Having endured many plot twists since the United Kingdom voted to leave the European Union (EU) in 2016, the UK stock market has been a notable laggard among global peers.

As of the end of July 2023, US-listed UK mutual funds and exchange-traded funds continued to see year-to-date outflows of US$560 million.1 For the past 12 months through July 31, 2023, UK equity outflows totaled US$1.1 billion, making the market particularly unattractive amid the outperformance of US and European stocks over the same timeframe.2

But with a flagging US stock market, investors are again eyeing the UK’s undervalued and long-unloved market. Outflows have recently slowed in the United Kingdom as investors have been signaling a return of some optimism for the economy’s enticingly cheap investment prospects. Falling energy and stabilizing food prices helped cool Britain’s annualized consumer price inflation rate from June’s 7.9% to July’s 6.8%. While the UK’s inflation rate is still far higher than the Bank of England’s 2% target, we believe its recent downturn could suggest a turning point. The Conservative Government—trailing significantly in polls ahead of a general election expected in late 2024 or early 2025—has made bringing down inflation one of its campaign priorities.

Compelling valuations

Undervalued in absolute terms, relative to their own history and compared to other developed markets, British stocks remain in the bargain bin. In our analysis, they appear particularly cheap against equities in the United States and Japan, whose weightings dominated the FTSE Developed Index at the end of July with 67% and nearly 7%, respectively. The United Kingdom held a 4.3% weighting in the index.3

Corporate fundamentals

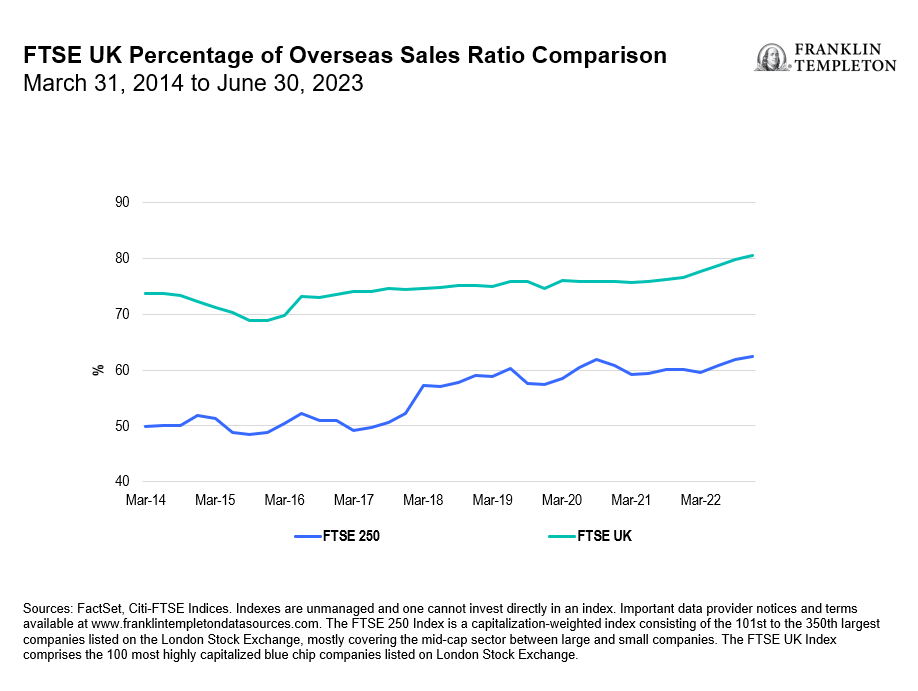

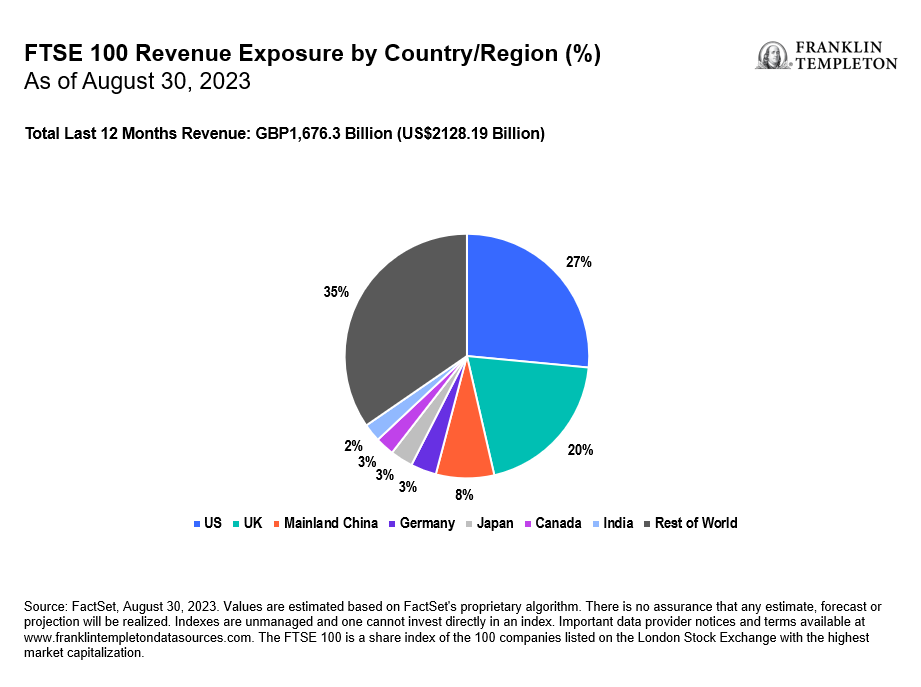

The FTSE UK Capped Index’s top holdings—banking and financial services group HSBC Holdings and energy and health care giants Shell, BP, Astrazeneca and GSK—target revenue from foreign customers and sales abroad, which presents investors with the opportunity to gain global exposure without overpaying for it. The index also has slightly more than a 30% weighting to defensive sectors, such as health care and consumer staples, which may help it weather market volatility.4

UK economy

Recent news about the UK’s economy still shows some headwinds, but the International Monetary Fund (IMF) announced in May that it no longer anticipates a recession this year. July saw upward revisions to its previous estimate of gross domestic product (GDP), which means the UK’s debt ratio for recent months saw an encouraging improvement. Public sector debt at the end of July 2023 was estimated at 98.5% of GDP—signaling improving debt.5

But there’s more to the UK’s economic picture. The UK Department for Business, Energy & Industrial Strategy together with the UK Space Agency announced the allocation of its largest-ever research and development budget, worth US$50.2 billion, to drive forward the government’s ambitions as a science superpower. Allocations will deliver on the government’s “Innovation Strategy,” including its ambition to increase total research and development investment to 2.4% of GDP by 2027.6

Should the Labour party win the next general election, Labour politician Rachel Reeves recently ruled out any version of a wealth tax on the richest in society. She told the Sunday Telegraph that Labour would instead do “whatever it takes” to attract business investment into the United Kingdom.

Government measures to boost the UK’s growth potential also include agreements to restore a smooth flow of trade within the UK internal market known as the “Windsor Framework,” in addition to an expansion in the range of businesses able to benefit from them. IMF officials have also recently stated that a more measured approach to reviewing retained EU laws “will help reduce Brexit-related uncertainty (while) . . . enhanced childcare support and tax relief on investment in plant and machinery introduced in the spring budget should support labor participation and business investment, respectively.”

Taken together, these points make for an appealing case for investors to hold UK companies that seem to be signaling good prospects and perhaps a recognition of undervalued stocks amid a slew of buybacks across several sectors to boost shareholder returns. Consider that BP, Diageo and Unilever are among the FTSE UK Index companies that launched buybacks in 2023. While Shell (the largest holding in the index) reported lower-than-expected second quarter earnings, it also launched a US$3 billion share buyback program.7 In addition, Lloyds Banking Group and Reckitt Benckiser both announced plans in July to raise dividends.

For those implementing global asset allocation, we often tout the benefits of single-country and regional ETFs as tools that can help investors create differentiated outcomes. In our opinion, selecting cost-effective investment vehicles, such as single-country ETFs that are tailored for precise implementation, can make sense in this environment for many investors.

We believe investors should think about country allocation with the following considerations:

- Fundamentals: the companies and sectors that represent each country

- Macroeconomic: GDP growth, monetary policy, geopolitical, demographics

- Emerging themes: more transient trends that favor select countries

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Commissions, management fees, brokerage fees and expenses may be associated with investments in ETFs. Please read the prospectus and ETF facts before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Morningstar Direct, August 2023.

2. Ibid.

3. Source: FTSE, July 2023. The FTSE Developed index is an international equity index, which tracks stocks from developed markets worldwide.

4. Source: FTSE, July 2023. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges.

5. Source: Office for National Statistics, “UK economy latest,” August 2023. There is no assurance that any estimate, forecast or projection will be realized.

6. Source: GOV.UK, “Government announces plans for largest ever R&D budget,” March 14, 2022.

7. Source: Morningstar, July 26, 2023.