In episode 15 of our Alternative Allocations podcast series, I had the opportunity to sit down with Nick Veronis, Co-Founder and a Managing Partner of iCapital Network. Nick and I discussed a wide range of topics, from product evolution to advisor adoption and the shrinking universe of public companies. We began our journey by revisiting the founding of iCapital and the challenges for advisors at that time. We explored how the industry has evolved to meet those challenges.

A decade ago, the wealth-management community struggled with paperwork and technology to open and process accounts. There was limited access to the private capital markets, no institutional-quality due-diligence reporting, and not a lot of research available to wealth advisors. Advisors often lacked sufficient knowledge about the asset class, the products available to them and how to use these tools appropriately.

Now, we are seeing a robust lineup of institutional managers offering products to a broader group of investors, in a more flexible structure, with lower minimums. Firms like Franklin Templeton, CAIA, iCapital and others have built comprehensive training programs and thought leadership to help advisors, and the technology and online processing of paperwork has improved dramatically over the last decade.

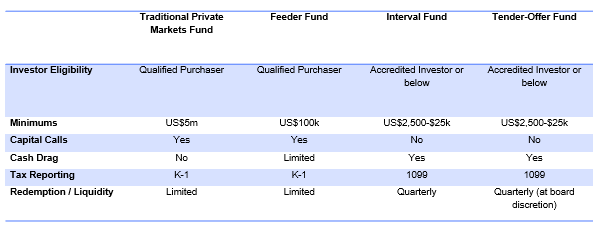

Nick and I discussed product evolution as a key lever for advisor adoption. The first generation of funds were limited to the roughly two million qualified purchaser (QP) households in the United States, possessing high minimums and limited liquidity. Feeder funds were introduced to bring the minimum investment down to US$100,000 and streamline the processing of capital calls, distributions and K-1s. These were still only available to QPs.

Registered funds, including interval and tender offer funds, are available to the roughly 14 million accredited investor households. Minimum investment requirements for these range from US$2,500 to $25,000. They also eliminate the complexities of closed-end drawdown funds, and they offer quarterly liquidity (typically restricted to 5% per quarter) and simplified 1099 tax reporting. These funds are often called “perpetual” or “evergreen,” describing their availability. Note, there are structural tradeoffs associated with the various vehicles (Exhibit 1).

Exhibit 1: Structural Tradeoffs

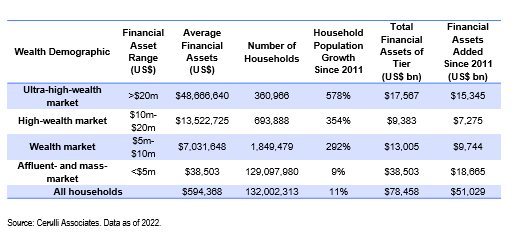

Registered funds have helped democratize the access to alternative investments by expanding the number of investors who can use these unique investments. As the Cerulli data in Exhibit 2 illustrates, the number of households that meet the QP threshold (US$5 million or more in investable assets) is fairly limited, while registered funds are available for accredited investors (US$1 million or more in investable assets) and others below that threshold.

Exhibit 2: Wealth-Tier Demographics

Nick noted that the game really changed when top-tier firms decided to launch evergreen products in the wealth channel, “… taking greater ownership of these products, eliminating the intermediaries, bringing institutional style pricing to the marketplace.” He added that “… by the way, they’re doing that because they want to deliver strong results. They want to protect the integrity of their brands.”

Nick and I discussed the growing need for more robust and comprehensive training around the use of alternatives. He noted that basic training is essential—but emphasized that advisors need to understand liquidity constraints, fees, structural tradeoffs, asset allocation and portfolio construction.

We agreed this is a journey where the industry needs to meet advisors wherever they are on their path toward alternatives. We need to offer education through different means, including online and in person. We need to provide objective and transparent advice, focusing on helping investors achieve their long-term goals.

Nick reminded about how far we have come as an industry—and also how much work still needs to get done.

Make sure you don’t miss an episode by subscribing to Alternative Allocations on Apple, Spotify or wherever you get your podcast.

*The podcast was honored by the 2024 WealthManagement.com Industry Awards in the thought leadership category, which recognized its outstanding contributions moving the industry forward by providing insights to advisors helping to improve their understanding of alternative investments. The 2024 WealthManagement.com Industry Awards, known as the Wealthies, were awarded in September 2024 for the Alternative Allocations podcast for the period between September 2022 and May 2024. For the details of the award, including the assessment methodology and judging criteria, please refer to the official award website. Franklin Templeton did not pay an entry fee or other compensation for the award.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Investments in many alternative investment strategies are complex and speculative, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative strategies may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. Diversification does not guarantee a profit or protect against a loss.

Risks of investing in real estate investments include but are not limited to fluctuations in lease occupancy rates and operating expenses, variations in rental schedules, which in turn may be adversely affected by local, state, national or international economic conditions. Such conditions may be impacted by the supply and demand for real estate properties, zoning laws, rent control laws, real property taxes, the availability and costs of financing, and environmental laws. Furthermore, investments in real estate are also impacted by market disruptions caused by regional concerns, political upheaval, sovereign debt crises, and uninsured losses (generally from catastrophic events such as earthquakes, floods and wars). Investments in real estate related securities, such as asset-backed or mortgage-backed securities are subject to prepayment and extension risks

An investment in private securities (such as private equity or private credit) or vehicles which invest in them, should be viewed as illiquid and may require a long-term commitment with no certainty of return. The value of and return on such investments will vary due to, among other things, changes in market rates of interest, general economic conditions, economic conditions in particular industries, the condition of financial markets and the financial condition of the issuers of the investments. There also can be no assurance that companies will list their securities on a securities exchange, as such, the lack of an established, liquid secondary market for some investments may have an adverse effect on the market value of those investments and on an investor’s ability to dispose of them at a favorable time or price. Past performance does not guarantee future results.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.