Summer has flown by, and we find ourselves once again preparing for the start of a new academic year. For my household in particular, this September sees another transition from junior to senior school.

Since the formative years of junior education set the foundation to prepare students for senior school and university, it got me thinking about “fundamentals.” My son is starting algebra this term, which would not have been possible had he not already learned the fundamentals of multiplication and division. For exchange-traded fund (ETF) trading, I wanted to ensure that those new to these vehicles understand related ETF fundamentals—after all, these are the building blocks that help us navigate tasks and problem-solve.

So, in the spirit of back-to-school, let’s review some trading/ETF trading fundamentals.

The ETF vehicle—the basics

Let’s quickly review the basics, lest there has been some “summer learning loss.” Exchange-traded funds are open-ended investment vehicles that benefit from the flexibility to trade intraday, just like stocks. This means they can be bought or sold on a regulated stock exchange or over the counter (OTC) via a broker or multilateral trading facility (exchange venue/request for quote [RFQ]) at any time.

The price or value of an ETF is directly derived from the price of the underlying stocks or bonds it invests in. Likewise, the liquidity of an ETF is derived from the liquidity of the underlying stocks or bonds it invests in. Since ETFs are open-ended investment funds, their ability to freely increase or decrease in size, based on subscriptions or redemptions, means that trading volumes—a metric many use to measure fund liquidity—is inaccurate. Trading volumes tell investors what has traded, not what can be traded.

Trading fundamentals

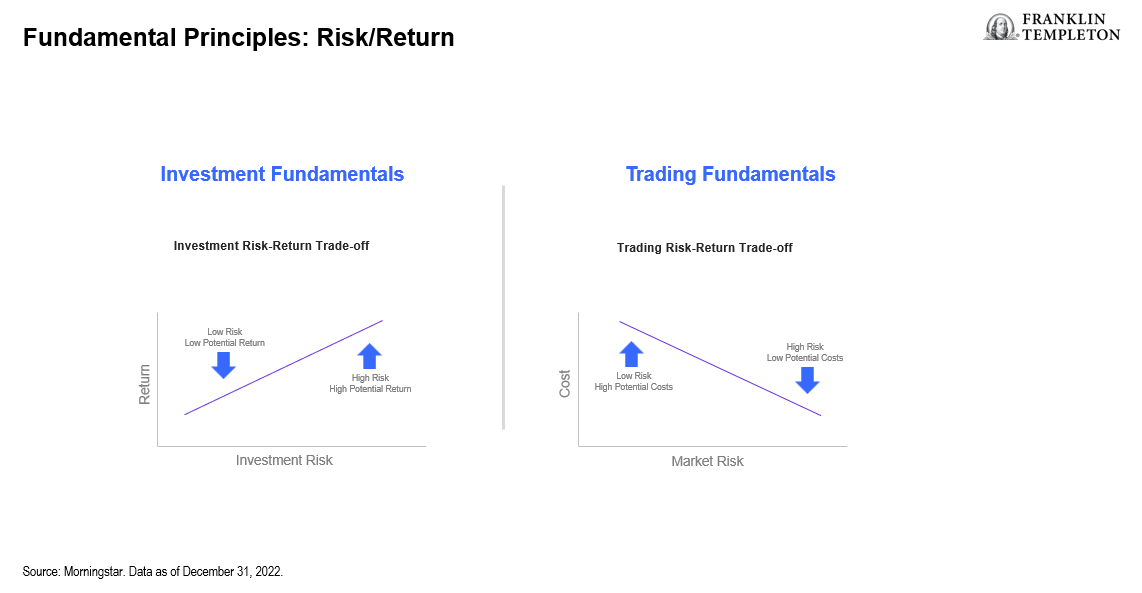

However, let’s stick to the fundamentals I’m keen to discuss. A fundamental principle of investing revolves around risk and return. When considering any investment, the trade-off between risk and return is a key starting factor.

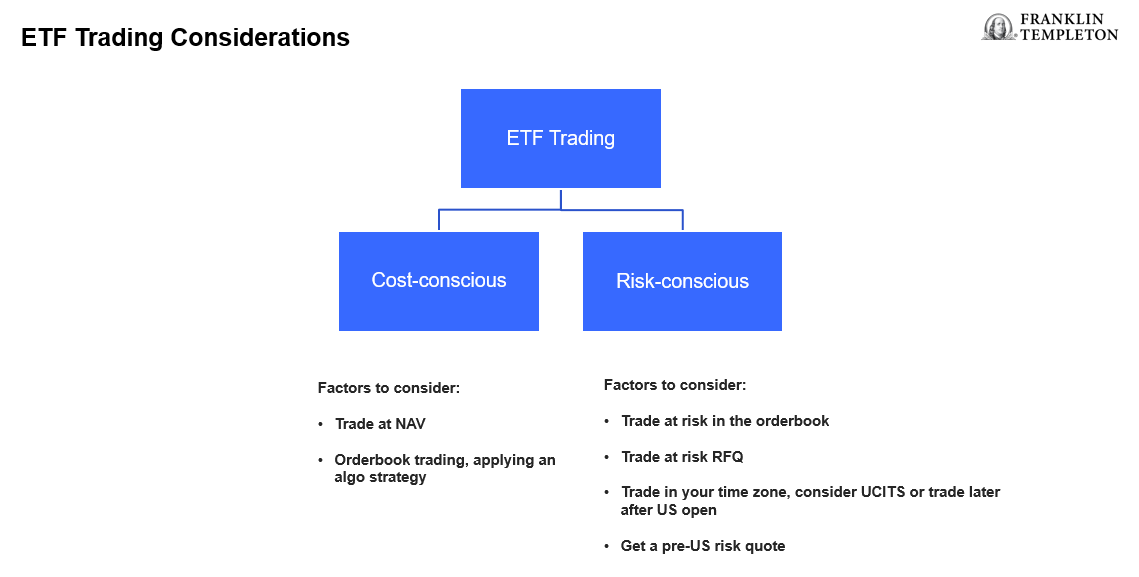

Trading is the same—a continuous trade-off between (market) risk versus return (cost). Understanding and appreciating an investor’s preference for either cost or market risk makes all the difference to their resulting choice for execution. The same applies to trading ETFs. Understanding investor preferences around cost or risk for ETF execution can help make for a more informed and defined method of execution.

ETF investors

International adoption of UCITS ETFs—which stands for undertakings for collective investment in transferable securities—continues to grow. Our conversations with Latin American and Asia-based ETF investors have surged over the course of this year. The cost versus risk trade-off is especially relevant for these time-zone overlapping investors. In fact, a recent conversation with an Asia-based institutional investor got me thinking in more detail about this trade-off.

If urgency is required for an Asia-based investor, then the avoidance of market risk, meaning choosing to execute on-exchange during the last two hours of the Asian trading day (as it overlaps with Europe market hours) makes sense. Otherwise, if an investor is more cost-conscious, trading at the ETF’s net asset value (NAV) might make more sense, just how they would buy a mutual fund or trade over a period of time using an algorithmic trading strategy.

Europe has seen ETF trading evolve significantly over the last decade. Cost versus market risk preference fundamentally drives the options to trade on-exchange or OTC. Appreciating the differing options and aligning those to one’s preference for either cost or risk can help the trader or investor achieve a desired outcome. Before one even considers such elements as trading volumes or the size of an ETF’s assets under management (AUM), one should take the time to better understand the options outlined below.

It’s worth considering this first review session on ETF fundamentals to make ETF trading simpler and easier. As with other subjects, mastering the fundamentals first can then lead to more advanced understanding and discussions. When my son worried aloud about entering his new phase of schooling, this is the same response I gave him: Just have faith that you understand the fundamentals of each subject and you’ll be well-positioned to tackle what comes next!

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Generally, those offering potential for higher returns are accompanied by a higher degree of risk.

For actively managed ETFs, there is no guarantee that the manager’s investment decisions will produce the desired results.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Commissions, management fees, brokerage fees and expenses may be associated with investments in ETFs. Please read the prospectus and ETF facts before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.