A Federal Reserve survey1 last year found that participants cited “persistent inflation; monetary tightening” as the potential shock that would have the biggest negative effect on the US financial system. On 30 November, Federal Reserve (Fed) Chair Jerome Powell told Congress that “it’s probably a good time to retire” use of the word “transitory” when describing inflation. He then opened the door to a possible acceleration of monetary policy actions to rein it in. This has investors questioning whether the Fed can effectively manage a “soft landing”.2 Year-to-date (through 28 January), global equities have returned -7.9%.3 There is no doubt that we find ourselves in unusual waters. What does the Fed’s course mean for asset allocation?

Key Points

- Hawkish Fed: The Fed has made it clear—it has turned more hawkish.

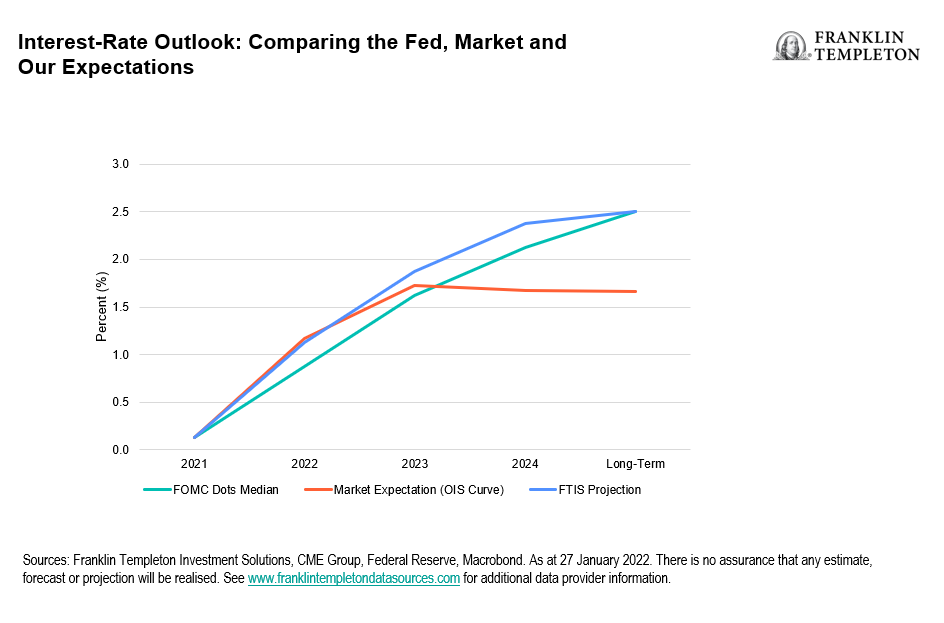

- Great (Fed) Expectations: We expect the Fed to raise interest rates four times in 2022 and to begin reducing its balance sheet. We believe the terminal rate (the natural rate consistent with full employment and stable prices) will be around 2.5%, higher than current market expectations.

- Macro Comparisons: The current macro environment differs from previous hiking cycles in three ways: interest rates are lower, valuations are richer, and macro fundamentals are more “late-cycle” than usual.

- Multi-Asset Implications: We became less bullish on equities in December 2021, though we still favour stocks over fixed income and will look to take advantage of market volatility going forward. Within fixed income, we remain short duration although we view the recent back-up in yields as an opportune time to add back some duration exposure. We provide further detail below on our preferences for equity regions, fixed income sectors and currency exposures.

Fed Increasingly More Hawkish

US Consumer Price Index (CPI) growth reached 7.1% on a year-over-year basis in December 2021 (starting from a very low point), the highest since the early 1980s. Nearly every type of inflation measure has hit a cyclical peak. Throughout 2021, the Fed and many investors viewed price pressures as transitory, driven by COVID-19 and supply-chain disruptions. More recently, however, Powell made it clear that the “transitory” language should be retired as the Fed’s attention has shifted to increasing wage pressures and other areas that could become more persistent sources of inflation.

As a result, we have seen the Fed becoming more hawkish.

15 December 2021, Federal Open Market Committee (FOMC) Meeting: In this meeting, the Fed accelerated the tapering of quantitative easing (QE), such that it would end by March 2022, sooner than it had previously projected. Additionally, the median summary of economic projections (SEP) for the first-time signalled rate hikes in 2022, with three hikes projected then.

5 January 2022, FOMC minutes: FOMC minutes (meeting notes) reinforced the hawkish pivot at the December meeting as participants emphasised the possibility that the Fed could hike, “sooner or at a faster pace than participants had earlier anticipated”. Further, the minutes explicitly pointed to raising the federal funds rate as part of Fed policy, noting that balance sheet shrinkage would begin “relatively soon after beginning to raise the federal funds rate” and at a faster pace than in the last cycle.

Fed Speak: Comments in January from various Fed speakers, including Chair Powell and incoming Vice Chair Brainard, have indicated that controlling inflation is currently their “most important task”, with March the likely date for rate liftoff.

26 January 2022, FOMC Meeting: In the press conference following the Fed’s decision, Powell reaffirmed the market’s expectations for a March hike. Importantly, he declined to characterise the outlook for rate hikes as gradual (Fed code word for every quarter), instead indicating the Fed would be moving “steadily away from the very highly accommodative monetary policy…going to need to be…nimble…as the economy is quite different this time”. This language is much stronger than in the last cycle where it raised rates every quarter.

Our Expectations for this Fed Cycle

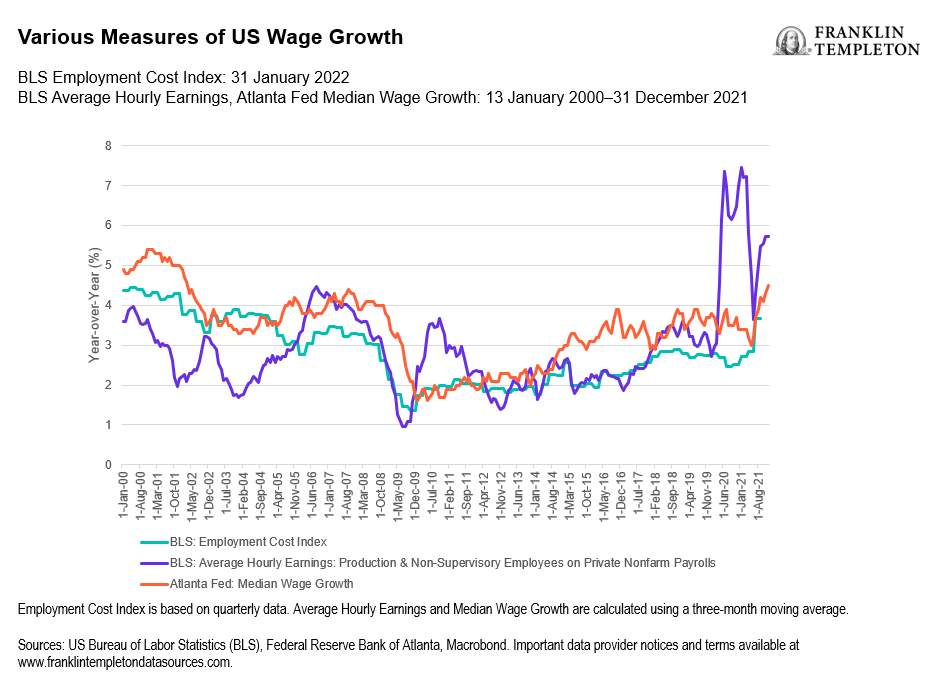

In our view, the US labour market is behaving as if it is at full employment. Some signs of this include the elevated ratio of job openings to unemployed, resulting in wage pressures that (barring an anomalous reading in April 2020) are at multi-decade highs. Labour force participation-rate progress could affect this, but as we wrote previously (Where Are the Workers?), recent changes seem structural and unlikely to be reversed quickly.

Exhibit 1: Wage Growth Is Increasing

Thus, we expect the Fed to raise interest rates in March and May of this year, begin reducing the size of its balance sheet (often referred to as quantitative tightening or QT4) this summer, and raise interest rates again twice in the second half of the year for a base case of four rate hikes this year. The Fed has indicated that it will remain ever-so dependent on the data, which we expect to remain hot, and there is a very real possibility the Fed may go beyond four hikes.

We believe that market expectations for the terminal rate—where the Fed will stop hiking—remain too low and real yields remain depressed by extraordinary global stimulus. We expect US Treasury yields to drift higher as the Fed proceeds with the tightening cycle. Tightening by most of the G10 central banks should also add to upward pressure on yields.

The Fed has indicated that its primary tool is, and will remain, rate hikes, but the Fed also has a very large balance sheet which it will try to reduce. It is important to note that quantitative easing (QE) and QT are relatively new policy tools. The Fed has only utilised these measures in response to, and after, the global financial crisis of 2008. In the last cycle, tightening measures, which included tapering Treasury purchases, hiking interest rates and QT were spaced out over years. During that extended timeframe, the Fed was able to take a read on how the economy and markets were responding. Now, the Fed has indicated that rate hikes could begin concurrently with QT. Given higher levels of uncertainty, we see two potential policy mistakes the Fed could make, which come with their own set of market risks:

1) The Fed tightens too much, too quickly. In our view, embarking on restrictive measures in a compressed timeframe has the potential to negatively hamper growth and increase market volatility.

2) The Fed tightens too slowly and inflation pressures become embedded into the broad economy. Should this occur, the risk of an ensuing wage-price spiral6 increases. At first, risk assets may do well as policy would remain relatively stimulative, but eventually, the Fed could be forced to increase tightening measures substantially, risking a recession.

Exhibit 2: Expectations for the Terminal Rate Remain Too Low

How Does the Macro Backdrop Compare to Previous Fed Tightening Cycles?

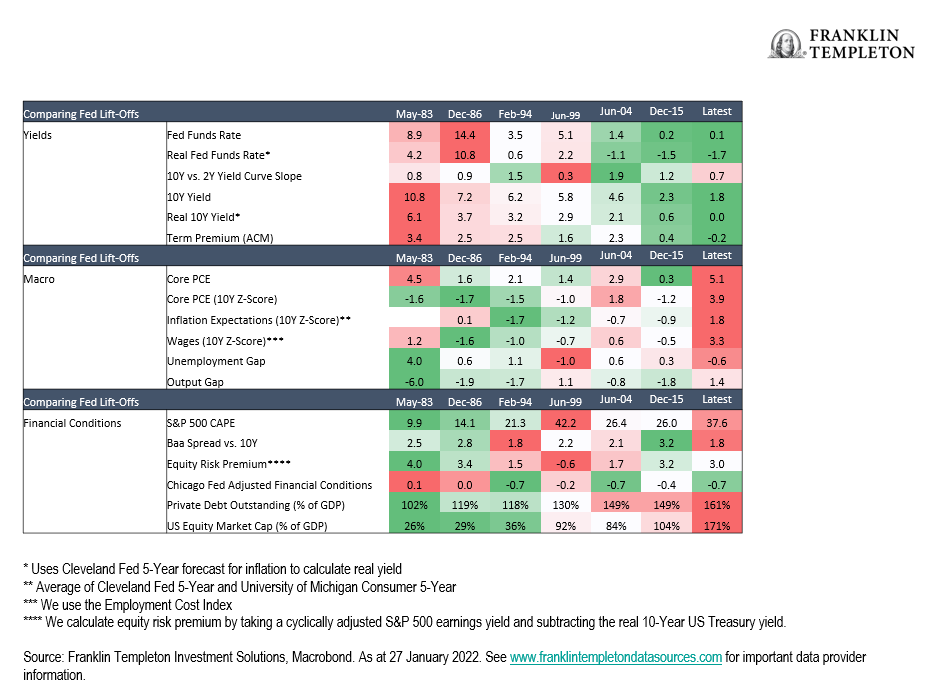

The Fed has pivoted hawkish. To gauge its impact on asset allocation, we start by comparing the current macro environment to six previous hiking cycles. There are a few elements that stand out:

Rates are lower: both nominal and real measures of interest rates are the lowest ever, as compared to previous hiking cycles. Yield curve slopes are near average, although currently they are significantly flatter than they were at the start of the previous two hiking cycles.

Valuations are rich: valuations for assets like equities and credit spreads are expensive. In a similar vein, financial conditions indices show that conditions are still easy and accommodative. One measure of relative valuation, equity risk premium, juxtaposes expected equity returns with risk-free interest rates. This measure currently places valuations in line with historical averages. However, as real yields rise, this valuation measure may also look stretched. Lastly, levels of debt and equity market capitalisation (as a % of gross domestic product [GDP]) are the highest ever.

Economic indicators—more late-cycle than usual: measures of inflation and inflation expectations are much higher than usual. Labour market indicators, like wage growth and the unemployment gap, also suggest we are at least mid-cycle, if not past it. Lastly, estimates of the output gap are the most positive ever, indicating GDP growth has exceeded estimates of potential growth.

Exhibit 3: There Are Some Unique Aspects to the Current Environment

Multi-Asset Implications

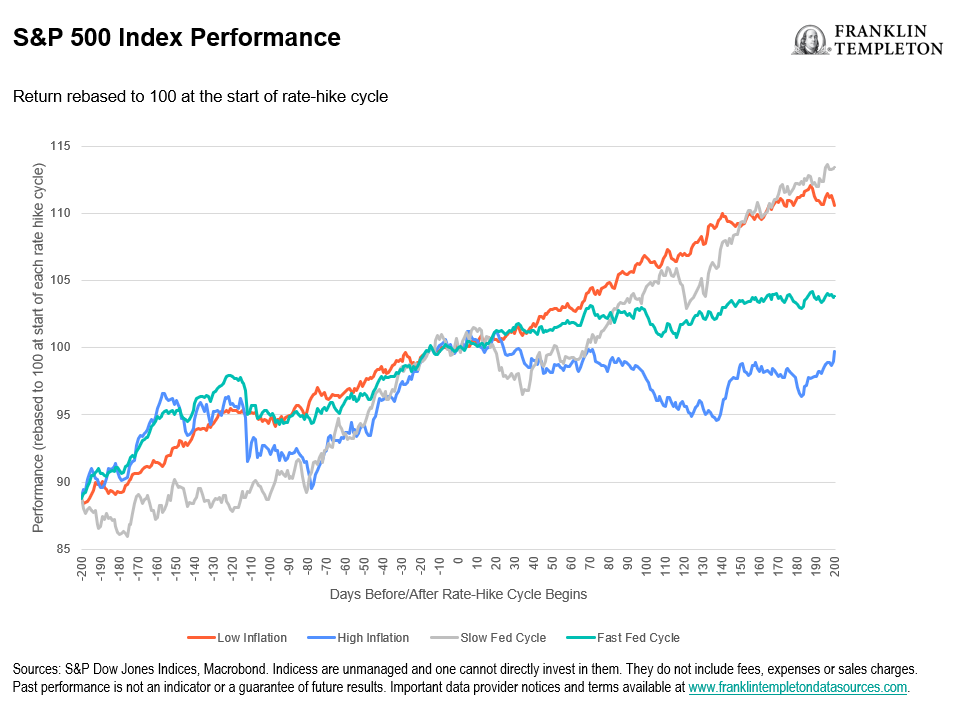

We tempered our outlook for equities in late December 2021, as we saw the prevailing policy environment becoming more challenging. Though we are less bullish, we remain positive on equities overall and will look to take advantage of market volatility.

Policymakers were slow to evolve their thinking around transitory inflation, and there is the potential that their hawkish pivot will have a similar effect. In the near term, a Fed “put” option6 is unlikely in our view, it would take an equity selloff or growth slowdown larger than those experienced in past cycles for the Fed to change policy and provide support. Our analysis also suggests that Fed rate-hike cycles that occur during high-inflation periods tend to be faster than usual and lead to lower equity returns.

Exhibit 4: Equities Perform Worse in Rate-Hike Cycles Characterised by High Inflation

In addition, the current macro environment presents unique challenges for risky assets. Rich valuations make equities more vulnerable to a correction. Furthermore, the amount of risk assets in the economy is elevated relative to history (as measured by market capitalization as a % of GDP). In our view, this increases the sensitivity of asset prices and economic growth if interest rates rise.

Within equities, we still have a regional preference for US equities due to strong earnings expectations. We are moderating this view, at the margin, as Fed policy increases headwinds to the US technology sector. Our US equity view will continue to evolve alongside inflation and Fed policy. Outside of the United States, we favour regions such as the eurozone and Japan that have less monetary policy headwinds and positive earnings outlooks. We continue to be less constructive on emerging market equities, including China (Is Now the Time to Consider Chinese Equities?).

Within fixed income, we are cautious regarding duration exposure, although we view the recent backup in interest rates as an opportune time to add-back some duration to portfolios. Within US credit, corporate fundamentals remain a bright spot and should continue to support strong valuations, even as growth slows. While inflation, tightening liquidity, and the Fed present meaningful risks to credit in 2022, the risk-reward remains skewed to the upside for loans and high yield, whereas we have a more neutral stance on emerging market debt. Lastly, we have a slight positive view on the US dollar versus other major currencies given our outlook on relative growth and interest rate differentials.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline. Floating-rate loans and debt securities tend to be rated below investment grade. Investing in higher-yielding, lower-rated, floating-rate loans and debt securities involves greater risk of default, which could result in loss of principal—a risk that may be heightened in a slowing economy. Interest earned on floating-rate loans varies with changes in prevailing interest rates. Therefore, while floating-rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_____________________________

1. Financial Stability Report – November 2021. The Federal Reserve Bank of New York surveyed 26 market contacts from August to October 2021. Responses are to the following question: “Over the next 12 to 18 months, which shocks, if realised, do you think would have the greatest negative effect on the functioning of the US financial system”?

2. A soft-landing, in economic terms, refers to the ability of stimulative policy measures to be removed without causing a recession.

3. As measured by the MSCI All Country World Index. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

4. Under Quantitative Easing, the Fed buys US Treasuries; in doing so, the proceeds (cash) from those purchases eventually makes its way through the financial system to banks. The intent of this policy is for that cash to provide a stimulative effect to the economy. Quantitative Tightening, whereby the Fed does not replace maturing Treasuries on its balance sheet, reverses this measure. It is done with the intent of cooling an overheated economy (inflationary environment).

5. A wage-price spiral typically occurs when businesses increase prices to maintain their markups of prices over wages and/or costs, while at the same time, workers demand or seek out higher wages to compensate for higher prices. It is characterized as a perpetuating loop of increasing prices.

6. “The ‘Fed put’ terminology implies that Fed policy adjustments, by analogy with a put option, will prevent stock price declines beyond some point”. – W. Poole. (2008). Federal Reserve Bank of St. Louis Review, 90(2), pp. 65-73.

English

English