The latest US economic data gives the Federal Reserve (Fed) the green light to cut interest rates, in my view. The much-awaited easing cycle is therefore very likely to start at the Fed’s next meeting in September, and the prospect has generated instant excitement across financial markets. But as I have stressed for a long time now, the really important issue is the nature of the easing cycle ahead, namely its duration, its speed, and the endpoint for the policy rate. I remain convinced that we will see a gradual easing of policy, with rate cuts totaling somewhere around 125-150 basis points (bps), leaving the fed funds rate at or above 4%—significantly higher than what many analysts are now expecting.

The latest employment report was likely the clincher for the Fed. US non-farm payrolls came in at a weak 114,000 for the month of July, signaling a slowdown in hiring. This, together with an uptick in the participation rate, pushed the unemployment rate to 4.3% from 4.1% previously. This was a genuinely weak report, albeit the extent to which it was impacted by Hurricane Beryl, which struck the Gulf Coast during the month, is unclear. Labor flows from unemployed to employed have slowed, and wage growth decelerated to a 0.2% month-on-month—all coming on the back of rising jobless claims.

Inflation is not yet back to target (core personal consumption expenditures stood at 2.6% in June), but it remains within striking range, and the cooling of wage growth should reduce the risk of a flareup. Overall, the balance of risks has shifted sufficiently that it looks appropriate for the Fed to start easing policy, to help prevent a faster deterioration in the labor market.

As could be expected at such a meaningful turning point, a number of investors and analysts are now rushing to anticipate a very sharp policy correction. Some are calling for a 50-bps cut in September; others expect the fed funds rate to swiftly fall to close to 3% next year. I think the current economic outlook doesn’t justify these predictions.

Let’s try to put things in perspective. With the exception of the exuberant days in the runup to the global financial crisis, the US unemployment rate had averaged close to 5% in the prior decade. The non-accelerating inflation rate of unemployment (NAIRU) may have dropped in the more recent period, but an unemployment rate below 4.5% still signals a rather healthy labor market, and the weakening has so far been very gradual, consistent with the kind of slowdown in hiring that one would expect to see in an economy already at full employment.

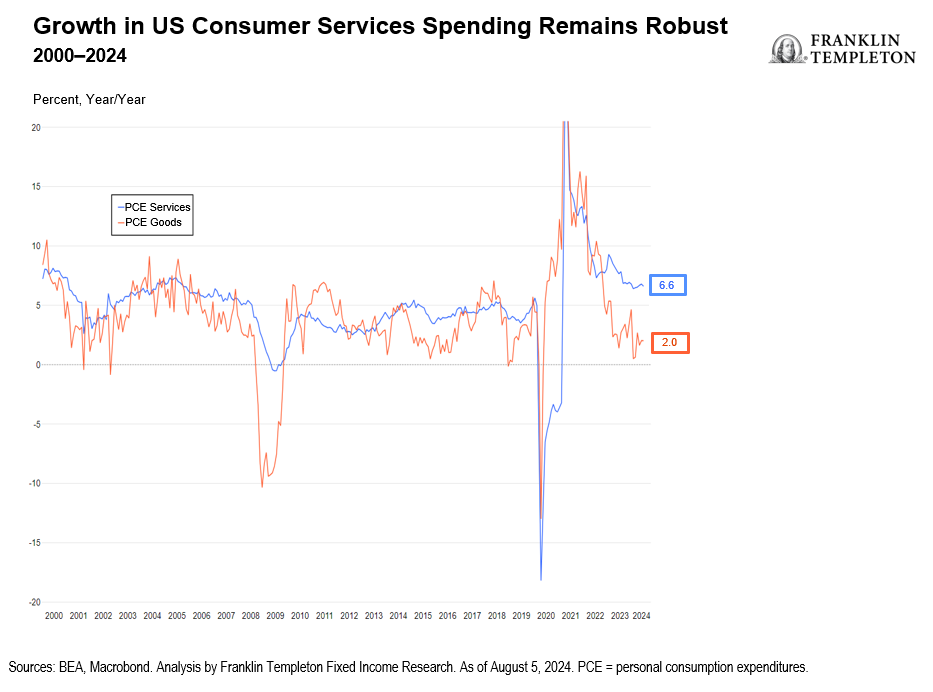

The production side of the economy has shown signs of slowing, in particular with weak readings in the Institute for Supply Management (ISM) manufacturing index and the Purchasing Manager Index. But consumer spending is holding up well. June retail sales were stronger than anticipated, personal spending grew at a faster pace than the previous month. The main engine of growth of the US economy, in other words, keeps humming along. The July ISM services index rebounded quite strongly. And let’s not forget fiscal policy, which remains exceptionally loose for the current stage of the cycle and seems unlikely to tighten any time soon. Both Democrats and Republicans favor high spending and seem intentioned to keep pushing the envelope on the fiscal deficit for as long as markets will allow.

This has two implications as far as the Fed is concerned. First, there seems to be no reason to panic at this stage. The data confirm that the Fed has played its cards well, keeping policy tight long enough for disinflation to get better entrenched, taking advantage of the resilience in the labor market. As a consequence, it can now kick off its easing cycle in a situation where economic activity has not yet entered the danger zone. In other words, I do not believe the Fed is behind the curve—though some analysts and investors think otherwise.

Second, extremely loose fiscal policy keeps upside risks to inflation alive. A sharp and fast easing in the monetary stance when fiscal policy remains recklessly loose would quickly juice up financial markets; and if the weakening in economic activity turns out to be very moderate, it might halt disinflation in its tracks and leave the Fed with inflation rates anchored uncomfortably above target.

All this to me suggests that the Fed will start the easing cycle next month with a standard cut of 25 bps, rather than 50 bps, which might signal panic and might convince investors that the Fed does indeed feel behind the curve. It also indicates that a moderate gradual easing of monetary policy will likely be enough to keep the economy on an even keel, setting the economy on track to avoid a recession, with policy rates at around 4%.

Should the economy weaken faster than I anticipate, the Fed would be in a good position to react with deeper rate cuts. And with loose fiscal policy, that should be enough to make a recession short-lived. My long-term outlook, in either case, remains unchanged: The new long-run equilibrium will have real short-term rates closer to their long-term 2% average than the near-zero level of the recent past.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E and Legg Mason Asset Management Singapore Pte. Limited, Registration Number (UEN) 200007942R. Legg Mason Asset Management Singapore Pte. Limited is an indirect wholly owned subsidiary of Franklin Resources, Inc. 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.