Artificial intelligence’s (AI’s) hype phase may be over. With tech firms investing tens of billions of dollars in AI and new competitors continuing to emerge, a more subdued investment phase may eventually take hold.

Nonetheless, the potential for AI to have a transformative impact continues to draw interest and investment. Not only is this investment in new chips and software, but also in the old economy companies that build the infrastructure to support tech’s AI ambitions. And as AI models get cheaper and more users learn how to get useful results from them, we could see usage, and the resources needed to support AI, surge. So far, broad-based adoption seems far off. But like past booms, be it the railroad, mainframe computer or internet frenzies, AI’s full potential may become much clearer over the next decade.

With US companies still spending lavishly to fill a shortage of computing power, data centers and energy, value investors need to remain picky and nimble, in our opinion, when looking to take advantage of potentially cheaper AI opportunities.

Spend, spend, spend?

The recent emergence of a new AI competitor that needs fewer chips, less capital and less energy than those models the major US tech firms run has raised questions. Can the boom in AI-related capital spending continue at its current pace without a pickup in AI users and profits?

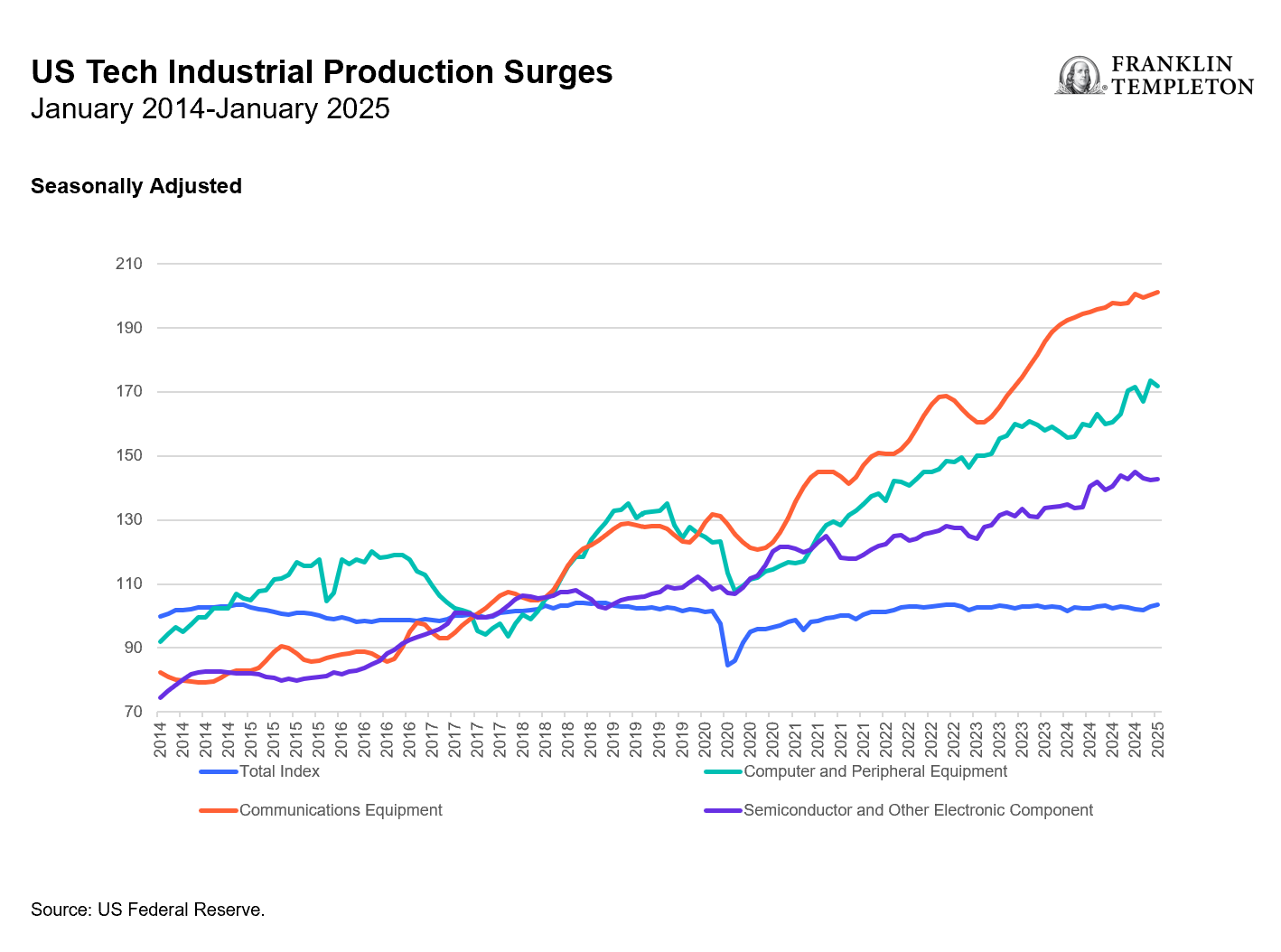

Major tech companies like Google, Meta, Amazon, Oracle and Microsoft are spending vast sums of money on AI-related infrastructure. Their fourth-quarter earnings announcements showed no signs of a pullback in investment in servers, routing and optical equipment, load balancing and latency in addition to the chips that power the models. All this spending has translated into a corresponding increase in high-tech industrial production in recent years. (See Exhibit 1.)

Exhibit 1: US Tech Spending Boosts Tech Industrial Production

However, like in past tech spending cycles, be it the mainframe expansion in the 1960s and 1970s, personal computers in the 1980s or the internet boom of the late 1990s, how people ultimately use this computing power and the new services and applications that spring up to support it may not fully manifest for a decade or so. According to the US Census, only 8% of US households owned a personal computer (PC) in 1984. It took until about the year 2000 before half of US households had them and another 10 years before nearly 80% of the population had a PC.1 It was their increasing usefulness that spurred greater adoption. Big US tech companies are spending billions profitlessly on AI today in hopes of bigger future rewards.

As value investors, we see few investment opportunities in this space currently—the semiconductor and hardware companies have run hard over the past few years—but years of research and experience suggest to us that opportunities for AI-related value investments may arise either as current darlings stumble, or as out-of-favor firms find innovative ways to tap into AI’s vast potential. We believe research and an eye on valuations will be crucial.

Building out the infrastructure

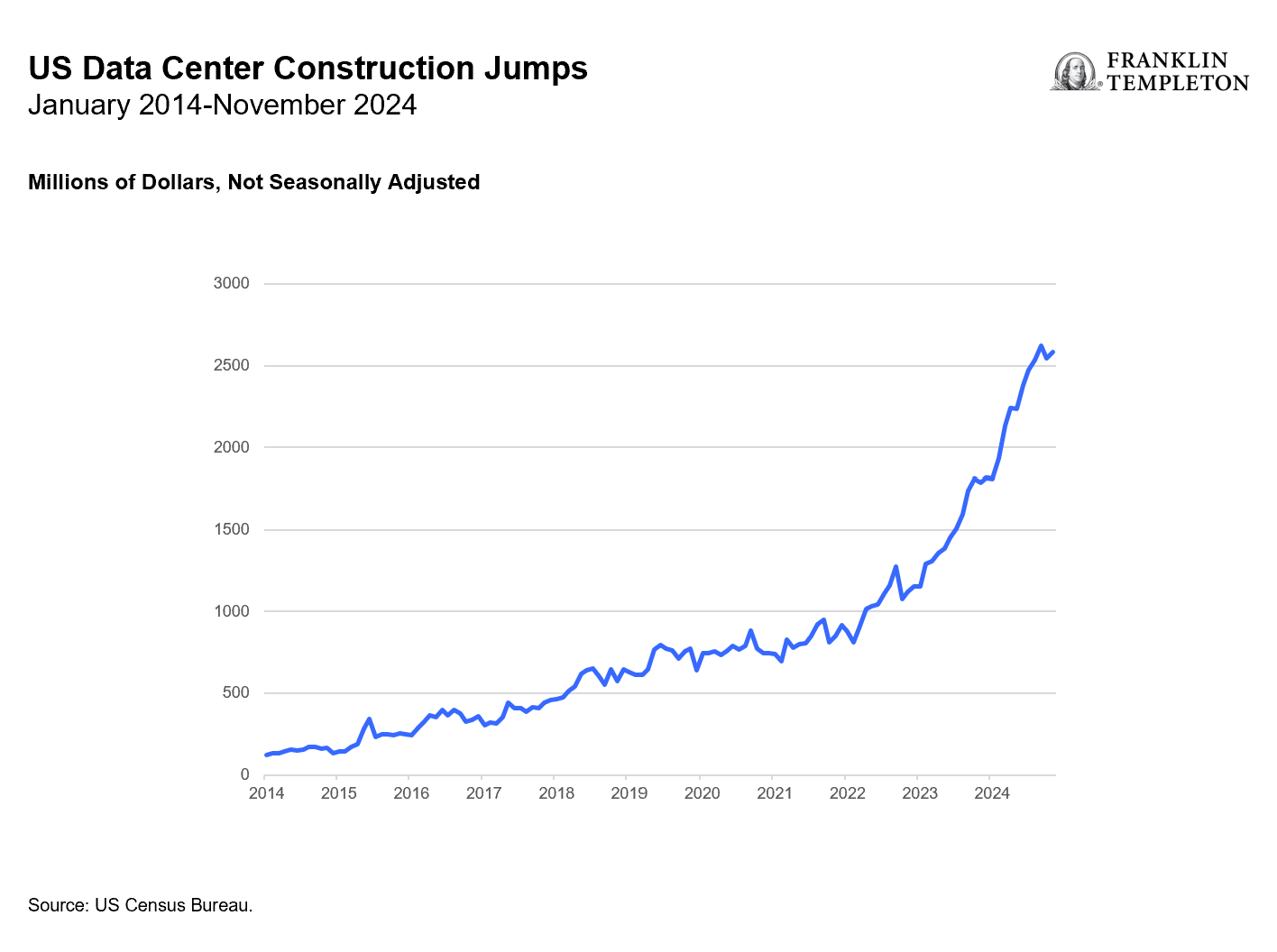

As the spending continues for now, we see an ongoing need for larger data centers to run the AI models and process the expected jump in data volumes. Some existing data centers are being repurposed to support AI, while others are being built from scratch in places like Northern Virginia, known as “data center alley.” AI optimism has led US spending on data centers to climb sharply over the past year as shown in Exhibit 2.

Exhibit 2: The US Is Building More Data Centers

This construction is providing many traditionally value industrial companies with new economy opportunities. AI data centers are more power and heat intensive than standard data centers. The large-language AI models are being run nonstop in the training phase, as they are fed information. That leads to greater electricity consumption, which generates heat, and requires not only more physical space, but also electrical and mechanical equipment to run all the servers and tech gear as well as water and equipment to keep the data centers cool and reduce the possibility of overheating or power disruptions.

The servers, for instance, need to be cooled locally, so that the racks they sit on may have coolants running through them, with chillers sitting outside the data centers. The air also must be kept cold, requiring HVAC systems. Meanwhile, keeping the data centers running requires power distribution systems, switches and gear to ensure power supply is uninterrupted. And the whole data center needs to be tied back into the electrical grid with transmission lines or powered by mobile generation solutions. (See image below.)

Overhead View of a Data Center

Source: Adobe Stock.

Overall, spending on the required industrial equipment needed to run new data centers could total US$250 billion by the end of the decade, consulting firm McKinsey estimates.2 While many industrial stocks may already reflect the optimism about all this AI data center spending, we believe there could be places where both large- and small-cap value investors may still find overlooked opportunities.

A power revolution

Powering all this tech and industrials equipment also requires more and more power. A utility sector that has not seen load growth in nearly 40 years is at the beginning of a major power revolution, in our view. Overall, the US Department of Energy and the Berkeley Lab estimate that US data center electricity demand should grow at an increasing rate over the next few years, reaching 6.7%–12% of total US power consumption by 2028 compared with 4.4% in 2024.3

After years of flat or shrinking power demand around the developed world, the staid utilities sector may need to spend more on both power generation and transmission to meet the growing demand from AI data centers. And currently, access to sufficient power has constrained some data center construction, which we believe means there is pent-up demand still to be unleashed.

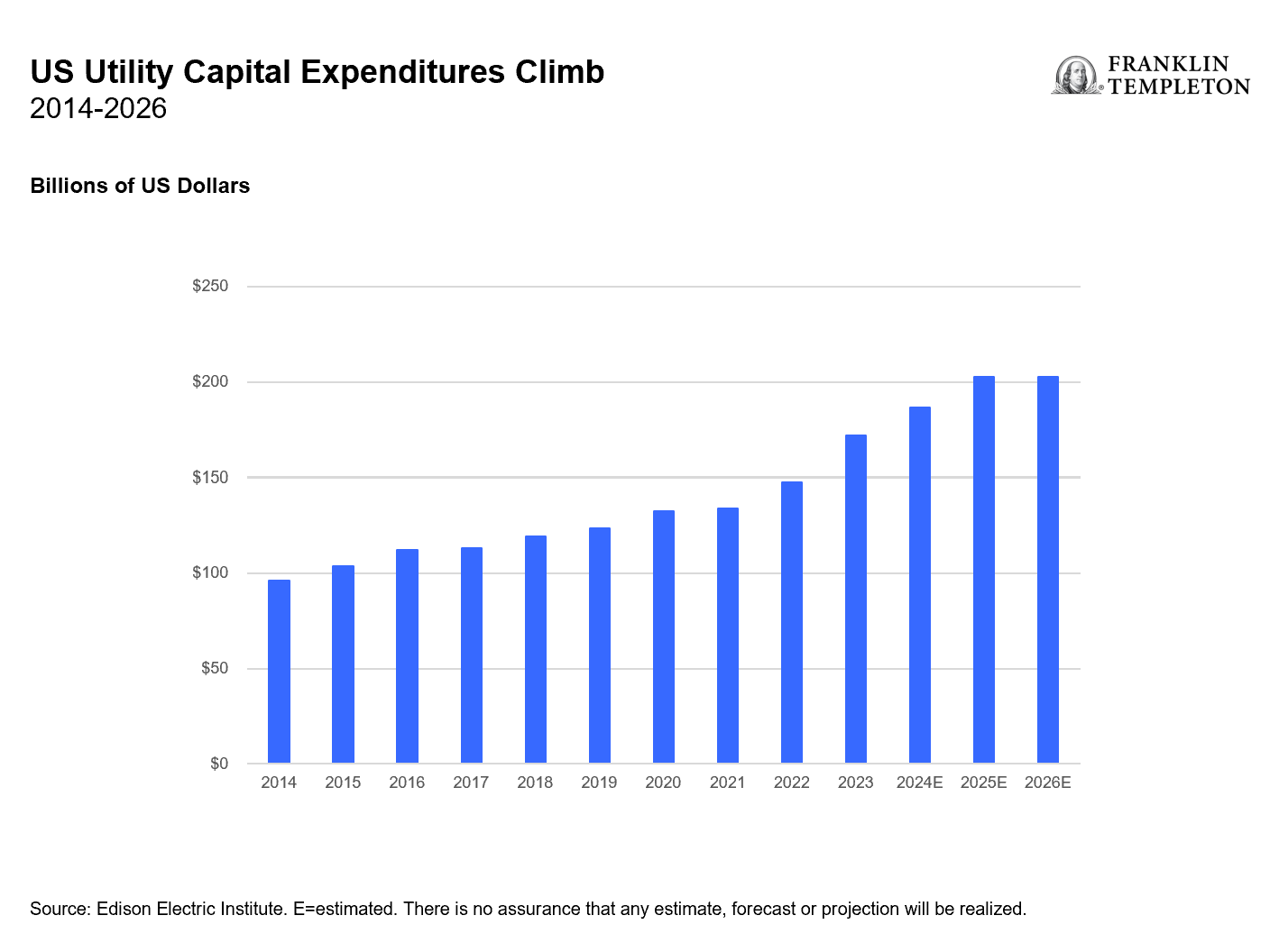

Bain & Co., a US consultancy, forecasts that utilities will need to increase annual energy generation by as much as 26% above 2023 levels by 2028 to meet projected demand, well above the 5% boost seen in the prior two decades.4 We have seen US utility industry capital expenditures begin to rise to meet the growing demand for US electricity. (See Exhibit 3.)

Exhibit 3: US Utilities Spend More to Meet Growing Demand

All this new power demand will require a modernized electrical grid, greater generation facilities and equipment like gas turbines and green energy alternatives given grid capacity constraints. With power demand likely to increase and supply likely to rise to meet it, we expect to see growth for the sector, for the first time in decades, over the next few years. The boring old utilities sector could start to see growth, providing a necessary catalyst for utility sector multiple expansion beyond the increases we saw in 2024.

A decade’s wait?

While all this money goes into building the infrastructure to support AI, the meaningful use cases seem way off. We expect that AI’s full potential may become clearer over the next decade, as the tech booms of the past have suggested. Whether AI investment can be made more cheaply and with less tech and fewer data centers is now an open question.

Nonetheless, as value investors, the rise in AI is not just a growth and technology story. Realizing this new technology’s potential still needs more traditional electrical equipment, cooling systems, and power generation and transmission over time. Recent market gyrations may provide value investors with potential opportunities to seek to take advantage of this growth as the old economy meets the new; new opportunities may also arise as AI becomes more widely adopted. In the meantime, be mindful of the valuations.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Large-capitalization companies may fall out of favor with investors based on market and economic conditions. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks.

Value securities may not increase in price as anticipated or may decline further in value. Growth or value as an investment style may become out of favor, which may have a negative impact on performance.

Active management does not ensure gains or protect against market declines.

Investment strategies which incorporate the identification of thematic investment opportunities, and their performance, may be negatively impacted if the investment manager does not correctly identify such opportunities or if the theme develops in an unexpected manner. Focusing investments in technology-related industries, carries much greater risks of adverse developments and price movements in such industries than a strategy that invests in a wider variety of industries.

Securities issued by utility companies have been historically sensitive to interest rate changes. When interest rates fall, utility securities prices, and thus a utilities fund’s share price, tend to rise; when interest rates rise, their prices generally fall.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2025 Franklin Templeton. All rights reserved.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: “Computer and Internet Use in the United States: 2016.” US Census. August 2018.

2. Source: “AI power: Expanding data center capacity to meet growing demand.” McKinsey & Company. October 29, 2024.

3. Source: “2024 United States Data Center Energy Usage Report.” Berkeley Lab. December 2024.

4. Source: “Utilities Must Reinvent Themselves to Harness the AI-Driven Data Center Boom.” Bain & Company. October 2024.