Key takeaways:

- Gold prices soar, reaching an unprecedented high in early February, surpassing US$2,900 bolstered by safe-haven demand amid persistent inflation concerns.

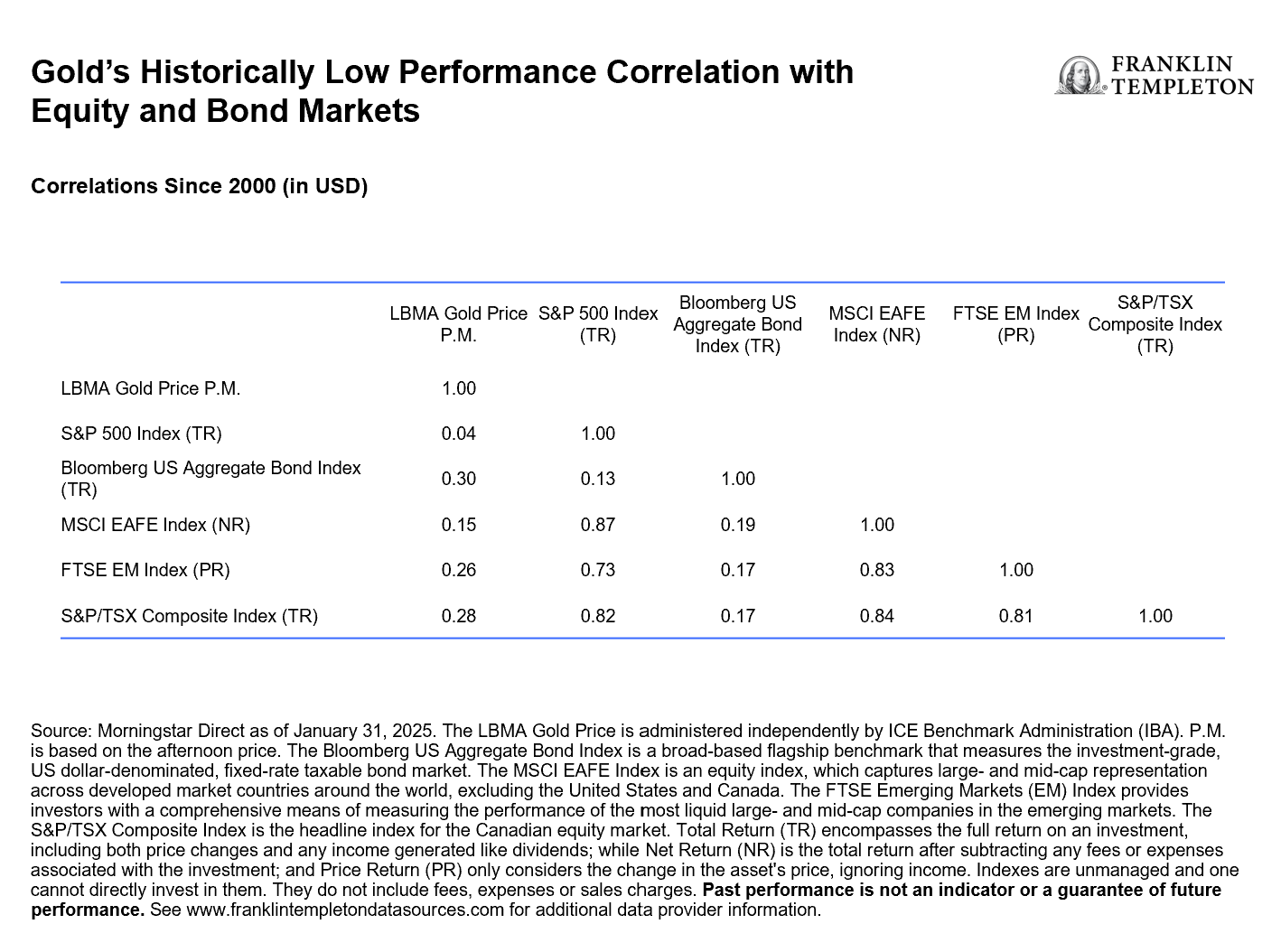

- Gold as a reliable diversifier, stands out as a robust hedge against economic uncertainty, offering low correlation to traditional assets for enhanced portfolio diversification.

- Gold as good, a closer look at efforts to responsibly source gold and how this has sparked a new category of physical gold ETFs.

Gold prices surged in time for Valentine’s Day this year, breaking through the significant US$2,900 mark for the first time. Fueled by safe-haven demand following President Donald Trump’s aggressive tariff talk—which is expected to extend to steel and aluminum imports in March—the rally is bringing more investor attention to the precious metal.

Investors continue to view gold as an effective hedge against inflation, currency fluctuations and economic instability as well as a compelling portfolio diversifier given its historically low correlation to traditional stocks and bonds.

Furthermore, gold’s diverse sources of demand naturally contribute to its resilience as an asset that can deliver solid returns in a variety of market conditions. This resilience is twofold. The price of gold, as a reliable store of value, tends to be driven up by counter-cyclical investment during rocky markets. Meanwhile, during stronger economic environments, pro-cyclical consumer demand for gold, used in an array of industries, can support its performance.

The fact that gold is mined across many diverse geographies can help mitigate volatility. Moreover, gold’s trading volumes averaged about US$227 billion per day in 2024, making the market more liquid than some major markets like the Dow Jones Industrial Average.1 And even though Federal Reserve Chair Jerome Powell recently likened bitcoin, a.k.a. “digital gold” to the bullion, gold still reigns as a store of value that does not tend to experience the same dramatic swings as cryptocurrencies. We do, however, believe that crypto’s own unique scarcity, utility and potential can complement an investor’s portfolio.

Recent advancements in responsible sourcing have also enhanced gold’s appeal

Environmental and social issues, including high levels of pollution, have historically plagued the gold mining industry. But the London Bullion Market Association (LBMA) has been at the forefront of efforts to improve the industry’s sustainability credentials in recent years through responsible sourcing.

The LBMA’s program requires approved refiners to demonstrate their commitment not only to environmental protection but also to combating money laundering, terrorist financing and human rights abuses. This ensures that the gold traded on the London market is conflict-free and ethically sourced, protecting the integrity of the global gold supply chain.

Artisanal and small-scale mining (ASM) is a crucial sector within the gold industry, employing over 40 million informal laborers across 80 countries.2 While ASM can promote economic development in challenged communities, it also poses a number of other risks. A primary concern is the release of highly toxic mercury, which occurs during the process of extracting gold. To address these issues, the LBMA has developed new methods for ASM sourcing that aim to reduce greenhouse gas emissions and improve mining productivity.

The convenience of gold exchange-traded funds (ETFs)

Before the introduction of exchange-traded products, investing in gold was often cumbersome and costly. Physical gold required secure storage and high insurance premiums, while derivatives and futures contracts were primarily accessible only to large institutional investors. The launch of the first physical gold ETF in the United States in 2004 changed this landscape, offering a low-cost, efficient way to invest in gold bullion without the need for physical storage or the complexities of derivatives.

Today, there are 33 gold ETFs in the United States, with total assets of US$161 billion.3 Just in the last year, physically backed global gold ETFs traded an average of US$2 billion per day.4

Within the physical gold ETF space, offerings that incorporate the LBMA’s program have emerged. These ETFs provide exposure to a resilient and low-correlation asset, while supporting a responsible gold mining ecosystem that adheres to rigorous environmental and social standards. By choosing to invest in sustainable gold, investors can contribute to a more ethical and sustainable global gold supply chain, while reaping the financial benefits of this timeless asset.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Commodity-related investments are subject to additional risks such as commodity index volatility, investor speculation, interest rates, weather, tax and regulatory developments.

Blockchain and cryptocurrency investments are subject to various risks, including inability to develop digital asset applications or to capitalize on those applications, theft, loss, or destruction of cryptographic keys, the possibility that digital asset technologies may never be fully implemented, cybersecurity risk, conflicting intellectual property claims, and inconsistent and changing regulations. Speculative trading in bitcoins and other forms of cryptocurrencies, many of which have exhibited extreme price volatility, carries significant risk; an investor can lose the entire amount of their investment. Blockchain technology is a new and relatively untested technology and may never be implemented to a scale that provides identifiable benefits. If a cryptocurrency is deemed a security, it may be deemed to violate federal securities laws. There may be a limited or no secondary market for cryptocurrencies.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2025 Franklin Templeton. All rights reserved.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Sources: Bloomberg, Bank for International Settlements, International Capital Market Association (ICMA), Nasdaq, World Gold Council.

2. Sources: 2020 State of the Artisanal and Small-scale Mining sector report. World Bank.

3. Source: Morningstar Direct, as of February 10, 2025.

4. Sources: Bloomberg, Nasdaq, World Gold Council. Based on average daily trading volume from January 1, 2024, to December 31, 2024. Gold liquidity includes estimates of over-the-counter (OTC) transactions and published statistics on futures exchanges and gold-backed exchange-traded products.