Since China’s lackluster post-COVID reopening, we’ve been asked some form of this question many times—“Is India the next China?”

With its more youthful population, India recently surpassed China as the world’s biggest nation. Its manufacturing and services purchasing managers’ indexes (PMI) have long been in expansion mode as the world’s largest democracy continues to lure investment from foreign tech giants. What’s more, India took big leaps forward in aerospace achievements and diplomatic leadership last year as host of the G20 summit. India has drawn praise for embarking on a path of military modernization and reducing its reliance on Russian defense equipment. And by 2026, about US$534 billion in new infrastructure is expected to be rolled out, equal to the inflation-adjusted value of all infrastructure built over the past 11 years, according to Bloomberg Economics. Earlier this year, India also struck a new trade agreement with the European Free Trade Association (EFTA) to lift tariffs in exchange for US$100 billion in foreign direct investment commitments. The EFTA accord is expected to generate 1 million jobs in India over the next decade and a half.

Few would disagree that India is benefiting from China’s slowdown. But especially now that the dust has settled over Prime Minister Narendra Modi’s electoral setback, we believe the political outcome underpins the view that this noisy democracy is distinctly different.

Rather than splintering, several opposition parties united during general elections in what amounted to an anti-BJP (Bharatiya Janata Party) vote that presented hurdles for Modi even as the untested new coalition government could still prove fractious and unstable. Despite difference in political ideology, we believe all sides are committed to the same underlying objective of advancing India’s economy, and to some extent the infighting amounts to jockeying for credit over positive outcomes. Nevertheless, the divided power structure arguably bodes well for the country’s consensus-building process—a positive in our view.

We remain optimistic that policy reforms already in place set a strong foundation for export growth and the ongoing rise of a new class of Indian consumers. Certain sectors like energy and defense also tend to be less sensitive to partisan issues, and India remains a trusted value-chain partner for electronic device and chip manufacturers.

Consider that India’s equity market recouped post-election losses of nearly 6% for the S&P CNX Nifty Index at the fastest rate in recent history—over merely three sessions.1 The rebound reflects unwavering confidence among domestic retail investors. The country’s retail inflation also edged lower in May to 4.75%, down from 4.83% in April, aided in part by lower fuel prices despite continued elevated food prices, according to new government data.2

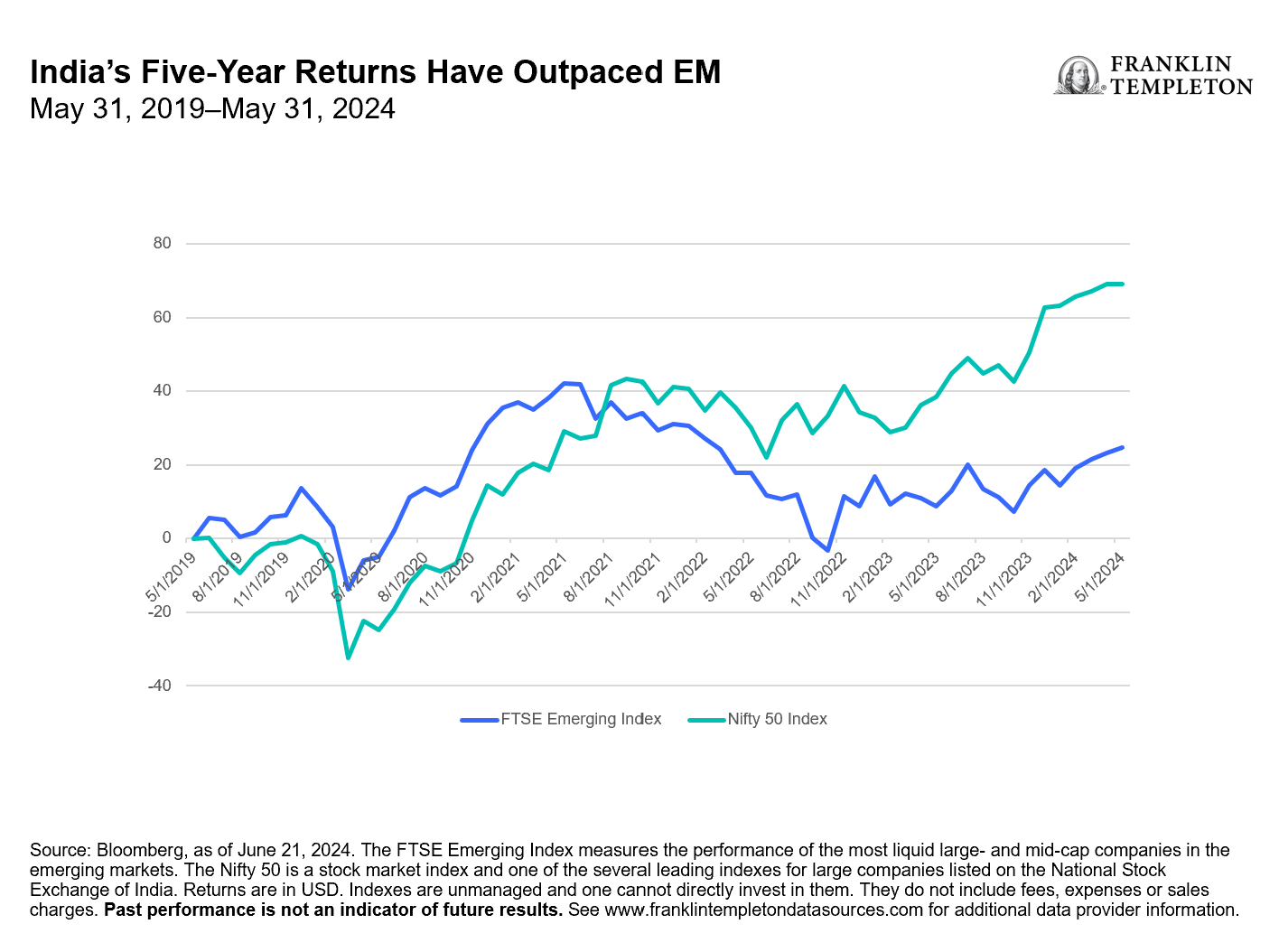

In January this year, the Indian stock exchange even overtook that of Hong Kong’s in capitalization (US$4.3 trillion versus US$4.29 trillion),3 reflecting India’s exceptional 2023 performance. This year, the Nifty 100 Index is up 12.7% year-to-date through June 20, compared to 9.3% for FTSE Emerging Index over the same period (returns are in USD).4

Most broad emerging market (EM) benchmarks are still heavily weighted toward China, though solid performance among Indian equities has been closing this gap. A case in point for India’s rising prominence in EM: In May, MSCI boosted India’s weighting in its Emerging Market Index to nearly 19%, up from roughly 9% in 2020.

Investors seeking more targeted exposure to India may find single country exchange-traded funds to be compelling low-cost building blocks for asset allocation. For those wanting to tap exposure to India’s attractive mid-cap segment, keep in mind that some indexes offer a deeper portfolio compared to others.

India’s equity markets are also well-diversified across sectors and company types that potentially offer an elevated growth outlook and opportunities driven by domestic consumption and emerging industrial prowess. Financials hold the largest share, followed by significant consumer discretionary, industrial, energy and technology weightings. The market also offers good exposure to consumer staples, utilities and health care names.

As India’s gross domestic product (GDP) is forecast to increase at an average of 6.5% annually over the next five years, we feel optimistic that this diverse and dynamic economy can potentially realize a multi-decade growth story, perhaps with even hardier democratic checks in place.5

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Bloomberg, June 11, 2024. The S&P CNX Nifty Index, also called the Nifty 50, is a stock market index and one of the several leading indexes for large companies listed on the National Stock Exchange of India.

2. Source: Ministry of Statistics and Programme Implementation. June 11, 2024.

3. Morningstar as of January 23, 2024.

4. Source: Bloomberg, as of June 21, 2024. The Nifty 100 represents the top 100 companies based on full market capitalization listed on the National Stock Exchange of India. It intends to measure the performance of large market capitalization companies. The FTSE Emerging Index measures the performance of the most liquid large- and mid-cap companies in the emerging markets. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator of future results. See www.franklintempletondatasources.com for additional data provider information.

5. Sources: Statista and IMF World Economic Outlook. Data calculated to December 31, 2023, released in April 2024, amended on May 21, 2024. There is no assurance that any estimate, forecast or projection will be realized.