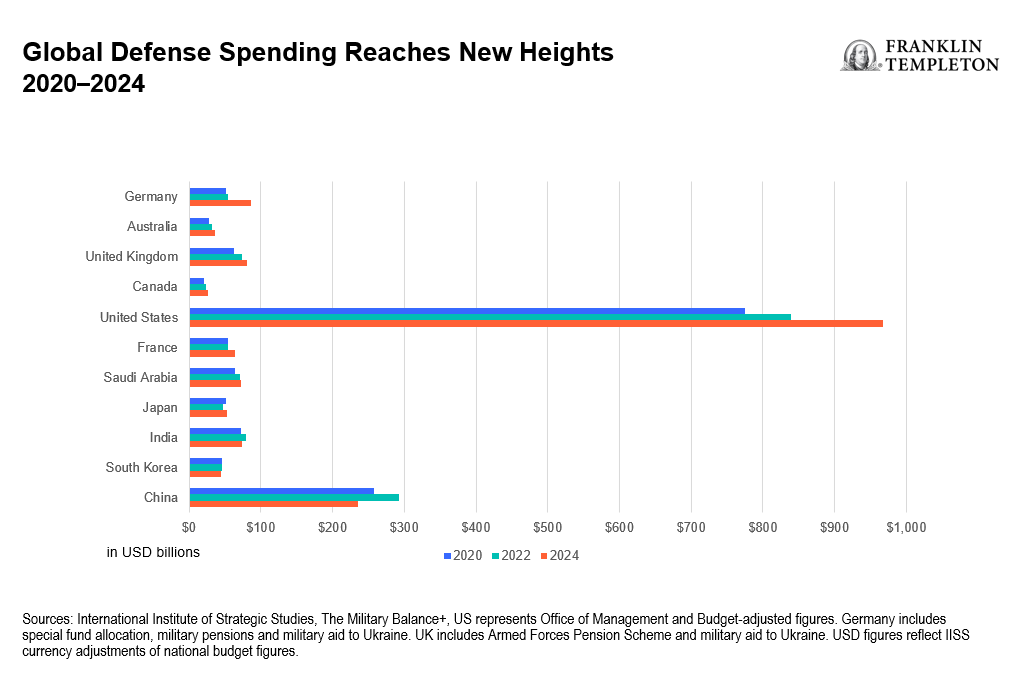

While the United States is still by far the world’s largest spender on aerospace and defense, countries including the United Kingdom, Germany and Canada are increasing their military budgets at a faster rate. In fact, global defense spending last year reached a record high of nearly US$2.5 trillion—more than a 7% rise in real terms from the prior year and an average of 1.9% of gross domestic product.1 We see this as an ongoing trend, driven by rising threat perceptions and the demand for more modernized technologies, such as advanced cybersecurity and drone innovations that are increasingly reliant on artificial intelligence capabilities.

The European Union (EU) is now aiming for roughly US$870 billion in investments to strengthen its defense capabilities amid growing concerns over US commitments to European allies. While the implications for defense companies—such as specific allocation and concrete order timelines—are still being assessed, European defense stocks have already seen a dramatic upward trajectory in recent months. Once further details on orders can be clarified, we may see further upward adjustments to projections. What’s more, the significant boost in military spending is reshaping alliances worldwide and spurring investment opportunities in select markets.

Germany, Europe’s largest economy, is at the forefront of ramping up military spending, and equity markets have reacted favorably. German equities have surged year-to-date, with the DAX Index up more than 19% compared to a decline of over 2.5% for the S&P 500 Index.2 Europe’s developed market stocks have also trounced US stocks year to date, up more than 12%.3

Investors pursuing the potential benefits of portfolio diversification may want to consider the cost-effectiveness of country-focused exchange-traded funds (ETFs). Among European equities, Germany has attracted the most positive net flows in ETFs year-to-date with US$5.9 billion, followed by Switzerland with US$2.2 billion, and ranks third globally by country in terms of ETF net flows.4

Of course, the latest US auto tariffs are expected to add further pressure to Europe, with particular pain for Germany’s already struggling car industry. The country’s three largest auto exporters account for about 73% of the EU’s vehicle exports to the United States, according to JATO Dynamics.

Despite the strong performance of European stocks this year, relative valuations remain attractive to us. The STOXX Europe 600 is trading at 14.7x 2025 earnings, compared to 22.6x for the S&P 500.5

The significant rise in European defense spending is also notably impacting alliances elsewhere around the world. Since US President Donald Trump’s on-again, off-again tariff turmoil began, Canada has been further aligning itself with partners across the Atlantic, aiming to diversify its trading relationships and defense alliances beyond its primary ties with the United States.

We believe the trend of localization in the defense industry is creating significant opportunities in Asia, where defense budgets are also growing. While defense spending in Asia is growing at a more moderate pace than Europe and North America, Asian nations are pouring resources into developing next-generation military capabilities, which now account for 23% of global defense spending.6 Indian authorities, for example, recently announced a 9.53%7 rise in its defense budget for 2025-26 and are engaging more private companies to build military aircraft, which seems likely to create new opportunities in its aerospace sector.

As global defense spending climbs, nations are focusing on localizing defense production to boost self-reliance and reduce foreign dependency. Besides India, South Korea and Taiwan are also heavily investing in their domestic defense capabilities. In October 2024, Washington and Seoul finalized a new multiyear plan over the shared costs of keeping US troops on the peninsula. For 2026, the nations agreed to raise defense costs by 8.3% to roughly US$1.13 billion8. Taiwan, meanwhile, is aiming to overhaul its military and lift defense spending to more than 3%9 of gross domestic product, up from its current 2.45% (though well short of the 10% of economic output that Trump has demanded.)

Given expectations for a sustained lift in global defense spending, investors may increasingly seek portfolio diversification with strategic country exposures. While defense spending is subject to future election outcomes and changes in geopolitical risks, we believe this approach may not only help potentially mitigate risks but also help investors to capitalize on the opportunities arising in new cross-border alignments.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically. To the extent a portfolio invests in a concentration of certain securities, regions or industries, it is subject to increased volatility.

Diversification does not guarantee a profit or protect against a loss.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, http://www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

________________________

1. Source: International Institute for Strategic Studies (IISS). February 12, 2025.

2. Source: Bloomberg. March 27, 2025. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

3. Source: Bloomberg. March 28, 2025. STOXX Europe 600 Price Index and FTSE Developed Europe RIC Capped Net Tax Index (in USD). Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

4. Ibid.

5. Source: Bloomberg. As of March 31, 2025.

6. Source: JP Morgan, Asia Pacific Equity Research. As of March 15, 2025.

7. Source: Government of India Ministry of Defence press release. February 5, 2025.

8. “U.S., South Korea agree on five-year plan to share defence costs.” Reuters. October 4, 2024.

9. Source: American Institute of Taiwan. March 20, 2025.