The year ahead looks both very promising and highly uncertain. The US economy strides into 2025 with robust momentum—growth has surprised on the upside for the last few quarters, the labor market seems to have largely stabilized at a strong level, and both business and consumer confidence are on the upswing. The uncertainty stems in part from geopolitical volatility and from downside risks to the global economy because other major economic regions, including Europe and China, face significant challenges. But an even bigger source of uncertainty comes from the economic plans of the incoming US administration.

President-elect Trump and his team have floated a number of significant changes in economic policy. Some are unambiguously good—a more business-friendly regulatory environment would boost investment and economic growth; in fact, the expectation of some streamlining of regulation might be already lifting business confidence. Others are potentially damaging, depending on how and in what measure they will be implemented.

Let’s start with tariffs. To put things in context, it is important to keep a few things in mind. First, external trade has a relatively small weight in the US economy, so the trade channel has a relatively smaller impact on growth. Second, tariffs have a one-off impact on relative prices, not a durable impact on the overall inflation rate. Therefore, even if the new administration were to move ahead with a 10% across-the-board tariff on all trading partners and a 60% tariff on China, and if this were to trigger proportional retaliation, we estimate that this would cause a 0.5% temporary increase in inflation and potentially a modest negative impact on growth.1 To be clear, tariffs are not good policy, they are a weak and inefficient way to raise revenue, they would be damaging to the more open economies of some of our trading partners and could cause disruption to specific sectors depending on which goods and which countries are targeted, and at what rates. But the overall impact on US growth and inflation will likely be modest.

Next is the threat of mass deportations. Record immigration levels have contributed to the post-pandemic surge in employment. Over the past four years, the share of employment accounted for by foreign-born workers has increased by 1.5 percentage points, to 19.4%.2 This reflected an increase of 5.3 million foreign-born workers, or one-third of the total increase in employment. Both legal and illegal immigration therefore contributed to an important positive supply shock to the labor force. Mass deportations could partly reverse this. Even though labor demand has cooled off, a sudden reduction of labor supply could hurt growth—especially in industries such as construction and hospitality—and push up wages, hindering the ongoing disinflation process. A tightening of controls on illegal immigration would instead have much less of an economic impact. Again, all will depend on the specific measures to be implemented, but I believe that large-scale deportations would be logistically hard to implement and therefore unlikely.

Last but not least, Trump’s election promises add up to a very large increase in the fiscal deficit over the coming years. Elon Musk and Vivek Ramaswami have ambitious plans to improve government efficiency. Their efforts could have an important positive impact on growth—to the extent that they can reduce red tape—but the scope for actual expenditure cuts is limited. As I highlighted in previous articles, non-discretionary non-interest spending is now but a limited share of the budget, so that without tackling entitlement spending significant savings cannot be achieved.

Having acknowledged the uncertainty, there is little doubt that that the prospective policy agenda on balance looks growth-positive—including via the potential extension of the 2017 Tax Cuts and Jobs Act tax cuts. This might help explain Federal Reserve (Fed) Chair Jerome Powell’s upbeat attitude in the Fed’s last press conference of 2024. Powell reiterated that the economy “is in a good place” and expressed confidence that the coming year will be even better than the one about to end.

This positive tone accompanied a very significant change in the Fed’s stance: Powell signaled that further rate cuts will likely be few and far between. He noted uncertainty on inflation is now higher due both to policy uncertainty and to the recent higher-than-expected inflation readings. And while insisting that monetary policy is still “meaningfully restrictive,” he also said it is now closer to neutral. The Fed feels it can now move with greater caution in adjusting policy, and the “dots” point to only two more rate cuts in 2025, with the fed funds rate ending next year at 3.9%. This is consistent with the Summary of Economic Projection’s (SEP) higher inflation forecast, which now sees core personal consumption expenditures (PCE) at 2.5% by end-2025.3 With this, the SEP has now largely aligned with my long-held view that this rate cutting cycle will be short and shallow—though I continue to see slightly higher inflation than the Fed.

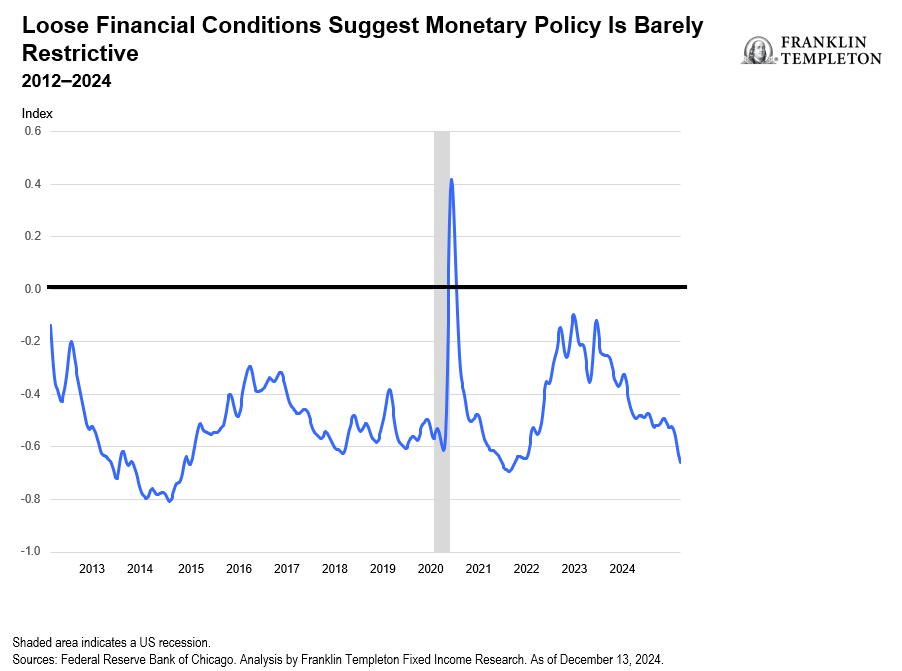

With rates closer to neutral, loose financial conditions, a higher inflation forecast, higher inflation risks and a strong economy, why did the Fed cut rates again this month? Powell conceded the decision was a close call, and it’s hard to shake the feeling that the Fed prioritized validating financial markets expectations that had fully priced in a cut.

I also got the impression that the Fed is willing to tolerate above-target inflation for longer. The strength of the economy and the persistent loosening in financial conditions (now the loosest since late-2021, according to the Chicago Fed index) suggest that monetary policy is barely restrictive, not meaningfully so.

A benign interpretation is that now that inflation has been substantially reduced, the Fed prefers to safeguard the strong growth environment rather than accelerating the last mile of disinflation. I can see the logic: Headline Consumer Price Index (CPI) is below 3%, and strong growth can help wages make up for lost purchasing power.

A more critical reading, however, would be that the Fed has de facto raised its inflation target to a 2.5%-3% range, and this is not without risks. Core CPI has been stuck at 3.3% since last summer, flagging some risk that headline consumer inflation might pick up again.

Where does this leave us for 2025? I think the US economy will maintain a strong growth momentum. The US consumer is in good shape, and as I mentioned above, the prospect of some business-friendly reforms should give a further boost. Continued loose fiscal policy will lend additional support. Policy uncertainty is significant, but I see mass deportations as logistically very hard to implement, and therefore unlikely. Chances of more aggressive moves on tariffs are higher, and here I see more of a risk for a temporary rebound in inflation rather than more lasting damage to growth. Overall, I think progress on disinflation might be even harder than the Fed envisions.

As we close 2024, both the Fed and market expectations have largely converged to my long-held call: I’ve been arguing that the “neutral” policy rate is around 4%. The policy rate is currently at 4.25%-4.5%, and we might see only one more 25 basis-point rate cut next year.

The selloff on US Treasuries (UST) immediately following the Fed meeting therefore seems justified, given that markets were previously expecting more Fed rate cuts. For 2025, I see further upside risk to UST 10-year rates. Trump’s fiscal agenda, were it to be fully implemented, would most likely push 10-year rates above 5%, in my view, because of the pressure on issuance that would come from even larger fiscal deficits. However, that agenda is likely to encounter some meaningful resistance from within the Republican ranks in Congress; this could limit the extent of the fiscal loosening and correspondingly cap the upside for UST yields to the 4.5%-5% range.

Against this background, positive interest-rate carry is still a focus in our investment decisions. By selecting fixed income positions that can provide monthly income pick-ups, it will allow us to add to returns independently of moving yields and the shape of the yield curve.

Within the fixed income universe, we feel some sectors are less vulnerable to negative policy surprises. Lower-quality corporate bonds are more dependent on the robustness of the US economy and less exposed to potential policy changes (albeit spreads are extremely tight already). Proposed reduced bank regulation should be a tailwind for securitized products. On the other side, non-US corporate credit and emerging markets bonds could be strongly impacted by major shifts in US policies, and here investment focus should be on selecting those sectors and issuers that have some degree of insulation from US policy swings.

President-elect Trump has voiced his desire for a weaker US dollar, but many of the policies he has outlined (with the major exception of fiscal policy) point to a stronger dollar—all the more so given the weaker growth outlook in other major economic regions. Thus at least in the near term the dollar is likely to remain well-supported against the currencies of major trade partners.

Uncertainty means that we should once again brace for volatility. I believe an active investment strategy strongly grounded on fundamental analysis remains the best approach to this economic and financial environment. At Franklin Templeton Fixed Income, this is what we’ll continue to bring to our investors.

I wish all of you a very Happy Holiday Season and a happy and successful 2025!

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Active management does not ensure gains or protect against market declines. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

____________

1. There is no assurance that any estimate, forecast, or projection will be realized.

2. Source: Bureau of Labor Statistics. As of July 18, 2024.

3. There is no assurance that any estimate, forecast or projection will be realized.