The Bank of Japan (BoJ) ended its negative interest rate policy (NIRP) and raised rates by 10 basis points to a range of 0.0%–0.1% on March 19, 2024. This decision signals policymakers’ confidence in their deflation fight. The prolonged period of low and negative interest rates in Japan has put downward pressure on the USD-JPY exchange rate. It also encouraged Japanese investors to buy higher yielding foreign assets and created the right environment for a carry trade—borrowing Japanese yen to invest in higher yielding currencies.

The impact of the policy change on the USD-JPY rate is likely to be gradual given that it was well telegraphed. Consensus expectations are for a slow rise in interest rates to 0.25% by the end of 2024.1 Higher interest rates and rising inflation expectations are positive for the Japanese equity market.

The extended period of low and negative interest rates has led to a significant increase in the carry trade. Over the past three years, Japanese yen loans to foreign investors have increased by US$460 billion to US$1.8 trillion.2 Conversely, yen weakness has increased the value of overseas investment income received by Japanese investors by US$233 billion to US$551 billion over the same period.3Significant yen strength could reduce these flows, leading to increased volatility in global bond and equity markets.

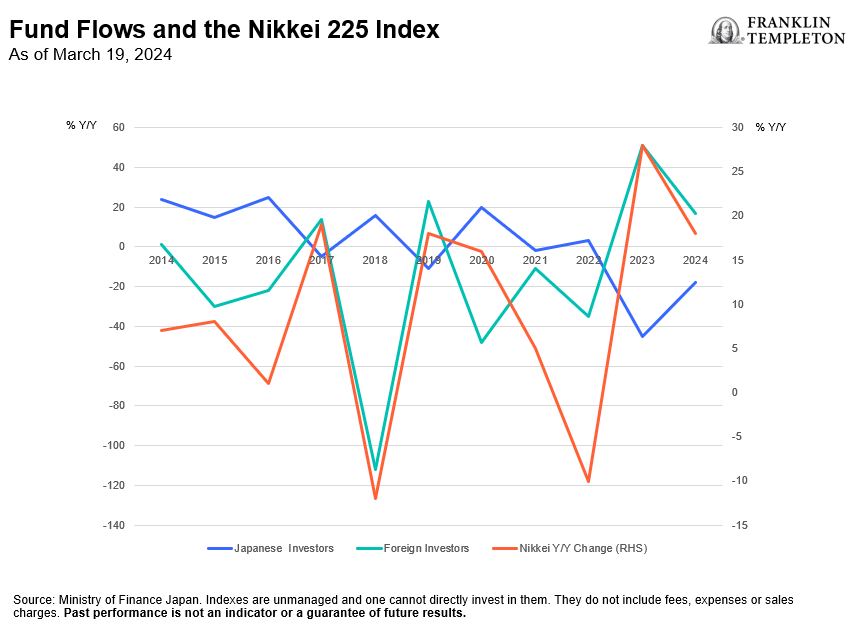

The implications of the interest-rate increase for the Japanese equity market are positive. A return of modest inflation creates a tailwind for corporate earnings, potentially restarting the investment cycle. For households, the end of falling goods prices may release pent-up demand. Foreign investor flows are also an important market driver, as can be seen in the chart below.

Exhibit 1: Foreigners Are the Marginal Drivers of the Japanese Equity Market

We are positive on Japanese banks, industrials and consumer discretionary companies. Banks are expected to see improved profitability as net interest margins and loan growth increase. Industrials may benefit from a revival in investment. Consumer discretionary companies are beneficiaries of rising wages and a return of pricing power.

While we acknowledge the positives, we are monitoring the downside risks associated with the end of NIRP. We are focusing on the USD-JPY exchange in case of a significant move lower. Such an event could lead to a sharp fall in the US Treasury market as Japanese investors repatriate their US bond market investments. International equity markets could also come under downward pressure if the unwinding of the carry trade leads to the sale of equities by Japanese investors.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. There can be no assurance that multi-factor stock selection process will enhance performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Active management does not ensure gains or protect against market declines.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

______________________

1. Source: Bloomberg, March 19, 2024.

2. Source: Ministry of Finance Japan. December 31, 2023.

3. Ibid.

English

English 简体中文

简体中文