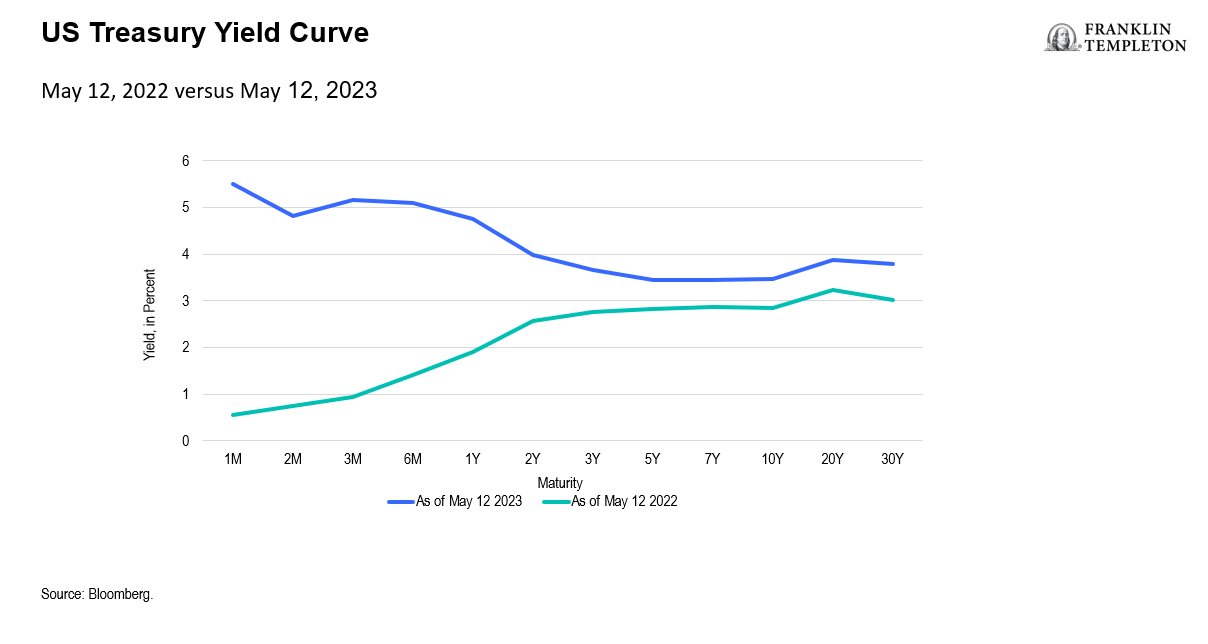

The resolve of central banks to fight inflation has caused increased volatility across capital markets—particularly in the US Treasury yield curve—owing to considerable uncertainty regarding the outlooks for inflation, growth and a potential US recession.1 Even though the US Federal Reserve (Fed) clearly stated it does not anticipate cutting interest rates later this year, the market has a sharply different view, pricing in significant Fed easing by January 2024.

Do market participants “know” what is going to happen more than the central banks? No, quite the opposite. The uncertainty of investors is reflected in the elevated volatility of interest rates in the first half of 2023.

Adding to the “known unknowns” are the recent stresses in the banking sector, which themselves were due in large part to rapidly rising interest rates. That serves as another reminder that when central banks tighten, “stuff happens.”

This time, bitter irony compounds the misery of commercial banks. In part, they face potentially large losses on their holdings of US Treasuries (i.e., Silicon Valley Bank) because regulators were keen to see banks remain liquid and safe, and nudged them in that direction over the years.

Talk about unintended consequences!

In short, monetary policy uncertainty, financial fragility and hard-to-predict outcomes for growth and profits confronted investors. But the solution is not despair. Rather, the appropriate response (at least in our view) is to take advantage of what is on offer—including higher fixed income yields at shorter maturities—and complement that approach with judicious allocations to risk assets, particularly when volatility offers opportunity.

Opportunity of (nearly) a lifetime

We begin by noting that for the first time in 15 years, investors are offered 5% returns on near-cash instruments, such as money market funds. We believe they can boost that return, with little risk, by investing in high-quality corporate bonds of less than two years’ duration. Those returns easily beat bank deposit rates, which also remain restricted to a statutory US$250,000 deposit insurance cap.

Money market funds and short-duration, high-quality bonds may seem an uninspired choice for many investors, but there are times when they make sense, above all when volatility is high, uncertainty prevails, and fundamental risks (i.e., recession) loom for corporate credit and equity markets.

Pounce on opportunity

That is not, however, to say that portfolios should be 100% parked in instruments of less than one year in duration. Not only might that be tax inefficient, but it also misses our second key point.

Specifically, by holding onto a larger fraction of interest-bearing and highly liquid assets, investors can act nimbly when opportunities present themselves. High volatility and market dislocations, which are historically probable when the Fed and other central banks are tightening aggressively, create more attractive entry points for stocks, government bonds and corporate credit. When bought at discounts, those assets typically offer outsized returns for investors.

Moreover, by increasing holdings of (nearly) riskless assets, investors are better placed to take selective risk today.

What do we mean by selective? Consider the challenges of buying Treasury bonds. Taking duration risk when the yield curve is inverted (as it is presently) requires high levels of confidence that inflation will rapidly decline to the Fed’s target or that a significant US recession is on its way. That’s because longer-dated bonds offer yields as much as 170 basis points below shorter-dated Treasuries. That means the total returns on long maturity bonds will be lower unless yields fall further. That’s a lot of risk relative to the potential rewards.

As noted, within fixed income markets, a tilt toward shorter-dated (1-2 year) baskets of investment-grade corporate bonds seems prudent, with average yields above 5%. This is a way for investors to create steady returns in the face of earnings weakness (investment-grade companies are less likely to be downgraded) without taking unappealing duration risk.

When looking at high-yield corporate bonds compared to other fixed income opportunities, risk versus reward looks challenged given headwinds facing corporate profits and cash flows. However, a large proportion of the high-yield universe has increased in credit quality. We believe this creates a reasonable case to swap equity exposure with selected high-yield debt that is facing lower default risk than the asset class in general. This provides the protection of the currently elevated shorter-duration yield (averaging roughly 8.6%) while still providing exposure to the upside to any improvement in underlying company fundamentals.

Through funds, diversification is also a benefit. Similarly, we prefer local currency emerging market debt securities. They should benefit from stronger Chinese growth this year (many emerging economies are exporters to China), as well as from a probable weakening of the US dollar once the Fed has concluded its tightening cycle.

Summary

Here’s the case we are making in a nutshell. Because of aggressive monetary policy tightening, we believe the Federal Reserve is making short-term money market and shorter-duration fixed income returns attractive, while at the same time creating the conditions in which equities, as well as longer-dated bonds, are unattractive, in our view. We think investors should take what the Fed is offering, and limit broad exposures to the rest.

But that’s not the end of the story. By taking refuge in safe, attractive yielding positions at the very front end of the yield curve, investors can also be prepared to seize opportunity when it presents itself.

Also worth noting, the recovery of the Chinese economy and a probable peak in the US dollar already offer investors opportunities via measured allocations in emerging market local currency debt.

The Fed remains the straw that stirs the drink. When it stirs this vigorously, stuff happens. Investors should take note, seize the more certain returns on offer and be prepared to take more risk when opportunity becomes present. This is a phase, but a phase worth managing well.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline.

Investments in lower-rated bonds include higher risk of default and loss of principal. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. High yields reflect the higher credit risk associated with these lower-rated securities and, in some cases, the lower market prices for these instruments.

Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

________________

1. Based on our analysis of data from ICE BofA Indices, the annualized standard deviation of monthly returns attributable to yield curve shifts for the ICE BofA US Treasury Index is 4.74% over the period January 2002 to April 2023, while over the last 12 months ending April 2023 that annualized standard deviation is at 7.80%. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.