The press conference following the December Federal Reserve (Fed) meeting raises one interesting question: Why did Fed Chairman Jerome Powell feel it necessary to supercharge an already-strong financial markets rally?

Reassuring US inflation data had already bolstered market bullishness going into the meeting, with a significant upswing in equity prices and 10-year Treasury yields down a full percentage point after peaking at nearly 5% in mid-October. Against this background, the very strong bullish moves during the Fed meeting and in its immediate aftermath show that Powell’s statements were a lot more dovish than expected. Indeed, most analyst comments are playing on the theme of an early holiday gift to investors.

A majority of analysts and investors clearly expected Powell to push back against bolstered expectations of early interest-rate cuts. But in the press question-and-answer session following the monetary policy meeting, Powell seemed to brush this off, arguing that since markets had seesawed so wildly in the past year, the Fed would be better off focusing on its job and ignoring market moves.

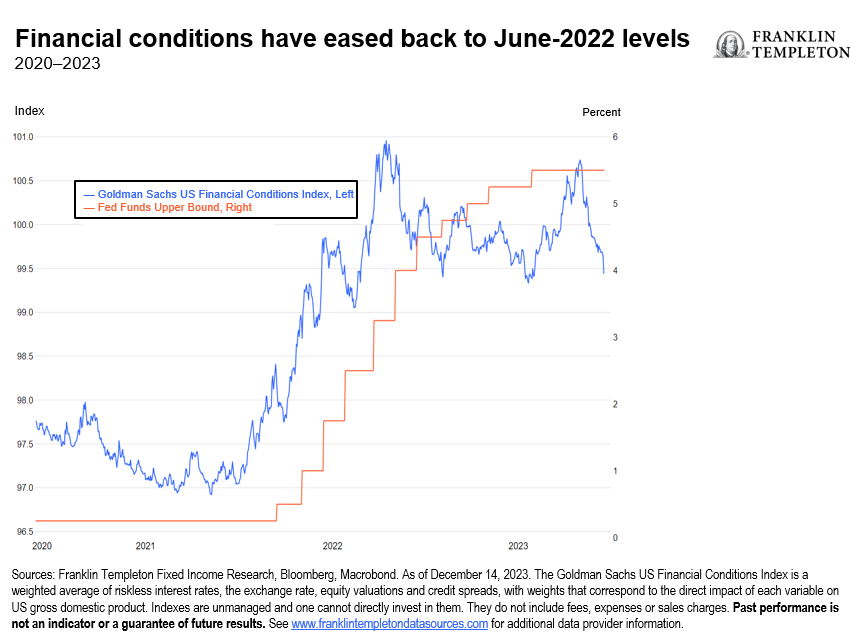

While some frustration with market volatility is understandable, ignoring the economic impact of financial conditions seems a rather odd development. Just over a month ago, Powell noted that a market-driven tightening in financial conditions was doing some of the Fed’s job in fighting inflation. The same logic implies that the strong market rally ahead of the December meeting had offset a significant portion of the Fed’s monetary tightening effort. Yet, Powell decided to brush it off. This is remarkable, since financial conditions are now back at the June 2022 level, when policy rates were just 1.75%.

(right click on chart to enlarge)

This strengthened the sense that the Fed thinks the inflation fight has been won already. And indeed, my impression was that Powell took a page out of Shakespeare’s Mark Antony—he declared victory while protesting loudly and repeatedly that he was not declaring victory. Mark Antony claimed, “I come to bury Caesar, not to praise him,” just before delivering an impassionate praise of the murdered emperor. Similarly, Powell cautioned that more progress on disinflation is needed and not assured, just before stressing that the reduction in inflation has been faster and much less painful than anyone thought, and it is expected to continue. He dutifully cautioned that more rate hikes are not off the table but told us the Federal Open Market Committee has already turned its attention to the timing of rate cuts.

The Fed has a lot to be proud of, and happy about. After a late start, it hiked rates fast and decisively; inflation has indeed declined faster than most forecasters expected, while both growth and the labor market have remained stronger than most analysts dared to hope. In fact, as Powell reminded us, most analysts predicted the United States would fall into recession in 2023. We at Franklin Templeton Fixed Income were at the optimistic end of the spectrum, arguing that if we did see a recession, it would be a short and shallow one.

Two key questions now are: To what extent has monetary tightening contributed to disinflation so far, and what monetary stance is needed to bring inflation sustainably down to target? Powell’s assessment seemed to swing back toward the “transitory inflation” view; the surge in US inflation, he argued, reflected some excess demand but especially a combination of extraordinary supply restrictions. These have since reversed, with a rise in labor supply and an easing of supply chain restrictions allowing progress on disinflation with little damage to the economy.

Powell further argued that there is some more supply driven disinflation in the pipeline. He conceded that once the supply side tailwind ceases and we need to rely on curbing demand, then the “last mile” of disinflation should in theory get harder; but, he added, we have not seen that yet. That suggests greater confidence that disinflation can be achieved mostly from the unwinding of supply shocks. In this view, one can argue that rate hikes were needed to prevent further demand overshoot and to keep inflation expectations anchored, but that at this stage that’s no longer an issue—with growth and inflation risks now in balance, and with some signs of weaker activity, the focus should then shift to easing policy in order to limit recession risks. In this context, Powell also strengthened his characterization of how restrictive monetary policy is, calling it “well into restrictive territory.”

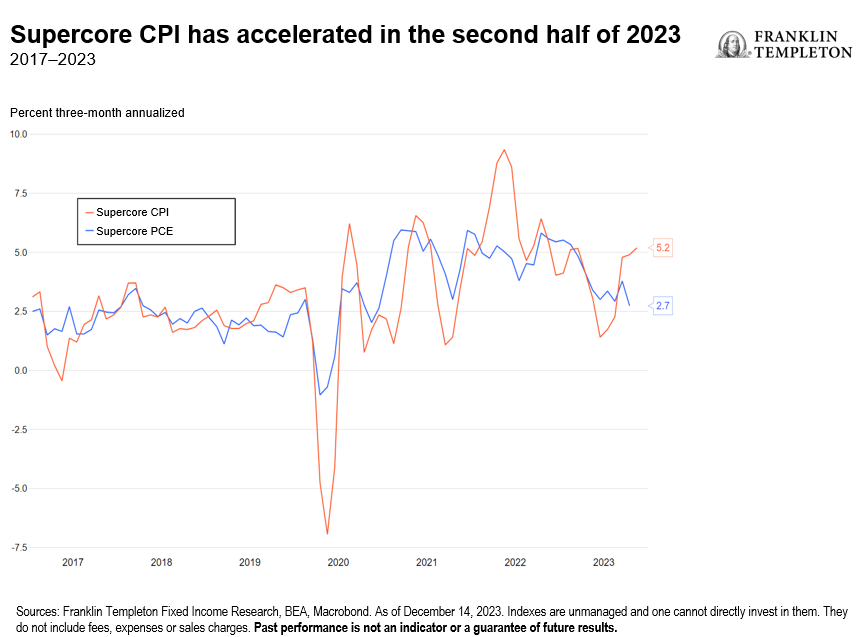

Whether this greater confidence in what we might call a “neo-transitory inflation theory” is justified remains to be seen. You can make the inflation picture sound more or less reassuring depending on what measure you take, as I noted in my previous “On My Mind,” whether it’s the Consumer Price Index (CPI) or Personal Consumption Expenditures (PCE), headline or core, 12-month change or monthly annualized. The Fed has been pointing to a “supercore” measure of services inflation excluding food, energy and housing as especially representative of underlying inflation pressures.

Over the past three months, the CPI supercore measure is running at an annualized rate of 5.2%. That’s still quite far from the Fed’s 2% target. Wage growth, as Powell acknowledged, is also still stronger than what the inflation target would allow.

(right click on chart to enlarge)

Looking at a sizable decline in inflation with a very resilient US economy, Powell argued that this justifies shifting the focus to rate cuts in order to limit downside risks to growth. The same macro outlook, however, could equally have justified a very different stance: The strength of the economy proves that monetary policy is not too restrictive, and gives the Fed room to hold the current policy stance for longer to make sure inflation comes back to target in a sustainable way.

In fact, most recent economic data should have cautioned against such an aggressive dovish pivot. Unemployment ticked lower in November despite rising participation; three-month annualized wage growth for non-managerial workers accelerated; retail sales beat expectations in November; supercore CPI accelerated over the past couple of months; and the US fiscal deficit is likely to continue to expand in the coming year.

Judging the balance of inflation and growth risks in 2024 is especially hard. Besides the economic uncertainty of a post-pandemic recovery, there is high geopolitical uncertainty, and the United States is entering an election year. Powell’s decision to supercharge the market rally when financial conditions had already eased substantially suggests to me that the Fed is much more relaxed about inflation risks. In my view, this further dramatic easing in financial conditions, however, increases the chances that the last mile of disinflation will indeed prove harder. This in turn will likely cause higher market volatility. Maybe the last mile will not be that much harder, but it will likely be bumpier than markets now expect.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.