Economic resilience, labor market volatility and stabilizing inflation

The US economy has continued to perform well this year, with gross domestic product growth at 2.8% in the third quarter of 2024 due to strong, broad-based consumer spending. However, the labor market has been experiencing significant volatility so far in 2024. Job creation averaged over 200,000 per month in the first half of the year but slowed to around 110,000-115,000 so far in the second half.1 We believe this shift requires close monitoring as it affects inflation dynamics.

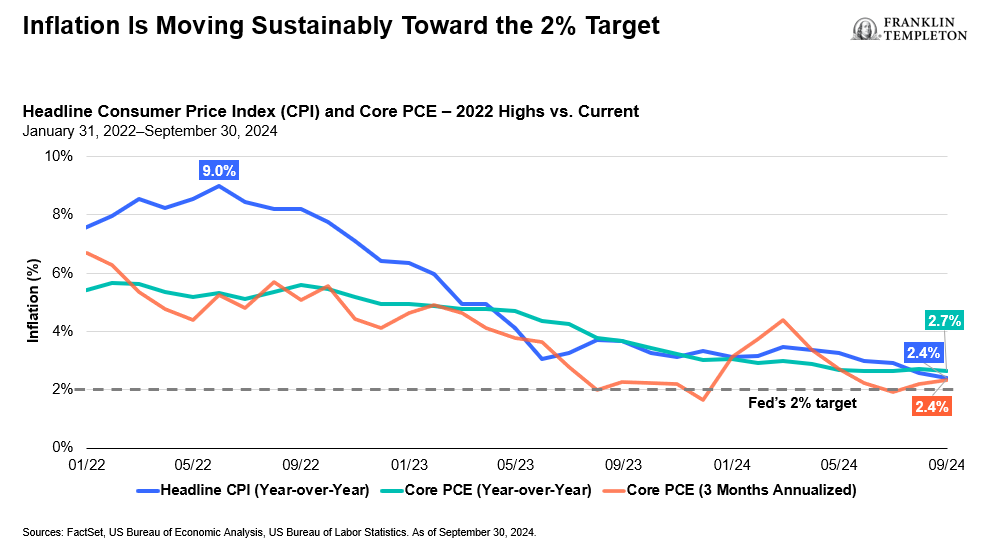

Headline and core personal consumption expenditure (PCE) readings are nearing the US Federal Reserve’s (Fed’s) inflation target of 2%, allowing the Fed to focus on its dual mandate of managing inflation and supporting the labor market. The Fed has started cutting rates, reducing the upper bound target from 5.5% to 4.75% to balance these dynamics. This shift toward a more neutral monetary policy also contributed to the economy’s resilience.

Market expectations for interest-rate normalization

In our opinion, it’s important to look at what the market is expecting in terms of the Fed’s path toward interest-rate normalization. The market currently anticipates around 100 basis points (bps) of cuts by the end of 2025, bringing the target range down to approximately 3.75%.2 This is a significant shift from three months ago when expectations were for a target rate of around 2.75%.3

Several factors have influenced these changes, including economic resilience and the recent presidential election cycle. Campaign policies perceived as potentially inflationary, or likely to increase the deficit, have altered market expectations for short-term interest rates. Thus, we believe continued monitoring of economic data and market sentiment will be crucial moving forward.

Fixed income opportunities and risks

Recently, the 10-year US Treasury yield rose from a low of 3.6% in mid-September to above 4.3% at the end of October, surpassing its 200-day moving average.4 This increase was partly driven by lower expectations for near-term Fed rate cuts, a resilient economy and potential changes in US deficit financing needs.

Higher yields create a constructive backdrop for income-generating investments, influencing our decision-making, not just within fixed income, but also in gauging the relative attractiveness of fixed income vs. equity securities. Compared to the pre-pandemic decade average of 2.3%, the current yield of 4.3% looks attractive to us, but this segment is not without risks.5

Credit spreads over Treasuries in both investment-grade and high-yield bonds are nearing record tight levels, indicating minimal compensation for credit risk. For instance, investment-grade bond spreads have tightened from 125 basis points a year ago to around 75 basis points as of November 12, 2024.6 Similarly, high-yield bond spreads have decreased from 425 basis points a year ago to nearly 250 basis points as of November 12, 2024.7

In our analysis, increased interest-rate volatility has opened an opportunity in agency mortgage-backed securities (Fannie Mae, Freddie Mac and Ginnie Mae). Unlike corporate bond markets, spreads in this area of the market have not contracted substantially, providing investors an attractive option despite the potential prepayment risk.

Broadening equity market performance and valuations

The US equity market has performed exceptionally well year-to-date through November 11, 2024, with the S&P 500 up 26%.8 This level of appreciation at this stage of the year hasn’t been seen since the late 1990s.9

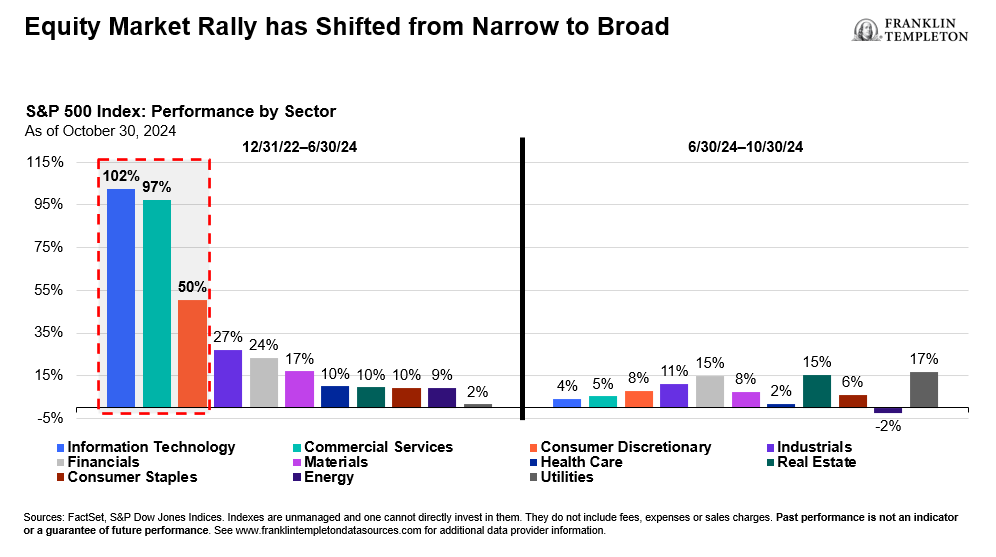

In the 18 months prior to June 2024, the stock market’s advance was incredibly narrow-led. The information technology, communication services and consumer discretionary sectors—where the “Magnificent Seven10” companies reside—delivered exceptional returns and accounted for 50% of the S&P 500’s market capitalization. However, the equal-weighted S&P 500 lagged significantly, indicating the narrowness of the market advance.

Since June 30, 2024, the market has broadened, with more sectors contributing to growth. Energy, utilities, materials, real estate, financials and industrials have performed well. Returns across the S&P 500 market-cap-weighted and S&P 500 equal-weighted indexes have shown relative parity. In our analysis, this broadening has created more opportunities in the equity markets.

Currently, valuation levels are around 22 times 2025 expected earnings, which does give us some pause.11 Expectations are set high, with consensus estimates for the S&P 500 in 2025 showing an acceleration in earnings growth to nearly 15%, with all sectors contributing positively.12 While this doesn’t necessarily mean stocks are overvalued, we believe it underscores the need to be selective when adding equities to portfolios.

Strategies for navigating market volatility

We continue to believe that being nimble is critical as we seek to take advantage of income opportunities that may arise from market volatility. Diversification in fixed income and equities also remains important.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

Equity securities are subject to price fluctuation and possible loss of principal.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Sources: FactSet, US Department of Labor.

2. Source: Bloomberg. Bloomberg World Interest Rate Probability as of October 7, 2024. There is no assurance There is no assurance that any estimate, forecast or projection will be realized.

3. Ibid.

4. Source: Bloomberg. The 200-day moving average is a technical indicator representing the average price of an asset over a 200-day period.

5. Ibid.

6. Ibid.

7. Ibid.

8. Source: Bloomberg. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance. See www.franklintempletondatasources.com for additional data provider information.

9. Ibid.

10. The “Magnificent Seven” are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

11. Sources: FactSet, S&P Dow Jones Indices, FactSet Market Aggregate. There is no assurance that any estimate, forecast or projection will be realized.

12. Ibid.