For those investors who entered the year expecting a continued regime shift away from growth equities, 2023’s equity market performance likely came as a surprise. US equities broadly posted double-digit returns through November 2023, with growth equites climbing roughly 36%.1 Those initial expectations were understandable as uncertainties about inflation, interest rates, global growth and geopolitical conflict dominated headlines and were top-of-mind issues for investors globally. As the year progressed, inflation moderated meaningfully, and the US Federal Reserve (Fed) slowed the pace of interest-rate increases in response to new data. Looking ahead to 2024, we expect inflation will continue to moderate and economic growth to slow; we remain positive and see the potential for rate cuts to come into focus in the second half of the year. Our outlook reflects an expectation for a soft landing. If the labor market remains healthy and unemployment hovers around 3%–4%, it is difficult to imagine a case where, if the United States does enter a recession, it is anything but shallow. That said, we continue to monitor consumer health along with corporate outlooks for signs of a weakening economy.

We believe 2024 will prove a positive year for US equites, driven by improving profit margins and rebounding earnings growth across most sectors. With current valuations not leaving much room for multiple expansion, a focus on relative growth and the ability to look beyond the concentrated benchmarks are where we see the greatest opportunities. As such, we believe 2024 looks particularly attractive for active managers where idiosyncratic factors drive returns outside of macro factors. In this environment, we believe investors should be focused on quality and earnings visibility and on areas of secular growth in the economy.

Several areas of focus for us in the new year:

Beyond the Magnificent Seven:2 We expect market breath to expand to include small- and mid-cap companies

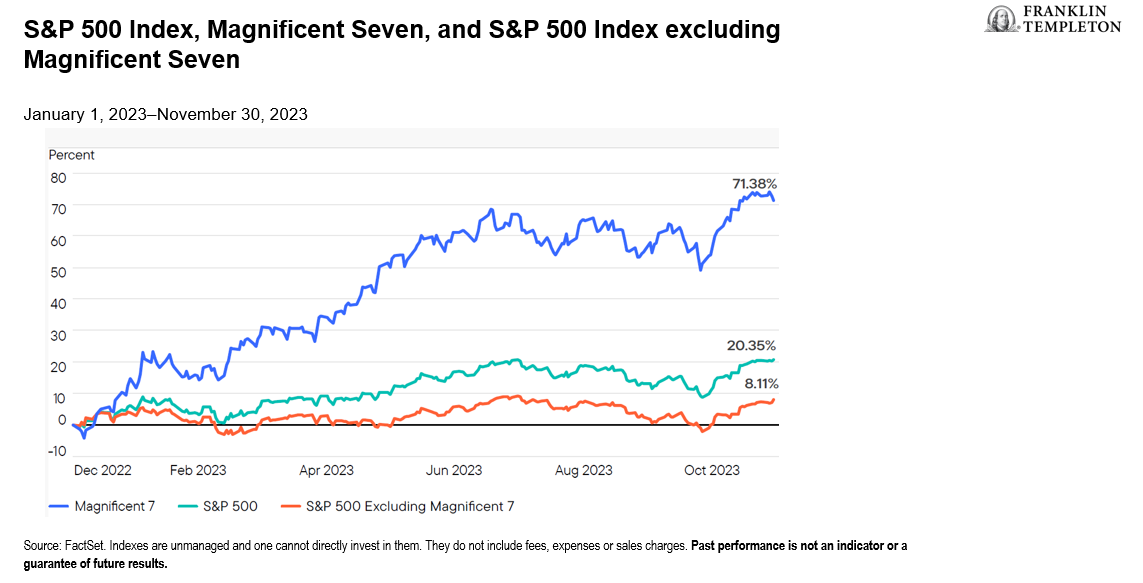

A narrow group of mega-cap growth stocks, the often-called “Magnificent Seven” dominated US market returns in 2023 (Exhibit 1). These companies offered strong cash flows, competitive strength, and exposure to Generative artificial intelligence (AI). While we continue to view these companies as market leaders, we do not think the level of relative outperformance for these stocks is sustainable. The outperformance of such a narrow group of companies has created an opportunity for active managers who are able to look beyond the benchmarks. We see 2024 as a year where market breadth will expand and small-, mid- and large-cap companies will take the spotlight.

Exhibit 1: The Magnificent Seven and “The Rest” – Bifurcation in US Equity Market Returns

US equities are continuing to outperform many global markets

The United States is one of the largest and most diverse economies globally, driven by technological innovation, entrepreneurship and a robust consumer market. In 2024, we think US economic growth and technology leadership can drive better returns than other global equity markets. We continue to see the US equity market as a growth-centered economy relative to other regions around the globe.

The excitement around AI will continue to grow

We believe generative AI represents the next major computing platform shift and will likely be a multi-trillion-dollar investment opportunity over the next decade. In 2024, we expect to see early AI applications enter the market for consumer and enterprise use. Longer term, generative AI has the potential to accelerate productivity growth, drive margin expansion for many companies, and be a tailwind for economic growth.

While we remain watchful of macroeconomic uncertainties, they do not drive most of our investment decisions. At Franklin Equity Group, we believe active management is critical to moving quickly and successfully in today’s dynamic markets. We look for opportunities that can potentially deliver positive long-term results, even in an environment of elevated interest rates. We have been finding opportunities in high-quality businesses levered to durable secular growth themes with market-leading competitive positions, strong financials and balance sheets with the ability to invest and grow through a range of economic conditions.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Active management does not ensure gains or protect against market declines.

Investment strategies which incorporate the identification of thematic investment opportunities, and their performance, may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner.

Focusing investments in technology-related industries, carries much greater risks of adverse developments and price movements in such industries than a strategy that invests in a wider variety of industries.

To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

______________

1.Sources: Morningstar Direct, Standard & Poor’s, Russell. Indexes used: S&P 500; Russell 1000 Growth. As of November 30, 2023. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

2.The “Magnificent Seven” are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.