Key takeaways:

- UK inflation remains high. However, the Bank of England’s (BOE’s) interest-rate increases have started to take effect as the economy is starting to slow down.

- The path of the UK economy is uncertain, and most asset classes will likely experience volatility.

- We believe now is a good time to consider UK gilts for their high yields and relatively low risk.

- Both international and domestic UK investors should find UK gilts more attractive as the UK economy stabilizes.

It’s been a year since the “mini-budget” of the short-lived Trussonomics era. So, now seems like a good time to check in on the United Kingdom and UK gilts. Back then, there was a lot of concern that gilt yields were high. But what’s interesting is that today, yields are actually higher than they were a year ago, and the BOE is still talking about raising interest rates.

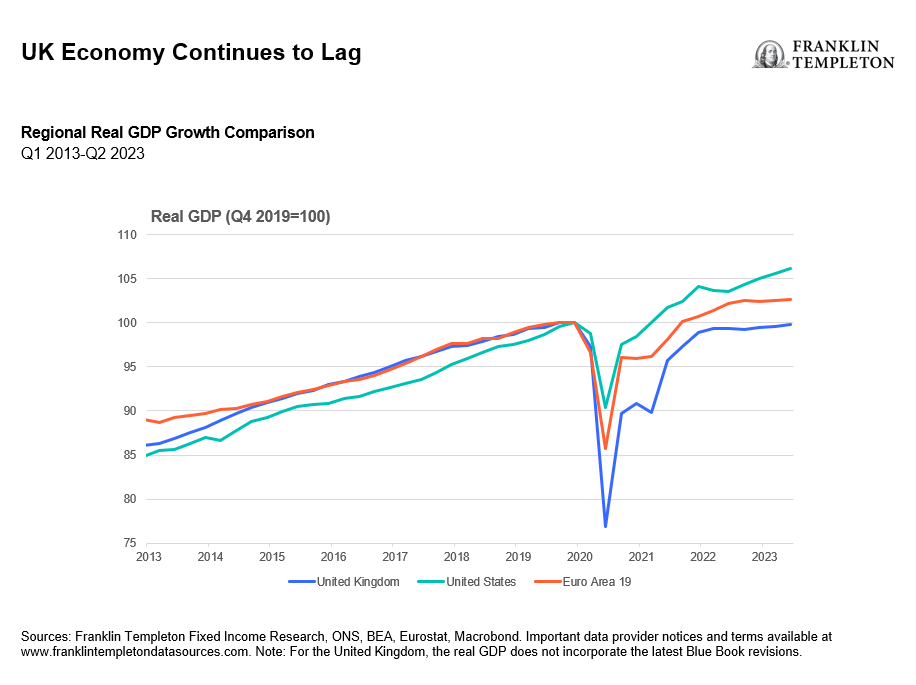

Currently, the UK economy isn’t looking all that great. Growth is low, inflation is high and the BOE was behind on tightening. The UK economy continues to lag its peers in the West and in the euro area. The country had a deeper drop due to COVID-19 in 2020, and the rebound since has been subpar.

A shrinking UK labor market and higher wages

The UK labor market shrunk significantly after Brexit, and during the pandemic, many people decided to leave the United Kingdom and return to their home countries. For some people who want to return, it is proving difficult, and the UK labor market has not recovered from the exodus. Also, many people dropped out of the labor force completely, and have not returned.1

That said, a tight labor market is good for those with jobs, as it means wages will go up. UK wages have been high compared to Europe, but not as high as those in the United States. But it also means that the cost of goods will continue to be elevated.

Cooling inflation and BOE rate actions

While inflation remains a concern, it does seem that the BOE’s rate hikes are now taking effect. It’s been taking longer for rate hikes to feed through the UK economy, as many mortgages and business loans are now on fixed rates. Food, alcohol and tobacco prices peaked at around 16% in 2022 but have come down in 2023. Along with caps on energy prices, the overall Consumer Price Index (CPI) should likewise continue to trend lower.

When the BOE will start thinking about reducing interest rates is the bigger question mark. When considering the major global central banks—the BOE, the European Central Bank, Bank of Japan and US Federal Reserve—we think the United Kingdom may be the first to see rate cuts, given its weak economy. We would also note that investors in gilts also need to look at what’s happening in the United States and in Europe—UK and US interest rates are more highly correlated than most people think.

Implications of current UK economic conditions for investors

With heightened uncertainty regarding the UK economy, we believe most asset classes—including credit, equities and sovereign bonds—will likely experience volatility over the next couple of quarters and even years. One positive about government bonds is that, at this point in the cycle, they are yielding considerably more than they have in the last several years.

The UK yield curve is currently inverted, but that isn’t new—that’s been the case for some time. In our analysis, the yield curve could invert further, as UK economic growth is expected to remain weak. That being the case, we believe it’s not too early for the BOE to start thinking about easing.

UK gilts have become an attractive proposition once more

In our opinion, UK gilts look attractive right now because they offer high yields with very low default risk—UK gilts are offering the highest yields in the G7. And, the BOE has demonstrated that it can print money when it needs to. In addition, if the government stabilizes after the next election, the United Kingdom will likely look more attractive to many investors, bringing in foreign asset flows.

Domestic UK investors seeking high yields with relatively low risk could also find gilts attractive.

Conclusion

In our opinion, now is a good time to consider increasing allocations to gilts. We believe an actively managed gilt portfolio can offer diversification, enhanced return potential and potential downside mitigation.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Investing in a concentration of certain securities, regions or industries is subject to increased volatility.

Currency management strategies could result in losses if currencies do not perform as expected.

Active management does not ensure gains or protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Sources: Franklin Templeton Fixed Income, ONS, Macrobond. Important data provider notices and terms available at www.franklintempletondatasources.com.