Key Points:

- Equity markets have rallied since the cyclical lows in October. We think markets have run ahead of both current and expected growth.

- Earnings season provides a potential catalyst for renewed equity weakness. We look for second quarter US earnings-per-share (EPS) growth to continue its downslide.

- We are defensively positioned, currently favoring cash and fixed income over equities in our dynamic outlook.

The “Running of the Bulls” is a tradition that occurs every summer in Spain which involves running in front of a group of bulls that have been let loose on sectioned-off streets in a town, usually as part of a summertime festival. Part of the allure is the inherent danger of this activity—poor timing and calculation could lead you to be on the wrong end of a bull horn.

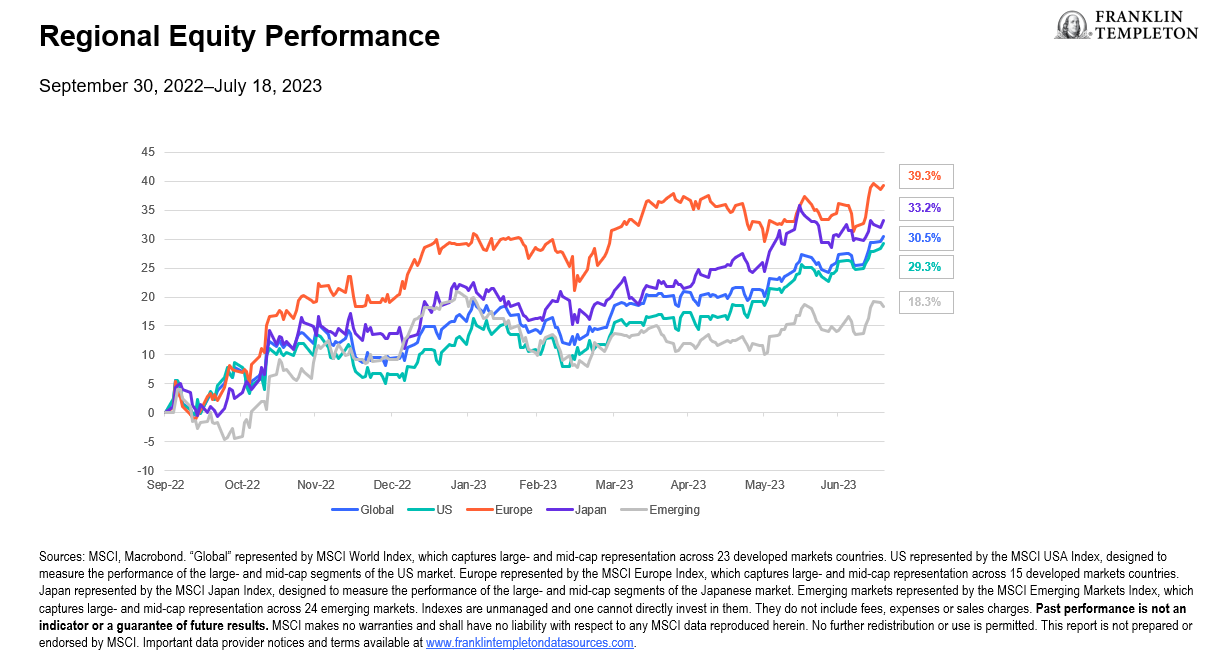

Since the equity market lows in October, many regions have entered a new bull market (Exhibit 1). As equity markets have rallied, sentiment has improved and volatility has diminished. A market that was previously obsessed with recession risk seems to have quickly moved on.

Exhibit 1: Bull Markets Are Emerging Across the World (right click on chart to enlarge)

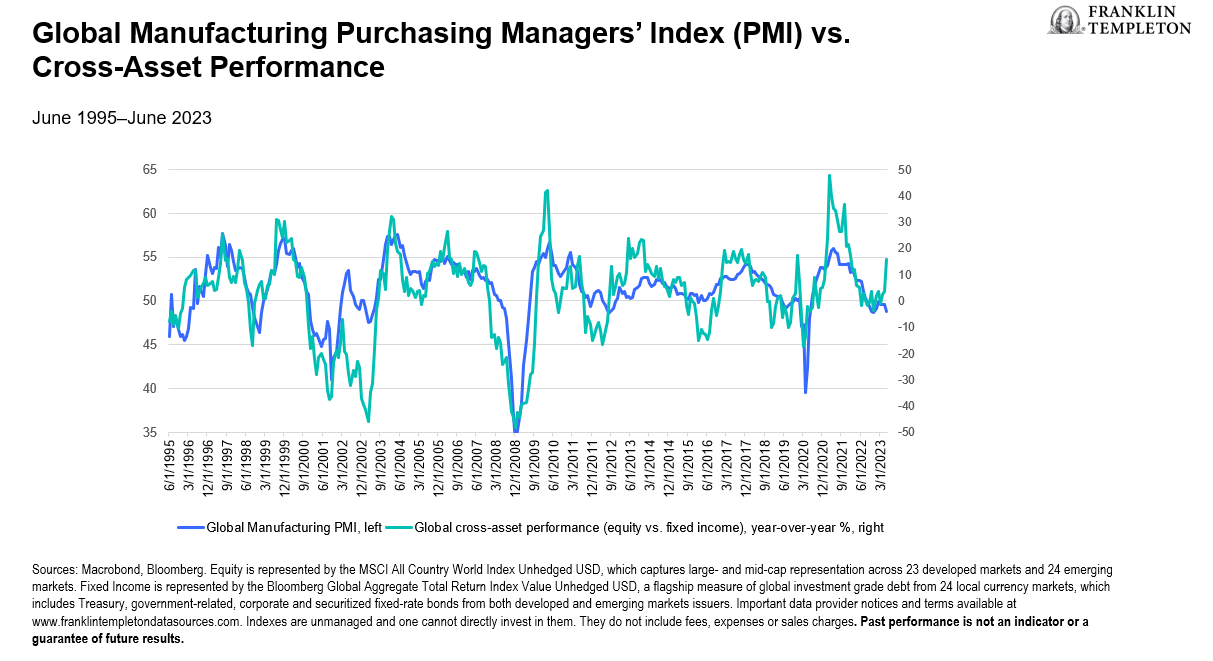

We believe there is risk in trying to run with the current bull markets. Asset prices are suggesting cyclical growth will not only remain positive, but will accelerate above-trend in the coming months. We think this is unlikely as central banks remain restrictive and cyclical growth momentum, outside of asset prices, remains subdued (Exhibit 2). In our view, even bullish macro forecasts should include positive—albeit below-trend—growth, for inflation to continue slowly normalizing.

Exhibit 2: Asset Prices Are Suggesting a Strong Rebound in Growth—We Think This is Unlikely (right click on chart to enlarge)

Is there a catalyst?

Restrictive central banks and weak growth momentum are nothing new—so what’s the catalyst for equity markets to move lower in the near term? We think the upcoming earnings season will be pivotal for a few reasons.

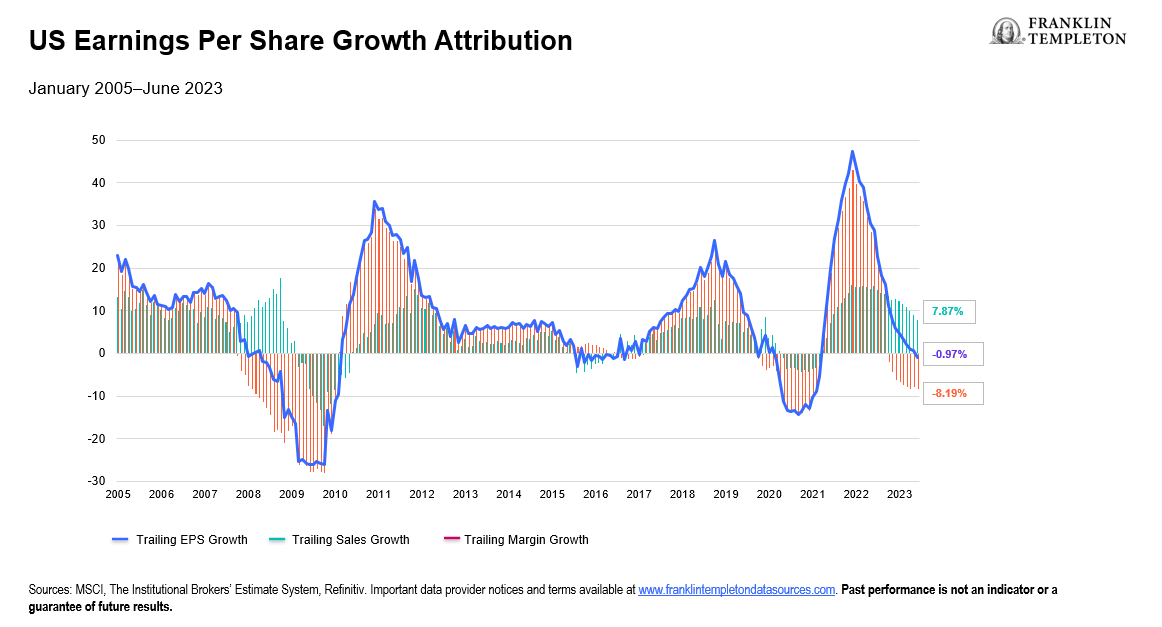

US earnings growth may worsen. In the United States, profit margins have declined 8% year-over-year, but EPS growth has barely contracted as sales growth remains strong. There are a few reasons why we expect this dynamic to weaken moving forward. First, profit margins typically lead sales growth lower when earnings turn negative (Exhibit 3). We expect margins to remain weak, if not deteriorate. Second, lower inflation is contributing to weaker pricing power for companies. We expect inflation to continue to normalize, and this will likely dampen sales growth and put additional pressure on margins.

Exhibit 3: Negative Margin Growth Is a Leading Indicator for Sales Growth to Weaken Further (right click on chart to enlarge)

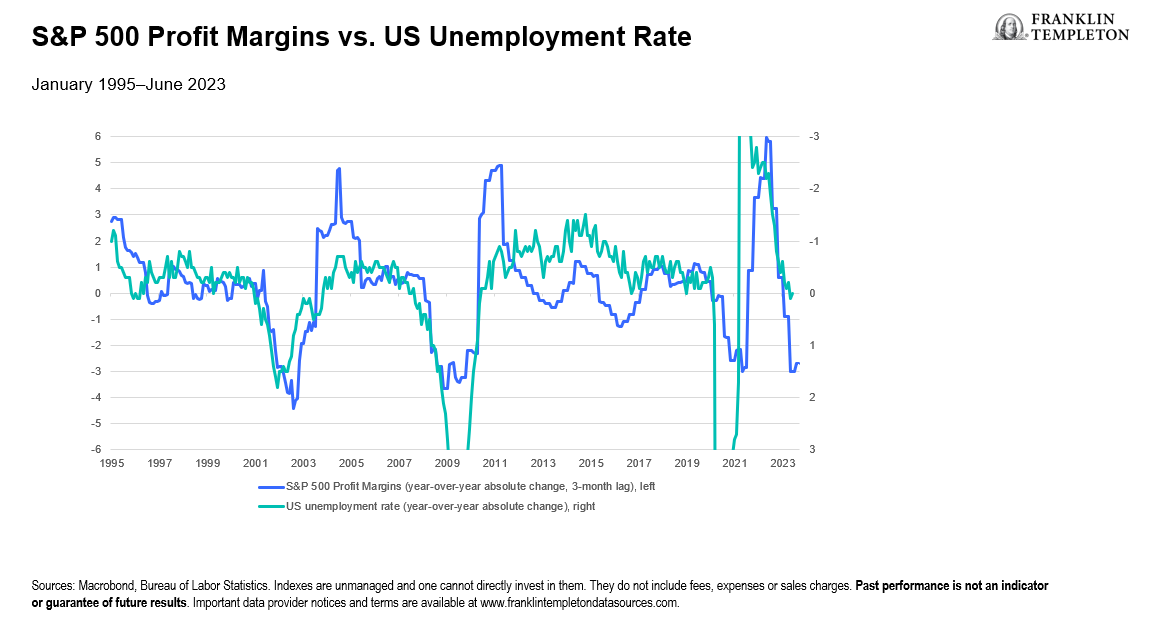

Weak profitability may lead to weaker labor markets. The resilient labor market has buttressed equity markets, and this resilience naturally pushes back on recession probability, as a weak labor market is typically needed for recessions to occur. So far, the strength of the labor market can be explained—firms entered the growth slowdown with record-high profits and weak labor supply.

However, these factors have corrected recently. US profit margins have moved meaningfully lower, and earnings growth has turned negative. Labor supply for prime-age adults is now stronger as compared to pre-COVID levels. In fact, many leading indicators in the US labor market suggest some softening is already taking place, including a slight rise in initial unemployment claims, lower hours worked, weak hiring intentions, and weakening breadth in payroll growth. We think additional weakness in earnings and profitability will push these employment trends weaker.

Exhibit 4: Weaker Corporate Profitability May Lead to Higher Unemployment (right click on chart to enlarge)

Multi-asset allocation: Putting it all together

Overall, our tactical view is to position multi-asset portfolios defensively; we currently prefer fixed income over equities. While our macro outlook supports this positioning, as we outline above, we also think relative valuations support fixed income. Equity risk premium, which measures the relative attractiveness of equities to interest rates, is currently more supportive of government bonds. Cash is another attractive option over equities, in our view. Many cash rates are near cyclical highs and now offer positive real returns—a rarity over the last decade.

There are also a number of sentiment and positioning indicators that suggest equity markets are over-extended and due for a pullback. While a growing number of investors are gaining confidence in running with the bulls, we exercise caution. We will continue to monitor leading economic indicators and corporate fundamentals going forward.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls.

The allocation of assets among different strategies, asset classes and investments may not prove beneficial or produce the desired results.

To the extent a strategy invests in companies in a specific country or region, it may experience greater volatility than a strategy that is more broadly diversified geographically.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Active management does not ensure gains or protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.