Key takeaways

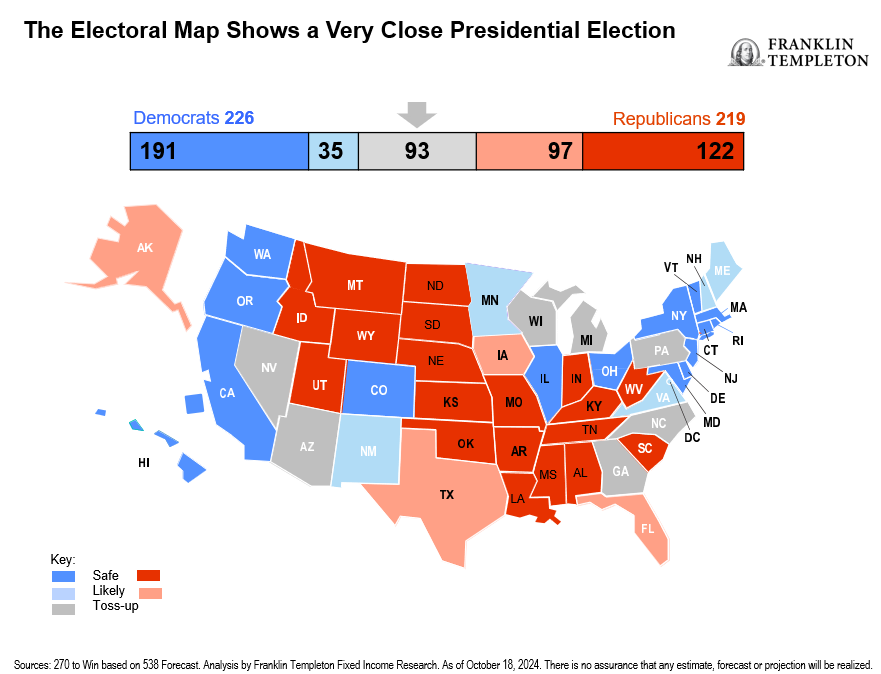

- The November US elections for the offices of the president, House of Representatives, and Senate remain close and difficult to predict.

- A Republican or Democratic sweep in the elections presents the most risks and opportunities, but some sectors could also be impacted under a divided government.

- Despite the potential tailwinds and headwinds, we believe individual security selection and focus on quality companies remain central to portfolio performance.

- Opportunities arise from potential challenges. Skilled active high-yield (HY) managers are well-positioned to help investors make this evaluation.

Potential scenarios in the November election

The outcome of the US elections in November remains tough to predict and it is likely to involve some close contests. We believe, however, that investors can position effectively by being aware of certain themes and probabilities. While the highest- probability scenario right now looks like a divided government, where no one party controls the House, the Senate, and the executive branch (president), sweep scenarios (where one party takes them all) cannot be ruled out. The Senate seems likely to flip back to Republican control due to a tough electoral map for the Democrats this time, but even that race will likely be close. Sweep scenarios present the most risks and opportunities for investors, while divided government could keep more ambitious partisan changes in check. Regardless of the outcome, fiscal policy changes (or the lack of), including the extension or modification of the 2017 Tax Cuts & Jobs Act (TCJA), will be important to monitor and are likely to dominate the 2025 agenda regardless of who becomes the president.

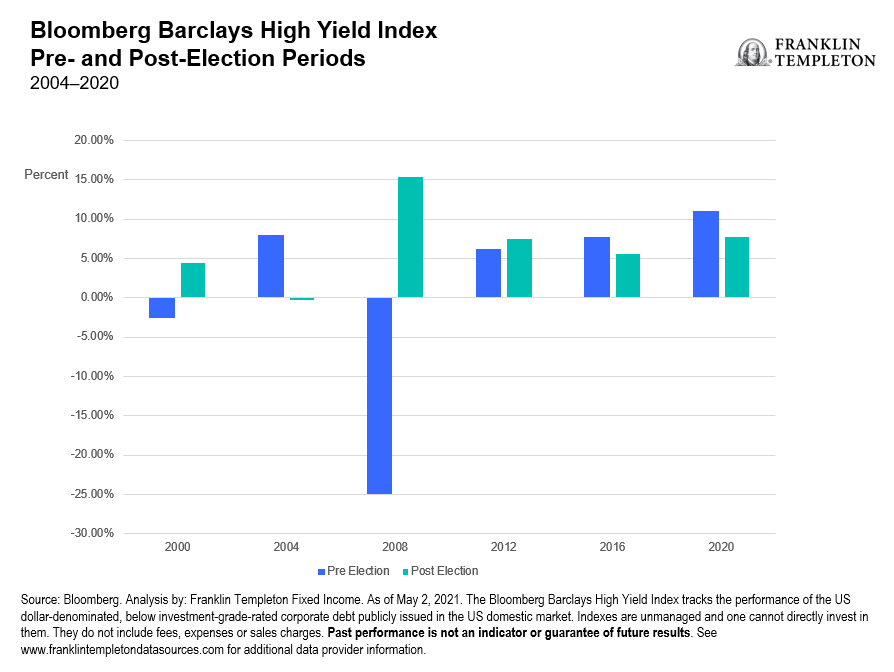

High yield has performed well post-election in recent contests

While it might seem natural to think that elections could cause HY investors to dial up their risk-off sentiments, in recent contests the HY market has performed well during the post-election period. Looking back at past elections, there has certainly been volatility in the weeks before and after the election itself. However, when we look six months post-election, the Bloomberg Barclays HY Index returns have been positive in five out of the last six elections. While a similar outcome remains possible again with this year’s election, 2025 is a year with some unique dynamics for investors to consider.

Possible outcomes in a Republican sweep

We expect some industries to be more heavily impacted than others from a Republican sweep scenario. Possible beneficiaries include the airline industry, which could experience a tailwind from potential roll-back of certain regulations and disclosure requirements. Financial services is another notable sector that could ride the tailwind from reduced regulatory risk for additional capital or consumer protections.

The automotive industry could benefit from more flexibility as a result of a rollback in electric vehicle mandates. If a Republican administration institutes a more industry-friendly Federal Trade Commission or Federal Communications Commission, parts of the telecom or cable industries could also benefit.

Conversely, there are industries we expect to be more at risk in a Republican sweep. For example, consumer products and construction machinery businesses that import finished products and components from China as part of the supply chain could be heavily impacted, should tariffs on Chinese imports be raised.

Moreover, a Trump administration could let enhanced subsidies for health care exchanges lapse to help pay for the tax cut extensions, which would be a headwind for portions of the health care sector.

Possible outcomes in a Democratic sweep

Similarly, in the event of a Democratic sweep, we expect some industries to be more impacted than others. For example, the renewable energy and electric vehicle industry is likely to experience a tailwind as support for the energy transition would likely continue under a Democratic administration. Also, the extension of Affordable Care Act subsidies under the Harris administration bodes well for the health care sector.

Conversely, we believe certain other industries could be more at risk in a Democratic sweep scenario. The pharmaceutical sector could experience headwinds from Democrats seeking to expand drug price negotiations. Vice President Harris has talked tough about price controls on food and grocery; thus, the food and beverage sector could be negatively impacted. Democrat support for increased minimum wages could also result in headwinds for restaurant and retail industries.

What about a divided-government scenario?

We expect certain industries to be impacted regardless of the outcome in the November elections. For example, both parties agree that housing affordability and supply are fundamental issues and are discussing initiatives related to housing and homebuilding. These policies could skew neutral or slightly positive for the sector, although the path of mortgage rates will be an important determinant of affordability. Portions of the aerospace and defense sector could benefit as both Republican and Democratic party leaders appear united in increasing defense spending.

A potential wildcard: Persistent fiscal deficit

As alluded to previously, we expect a partial extension of the 2017 TCJA regardless of the US presidential election outcome, which would worsen the fiscal deficit. Furthermore, neither presidential candidate plans on reining in fiscal spending and details on raising taxes remain scant, which are the only two fiscal levers that can be used to keep the deficit in check.

The need to fund this deficit year after year leads to upward pressure on increasing bond supply, which tends to push bond prices down and interest rates up for a given level of demand. On the inflation front, there is a concern that if the Federal Reserve (Fed) were to cut interest rates too aggressively, the economy could be stimulated to a point where inflationary pressure reassert itself. Simply put, persistent deficit and potential re-emergence of inflationary concerns matter because they affect the Fed’s ability to cut interest rates as the economy slows. Consequently, although the Fed has initiated a 50-basis point rate cut, we expect the Fed to be more measured in reducing rates going forward. Past experience suggests that financial markets will push for more easing than the Fed plans to deliver, especially as a number of investors still expect rates to revert to the extremely low post-global-financial-crisis levels. We therefore believe additional bouts of market volatility lie ahead as investors will probably overreact to economic data, increasing the potential for subsequent disappointments. In our view, active managers with extensive risk management experience are better positioned to help investors assess market volatilities and risk mitigation measures.

Conclusion: Back to basics matter

While we expect markets could be volatile around the time of November elections or afterward, we expect cooler heads to ultimately prevail. Candidates often promise more on the campaign trail than they can deliver once elected. This could be especially true if the elections result in a divided government. Even under sweep scenarios, the majority in Congress is likely to be slim, in our view.

Despite the potential tailwinds and headwinds for various HY industries and the associated implications on industry analysis and risk assessment, as active managers, we believe diligent individual security selection takes precedence. In our view, a core focus on quality companies defined not by their ratings, but by the sustainability of their business models, industry positioning, and financial liquidity remains central to portfolio performance.

With challenges come opportunities. Franklin Templeton Fixed Income (FTFI) is here to help assess the investment landscape amid election-related headlines and market developments. Our emphasis is alpha generation through diligent fundamental credit research. Our active approach is driven by highest-conviction research ideas as a key alpha source. Our ability to manage duration, sector and security concentrations, combined with our longer-term investment horizon (3-5 years), allows us to be contrarian during bouts of volatility.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

To the extent the portfolio invests in a concentration of certain securities, regions or industries, it is subject to increased volatility. Investment strategies incorporating the identification of thematic investment opportunities, and their performance, may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested.

Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the US, this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. US: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg – Tel: +352-46 66 67-1, Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400, Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100, Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

The views and opinions expressed are not necessarily those of the broker/dealer; or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent any broker/dealer policies, procedures, rules, and guidelines.

Copyright © 2024 Franklin Templeton. All rights reserved.