Manufacturing accounts for 8% of US employment, 20% of capital investment and 35% of annual US productivity growth.1 With all the influence this industry has on the US economy, we believe there could be significant positive effects for small-capitalization (small-cap) industrials and materials stocks if more US companies bring their manufacturing efforts back to the United States. In our opinion, this area of the equity market allows for targeted investments in companies that stand to benefit from an increase in onshore manufacturing.

YIMBY (yes, in my back yard)

Central-bank actions to tame inflation have been affecting economic growth globally. Gross domestic product (GDP) readings have waned in many regions, and consumers have been pulling back on spending as prices have climbed. In China and throughout Europe, the manufacturing sector has been softening as well. However, within the United States, manufacturing output has fared slightly better, remaining in expansion territory January through October of 2022. In addition, many areas of the US economy have shown relative strength. With this in mind, we think the US economy currently offers the most economic promise for the manufacturing sector.

A trend toward US-based manufacturing may be materializing, as we have seen new semiconductor fabrication plant construction and exponential increases in manufacturing construction spending data. Projects supporting growth for semiconductor fabrication, electric vehicle and battery plants, data centers and warehouse/distribution centers now account for approximately 65% of industrial construction starts.2 In addition, recent US legislative measures are incentivizing activities that may increase demand for construction materials and equipment. After pandemic-era supply chain disruption, a desire to improve sourcing and logistics is influencing corporate capital expenditure decisions as well, with money directed toward supply chain fortification. Specifically, we think construction equipment rental and storage companies, cement and aggregate businesses, rebar producers and similar companies may receive the largest effect.

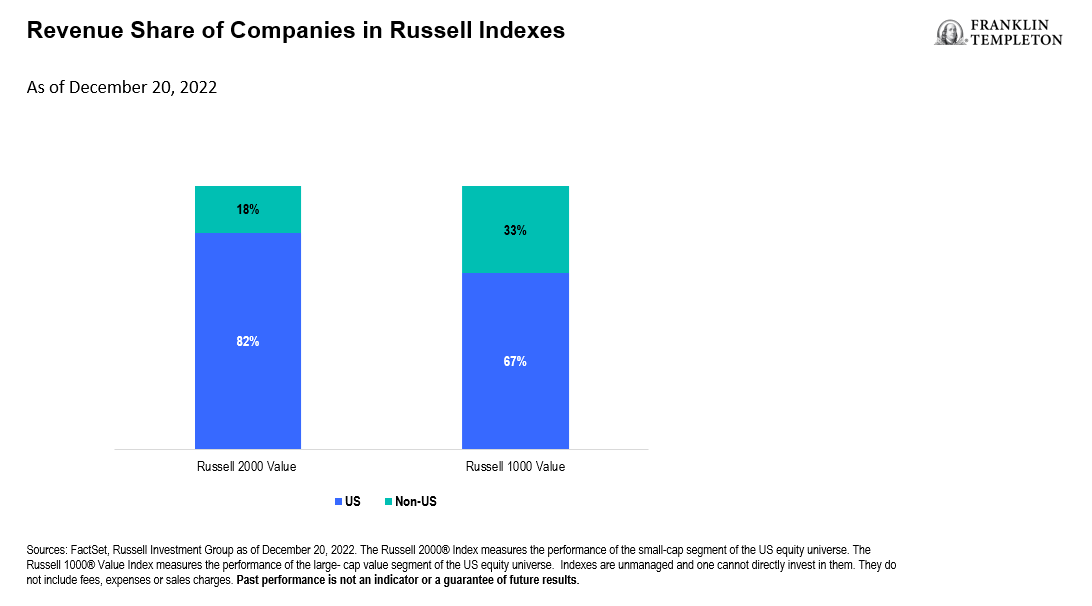

We think small-cap companies are good tools for investing in specific areas of the market that may experience a demand tailwind from these manufacturing-related trends. Small-cap companies tend to be more sensitive to US economic growth than their large-cap counterparts, due in part to their domestic client base. For example, small-cap US building products companies generate 90% of their revenue from clients located within the United States, whereas large-cap companies generate 67% of their revenue from domestic clientele.3 So, all else equal, a revenue bump from increased local demand typically moves the needle more for a small-cap company than a large one. The other side of the coin is that small companies are also comparatively insulated from economic headwinds generated outside the United States than their large-cap counterparts, in our opinion.

Exhibit 1: US Small- and Large-Cap Companies, US and Non-US Revenue Base

Incentivization nation

Recent federal stimulus programs are aimed at encouraging investment in US infrastructure, including incentives for reshoring US supply chains. These programs include the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA) and the CHIPS (Creating Helpful Incentives to Produce Semiconductors) and Science Act. We see this legislation as positive for small-cap value stocks, as they are designed to stoke demand across various aspects of the supply chain and incentivize a multitude of projects.

The IIJA has set aside US$550 billion for spending on various forms of infrastructure such as new roads, highway improvements, bridges and mass transit systems. More spending on highways can mean increased demand for cement, steel, asphalt and other aggregates, in addition to machinery and construction rentals. The IRA creates multiple improvements to the US’ clean energy practices, electronic vehicle manufacturing, battery cell manufacturing and HVAC system electrification. This means demand should increase for metals such as copper, as well as places to assemble electric vehicles and batteries, which require building materials to erect. The US$78 billion in manufacturing subsidies the CHIPS and Science Act offers could also have far-reaching effects. Each semiconductor plant built as a result of the Act not only improves the ability of goods makers to access semiconductors, but also requires its own input of cement and aggregates, rebar, construction equipment, copper wire and construction site rentals, all generating potential demand for products from companies in the small-cap value investable universe.

Bring it home

Sourcing difficulties during COVID-19 taught companies the benefits of having a more regionalized supply chain. In addition to benefiting from government incentives, companies may see fewer logistical complications and costs due to shorter shipping routes and increased inventory stability that can come from a local workforce producing components in local factories. Several US-based companies have already announced or broken ground on new semiconductor production facilities located stateside, such as semiconductor companies GlobalFoundries, Intel and Texas Instruments. In early October, Micron Technology announced plans to build the largest semiconductor fabrication plant in US history in upstate New York. Micron estimates it will spend more than US$100 billion on the facility over the next couple of decades.

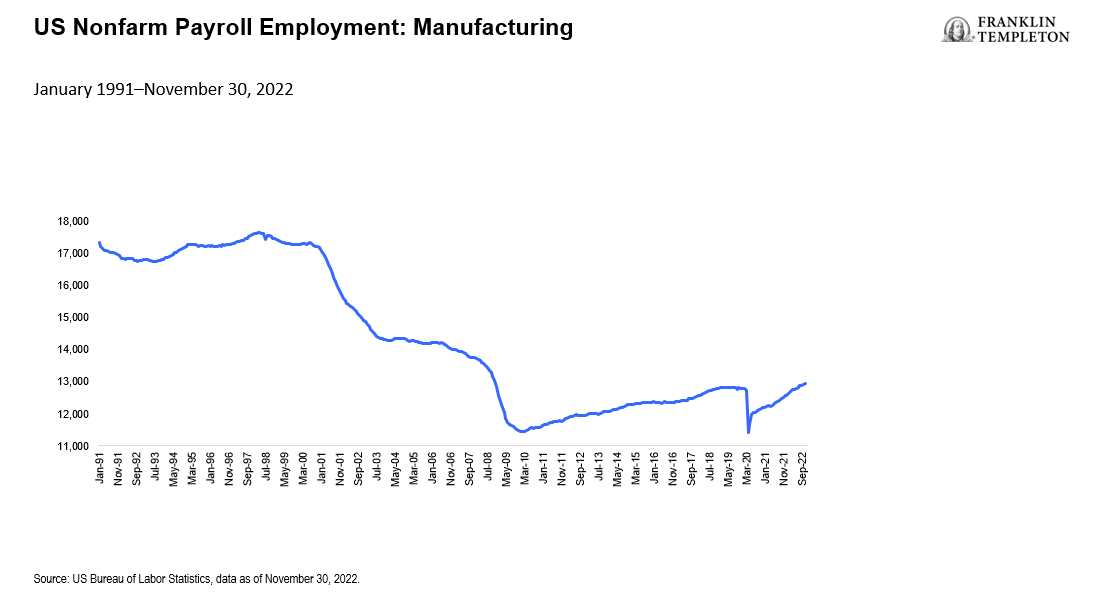

In addition, we have observed data points which we think support a trend toward reshoring. For example, US manufacturing employment has surpassed pre-pandemic levels. This is the first time since 2000 that the sector has reclaimed the jobs lost in an economic downturn.

Exhibit 2: US Manufacturing Employment Trends

Also, we’ve analyzed data from the US Census Bureau’s Construction Put in Place monthly report to see if there is corroborating evidence to the rebounding manufacturing employment levels. While broader manufacturing industry construction spending remains below prior peak levels, the computer, electronic and electrical manufacturing sub-category has not only rebounded sharply since 2021, it’s at the highest real-dollar level since 2005. We believe this suggests the United States is seeing some reshoring for higher value-added products.

According to one estimate, an effective reshoring of the US manufacturing sector could boost US GDP by US$185 billion by 2030.4 That’s quite the upswing, and a lot of increased demand for products and services that economically sensitive small-cap industrials and materials companies could potentially meet.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. Value securities may not increase in price as anticipated or may decline further in value. Investments in foreign securities involve special risks including currency fluctuations, economic instability, and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity.

Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_____________

1. Source: McKinsey Global Institute.

2. Source: Dodge Construction, KeyBanc Capital Markets Inc., as of October 31, 2022.

3. Source: FactSet, Russell Investment Group as of December 20, 2022.

4. Source: IHS Markit (January 2021 forecast); OECD; McKinsey Global Institute analysis

English

English