Inflation, labor markets and the Fed

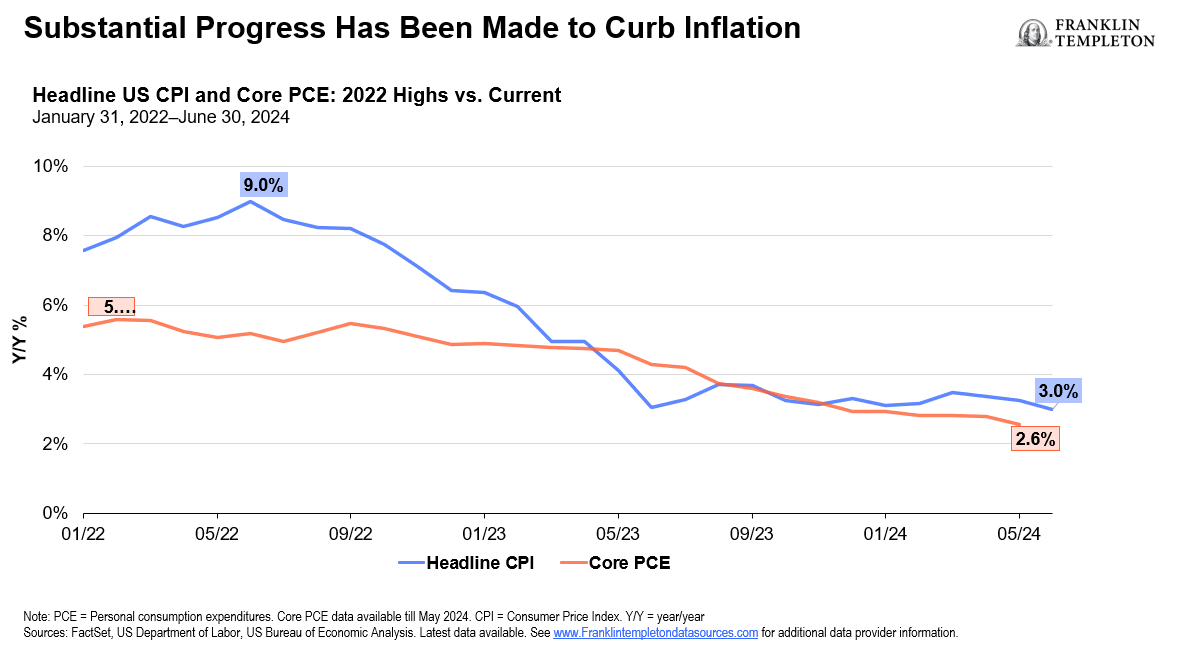

Before delving into income opportunities, it’s crucial to address the current state of inflation, as it remains a central focus for the markets. Over the past year, significant strides have been made in managing inflation rates. The core personal consumption expenditures index (PCE), the Federal Reserve’s (Fed’s) preferred inflation gauge, has decreased from a peak of 5.6% in early 2022 to approximately 2.6% today. While initial progress in reducing inflation was anticipated, the final steps toward reaching the Fed’s target are proving to be challenging. This difficulty has led to market fluctuations and adjustments in expectations regarding interest rates and the timing of the Fed’s rate cuts.

It’s important to remember the Fed operates under a dual mandate: to ensure price stability through inflation targeting and to promote maximum employment. The labor market is gradually returning to what we consider a more normalized state. In 2023, the unemployment rate experienced minimal fluctuations, moving from 3.5% to 3.7%. However, the first half of 2024 saw a more significant increase, reaching 4.1% by June. Other indicators, such as job openings, quit rates and consumer sentiment, have nearly returned to pre-pandemic levels. The Fed is likely reassured by these signs that the labor market disruptions caused by COVID-19 are subsiding.

Prospects for rate cuts in 2024

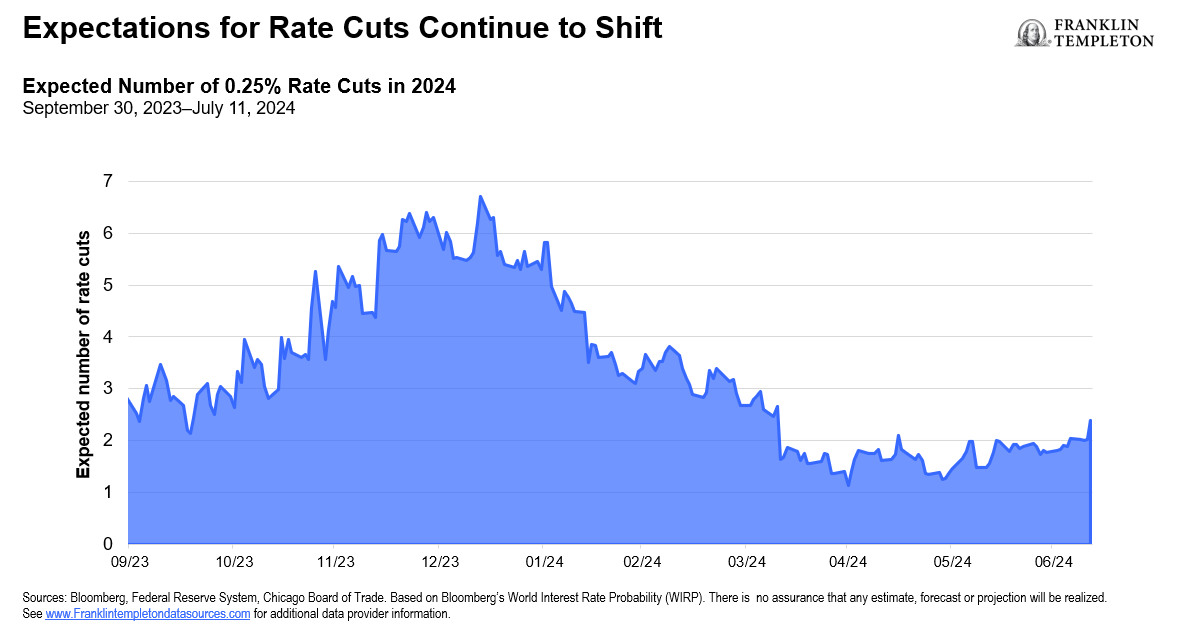

Expectations for interest-rate cuts have shifted dramatically over the past 6-9 months. At the end of 2023, the markets anticipated a series of rate cuts in 2024. However, as disinflation slowed, these expectations were adjusted. A few months ago, the futures market was predicting only one rate cut for 2024. Recent developments in inflation and labor market softening have once again altered this outlook. It’s important to note that the Fed’s transition from tightening to easing doesn’t need to be immediate. There is potential for a gradual shift to a more neutral or normal stance, as gross domestic product growth slows, labor market conditions soften further, and inflation goals are nearly met. This sets the stage for potentially 4-6 rate cuts by the first half of 2025. We anticipate Fed policy normalization will be beneficial for more rate-sensitive plays within the equity as well as fixed income markets.

Equities and market broadening

Interest-rate expectations have influenced market dynamics. In a tight-rate environment with a slowing economy, companies that have consistently delivered growth outperformed. This trend has resulted in a narrower equity market dominated by a few large-cap growth stocks, often referred to as the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla). However, with a reduced likelihood of a US recession versus last year, there’s potential for broader market leadership across various sectors. Approximately 40% of S&P 500 companies are currently trading more than 10% below their recent highs,1 highlighting opportunities for sector diversification in financials, technology, energy, health care, and utilities. We also see potential for diversification through common stocks, convertibles and other hybrid equity investments.

The second-quarter earnings season is underway, and the bar has been set fairly high. As we think about equity investing, we will continue to watch earnings and expectations going forward. We see a bit of a conflict between decelerating growth, a Fed that seems to be cautious about normalizing and cutting interest rates, and the very robust earnings expectations many analysts have.

Fixed income opportunities

The last 12-18 months offered yield levels, spread levels and overall prices of investment-grade securities that were quite attractive. In many instances, yield opportunities were the most attractive for high quality fixed income than we’ve seen over the past 10 or even 15 years, during the period where interest-rates were much lower overall, close to zero lower bound. These attractive opportunities were mostly within corporate credit, particularly investment-grade corporate bonds and high-yield corporate bonds.

But over the past year or so, we’ve seen yields come down. We’ve seen spreads tighten pretty dramatically within the corporate credit space. The market has returned once again to more of a fair value posture, in our opinion.

If we were to see interest rates gradually move down across the yield curve, we would still view that as positive from an investment standpoint. But, in our view, the real attractive relative value is not as appealing today as it has been for most of the past 12-18 months.

That said, credit exposure remains an area that we like; investment-grade and high-yield corporates are still generating yields that remain fairly attractive. However, we are being more selective today. We want to ensure we are adequately compensated for the incremental risk we take, particularly in a period where we think it’s reasonable to assume there will be moderation or deceleration of economic growth. Many companies within the high-yield space did well within the low-rate environment of the past and are now facing maturities and the prospects of refinancing debt at much higher rates. So, we’re going to be a little more selective and cautious there.

A nimble strategy in uncertain times

With US economic growth likely to decelerate and significant events such as the upcoming presidential election on the horizon, we believe adopting a flexible investment strategy is essential. Our approach balances equities and fixed income, adjusting dynamically based on market conditions and yield opportunities. This nimble strategy is crucial for navigating potential volatility and capitalizing on income opportunities in uncertain times.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. Equity securities are subject to price fluctuation and possible loss of principal. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E and Legg Mason Asset Management Singapore Pte. Limited, Registration Number (UEN) 200007942R. Legg Mason Asset Management Singapore Pte. Limited is an indirect wholly owned subsidiary of Franklin Resources, Inc. 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

_______________

1. Source: FactSet, S&P Dow Jones Indices, FactSet Market Aggregates. As of June 30, 2024.

English

English 简体中文

简体中文