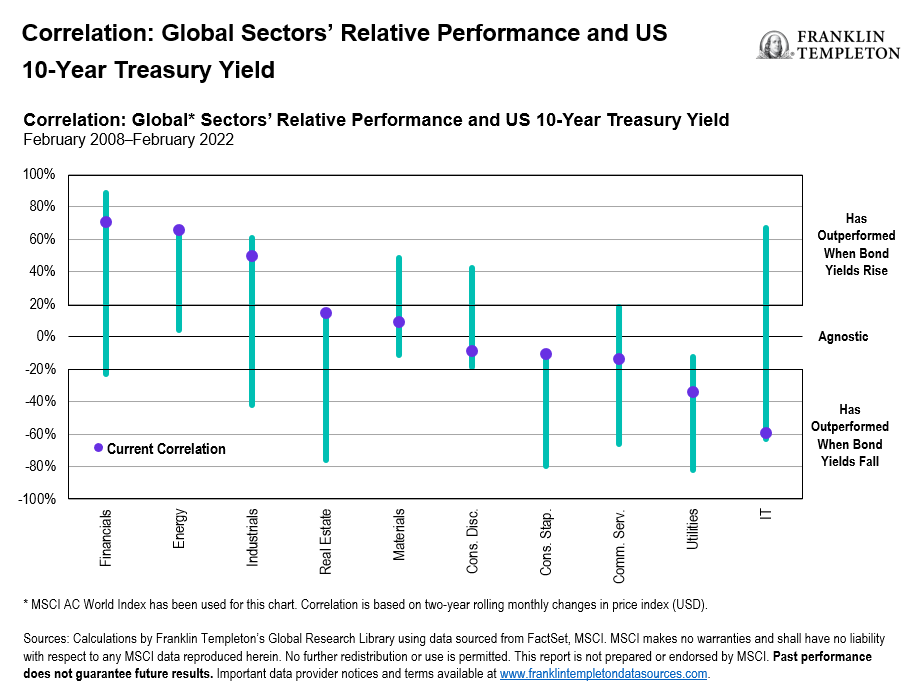

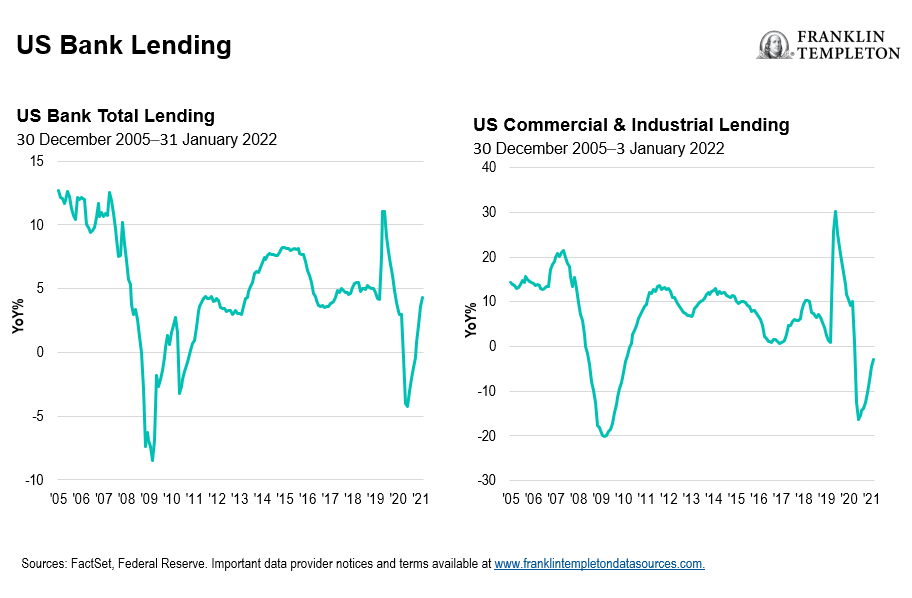

It has been a bumpy 2022 so far for the financials sector, and value stocks more broadly. As a major part of the value indices, the sector’s performance can influence how the style performs. With the US Federal Reserve (Fed) raising interest rates again, the environment for both financials and value may be turning more favourable, in our view. After a lengthy period of historically low interest rates, rising rates can help boost earnings for financial companies, particularly for those that lend or invest their premiums in fixed income. Banks are also seeing a sharp pickup in loan demand, further supporting more positive industry fundamentals, and creating new opportunities in both the United States and Europe. The longer the war in Ukraine rages and energy prices remain high, however, the greater the potential for a sharp deceleration in global economic growth, which may abruptly end this tightening cycle.

Lower for (Not Much) Longer

It seems like a lifetime ago that 30-year fixed rate mortgages were above 15% and money market yields were measured in actual, whole percentage points. Financial stocks across the developed world have been coping with a historically low interest-rate environment for over a decade. In response to the 2008 financial crisis, global central banks slashed interest rates. It was only when the recovery was well underway in late 2015 that the Fed began raising rates again, ending the tightening cycle in 2018.

The pandemic forced central banks to slash rates and restart the quantitative easing measures first rolled out during the financial crisis. As a result, some financial companies have seen their profitability suffer, dragging down stock prices. Near-zero interest rates in the United States and negative rates in Europe have compressed net interest income (NII), or the difference between the income banks generate from their lending and their funding costs, like the interest rates they pay out on deposits.

For banks, as rates rise, they are generally able to boost the interest they charge on newly originated loans and existing loans with floating interest rates faster than they increase what they pay out on deposits. Loan origination is picking up, as people burn through money they saved during the pandemic and companies borrow more amid the healthy economic environment. Eventually, higher rates will lead to higher deposit rates, but we believe it may take several hikes before banks feel any pressure from the pinch of higher funding costs.

For life insurers, rising rates mean they can invest their premium income at higher rates, improving the yield on their investment portfolios. Other areas of the sector that make money from interest-rate differentials may also see a profit benefit from higher rates.

Location, Location, Location

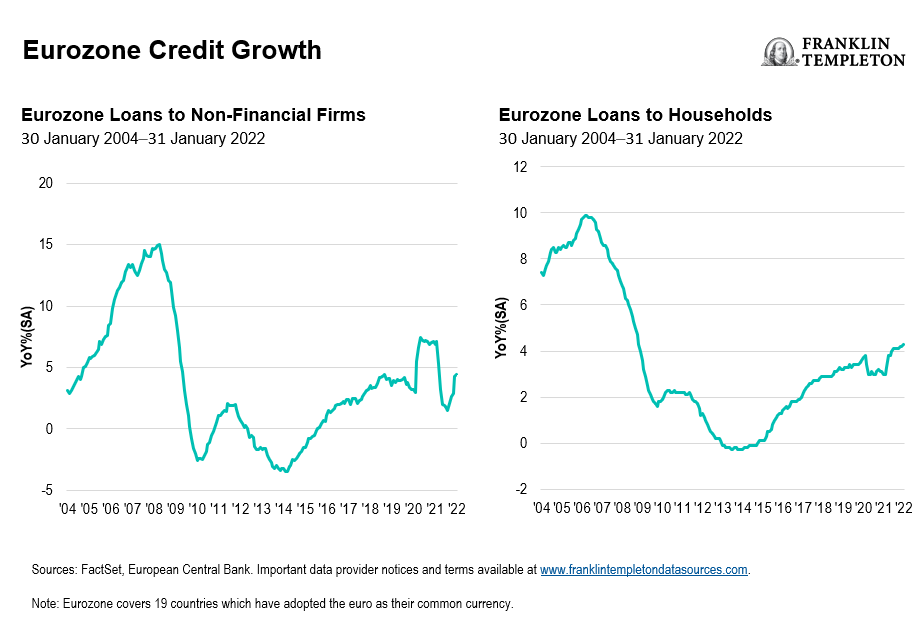

Globally, we see clear valuation discrepancies between the United States and Europe. Europe remains behind the United States both in terms of economic recovery and when the first interest-rate increase might occur. Some US bank stock prices are already baking in a more favourable rate environment. We think large-cap US banks that have been improving their businesses offer some good opportunities for value investors.

In Europe, banks have become even cheaper following the Russian invasion of Ukraine and resulting weakness in the sector as investors assess the impact. Although the greater economic uncertainties in Europe stemming from the spike in energy prices and any exposure to Russia and Ukraine may temper the outlook in the near term, particularly if banks are forced to raise their provisions for bad debts, we expect any jolt is likely to be to bank earnings and not banks’ capital. Moreover, we view the recent selloff in banks across the region as overdone given the potential impact.

Among the large-cap banks, European valuations look more attractive to us than US valuations, mirroring a similar discrepancy between US and European equities more broadly. Our view continues to be that even a slightly less negative interest-rate environment in Europe should improve banks’ earnings outlook, and we expect the European Central Bank to eventually follow the Fed in raising rates. In addition to a more favourable fundamental backdrop, we see opportunities for several European banks to unlock value for shareholders by making their operations more efficient and selling assets.

No Free Lunch

The recent market volatility may create new challenges for parts of the sector. After several years of strong markets and large volumes of equity and debt issuance, US and European banks with significant capital markets businesses may struggle. Market volatility can make issuing equity and debt more difficult, reducing income for these areas of the business that focus on underwriting new stocks and bonds as a major revenue source. This could weigh on companies’ bottom lines, even if their traditional banking operations get a lift from higher NII and faster loan growth.

Property insurers may be one area of the sector that can provide some respite from any pickup in volatility. Unlike banks and life insurers, their businesses are less linked to changes in rates and more tied to demand for coverage for autos, homes, commercial property, and other areas like workers’ compensation.

While financials could broadly benefit from a rising-rate environment, we believe that stockpicking is likely to remain crucial, since the impact may will be unevenly felt throughout the sector, and should the potential for a recession increase. As value investors, we believe that those financial stocks trading below what we view as their fundamental value, but with a clearly defined catalyst to get the stock price higher, are likely to offer the best opportunities over the longer term. Finding those companies best positioned to benefit is likely to take insight and skill. Rising rates can only do so much to unlock value.

What Are the Risks?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stocks historically have outperformed other asset classes over the long term but tend to fluctuate more dramatically over the short term. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments. Value securities may not increase in price as anticipated or may decline further in value.

Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by the CFA Institute.

English

English