This post is also available in: German

- Instead of losing ground amid the Ukraine conflict, Brazil is luring investor attention with recent outperformance, deeply discounted valuations and attractive dividend yields.

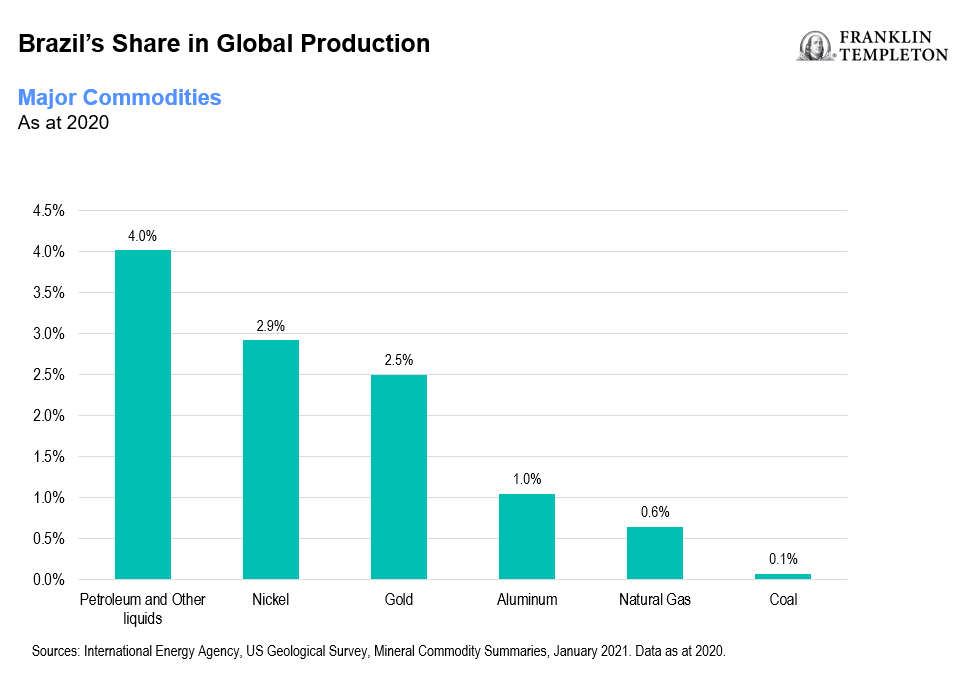

- Resource-rich Brazil stands to benefit further from surging global oil and commodity prices.

- Renewable energy sources already account for more than 80% of the electricity matrix in Latin America’s largest nation, and its green agenda reform goals bode well for long-term growth.

The evolving tumult from the Russia–Ukraine war has added to the list of uncertainties facing investors everywhere. For commodity-rich Brazil, the implications are even more fraught.

A mere week before the assault, Brazilian President Jair Bolsonaro traveled to Moscow to shake hands with Vladimir Putin in a show of “solidarity”. After Russia’s attack on Ukraine, Bolsonaro admonished his vice president for criticising the act. Brazil, nonetheless, voted alongside other UN Security Council members for a resolution to condemn the invasion—at the reluctance of its “neutral” president.

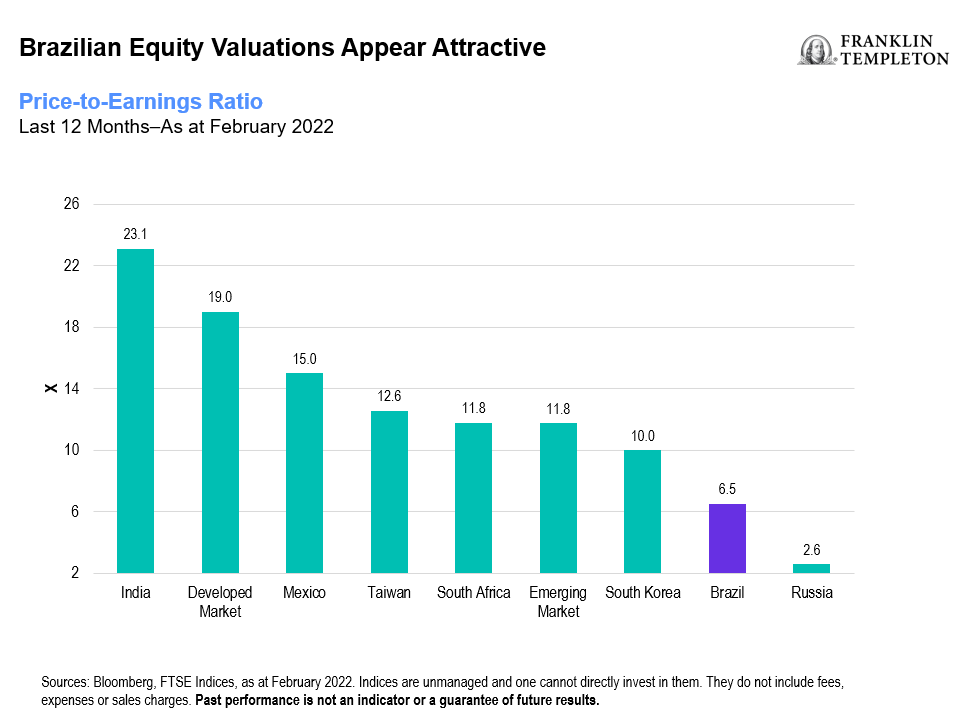

Geopolitical tensions have a way of turning upended markets red all at once. But stocks around the world tend not to fluctuate in lockstep for long. This keeps global diversification appealing and has recently steered investor attention towards Latin America. In February, broad emerging market stock valuations traded at a 40% discount to the S&P 500 Index’s forward price-earnings (P/E) ratio, its cheapest level in 18 years.1 Investors wanting more targeted foreign market exposure have turned to Brazil, which boasts deeply discounted valuations. Its P/E ratio at about 6.5 is more than 70% lower than its five-year historical average.2

In the first two months of this year, the FTSE Brazil Capped Index was up about 17%, roughly the same as it lost for all of 2021 (when it fared better than only China). Boosted by heavy weightings in the materials and energy sectors, the index has rebounded remarkably. It has outperformed other developing economies and the FTSE Emerging Market Index, which returned -3%.3

As world sanctions on Russia lead to a spike in commodity prices, Brazil stands to benefit from its position as one of the world’s top exporters. As with other agricultural exporters, Brazil could face higher fertiliser prices and energy costs due to the Russia-Ukraine conflict, as fertiliser has been its primary import from Russia.

Brazil’s renewable energy sources account for 83% of the country’s electricity matrix, which gives it a competitive edge over other agricultural exporters. This helps shield it from higher prices for carbon intensive electricity production.4

Two years ago, Brazil was the sole South American nation to increase crude oil production, according to the US Energy Information Administration. Its importance has been further elevated given estimates that the country will become responsible for the production of roughly half of the world’s offshore oil by 2040.5

This presents fresh investment prospects and an attractive entry opportunity into Latin America’s largest country. Brazil currently offers attractive dividend yields of about 8%, bolstered by the energy and materials sectors, which account for nearly half.6

Brazil has minimal trade exposure to Russia. Pre-conflict, annual exports to Russia accounted for less than 1% of Brazil’s overall exports.7 Since Brazil sells considerably less in goods to Russia (about US$1.6 billion annually) or the European Union than it does to the United States (about $US31 billion), Bolsonaro’s controversial trip to Moscow would seem to have little economic point. But in what has become a turbulent re-election year, analysts say the unpopular president may have been hoping to boost his image with a display of global diplomacy.

Political uncertainty in Brazil indeed clouds the outlook for its growth dynamics. There is the risk that high oil prices may lead to demand destruction, the prolonged or permanent loss of demand due to suddenly unsustainable prices. A protracted war in Ukraine no doubt poses further concerns. It may not only exacerbate Brazil’s already high inflation rate, which reached 10.4% at the end of January, but that of most world economies.8

Brazilian Central Bank President Roberto Campos Neto, however, is optimistic, forecasting an accelerated drop in the country’s inflationary pressures to come later this spring. Economy Minister Paulo Guedes was equally upbeat. He posited recently that inflation in Brazil could be even lower this year than in the United States.

The world, he noted, was already in “synchronised deceleration” when the pandemic began, but Brazil was heading in the other direction and “out of sync with the global economy”. Guedes has pointed to renewed growth of overseas investment in Brazil, which he said would amount to US$200 billion in commitments by the end of the year.

Rather than rely on the next commodity price boom cycle, Brazilian leaders are attempting to enhance their pro-investment climate for more sustainable growth. Brazil’s fiscal and current accounts have improved, with higher oil prices aiding the net oil exporter. Foreign direct investment in Brazil reached US$4.7 billion in January, its highest level since August 2021.9 The macroeconomic tailwind also plays out well at the company level in terms of surging cash flows aided by rising oil prices to help its major oil producer notably reduce debt. What’s more, Brazil appears to be benefitting from the recent removal of Russia from the benchmarks of index providers MSCI and FTSE, which is leading investors to reallocate capital towards the world’s sixth most populous nation.

“The most important thing that’s happening in Brazil is the transition from a state-driven economy to a market-driven economy”, Guedes said, adding that longer-term critical infrastructural shifts are underway.

Brazil’s aggressive interest rate hikes have been bolstering its currency, the real, as well as foreign investment inflows. For Brazil’s central bank, autonomy itself—which was signed into law just last year—is a significant reform that aims to protect it from political meddling and help burnish the nation’s economic credibility among investors.

An ongoing risk to monitor: Bolsonaro has set the stage for his supporters to reject October’s presidential election results, echoing the discourse of former US President Donald Trump. However, markets already appear to be factoring in a win by left-wing politician and former Brazilian President Luiz Inacio Lula da Silva, who is currently leading by eight points in the latest PoderData poll, showing 40% of voters would vote for Lula, versus 32% for Bolsonaro.10

Should Lula prevail in his election bid, the world’s fourth-largest democracy may stand a better chance at advancing some of its green agenda goals to achieve carbon neutrality—a key theme to watch, especially with regard to the Amazon. Fortunately, as a water-abundant nation, Brazil is the world’s second-largest producer of hydroelectric power after China. As part of its 10-year energy expansion plan, non-hydro renewables are expected to grow steadily, reaching up to 28% of the domestic energy mix by 2027.11 On the innovation and digitalisation fronts, Brazil is expected to launch its central bank digital currency pilot during the latter half of this year. Such initiatives bode well for the economy to be well-positioned for long-term growth.

What Are the Risks?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________________

1. FactSet, MSCI, S&P Dow Jones Indices, FactSet Market Aggregates. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results. See franklintempletondatasources.com for additional data provider information.

2. Sources: Bloomberg, FTSE Indexes. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

3. Source: Ibid.

4. Source: Brazil Government Ministry of Mines and Energy, 28 January 2020.

5. Sources: International Trade Administration, International Energy Agency (IEA).

6.Source: Bloomberg. FTSE Brazil RIC Capped Index, 4 March 2022.

7. Source: FactSet, Brazilian Ministry of Development, Industry, and Trade (MDIC).

8. Source: Reuters, February 2022.

9. Source: Bloomberg.

10. Source: Bloomberg, Poll: Poder360, 2 March 2022.

11. Source: IEA.

English

English Deutsch

Deutsch