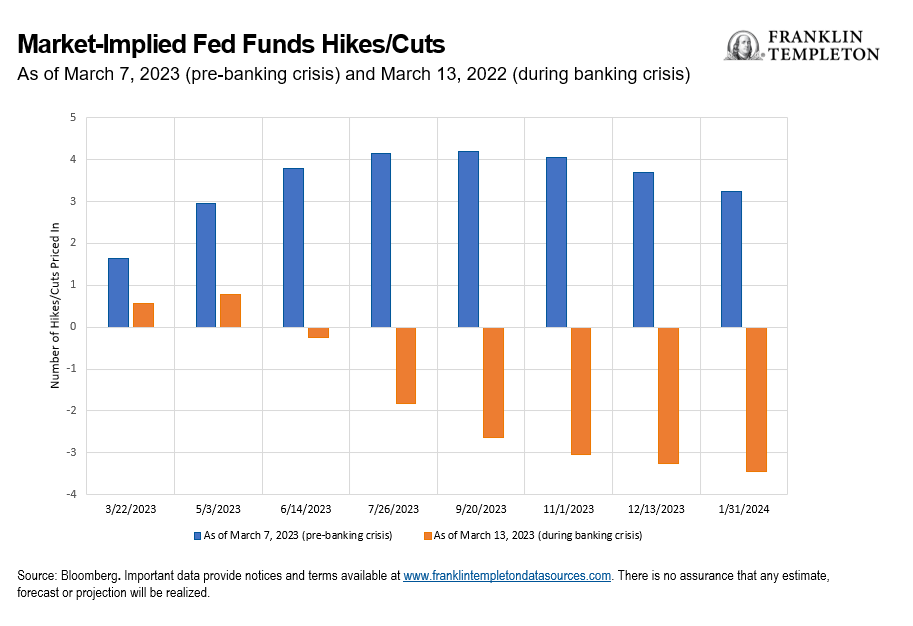

The large macro impact within energy markets over the second half of 2022 continued through the first quarter of 2023, highlighted by OPEC’s surprise production cut. OPEC+ announced a surprise oil production cut that will exceed one million barrels a day, abandoning previous assurances that it would hold supply steady to maintain a stable market. This was a significant reduction for a market where—despite recent price fluctuations—supply looked tight for the latter part of the year. Oil fell to a 15-month low in the middle of March due to the turmoil caused by the banking crisis, but prices recovered as the situation showed signs of stabilizing. This decision highlights concerns over recessionary risks and the impact on demand. A return to growth within China could buoy forward-looking prices across the crude complex, but the main question is whether that potential increase in Chinese demand will offset the potential Western demand destruction should there be a recession.

Exhibit 2: Oil ETFs See Fund Outflows

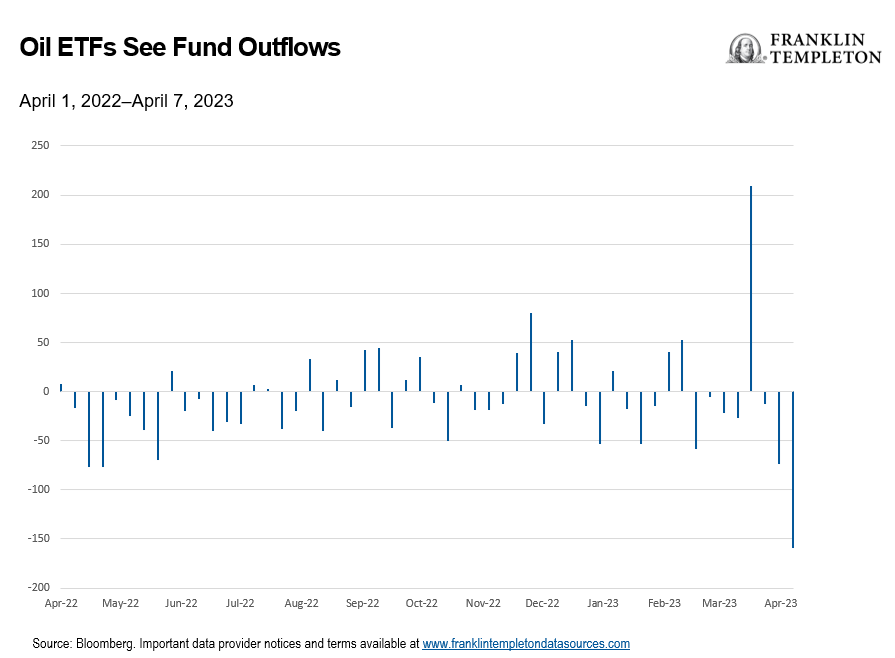

Insurance-linked securities (ILS)

The January 2023 renewals were one of the most-anticipated renewal periods since the inception of the ILS asset class in the early 1990s. Many market participants were anxious to see the level of capacity available as well as the cascading impact on pricing, both on an absolute and risk-adjusted basis. We expect the supply and demand imbalance across the global reinsurance markets to continue given anticipated strong pricing. The January 2023 reinsurance renewals saw a strong increase in the pace of pricing year-over-year. In a big difference from prior renewal periods that followed event-heavy years, there was a dearth of new capital from traditional reinsurers. Additionally, flows from alternative capital providers were limited, leading to potentially the most attractive risk-adjusted rates since the immediate aftermath of Superstorm Sandy. Further buoying our positive outlook toward the ILS asset class is its floating rate structure. ILS instruments are priced as a spread above the risk-free rate. With a sizable increase in money market rates, the forward-looking total yield expectations remain near record highs.

Exhibit 3: Guy Carpenter Global Property Rate on Line Index

WHAT ARE THE RISKS?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.