In the latest issue of the Alternative Allocations podcast series, I had the pleasure of interviewing Jenny Johnson, President and Chief Executive Officer of Franklin Templeton, as we explored the democratization of alternative investments. We began our discussion by examining the firm’s acquisitions of Clarion Partners, Benefit Street Partners, Alcentra, Lexington Partners and K2 Advisors—and why these acquisitions are such an important addition to its offerings. Jenny noted that “Franklin Templeton was founded on the principle of the average investor participating in the stock market through mutual funds. We see a similar opportunity in alternatives, particularly in the wealth channel.”

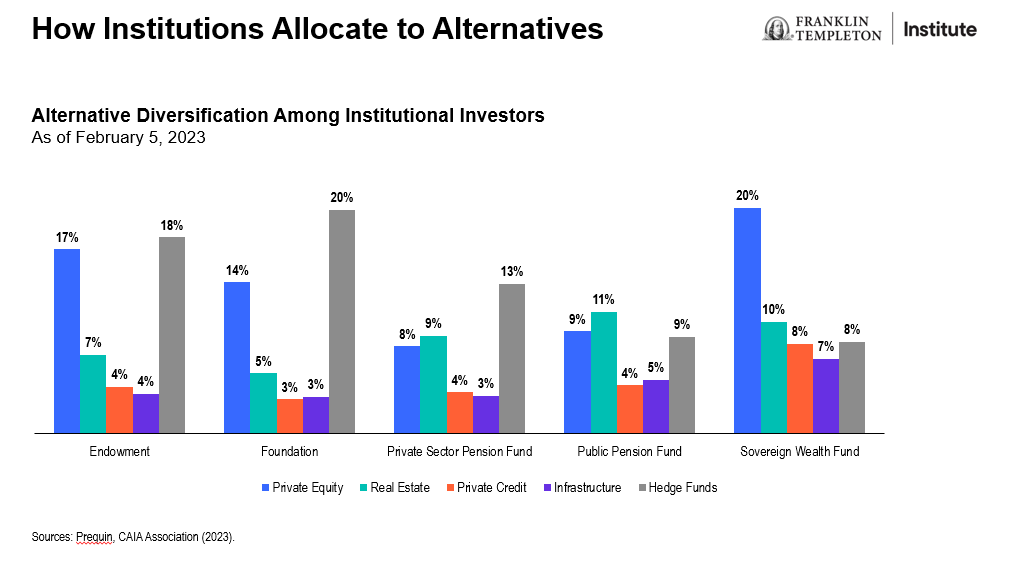

Institutions and family offices have historically made significant allocations to alternative investments to source growth and income, dampen portfolio volatility through diversification, and hedge the impact of inflation. Product innovation, and access to institutional-quality managers, has helped to fuel the growth and adoption of alternatives investments by the wealth management channel.1

Jenny and I discussed the need for advisor education, and practical thought leadership, to help advisors and investors in using these versatile tools in the appropriate fashion. She shared the firm’s commitment to educating both investors and advisors regarding the role and responsible use of alternative investments by building a robust library of new content, including white papers, webinars, blogs and podcasts.

We also peered into the future of alternatives in retirement plans. Defined benefit pension plans have historically allocated to alternatives—but the access to alternatives in defined contribution plans has been more muted. Last year exposed the interconnectivity of most traditional investments, with both stocks and bonds being down double-digits.2 Given today’s market environment, and products more conducive to defined contribution plans, Jenny felt this market represents a significant opportunity for advisors and investors.

Lastly, we discussed the relative attractiveness of private markets—especially private credit and secondary private equity—given the prevailing market conditions. Private credit managers can take advantage of the dislocation created by Silicon Valley Bank, as banks have stepped away from lending to small- to middle-market companies, and they can negotiate better terms and pricing.3 Secondaries managers can take advantage of the slowing pace of exits and the overallocation of many institutions and they can also source private equity opportunities at favorable valuations.4

There are even opportunities across real estate despite the headwinds of rising rates, tighter lending conditions and a challenging office environment.5 While there might be an oversupply of office and retail space, there is a shortage of industrial and multifamily real estate. We believe that the changing economy is driving growth in industrial properties, which represents a long-term secular trend.

The democratization of alternative investments represents a positive development for our industry, with the ultimate beneficiary being the individual investor. Make sure you don’t miss an episode by subscribing to Alternative Allocations on Apple, Spotify or wherever you get your podcast.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Equity securities are subject to price fluctuation and possible loss of principal. Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls.

Alternative strategies may be exposed to potentially significant fluctuations in value.

Real estate investment trusts (REITs) are closely linked to the performance of the real estate markets. REITs are subject to illiquidity, credit and interest-rate risks, and risks associated with small- and mid-cap investments.

Privately held companies present certain challenges and involve incremental risks as opposed to investments in public companies, such as dealing with the lack of available information about these companies as well as their general lack of liquidity.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

__________

1. Democratizing alternative investments for financial advisors: Why now? (advisorengine.com)

2. Alts Angle: Rethinking retirement with alternative investments | Franklin Templeton

3. Alts Angle: Disruption creates opportunities | Franklin Templeton

4. Alternative Allocations: The growth and diversification of secondaries | Franklin Templeton

5. Alternative Allocations: Opportunities in commercial real estate | Franklin Templeton