Key takeaways:

- Falling valuations of commercial real estate (CRE), especially in downtown office areas, will have a limited impact on both large globally systemically important banks (G-SIBs) and regional banking organizations, due to manageable exposure to the sector.

- Enhanced risk-based reserve requirements and stricter accounting methodologies, enacted following the global financial crisis (GFC), require banks to identify potential losses and absorb them over time, reducing the potential for large, one-time write-offs.

- In the event of a default on loans, banks retain the ability to work with borrowers to reach a settlement that is beneficial for all parties.

Office CRE, how bad is it really?

Lower-than-expected Return to Office (RTO) dynamics and declining CRE valuations have captured headlines over the past several months with tales of barren city centers. There are reports of wastelands full of empty offices and storefronts that have been beset by increasing crime rates, creating a “doom loop” where property prices continue to fall unchecked. Although we believe this is going a bit too far, we do have some concerns about vacancy rates. Office vacancy rates reached 17.1% nationwide in July with heavily impacted areas—such as San Francisco, Austin and Houston—topping 20%.1 This is in addition to a large amount of office space that is available for sub-lease.2

We have begun to see an uptick in office property delinquency rates. Trepp, a commercial mortgage-backed securities analytics firm, reported that office delinquencies increased to 2.38% in the first quarter 2023 (Q1), up from 1.58% at the end of last year. Trepp also reported serious delinquencies, 90 days or more, also moved higher, reaching 1.03% at the end of Q1. Projections are for delinquencies to continue higher as vacancy rates are increasing. It should be noted that delinquency rates for retail (6.75%) and lodging (4.45%) still far exceed office delinquencies, although those levels are trending lower.

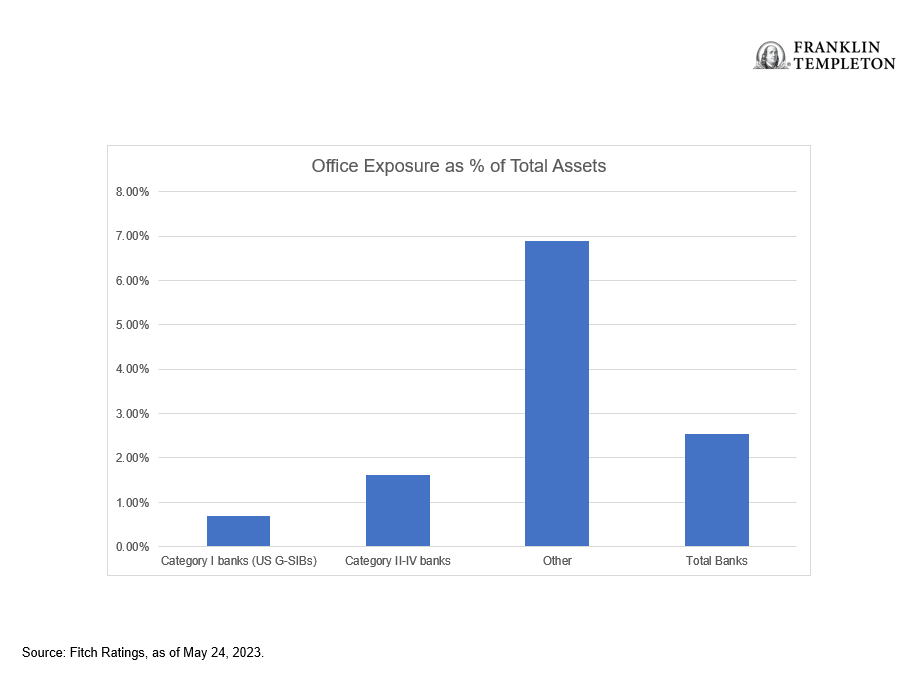

However, banks also hold a blend of exposures across other sectors including health care, lodgings, industrial warehousing, multi-family residential and retail. Exposure to downtown office and retail (the most problematic sectors) is more heavily focused on smaller community banks (Other) versus Category I G-SIBs (e.g. Bank of America, Bank of New York Mellon, Citigroup, and JPMorgan Chase & Co.) and Category II–IV regional banks (e.g. Regions Financial Corp., U.S. Bancorp, PNC Bank, Bank of the West).3

The smaller the bank is, the higher likelihood of overexposure to CRE loans with larger concentrations to geographical areas that may experience local recessions. G-SIBs have more diversified loan books that will lessen the impact of idiosyncratic pockets of weakness.4 Since smaller community banks typically do not issue public sector debt, they are not part of corporate bond indexes, reducing the ability of smaller bank weakness to impact spread levels across the broad banking sector.

Impact of delinquent loans and foreclosures on banks’ balance sheets and capital ratios

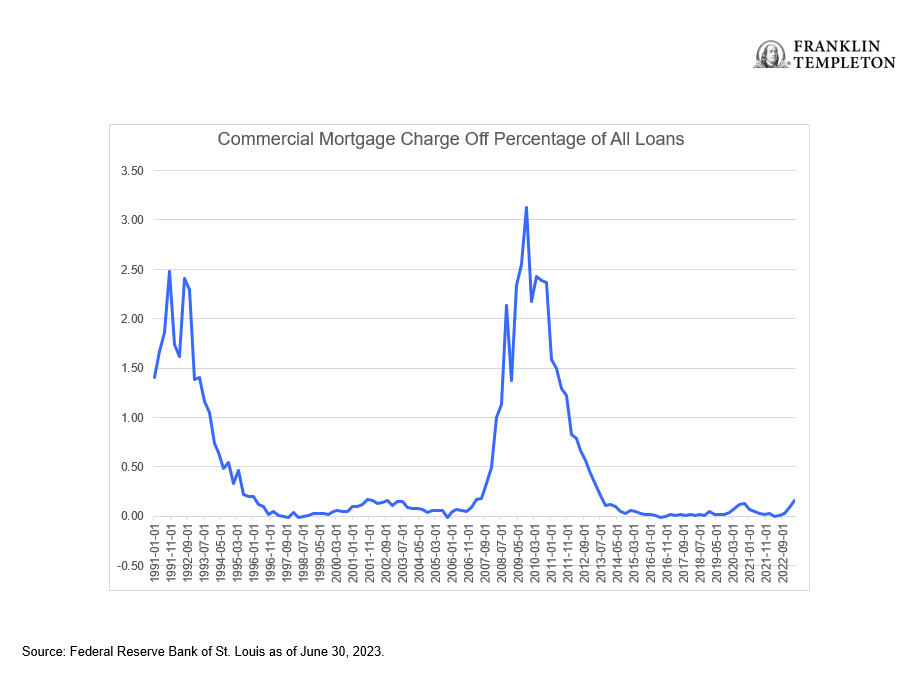

One positive thing that came out of the GFC was stricter standards on risk-based capital ratios for banks. This requires banks to periodically review all credit exposure, including CRE loans. As banks identify loans that may look impaired in some way, they are forced to set aside loan loss reserves to account for potential decreased valuations. Banks will use a number of metrics to determine if loans need to be reserved against, including any delinquent payment history, valuation of the property, and debt service coverage ratios. Once a loan is determined to be unpayable, it is “charged off” from the bank’s balance sheet. These charge-offs, which can occur when a property is liquidated below the face value of the loan, are muted by the amount of loan loss reserves already accrued by the bank. This has the effect of limiting the one-time negative impact on total bank assets as they, in theory, had already accounted for the full loss prior to the resolution. There has recently been an increase in charge-offs for CRE, but levels are coming off historically low values and remain manageable, in our opinion.5

We should continue to see charge-offs increase through the remainder of the business cycle, and further, as levels tend to peak up to a year after a recovery begins.

Wary of the potential of large write-downs of assets, as seen in the GFC due to sub-prime residential mortgage-backed securities, the US Federal Reserve (Fed) has issued guidance for banks in dealing with CRE loans. The regulator will pay close attention to how banks evaluate the value of their CRE holdings with additional scrutiny on banks with large allocations and those that have added heavily to exposures over the past several years.

Resolution of bad loans

We believe there is no doubt that we will see office CRE loans continue to default in the coming years. There was a large pump up of CRE prices just before the COVID-19 shutdowns, with valuations gaining as much as 16% year-over-year.6 Areas that are now in the most jeopardy are the ones that enjoyed strong growth in high-tech including San Francisco and Austin, which caused rent-per-square-foot to increase rapidly. This led to a building boom in some areas, and yet-to-be-finished construction continues to come online, increasing vacancies. RTO behavior is unlikely to change radically in the short term. Employees are willing to forgo higher wages if a company can provide an advantageous full remote or hybrid working environment. Urban centers will ultimately bear the brunt of this change in demographics, especially large office and mixed-use buildings. As much as 25% of office CRE will mature in 2023 and 2024, putting pressure on funding opportunities.7 Additionally, borrowers face challenges as higher interest rates and lower occupancy levels negatively impact their ability to turn a profit.

Banks, generally, are not really interested in managing a lot of property. They typically try to avoid “taking the keys” that leave them to administer the properties. Banks will look for a wide variety of ways to work with the current borrower or a new company before a formal default on the loan. Resolutions can take the form of measures including reduction of loan amount, additional equity injected by the borrower, subsidized interest rates for a period of years, and partial ownership. These actions will impact the present value of the CRE mortgage held by the bank as an asset, but again in our view this will likely already be reserved against on the bank’s balance sheets. There is also anecdotal evidence that a substantial amount of private debt money is being accumulated to take advantage of opportunities to refinance CRE mortgages at attractive rates.

Summary

Banks’ exposure to CRE will remain in the headlines for the foreseeable future. It is very likely that we will see defaults on large office buildings in major cities creating some concern for the overall market. We feel G-SIBs and regional banks’ overall CRE holdings remain within reasonable levels. Charge-offs will continue to rise as the banks sort through the current market environment. We are experiencing a systemic shift to how people work, and it is uncertain what the long-term effects will be. There have been other shocks to the CRE market in the past, including the GFC and the building boom of the early 1990s. These events took years to resolve, and it was very painful for both borrowers and lenders. Defaults continued to increase for over two years following the official end to the GFC recession.

We continue to monitor the banks and their handling of the CRE crisis. In our view, large and regional banks are effectively managing the issues. Their overall downside exposure is limited, and current management processes will help contain the overall impact to their balance sheets. Our credit research process routinely evaluates individual bank exposures to seek to identify issuers that have increased risks to CRE deterioration.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. High-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Federal Reserve Bank of St. Louis, “Commercial Real Estate Market Stress Poses a Challenge to Banks,” July 6, 2023.

2. Source: Wall Street Journal “Office Owners Already Reeling from Remote Work now Face Recession Risk in 2023” as of January 2, 2023.

3. Source: Fitch Ratings, “US Regional and Small Banks’ CRE Exposure Could Pressure Ratings,” May 2023.

4. Source: Fitch “US CRE Risk Concentrated in, but not Confined to, Office Sector” May 23, 2023

5. Source: Federal Reserve Bank of St. Louis Economic Research as of June 30, 2023.

6. Source: International Monetary Fund Financial Soundness Indicators via US Federal Reserve.

7. Source: USREO Partners, “Estimated Total Commercial Mortgage Maturities,” March 10, 2023.