Key takeaways

- Economic factors including all-time-high house prices, elevated mortgage rates and record-low inventory have made it challenging for many people, especially first-time buyers, to purchase a home

- A range of lifestyle and demographic factors are also contributing to the global rise in rentership, and increasingly even those who can afford to buy prefer to rent

- The global trend toward higher rates of rentership creates opportunity for residential landlords and investors in rental properties

- Real estate investment trusts (REITs) can be an effective way to gain exposure to this highly desirable segment

Across the globe, renting is on the rise

“Do I own, or do I rent?” It’s a personal decision we all make. However, the global collective trend is undisputed: Rentership is on the rise.

Today, there are more than 45 million renter households in the United States.1 The 2020 Census revealed rentership increased 9.1% over the prior decade, a jump fueled in large part by the “wealthy renter” (those making over US$150,000, who could afford to buy but opt to rent). Wealthy renters rose 82% between 2015 and 2020. 2

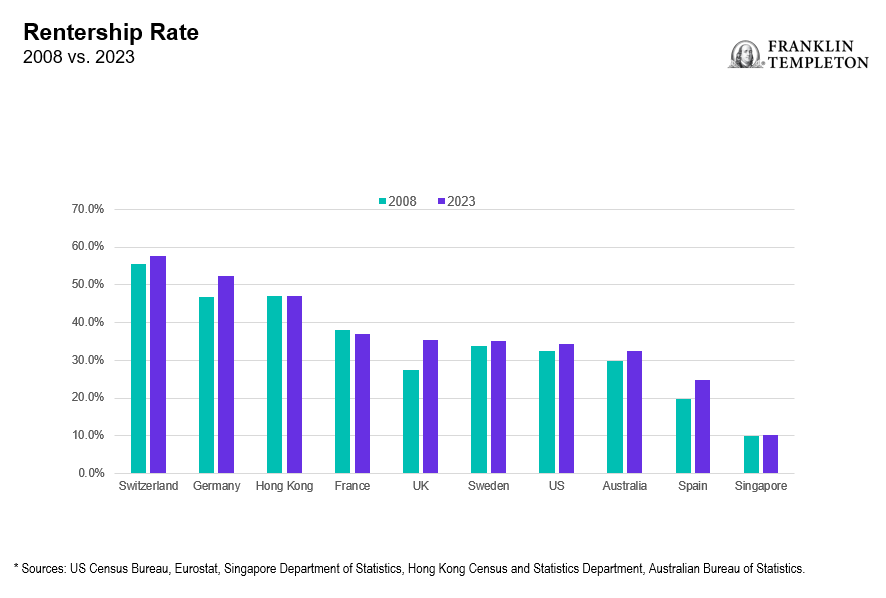

This shift extends beyond the United States to the global stage. In Canada, the 2021 Census reported that over the previous decade, renters increased at three times the pace of homeowners, rising by nearly 900,000 households.3 In the United Kingdom, the number of first-time home buyers dropped to the lowest levels in a decade in 2023, reinforcing the country’s reputation as a “renter nation.”4 In countries like Germany and Switzerland, the concept of the “forever renter” is not uncommon, and rentership rates are among the highest in the world at over 50%.5

Exhibit 1: Rentership Has Increased in Many Countries since 2008

What’s driving this change?

Economic factors including all-time-high house prices, elevated mortgage rates, and record-low inventory have made it challenging for many people, especially first-time buyers, to purchase a home. Renting is now cheaper than buying in more than 50 major US cities—in fact, in over 20 US major metropolitan areas, the monthly cost of owning is at least 50% higher than renting.6 A global shortage of available housing has exacerbated the issue; major economies are simply not building enough homes to keep pace with demand. In the United Kingdom, a deficit of 4.3 million homes has sparked commentators to label it the country’s worst housing crisis since World War II.7

Recent reductions in mortgage rates may ease the affordability constraint for some, but the obstacles remain insurmountable for many, including high financing costs and the challenge of saving for a down payment. A recent Zillow survey showed that median savings for prospective homebuyers was about $29,000, covering just 8% of the typical US home price (and well below the standard 20% down payment).8

The rise in rentership is also tied to a range of lifestyle and demographic factors, including increased value placed on flexibility and convenience, higher immigration, more people living alone and rising skepticism around the financial benefits of ownership. A survey in New York City found that 40% of Generation X renters thought buying a home was not a good investment, even though 78% said they could afford it.9 A 2023 study found that 46% of Canadian renters simply preferred to rent, citing benefits of “added services” and freedom from a long-term financial commitment.10

Capitalizing on rising rentership through REITs

This rise in rentership creates a profitable opportunity for the residential landlord. But for most investors, owning a portfolio of rental properties is impractical, if not impossible. Owning specialized residential REITs can be a much more effective way to gain exposure to this desirable sector with transparency and liquidity.

Investing in a professionally managed REIT portfolio can provide the benefits of expert, in-depth analysis across several factors:

- Superior asset quality: focus on well-located properties (i.e., central, walkable, accessible), those with sustainability practices and/or properties that provide amenities, such as fitness centers or communal spaces

- Use of revenue optimization software: machine learning algorithm that optimizes for occupancy and rents

- Additional revenue sources: consider parking, package lockers, Wi-Fi, pet fees

- Use of technology for increased customer satisfaction: examples include portals for payments and requests, automated reporting and analytics using artificial intelligence (AI) and machine learning, smart home integrations, virtual tours/showings

- Standardized purchasing systems: realizing reduced costs through competitive sourcing contracts, improved pricing and enhanced operating efficiencies

- Access to a range of capital sources: providing the necessary means to invest in building improvements and expansionary opportunities

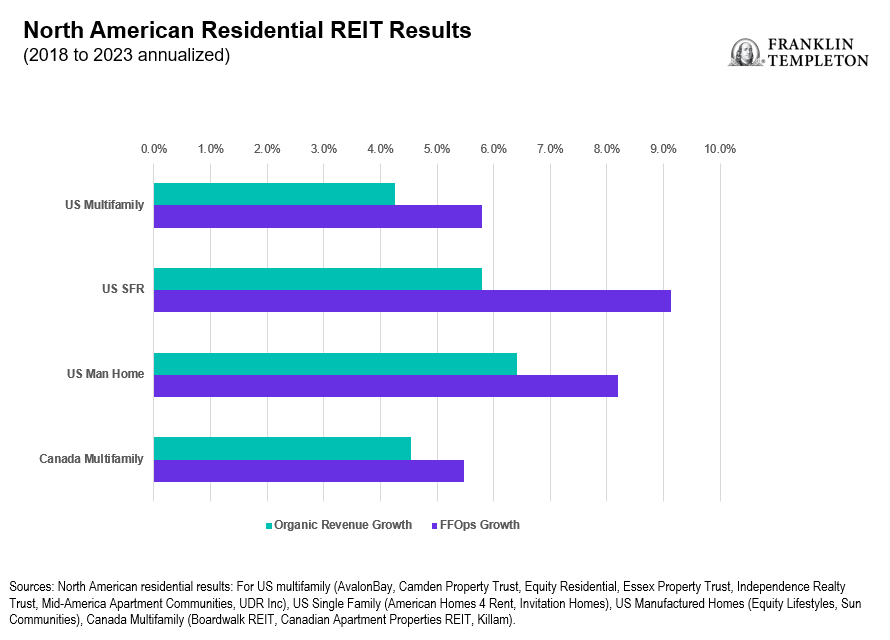

Exhibit 2: Single-Family Residential REITs Have Outperformed in North America

However, not all residential real estate is created equal. Performance dispersion exists between respective formats and geographies tied to differences in supply/demand dynamics, demographics and regulatory backdrops. As you can see in the chart above, financial performance of single family homes has outpaced multi-family properties in both the United States and Canada.11 We believe a professionally managed portfolio can help investors optimize residential REIT investments.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Investment strategies which incorporate the identification of thematic investment opportunities, and their performance, may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner.

Real estate investment trusts (REITs) are closely linked to the performance of the real estate markets. REITs are subject to illiquidity, credit and interest rate risks, and risks associated with small- and mid-cap investments.

Risks of investing in real estate investments include but are not limited to fluctuations in lease occupancy rates and operating expenses, variations in rental schedules, which in turn may be adversely affected by local, state, national or international economic conditions. Such conditions may be impacted by the supply and demand for real estate properties, zoning laws, rent control laws, real property taxes, the availability and costs of financing, and environmental laws. Furthermore, investments in real estate are also impacted by market disruptions caused by regional concerns, political upheaval, sovereign debt crises, and uninsured losses (generally from catastrophic events such as earthquakes, floods and wars). Investments in real estate-related securities, such as asset-backed or mortgage-backed securities are subject to prepayment and extension risks.

The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested.

Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the US, this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. US: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg – Tel: +352-46 66 67-1, Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400, Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100, Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

The views and opinions expressed are not necessarily those of the broker/dealer; or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.

Copyright © 2024 Franklin Templeton. All rights reserved.

_____________

1. Source: 2020 US Census. US Census Bureau.

2. Ibid.

3. Source: Canadian Census 2021. Statistics Canada.

4. Source: Eurostat, distribution of population by tenure status, type of household and income group. August 24, 2024.

5. Sources: US Census Bureau, Eurostat, Singapore Department of Statistics, Hong Kong Census and Statistics Department, Australian Bureau of Statistics.

6. Source: “Buy or Rent? Study Shows Renting is More Affordable in the 50 Largest Metros.” Bankrate. April 29, 2024.

7. Source: “The housing crisis: The UK’s 4 million missing homes.” Centre for cities. February 22, 2023.

8. Source: “Prospective Buyers: Results from the Zillow Consumer Housing Trends Report 2023.” Zillow, September 18, 2023.

9. Source: “Why Two-Thirds of New Yorkers Rent, Not Buy.” Easy Street. February 21, 2019.

10. Source: “2023 Canadian Multi-Residential Satisfaction Survey Report.” Simplydbs, Based on data collected May-July 2023.

11. Sources: North American residential results: For US multifamily (AvalonBay, Camden Property Trust, Equity Residential, Essex Property Trust, Independence Realty Trust, Mid-America Apartment Communities, UDR Inc), US Single Family (American Homes 4 Rent, Invitation Homes), US Manufactured Homes (Equity Lifestyles, Sun Communities), Canada Multifamily (Boardwalk REIT, Canadian Apartment Properties REIT, Killam).