- We believe increasing portfolio diversification appears more critical given ongoing uncertainty around the scope and implementation of US trade policy.

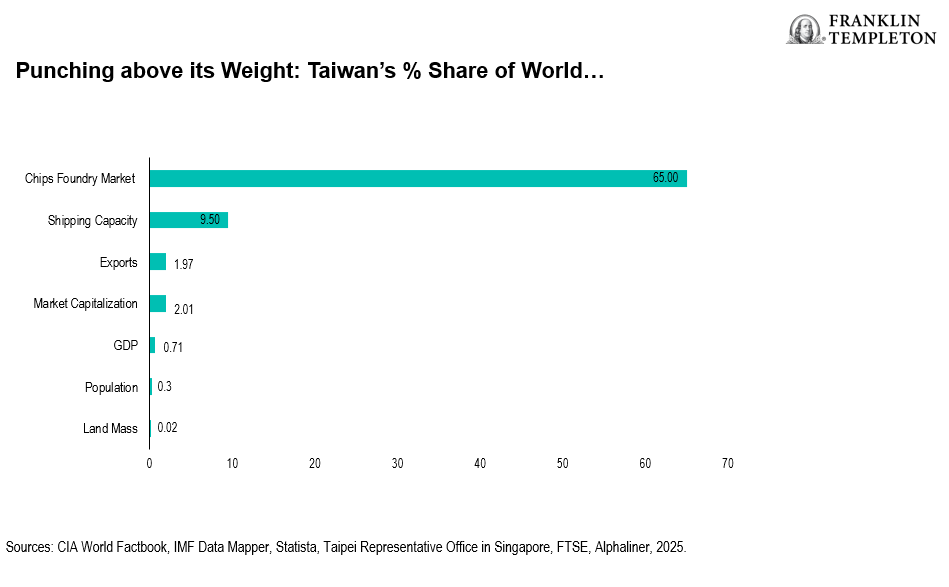

- Semiconductor chips are, for the time being, exempt from higher tariffs. Dominating the global foundry market with a two-thirds share, Taiwan’s firms hold near-total control over advanced chip production.

- With a greater emphasis on global trade negotiations, investors are shifting toward more tactical, country-specific strategies to amplify exposure in economies better able to weather tariff upheaval.

If US President Donald Trump’s so-called “Liberation Day” hasn’t freed you from the burden of more questions or the pangs of uncertainty, you’re in good company.

Washington is now set to impose an expansive barrage of universal new tariffs on all imported foreign goods, inciting retaliatory countermeasures from US trading partners. What could go wrong?

Holding up a sort of sandwich board of rates on a windy Wednesday in the White House Rose Garden, Trump noted China’s punishment prominently at the top. “Reciprocal” tariffs of 34% now push total levies on Chinese goods to a staggering 54%.

While the European Union and many other Asian economies are among the worst-impacted by this deliberate hit, much remains in flux. Precisely how all this will rewire the world’s interconnected supply chains, disrupt business dynamics and play out for portfolios remains to be seen. Especially since we are already seeing realignments of trade partnerships away from the United States, we continue to emphasize the—now particularly significant—wisdom of diversification.

Limited direct hits

With some goods and economies relatively less impacted, investors are turning to single-country exchange-traded funds to tweak tactical exposures. Canada and Mexico, which were previously subject to separate tariffs, have found some relief in exemptions for United States-Mexico-Canada Agreement-compliant goods, especially given that “certain minerals” have escaped higher duties. Mexico’s President, Claudia Sheinbaum, who has displayed savvy in her prior negotiations with Trump, continues to adopt a cautious stance, stating that Mexico will respond with a “comprehensive program” rather than necessarily imposing reciprocal tariffs.

If Canada and Mexico can make further progress with the emergency fentanyl issue that Trump used to justify the tariffs, they may be folded into a separate tariff regime.

Other countries seeing minimal direct costs of tariffs include Brazil, Australia and the United Kingdom, the largest nations with which the United States has a trade surplus. Steel, aluminum and imports of oil, gas and refined products are also exempt from the new tariffs, which may aid select economies and sectors—Saudi oil, for example.

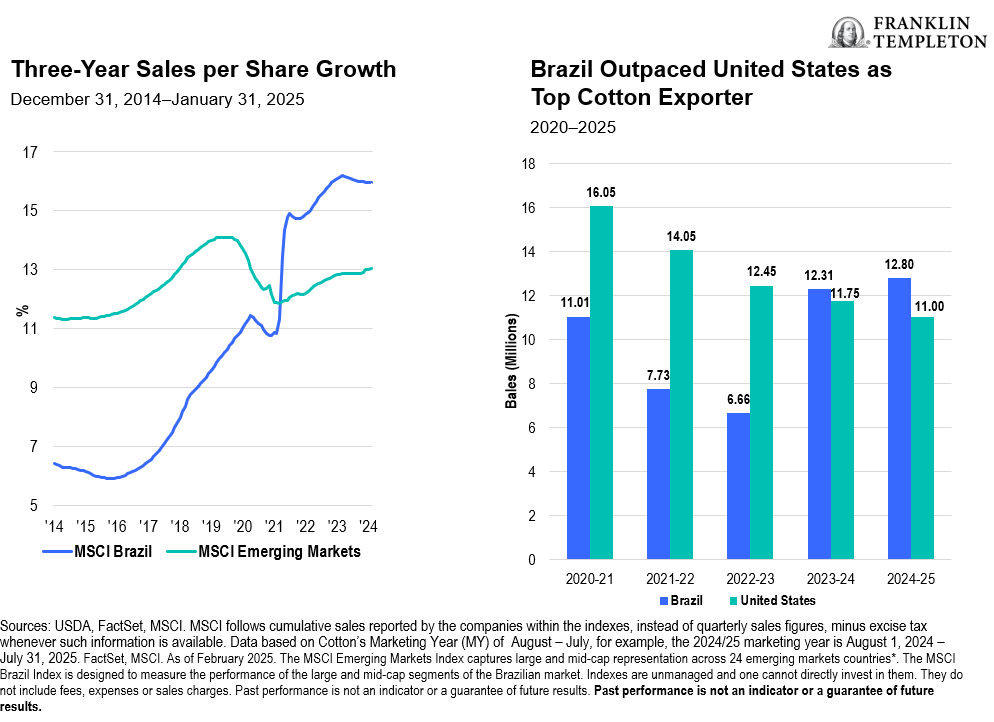

While Brazil still faces the challenge of taming its high public debt, its economy was strong and unemployment low through 2024, with robust domestic demand driving growth. Soybeans remain a pivotal crop in Brazil’s agricultural expansion, driving the country’s rise as a leading global supplier of farm products, but a recent historic shift has also seen Brazil’s cotton exports surpass those of the United States. Not surprisingly, China has been the main trade buyer for these products.

Stable foreign direct investment (FDI) inflows have also been a key driver for Brazil’s current account balance. In fact, Latin America’s largest economy is one of the world’s main recipient’s of FDI—the fifth largest globally with nearly US$66 billion in inflows in 2023.1 Its economic advantages also include vast natural resources as well as a large and young labor force.

Exhibit 1: Brazil’s Exports Help Power Growth

Semiconductor chips exempt from higher tariffs

Effective April 9, US-bound goods from Taiwan will be subject to a 32% import tax—a key exception being semiconductors, which are a complex tariff target due to their global and highly specialized supply chain. According to the announcement, reciprocal tariff rate calculations incorporated monetary tariffs, currency manipulation and trade barriers. Since no methodology has been published, this is difficult to verify, but blunt data suggests the approach may have been much more simplistic and crude, which may leave the door open for adjustments. Taiwanese officials have been quick to point to flaws in the calculations, and have pressed for immediate negotiations.

Thus far this year, the MSCI Taiwan Index is down nearly 9%—in correction territory2 but we believe this outcome is likely more a reflection of global uncertainty than the fundamentals of Taiwan’s current economy. The National Development Council of Taiwan has stated expectations for gross domestic product (GDP) to grow by 3.3% in 2025, driven by continued demand for artificial intelligence (AI) and other emerging technologies.3 The more moderate International Monetary Fund’s GDP forecast of 2.7% seems to take more heavily into consideration worries over global growth this year, but still positions Taiwan’s economy well ahead of most developed countries, and ahead of the G-7’s lackluster 1.7%.4

Exhibit 2: Taiwan’s Silicon Shield

Taiwan’s tech-driven economy relies heavily on exports to the United States. But exemptions or not, its semiconductor manufacturing capabilities still reign supreme. Taiwan currently holds a two-thirds share of the global foundry market, dwarfing second-ranked South Korea’s 10%. In the production of the most advanced chips, including those used to train AI applications such as large language models, Taiwanese firms maintain near-total domination on global supply, with a market share exceeding 90%.5 At the same time, the “most important company in the world of chips from Taiwan”—as Trump said during his Rose Garden speech—is diversifying production facilities overseas, not least for geopolitical reasons, with investment pledges of US$200 billion in the United States.

Nearly 70% of Taiwan’s index weighting is in the IT sector, but we would note that Taiwan’s benchmark exposure in global indexes constitutes just 1.8%—even as its economy and firms clearly punch above their weight.6

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically. To the extent a portfolio invests in a concentration of certain securities, regions or industries, it is subject to increased volatility.

The government’s participation in the economy is still high and, therefore, investments in China will be subject to larger regulatory risk levels compared to many other countries. There are special risks associated with investments in China, Hong Kong and Taiwan, including less liquidity, expropriation, confiscatory taxation, international trade tensions, nationalization, and exchange control regulations and rapid inflation, all of which can negatively impact the fund. Investments in Hong Kong and Taiwan could be adversely affected by its political and economic relationship with China.

Diversification does not guarantee a profit or protect against a loss.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, http://www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_______________

1. Source: World Investment Report 2024 published by UNCTAD.

2. Source: Bloomberg. As of April 3, 2025. The MSCI Taiwan Index is designed to measure the performance of the large and mid-cap segments of the Taiwan market. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

3. Source: National Development Council, 2025.

4. Source: International Monetary Fund, 2025. There is no assurance any estimate, forecast or projection will be realized.

5. Sources: Wired.com, October 2024, and Counterpoint Research, March 2025.

6. Sources” Bloomberg, FTSE. As of March 31, 2025.