At its July 31 policy meeting, the Bank of Japan (BoJ) raised its policy rate by 15 basis points (bps), in line with our out-of-consensus call. While most market participants flagged the risk of a hike in this meeting, the consensus was to stand pat on rates. The other important decision was the announcement on the paring back in Japanese government bond (JGB) purchases; the central bank had given forward guidance of this action in June.

The BoJ announcement included:

- Raising the short-term interest rate to 0.25% from the current 0%-0.1% by a 7-2 majority vote.

- Cutting its monthly JGB purchases to ¥5.3 trillion in August–September from ¥5.7 trillion in July. It plans to taper by ¥0.4 trillion each quarter thereafter, to ¥2.9 trillion by the first quarter of 2026 (a 7%-8% balance-sheet reduction in two years). This was a unanimous decision.

- There will be an interim assessment of the tapering plan at the June 2025 meeting, but the bank will make “nimble responses,” if necessary, as per the economic reality on the ground.

- The BoJ revised its gross domestic product forecast downward for fiscal year 2024 (ending March 2024) to 0.6% from 0.8% previously. Its forecast for the core Consumer Price Index (CPI) was also adjusted lower to 2.5% but was raised to 2.1% for fiscal year 2025 (ending March 2025). Core-core (stripping out fresh food and energy) was left unchanged roughly around the 2% mark for the next three years.

In his post-meeting press conference, Governor Kazuo Ueda said that a weak yen was a risk for further upside in inflation and that wages and prices were moving sufficiently toward the BoJ’s goal. On the question of weak growth and in particular private consumption, he said that wage growth should support consumption and that data still points to it being on solid footing. He outlined that real rates were still very much negative, and that the impact of the hike on the economy will be manageable. On future rate hikes, Governor Ueda cautioned on being data-dependent.

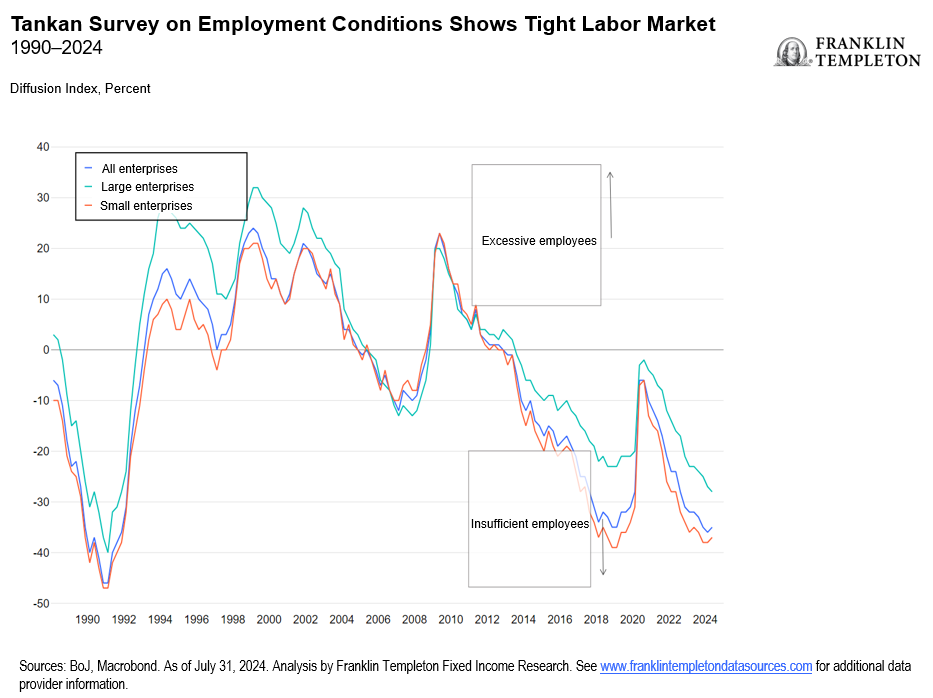

We are aware wage growth was a primary cause for the BoJ’s rate move. Not only have larger companies shown stronger signs of wage growth in the annual spring wage negotiations, hard data is now reflecting the increases. Scheduled full-time pay for the same sample base has stayed above 2% since September 2023, hitting a record high of 2.7% in May 2024. This trend is expected to remain for the coming months. Smaller firms also continue to feel pressures from labor shortages, according to BoJ’s Tankan survey, which will prompt them to raise wages sufficiently as well.

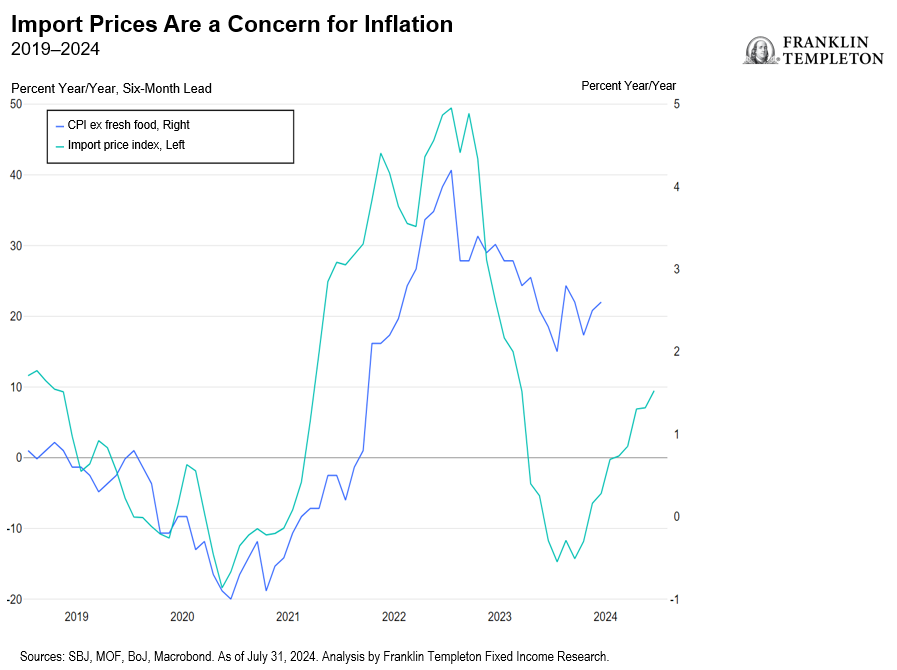

The other deciding factor for the BoJ was yen weakness. Governor Ueda went out to state the yen’s slide will pose upside risks to inflation. Import prices have been trending up since late last year but turned positive on an annual change basis starting February. It is already at 9.5% year/year in June. Import price rises tend to impact inflation with a six-month lag, indicating that the yen’s persistent weakness could cause sticky inflation going forward. Food makes up close to 10% of Japan’s total goods imports. Imports account for close to 90% of its total energy needs.1

We stick to our earlier assessment of one more rate hike this year (25 bps) in the fourth quarter. There was confidence in the growth-inflation dynamics in Ueda’s comments with BoJ forecasts for inflation barely changed from the April assessment. Real yields and real policy rates remain low, allowing the BoJ to hike while being supportive of economic expansion. While the yen’s recent strength is welcome, US Treasury yields were the main driver. We therefore see the yen’s immediate outlook very much dominated by overseas factors, including the Federal Reserve’s moves.

However, our key takeaway is that the BoJ is wary of currency weakness and its impact on inflationary expectations. It is also taking decisions based on economic fundamentals. Governor Ueda said 0.50% is not the ceiling for the policy rate, even though the market seems to think it is. We view this as a clear indication that further rate hikes cannot be ruled out even beyond the one later this year. Our outlook in this regard is more aggressive than market expectations currently, factoring in four additional rate hikes next year.

All in all, we think the BoJ has delivered on both fronts in its July policy meeting. By hiking rates even as many see growth to be shaky, it has tried to fight off allegations of falling behind the curve.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E and Legg Mason Asset Management Singapore Pte. Limited, Registration Number (UEN) 200007942R. Legg Mason Asset Management Singapore Pte. Limited is an indirect wholly owned subsidiary of Franklin Resources, Inc. 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

______________

1. Source: Center for Strategic and International Studies. As of May 22, 2024.