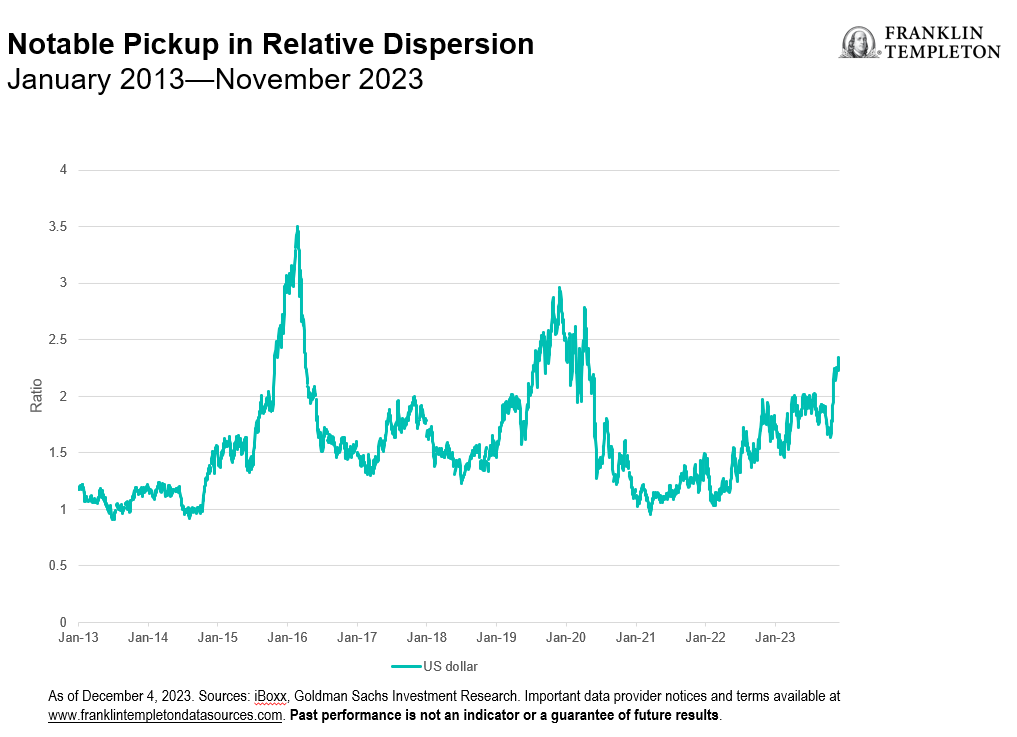

First quarter (Q1) 2024 outlook: Summary

Interest rates in most parts of the world appear to be stabilizing as we enter 2024, as inflation trends continue to decline from the high levels seen in the summer of 2022. Key macro elements providing a tailwind to global economies and equity markets include technological advancements in artificial intelligence, clean energy, and cloud computing.

Strategy highlights

- Emerging markets: Emerging markets (EM) may see a potential tailwind as macro policies shift in their favor. Recent policy trends may support flows into EM, while regional growth differences can improve the alpha opportunity set for specialist managers.

- Catastrophe bonds: Following a record year of new issuance, the catastrophe bond market spread is elevated relative to historical levels, despite tightening throughout the year. We believe it remains an attractive entry point.

- Long/short credit: Elevated absolute yields combined with higher dispersion due to varying issuer quality provide an attractive tailwind. In addition, an increase in upcoming maturities, refinancing, and increasing defaults may create opportunity.

Macro themes we are discussing

The Federal Reserve (Fed) remains laser-focused on inflation and suggested there may be five to six rate cuts in 2024 as inflation inputs are showing signs of relief. The recession timeline continues to be pushed down the road, as indications of economic robustness emerge. We question whether a recession will come at all, and to what magnitude if it does.

The technology sector has led overall market strength lately, though we are seeing signs of breadth expansion, which is healthy for the bulls’ risk appetite. We expect to see a moderation in technology sector strength and for market breadth to continue to expand over the upcoming earnings cycles. Market participants will likely focus on earnings, commentary around earnings, and corresponding market reactions for market clarity. We believe that artificial intelligence (AI) is a game-changer in the long run. However, since there has been a rush of “hot money” into this theme, a liquidation in the space may provide a more attractive buying opportunity.

We think the Fed will lead the global rate cycle. Chair Jerome Powell and team remain very data-driven. While recent US inflation and employment numbers look promising, they are not entirely conclusive, fueling the disinflation versus inflation debate. We think that investors should anticipate wider and fatter tails for future returns and risk distribution, both to the upside and downside. We believe active asset managers—with hedge funds being the most agile and dynamic—should be a larger component of asset owners’ portfolios for the foreseeable future.

Macroeconomic risks remain in the areas of geopolitics, real estate prices, unemployment and regulatory policies. We continue to monitor ongoing wars in Europe, the Middle East and Asia, with no short-term solutions expected. Moreover, in 2024, head-of-state elections will impact close to 50% of the world’s population. Political debates may induce periods of heightened market volatility. Commercial and residential real estate price cycles also bear watching, given higher costs of financing and more restrictive lending standards. We are monitoring a recent uptick in joblessness, despite unemployment remaining near historical lows in many countries.

Strategies with a high beta sensitivity to equity markets in 2024 may experience periods of performance pressure, given above average equity index valuations, a potential slowdown in economic growth, and geopolitical risks. Event-driven investment programs may also experience struggles, given the continued merger scrutiny and anti-monopolistic regulatory headwinds we see in Europe, the United States and China.

In terms of favorite strategies, we have tilted toward emerging markets in a subtle move and away from global macro discretionary. We foresee correlations dropping and dispersion increasing due to country-specific events, most notably the aforementioned election cycle. Long/short credit managers are positioned well to capture security dispersion and reversion due to stabilizing interest rate trends in the face of a weakening global economy. We continue to overweight insurance-linked securities due to the diversification they can provide, along with a yield pick-up and idiosyncratic risk/return profile.

Q1 2024 outlook: Strategy highlights

Emerging markets

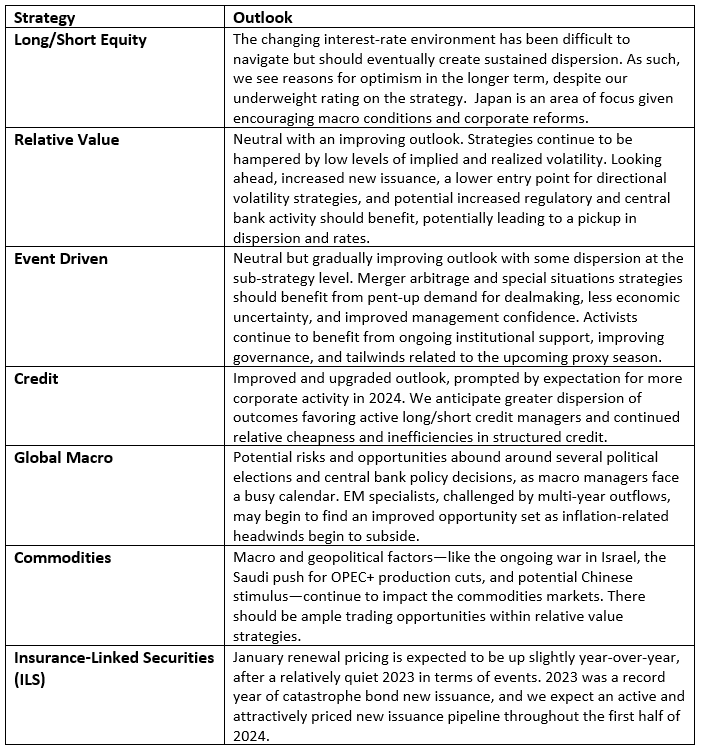

Many EM central banks were quick to hike policy rates to tackle inflation, even while developed market counterparts’ rhetoric focused on what they believed were transitory factors. Now that inflation has fallen from its highs globally, some EM central banks, especially in Latin America, have already begun new rate-cutting cycles. A sustained trend of policy easing, especially without a sharp economic slowdown, could produce a powerful tailwind for emerging markets. This macro tailwind, combined with regional differences in growth rates and inflation experiences, may provide an attractive opportunity set for active EM specialists in the months ahead.

Exhibit 1: Early to Hike Rates, Emerging Markets Have Begun Easing (right click to enlarge chart)

Catastrophe bonds

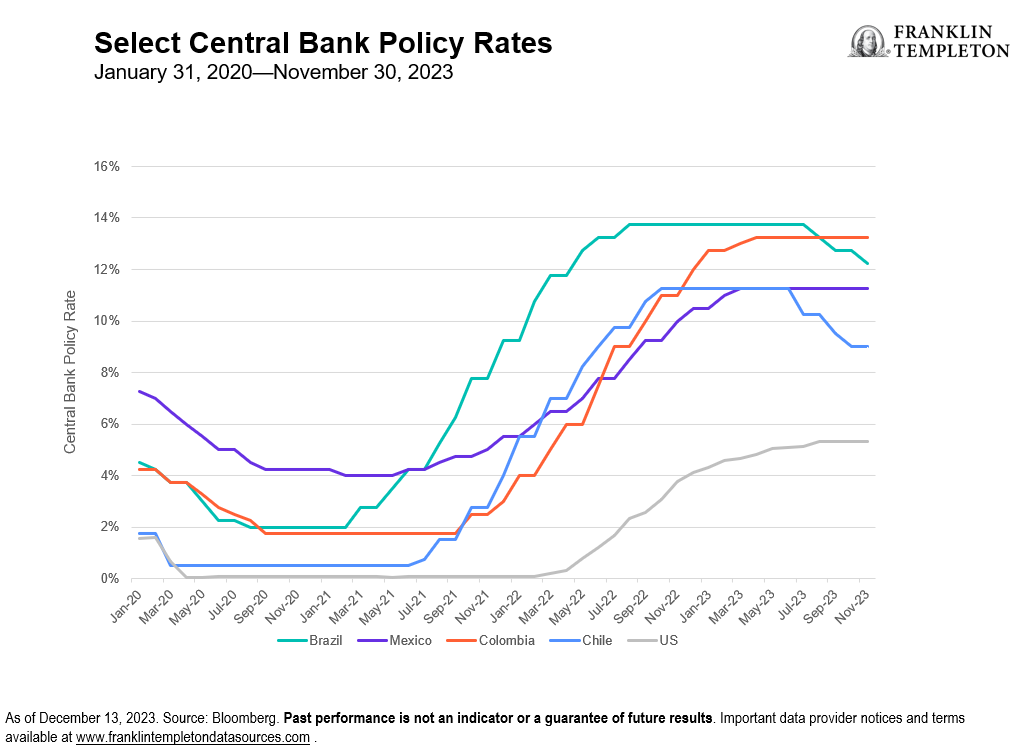

The Swiss Re Cat Bond TR Index, a proxy for the catastrophe bond market, is up over 19% in 2023 (as of December 15), outpacing most asset classes and generating the index’s highest single year return ever. Broad market repricing in the aftermath of Hurricane Ian, as well as an attractive collateral return as the Fed raised rates to over 5%, drove the strong performance. Despite tightening throughout the year, the catastrophe bond spread remains attractive relative to historical levels. We have also seen a record year of new primary market catastrophe bond issuance in 2023 (see Exhibit 2) and expect the positive momentum to continue into 2024. There were numerous new sponsors utilizing the catastrophe bond market to transfer risk in 2023, as well as sponsors who have not brought a bond to market in over five years. The combination of increasing investor demand for more senior insurance-linked securities (ILS) risk and higher total insured values, likely due to economic inflation, have led the catastrophe bond market to reach its largest size on record. While catastrophe bond pricing tightened throughout 2023, we are seeing signs of price stabilization. When coupled with a meaningful collateral return, we believe this provides an attractive entry point for investors into the catastrophe bond market.

Exhibit 2: A Record Year for Catastrophe Bond Issuance (right click to enlarge chart)

Long/short credit

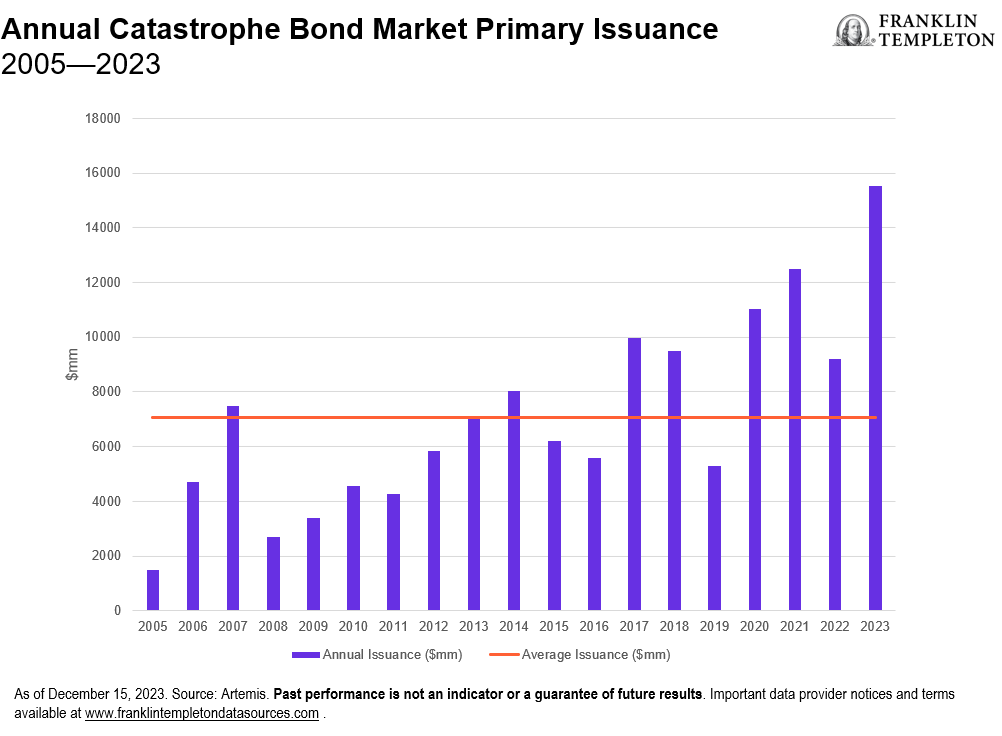

Fears of runaway inflation and elevated interest rates have abated in recent months, leading to a material risk asset rally. At the same time, it’s hard to ignore that expected slowing economic growth in the United States and other major markets in the coming quarters is the reason for this optimism. This fundamental headwind is materializing when other significant factors are coming into play—a large amount of corporate debt needing to be refinanced over the course of 2024 and 2025, an uncertain political calendar in the United States and other major economies, fast-rising default rates, and historically tight credit spreads. In our view, this conflation of positive and negative factors creates a very attractive environment for long/short credit investing, because of the expected high dispersion of outcomes for a wide range of issuers. Higher absolute yields suggest investors may get well compensated for picking the right issuers, while tight spreads allow for potentially attractive short opportunities. And the nature of debt maturities means there’s a built-in catalyst timeline for realizing elevated dispersion (see Exhibit 3), as stronger companies can engage in liquidity management and refinancing activity, while weaker issuers face a higher likelihood of default. Finally, increased capital structure complexity, varying covenant quality, and more aggressive investor behavior should benefit managers capable of superior fundamental, legal, and technical analysis.

Exhibit 3: Dispersion in High Yield Markets is Significantly Elevated (right click to enlarge chart)

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The allocation of assets among different strategies, asset classes and investments may not prove beneficial or produce the desired results. Some subadvisors may have little or no experience managing the assets of a registered investment company. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Derivative instruments can be illiquid, may disproportionately increase losses, and have a potentially large impact on performance.

Equity securities are subject to price fluctuation and possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Currency management strategies could result in losses to the fund if currencies do not perform as expected.

Commodity-related investments are subject to additional risks such as commodity index volatility, investor speculation, interest rates, weather, tax and regulatory developments. Short selling is a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. Investments in companies engaged in mergers, reorganizations or liquidations also involve special risks as pending deals may not be completed on time or on favorable terms. Liquidity risk exists when securities or other investments become more difficult to sell, or are unable to be sold, at the price at which they have been valued.

Active management does not ensure gains or protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of December 31, 2023, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

The views and opinions expressed are not necessarily those of the broker/dealer; or any affiliates.

Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.