Executive Summary

US economic review

US economy: The waiting game continues

________________________________________________________________________________________

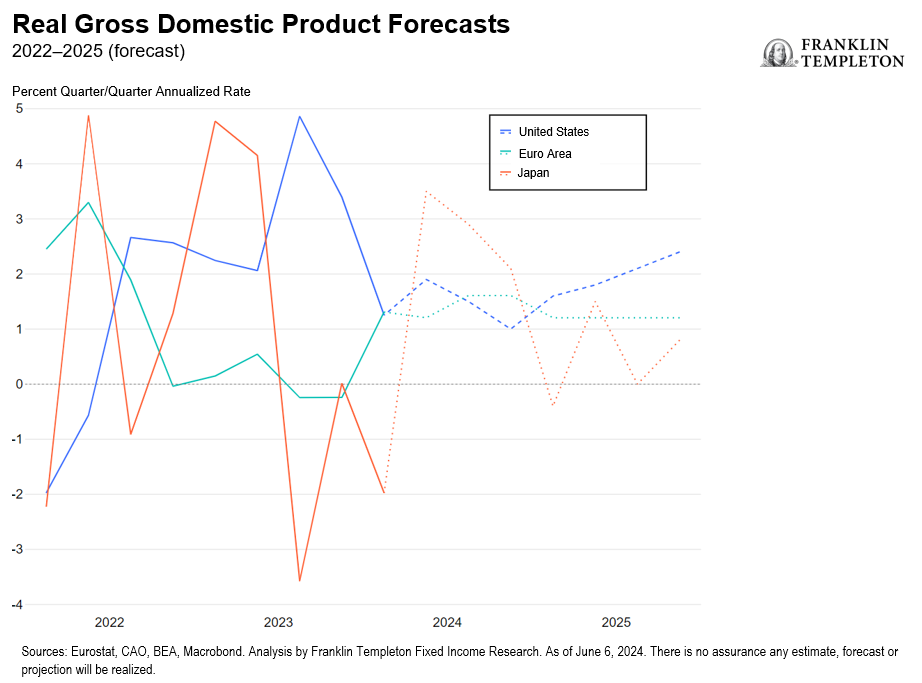

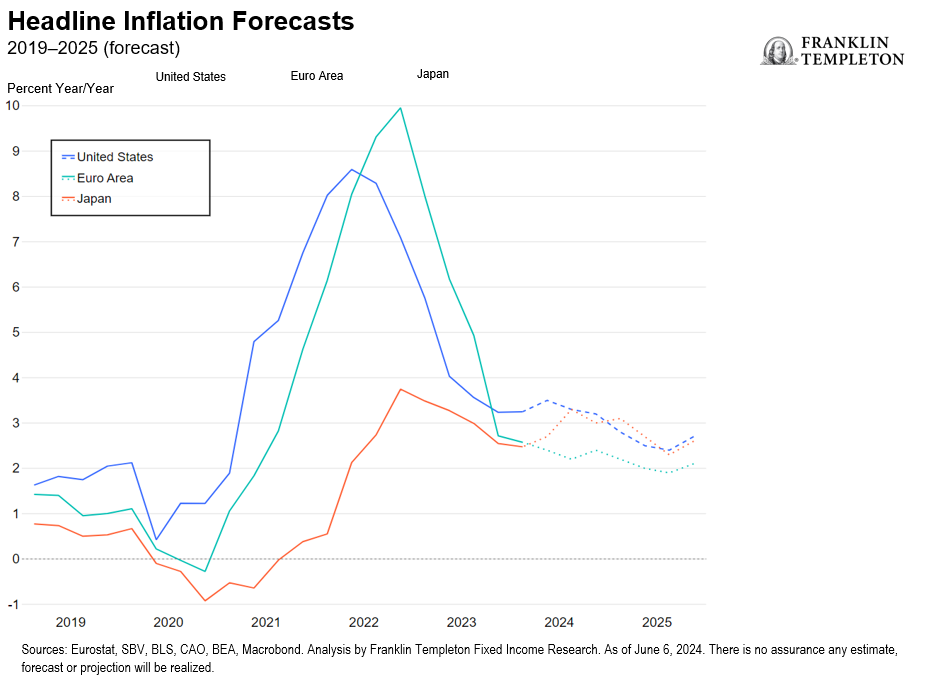

- Growth risks rising, but inflation is still top of mind: Although downside risks to growth are on the rise, upside risks to inflation have far from abated, in our view. Moreover, the Federal Reserve (Fed) is telling us that the tail risk of a rate hike cannot be ruled out, suggesting that further disinflation is far from guaranteed. With the future path of inflation uncertain, we expect just one rate cut in December, unless disinflation resumes.

- Cracks forming in the labor market: Households continue to grow cautious about their job prospects. State-level unemployment data have continued to deteriorate. Acyclical sectors have accounted for a disproportionately larger share of overall monthly job gains. However, aggregate layoffs have so far remained at historically low levels.

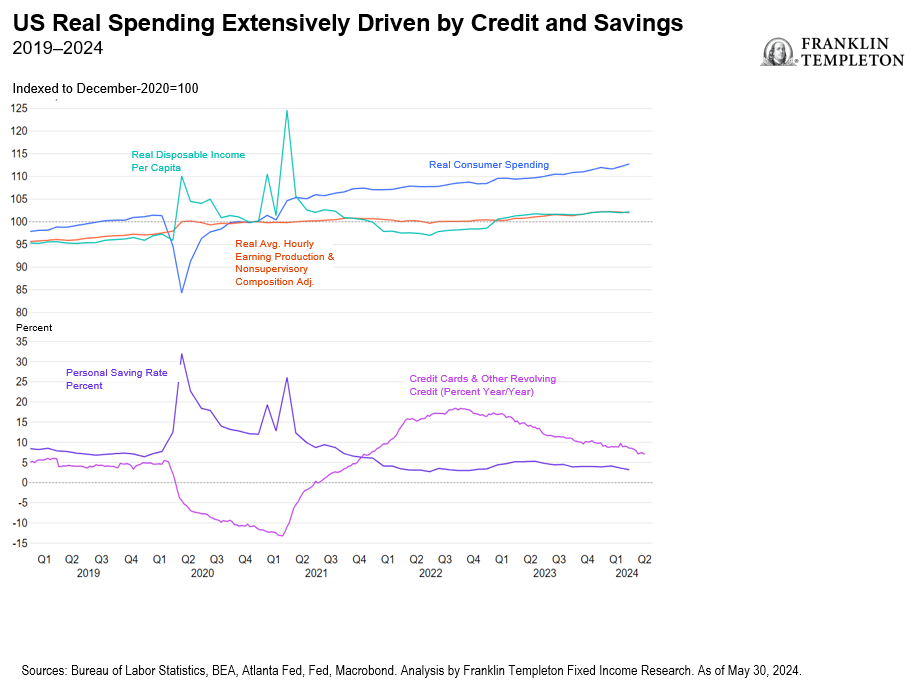

- Signs of consumer weakness: Real disposable income per capita has flatlined in the past year – much like the flattening that has taken place before almost every recession since 1959. Rising credit card rates have meant US borrowers’ non-mortgage interest payments as a percentage of disposable income are almost equal to mortgage interest payments. Credit card delinquencies have risen sharply for Gen Z and Millennial borrowers. Recent company earnings point to consumers prioritizing essentials over discretionary spending.

- Consumer balance sheets remain a source of comfort: Household wealth remains at historically elevated levels, the effective rate on mortgage debt remains at a rather low 3.8% and homeowners continue to own record equity in their real estate. Contrary to the popular narrative on excess savings, the Fed’s Flow of Funds data suggest that households’ cash-on-hand remains above the pre-pandemic trend. At 64% of nominal gross domestic product (GDP), it remains at a historically elevated level, posing potential upside risks to growth and inflation.

- Idiosyncratic factors driving core inflation: Shelter, auto insurance, and health care prices continue to play catch-up to the sharp increase in market rates and/or input prices. While health care still has ground to cover, transportation services should slow since prices and costs appear to have caught up. Multifamily rents may face downward pressure from increased supply, but single-family rents may stay high due to low inventory and strong demand.

- Wage pressures to moderate slowly: Nominal wage growth should moderate further since nominal GDP growth, hires and quits have cooled off. However, wages tend to be sticky-down. Business wage expectations are no longer falling and appear to have stabilized since the beginning of the year. Wages for the health care sector and unionized workers are still catching up with the past inflation environment. Therefore, the moderation in wages will likely be a slow grind and we believe wage growth will remain well above the pre-pandemic run rate through 2024.

European economic outlook

Euro-area economy: Getting there, but slowly

________________________________________________________________________________________

- The euro area (EA) has come out of stagnation, as GDP growth picked up in the first quarter (Q1) of 2024, coming in at 0.3% quarter-over-quarter.1 Going forward, we expect the positive growth momentum to continue. We are seeing consumer confidence recover from historically subdued levels, supported by lower headline inflation combined with still-elevated wage growth. While the savings rate remains above pre-pandemic levels—kept there by high deposit interest rates and some lingering economic uncertainty—a gradual reversal should further boost growth in the quarters ahead.

- A still-tight labor market is also supporting consumers, with the unemployment rate still at historical lows. Meanwhile, labor supply and demand imbalances are unwinding as labor shortages come down off their peaks, particularly for industry and construction. The services sector will likely experience a slower normalization process.

- Inflation continues to moderate, with bumps in the road. Despite headline inflation notching up in May, we expect the general downward trend to resume going forward, with some volatility toward the end of the year. Wage-sensitive items, such as hospitality and recreational activities, remain hot and are exposed to rising real demand from consumers.

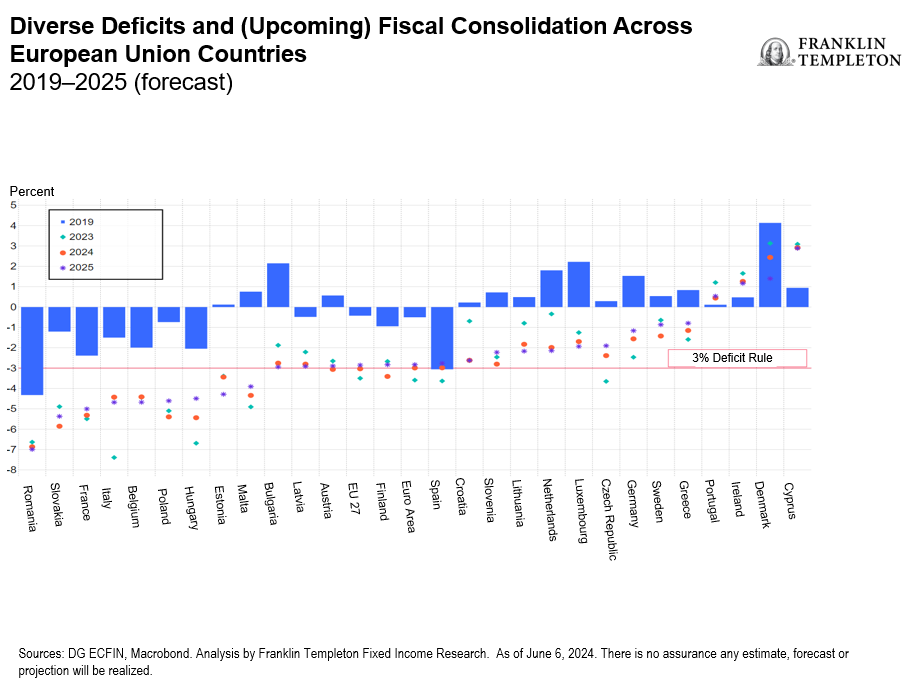

- Over the summer, our attention will likely turn to the newly approved fiscal rules that are aimed at reducing deficits and debt ratios across European Union member states. Fiscal spending has ballooned as governments responded to the COVID-19 pandemic and energy shocks. With 2024 seen as a transition year, we will monitor the different consolidation plans that various EA governments draw up in order to comply with the rules that come into force in 2025. This will mean a divergence from the current expected US fiscal path.

- The European Central Bank (ECB) is aiming for controlled and cautious monetary easing. The expected June rate cut was described as not “dialing back” restrictiveness, with policymakers wanting to maintain restrictive (real) rates throughout 2024. Going forward, the ECB will keep an eye on the still-elevated core inflation and wages, as it seeks further data to validate a sustained normalization path. This process might be lengthy, and therefore policymakers are likely to remain cautious. Consequently, our base case is that another cut in July is unlikely; we anticipate a next move in September and then December in conjunction with the release of new forecasts.

Japan economic outlook

Japan’s economy: Bank of Japan (BoJ) in a dilemma

________________________________________________________________________________________

- Growth remains on track despite a weak first-quarter GDP print, which was not unexpected. We expect a modest recovery, especially in the second half 2024, as auto production disruptions should ease, private consumption should be cushioned from strong wage gains and private capital expenditure picks up steam on the back of strong corporate earnings. The one-time tax rebates of ¥30,000 on income and ¥10,000 in individual resident tax per person including dependents will likely add to the synergy effect with simultaneous wage increases. We retain our 2024 growth forecast at 0.5% year/year (y/y) with a rebound to 1.2% in 2025.

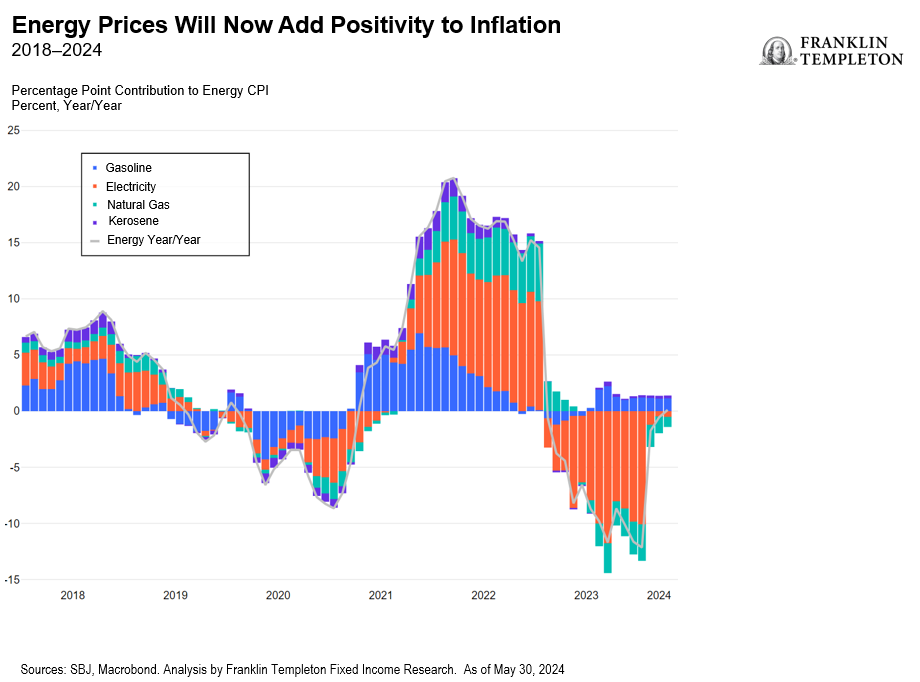

- Inflation was soft in April, but the momentum is set to revive starting May. Energy, which was the biggest drag to consumer price index (CPI) so far, should rebound, owing to both a hike in renewable energy charges as well as the end to the gas and electricity subsidies the government has provided since 2022. This—added to yen weakness which has already been stoking imported price inflation—will likely add to heightened price pressures in the coming months. We stick to our 2024 core Consumer Price Index (CPI ex fresh food) forecast of 2.9% y/y, which is well above consensus expectations. Sticky prices in the foreseeable future mean this measure will likely remain close to 2.7% in 2025.

- The BoJ is facing a dilemma: whether to hike rates owing to a weak yen, which is adding to inflationary expectations and weak real incomes while domestic demand is slow and growth momentum weak. BoJ Governor Kazuo Ueda still sees merit in yen weakness versus raising rates too quickly; the former is boosting tourism receipts and corporate earnings. Yet, we believe the BoJ will not be able to overlook yen weakness for long, as it risks tethering inflationary expectations higher, leading to stickier inflation prints, a fact we have argued is putting the BoJ behind the curve. We therefore see at least two rate hikes in the remainder of 2024, likely in July and October, to take the upper bound of the target rate to 0.50%. We believe markets will move closer to our forecast with time. We expect more solid forward guidance on possible quantitative tightening at the June meeting.

- Our expectation of stickier inflation underpins our call for a higher terminal rate, close to 2% by end 2025, which stands in contrast to market expectations and the BoJ’s own current assumptions of rate hikes being extremely gradual and paced out.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

____________

1. Source: Eurostat. As of May 15, 2024.

2. Ibid.

3. Source: Eurostat. As of May 31, 2024.