Executive summary

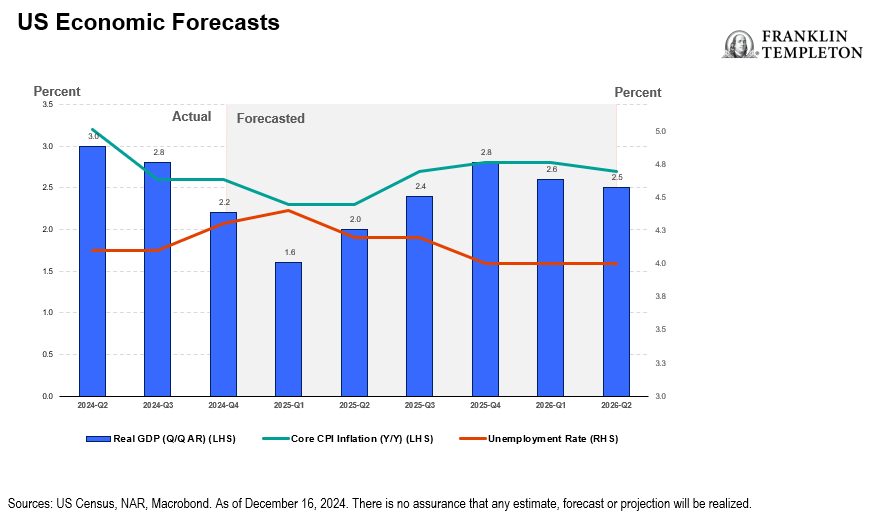

We remain upbeat on the US economy, with consumer spending driving moderate economic growth and reining in the number of cuts that the US Federal Reserve (Fed) will need to orchestrate a soft landing. There remains the potential for policy surprises as President-elect Trump moves forward with large, proposed mandates such as increased tariffs and immigration changes that may cause additional inflation pressures. In Europe, growth is still a concern for the European Central Bank as policy rate cuts are projected to outpace the United States.

Some fixed income sector spreads remain at multi-decade lows, but we are still finding value within securitized sectors that offer some diversification benefits to portfolios.

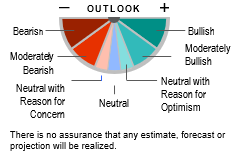

Fixed income dashboard

Outlooks for fixed income sectors are based on our analysis of macroeconomic themes and the technical conditions, fundamentals, and valuations for each asset class. We rate each sector from bearish to bullish to express our projections for relative returns over the next 6-12 months.

Portfolio themes

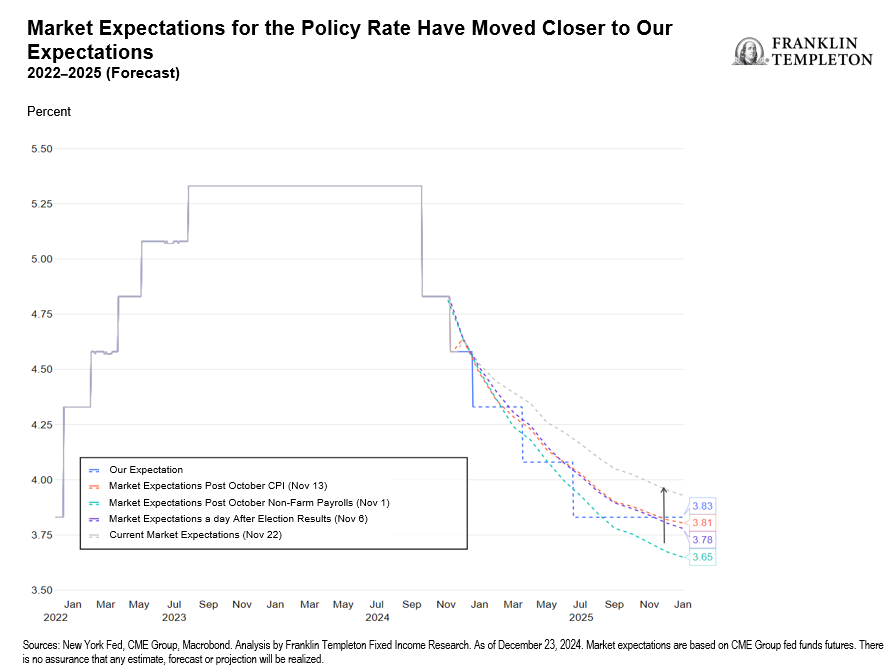

Fed expectations, what a quarter can do…

Fed Chair Jerome Powell signaled at the central bank’s December policy meeting that further rate cuts will likely be slower and more targeted. His outlook on inflation is now higher due both to policy uncertainty and to the recent sticky inflation readings. And while insisting that monetary policy is still “meaningfully restrictive,” he also said it is now closer to neutral. The Fed feels it can now move with greater caution in adjusting policy, and the Summary of Economic Projections (SEPs) points to only two more rate cuts in 2025, with the fed funds rate ending next year at 3.9%. This is consistent with the SEPs’ higher inflation forecast, which now sees core personal consumption expenditures (PCE) at 2.5% by end-2025. With this, the SEPs has now largely aligned with our long-held view that this rate-cutting cycle will be short and shallow. We have been positioning our portfolios with a cautious view toward duration exposure while allowing us to remain tactical as US Treasury yields move in a wide range.

Trump 2.0: Fixed income—who wins?

As we move toward the January swearing in of Donald Trump, we need to look at the implications of proposed policies on fixed income sectors. The continuation of US “economic exceptionalism” is expected as many of Trump’s policies will be focused on protectionism, such as higher tariffs on imported goods and limits on immigration. As such, we continue to favor US-based investments until full policy impacts are in view. We are focusing on security selection to identify sectors and issuers that have some insulation to undecided US economic policies.

Look for other baskets

US corporate bond spreads have reached 20-year lows, and keep on tightening. The investment-grade corporate bond sector makes up about 25% of the Bloomberg US Aggregate Index. This exposes the index to significant downside risk in a spread-widening scenario.

To lessen the negative impact of potential corporate spread increases, we have identified and increased allocations to asset classes that will provide less correlated overall returns. We are finding pockets of opportunity within sectors considered safer, such as agency mortgage-backed securities, that still offer attractive liquidity premiums and strong carry1 without increasing our overall risk profile of portfolios.

Overall risk outlook

Neutral

We have upgraded our overall risk setting to neutral, primarily due to an improving US economic picture which has supported market fundamental and technical conditions. Against this background, positive interest rate carry is still a focus in our investment decisions. By selecting fixed income positions that can provide monthly income pick-ups, it should allow us to add to returns independently of moving yields and the shape of the yield curve. Within the fixed income universe, we feel some sectors are less vulnerable to negative policy surprises. Lower-quality corporate bonds are more dependent on the robustness of the US economy and less exposed to potential policy changes (albeit spreads are extremely tight already). Proposed reduced bank regulation should be a tailwind for securitized products. On the other side, major shifts in US policies should strongly impact non-US corporate credit and emerging market bonds, and here investment focus should be on selecting those sectors and issuers that have some degree of insulation from US policy swings.

Key sector viewpoints

Moderately bullish

Municipal (muni) bonds: We remain moderately bullish on tax-exempt muni bonds going into 2025, as stable credit fundamentals, robust investor demand and compelling yields should continue to support the sector. Healthy economic growth has allowed states, counties and many municipalities to bolster their reserves, which means that they are well positioned to deal with any potential financial challenges that may arise. The fundamental strength of muni issuers is reflected in a 15-quarter streak of credit rating upgrades outpacing downgrades.2 At the same time, yields on muni bonds remain elevated versus historical levels and can be especially appealing on a tax-adjusted basis. We believe this will likely continue to draw retail fund inflows over the coming months. Moreover, since the muni yield curve has returned to a more normal, upward-sloping shape, we see opportunities across maturities as well as across the credit spectrum.

Floating-rate loans: We expect more business-friendly policies under the incoming administration to provide incremental support for the loan asset class, which should provide fundamental tailwinds to sub investment-grade corporate issuers. Loan issuers should continue to show improvement in interest coverage and access to capital markets, which will bring back mergers and acquisition activity and allow issuers to address upcoming maturities. We maintain our view that liability management exercises will continue to be the predominant method of restructuring in the coming months as near-term maturities or liquidity challenges are addressed by issuers who will not find timely relief from the upcoming rate cuts or improving revenues. Against the backdrop of a highly bifurcated loan market as higher-rated cohorts continue to perform better than CCC rated issuers, we remain focused on diligent loan selection as a critical component of portfolio outperformance.

Neutral with reason for optimism

US high-yield (HY) bonds: We remain broadly constructive on the outlook for high-yield (HY) amid favorable technical conditions and generally supportive fundamentals. As November’s US election concludes, HY investors, as well as those in other risk markets, have focused on the possibility of lower regulation and higher growth. While spreads are nearing the lower end of the historical range, the all-in yield for HY universe should drive attractive returns. We favor moving up in quality as investors do not need to give up much yield or spread to meaningfully reduce risk. Amid elevated dispersions across the market and an expected increase in the possible range of policy outcomes under a new administration, we expect idiosyncratic opportunities to be a major driver of performance. Consequently, we remain focused on diligent security selection as a key to outperformance.

Neutral

Structured Products: We believe within agency mortgage-backed securities (MBS), prepayment risk remains minimal, and we expect spreads to trade around current levels in the short term. However, economic data releases and Fed meetings could bring volatility. Lower rates, a steeper yield curve, and a decrease in regulatory uncertainty could drive bank deposit growth and increase bank deposits participation in the market. For residential MBS (RMBS), the accumulation of home equity, combined with a still-healthy labor market, should support mortgage credit in coming years. A lack of inventory combined with steady household formation should keep the housing supply and demand mismatch supportive of home prices. Despite the potential challenges facing the commercial MBS (CMBS) sector, fundamentally strong commercial real estate sectors/properties are likely to receive significant support from sidelined investor capital, which we believe could help prevent further price declines. We remain focused on rigorous loan-level analysis to uncover relative value opportunities.

Neutral with reason for concern

US Treasuries (USTs): The selloff on USTs immediately following the December Fed meeting pushed 10-year yields above 4.50%, which seems justified to us given that markets were previously expecting more Fed rate cuts over the course of the next two years. For 2025, we see further upside risk to UST 10-year yields. President-elect Donald Trump’s fiscal agenda, were it to be fully implemented, would most likely push 10-year yields above 5%, in our view, because of the pressure on increased UST issuance that would come from even larger fiscal deficits. However, that agenda is likely to encounter some meaningful resistance from within the Republican ranks in Congress; this could limit the extent of the fiscal loosening and correspondingly cap the upside for UST yields to the 4.5%-5% range. Given the magnitude of day-to-day swings in yields, we are being more tactical with our duration exposure as we look for attractive entry points for our portfolios.

Sector settings overview

Moderately bullish

Municipal bonds: Credit fundamentals in the muni market remain stable, while yields are still elevated versus historical levels and will likely continue to draw investor demand.

Floating-rate loans: The potential benefits of expected policy changes could help several loan issuers improve fundamentals, liquidity and access to capital markets. We remain focused on diligent loan selection.

US Treasury-inflation protected securities (TIPS): Inflation is likely to be stubborn over the near term, with break-even inflation rates trading in a tight range. We will look for better entry points as the new US administration’s policies may prove inflationary.

Neutral with reason for optimism

Emerging market (EM) sovereign debt: US policy uncertainty is likely to pressure EM currencies, leading us to favor EM hard-currency bonds versus local, with a focus on the B and single C rated sectors.

Mortgage-backed securities: We believe MBS prepayment risk remains minimal and we expect spreads to trade around current levels in the short term but to be volatile around economic data releases and Fed meetings.

US high-yield (HY) corporates: We remain broadly constructive on HY and favor moving up in quality as investors do not need to give up much yield or spread to meaningfully reduce risk.

Neutral

Asset-backed securities (ABS): Robust credit fundamentals and strong technicals should keep spreads rangebound with a bias toward tightening.

Collateralized loan obligations (CLO): Although CLO credit fundamentals have improved since last year, a slower economy and higher interest rates continue to pressure lower-rated loan issuers’ ability to refinance.

Commercial mortgage-backed securities: Despite potential challenges, fundamentally strong commercial real estate sectors/properties are likely to receive significant support from sidelined investor capital.

Emerging market (EM) corporates: The fundamental resilience of the asset class remains its most significant underlying strength, which we believe should help to mitigate any downside risk as volatility is likely to increase in 2025.

European government bonds: We expect deeper interest-rate cuts from the European Central Bank than many other financial market participants anticipate, but these cuts should be constructive for European bond investors in 2025.

Euro high-yield (HY) corporates: While positive technicals, stable macro conditions and average fundamentals offer support to the asset class, tight spreads and limited potential for capital appreciation lead us to maintain a neutral stance on the sector.

Euro investment-grade (euro IG) corporates: Fundamentals face challenges, but strong inflows have supported technicals thus far; however, with tight spreads and the potential for waning demand, we favor higher-quality credit exposure.

Global sukuk: In Sukuk-focused funds, we are comfortable taking on a modest overweight to duration in the sector and continue to focus our allocations to higher-quality issuers.

Non-agency residential mortgage-backed securities: We believe the accumulation of home equity, combined with a still-healthy labor market, should support healthy mortgage credit in coming years.

Neutral with reason for concern

US investment-graded (IG) corporates: Corporate bonds offer attractive yields, but tight spreads provide limited cushion against downside surprises. We favor high-quality credit and short maturities and seek opportunities in new issues or market dislocations to add exposure.

US Treasuries (UST): UST yields will continue to have upward pressure due to a higher neutral fed funds rate and increasing fiscal deficits. We are being tactical with our duration exposure.

Bearish

Japanese government bonds (JGBs): Our forecast is for a higher number of rate hikes from the Bank of Japan will be necessary to bring inflation under control. We keep our bearish outlook as yields will continue to increase from here.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Asset-backed, mortgage-backed or mortgage-related securities are subject to prepayment and extension risks. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Leverage increases the volatility of investment returns and subjects investments to magnified losses and a decline in value.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, http://www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_______________________

1. Carry refers to when an asset generates positive returns simply by maintaining the position, meaning the profit from owning the asset is substantial compared to the cost of holding the position.

2. Sources: Moody’s and S&P. As of the third quarter of 2024.