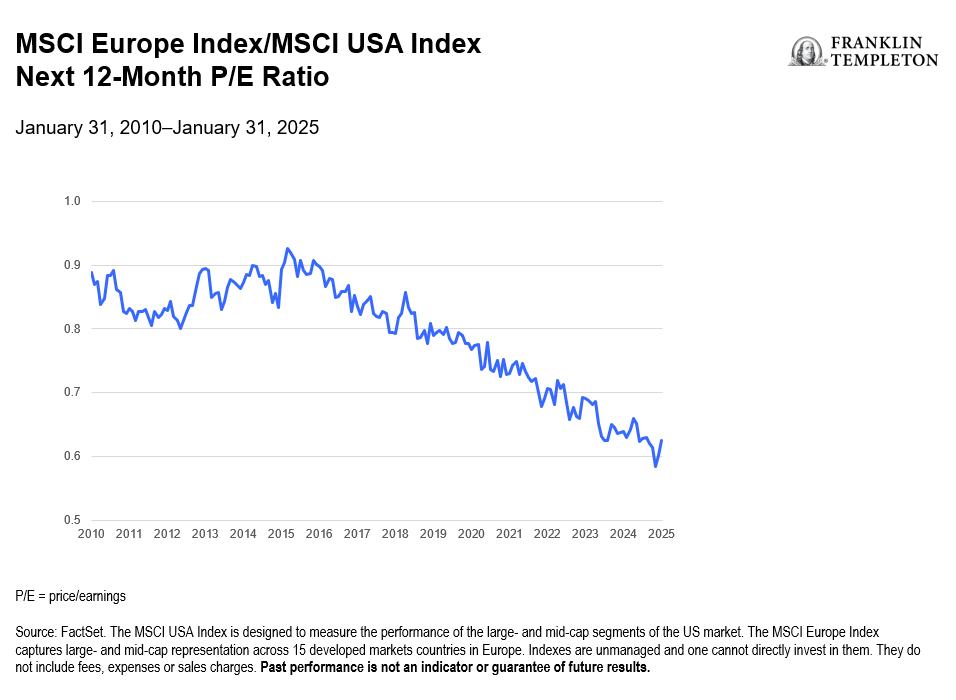

European stocks get little love. However, we think the yawning valuation discount of European equities to their US peers (see Exhibit 1) may be too wide for investors to ignore. Efforts to improve the region’s competitiveness, declining interest rates, and a potential political change in Germany—along with a focus on greater shareholder returns—could spark a revival. Europe is a market where value opportunities are loudly knocking, and we believe the early 2025 strength in local markets may continue.

Exhibit 1: The Valuation Gap between US and European Stocks Has Widened

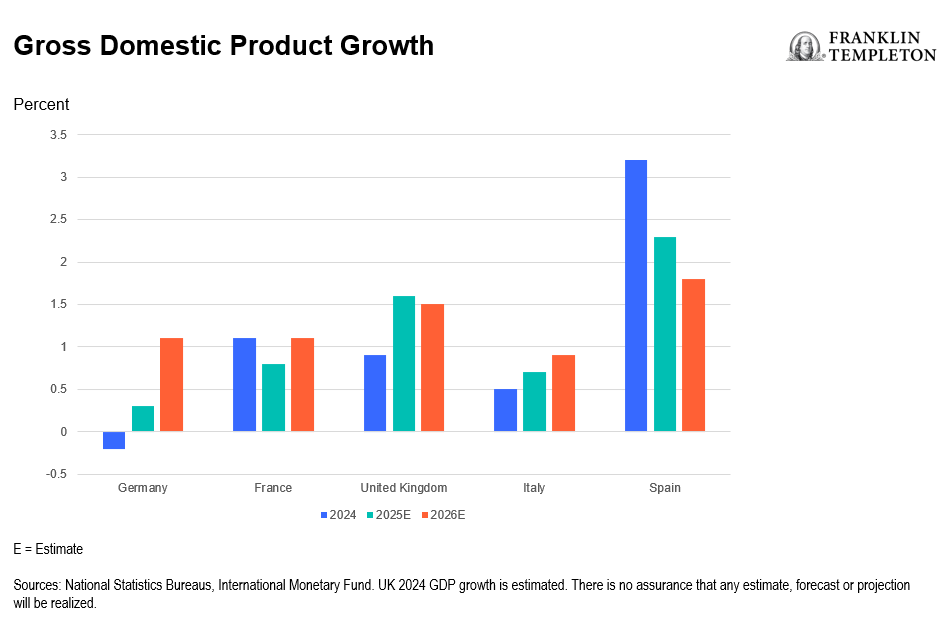

Sparking an economic revival

The economic picture in Europe has been mixed at best in recent quarters. Growth has been weak on the continent, particularly in Germany, but has been a bit brighter in parts of Southern Europe and the United Kingdom. Germany, Europe’s largest economy, saw growth slide in 2024 and is projected to post slight 0.3% gross domestic product (GDP) growth in 2025, according to an estimate from the International Monetary Fund. Growth in France and the United Kingdom should be a bit faster, while Spain is showing some of the fastest growth in the region in 2024 and 2025 (see Exhibit 2). In parts of Europe, growth appears to be improving.

Exhibit 2: European Economic Growth: Sluggish but on the Path to Improvement from a Low Base

Policymakers may finally be taking steps to improve the region’s competitiveness and economic vigor. Former European Central Bank (ECB) head Mario Draghi released a 400-page report on steps the region should take to do just that, including spending a sizable sum on electrification, infrastructure and research and development. It also calls for fiscal consolidation and greater support for merger activity to help improve returns.

We see early signs the European Union (EU) is serious about adopting some of Draghi’s suggestions. Should even a portion of the proposals come to fruition, we believe it would be positive for the European economy and regional markets.

The ECB also has been cutting interest rates to support swifter economic growth. However, inflation continues to stir, and energy markets remain vulnerable to shocks from supply disruptions, which can upend the economic outlook. Potential US tariffs are also a concern.

Shifting politics could ignite growth

A political change in the upcoming German election may also help. The current center-left government looks likely to lose to a center-right coalition, which could spark a series of initiatives to boost economic growth through more infrastructure spending after years of neglect and by seeking to reduce energy prices and cut taxes.

Faster growth in Europe’s largest economy would be positive for the region overall and for equity markets, in our view, as it would reinforce the efforts taking place at the EU level to foster a more competitive continent.

Additionally, we are seeing early indications that a peace deal in Ukraine may be possible. While still highly uncertain, a deal could boost domestic confidence as a major conflict in the center of Europe ends. Moreover, European companies may have an opportunity to help rebuild the country, and we see potential for energy costs to fall again in the wake of a ceasefire.

In the United Kingdom, some of the Labour government’s early missteps have been disappointing, but we are optimistic that growth will remain solid, and that UK policymakers will continue to take a more pragmatic approach to the EU after a decade of chaotic post-Brexit economic policy.

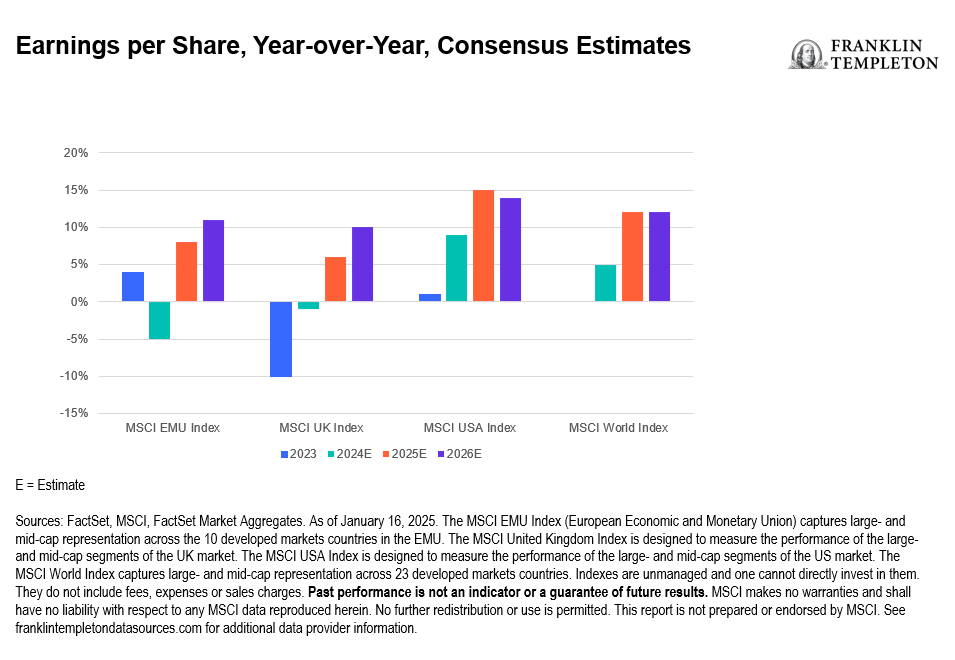

Value abounds

For global value investors, we think Europe remains fertile ground for finding companies trading at cheaper valuations while offering solid or improving global businesses that could eventually spark a re-rating. Consensus estimates suggest that corporate earnings growth for the region could get a bounce in the coming year (see Exhibit 3).

Exhibit 3: Company Earnings Growth Improvements Could Spark a Re-Rating

European companies are generally global companies, with about 27% of total revenue for the MSCI UK Index and 25% of total revenue for the MSCI Europe ex UK Index coming from the United States. We believe these companies should not be penalized with cheaper valuations simply because of where they have listed. These multinationals can offer investors global and US exposure, often at more attractive valuations than their US peers.

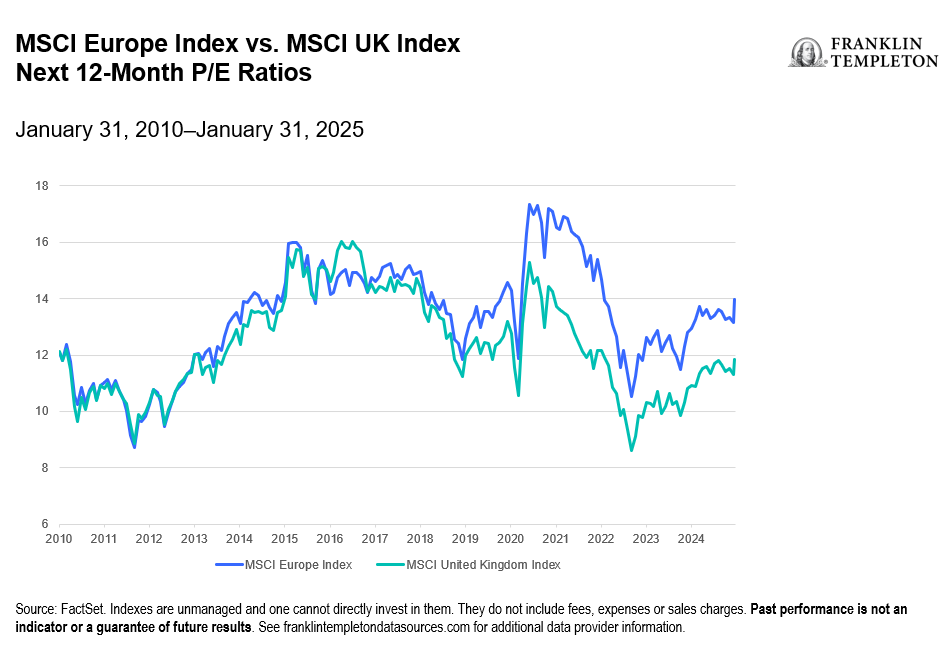

UK stocks look particularly cheap relative to other regional markets, in addition to their US counterparts, which may offer opportunities to find a range of companies which could narrow these valuation gaps over time (see Exhibit 4).

Exhibit 4: UK Market Valuations Look Appealing Relative to Europe Overall

We see plenty of domestically focused opportunities as well. Banks are one area where companies could benefit from improving economic growth and from efforts to push regional consolidation and improve competitiveness. Although we have seen little loan growth recently in Europe, lower interest rates and faster economic growth could drive increased loan demand and be positive for regional banks.

The right shareholder return profile

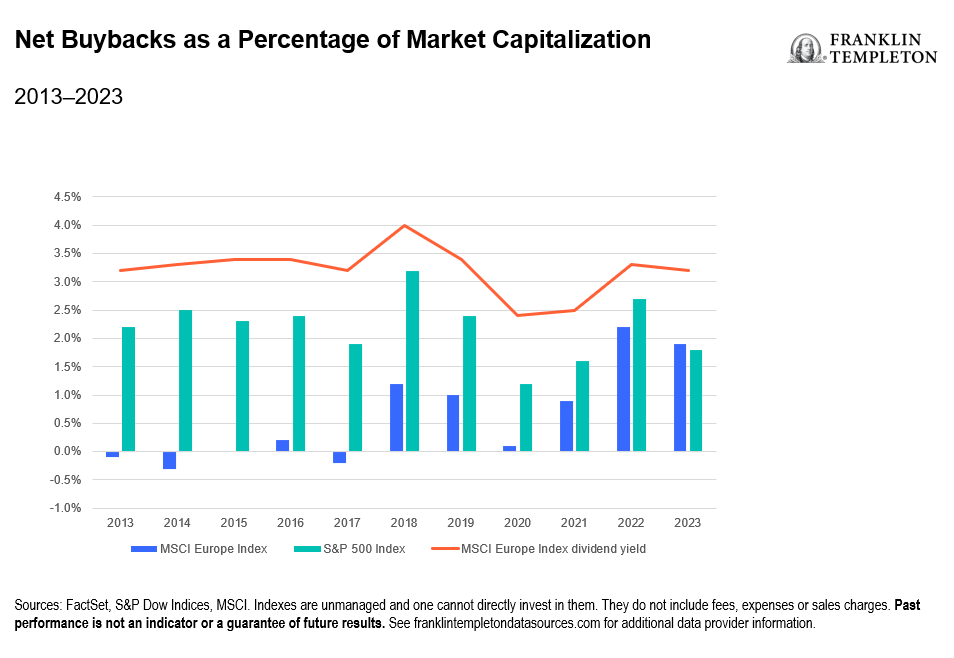

Companies are also focusing more on adding stock buybacks to their already significant dividend policies. While we are not ready to say European companies are becoming as shareholder-friendly as US firms, they are clearly more focused on offering better returns on invested capital (see Exhibit 5).

Exhibit 5: Net Buybacks as a Percentage of Market Capitalization on the Rise

Balance sheets look strong, so if there are opportunities to invest free cash flow in tangible growth initiatives, or in mergers in areas like telecoms or financials to reduce competitive intensity, or in stock buybacks, we would generally view the moves favorably.

European companies have also paid sizable dividends. According to data from MSCI, as of December 31, 2024, UK companies in the MSCI UK Index offer an overall dividend yield of 3.76% versus 3.26% for the MSCI Europe Index and a paltrier 1.27% for the MSCI USA Index.1 Any effort to supplement these robust dividends with additional capital returns can provide investors with an additional reason to focus on European stocks.

For investors willing to look past the current sluggish growth and ongoing political uncertainties, which appear headed toward resolution, we believe Europe offers prospects to find attractively valued companies with ample opportunities to spark a revival in their share price through improving growth, global focus or better shareholder returns. Europe is calling.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Value securities may not increase in price as anticipated or may decline further in value. Growth or value as an investment style may become out of favor, which may have a negative impact on performance.

Active management does not ensure gains or protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, http://www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

____________________

1, Dividends may fluctuate and are not guaranteed, and a company may reduce or eliminate its dividend at any time.