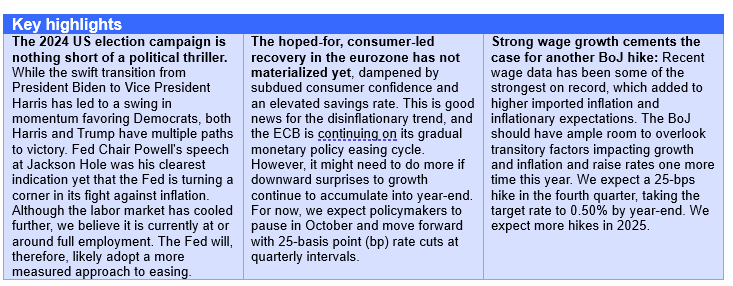

Executive summary

US economic outlook

US economy: Optics over economics?

_____________________________________________________________________________________

- Both Trump and Harris have multiple paths to 270 electoral votes. Vice President Kamala Harris’ entry into the presidential race has led to a shift in momentum favoring Democrats, along with a notable flattening of margins in key swing states. But despite the shift in momentum, the presidential race has reverted to a margin-of-error contest. Prediction markets currently imply a close contest between a Republican sweep and a Democratic divided scenario.

- Regardless of the election outcome, we expect a partial extension of the 2017 Tax Cuts and Jobs Act (TCJA) given that Republicans and Democrats have shared interests in extending several expiring provisions. These include extending the lower individual tax rates for those making under US$400,000, expanding the child tax credit, making the doubled standard deduction permanent and restoring full business research and development expensing. These alone add could add roughly US$4.5 trillion in deficits over the next 10 years to an already-weak fiscal outlook. The Congressional Budget Office’s baseline projections show that even without any tax cut extensions, the US’ fiscal position is likely to materially worsen as the fiscal deficit is expected to rise by a cumulative US$20 trillion over the next 10 years.1

- Under a Trump-led government (sweep or divided) proposals such as repealing the tax on social security benefits and reducing the corporate tax rate down to 15% are unlikely to find favor with Congress given already-large deficits and since the former cannot pass via the budget reconciliation process. However, we do expect the effective tariff rate to rise under a Trump presidency. Depending on the extent of tariff increases, lower- and middle-income consumers could see a drop in their after-tax incomes, which would more than offset the gains from extending the TCJA tax cuts.

- A Harris-led government will likely see a substantial expansion of the US$10,000 cap on state and local tax deductions. Letting the cap expire at the end of 2025 could raise the deficit by as much as US$1.2 trillion over the next decade. The US$25,0000 federal subsidy for first-time home buyers—more than Biden’s prior proposal for a US$10,000 tax credit—might stoke housing inflation if it isn’t balanced with an increase in supply. It might also enable riskier borrowers to qualify for mortgages they can’t afford, exacerbating the need for mortgage forgiveness programs.

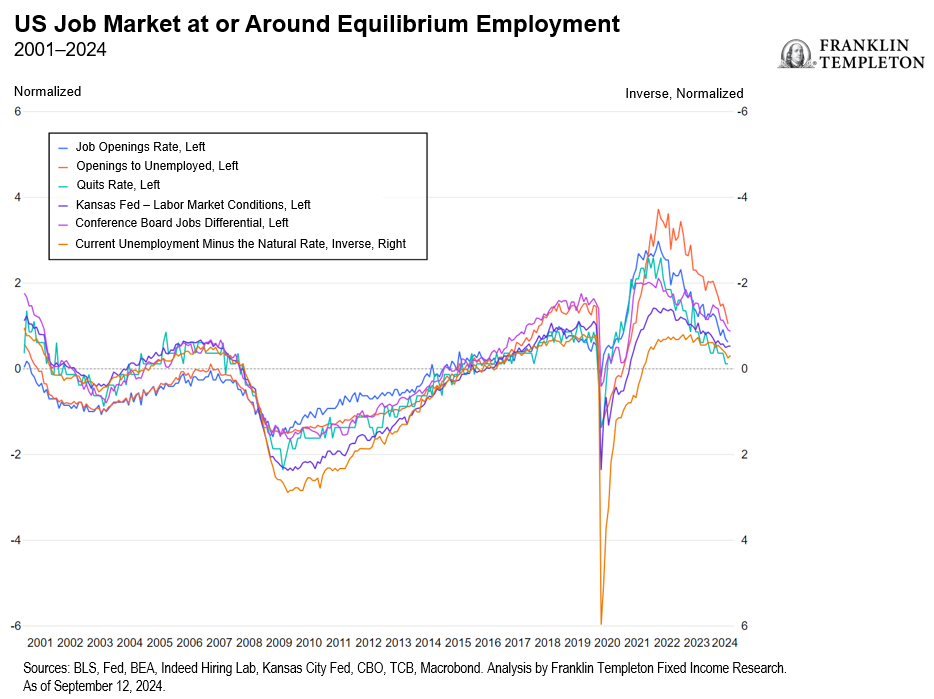

- Although the Federal Reserve (Fed) has signaled that the time is ripe for easing to begin, it remains non-committal on the pace of easing. Key labor-market measures seem to uniformly suggest that the current situation looks a lot like full employment. Wages continue to rise faster than inflation, while the services sector continues to show robust expansion. However, the downward revisions to past labor-market data, weak manufacturing activity and anecdotal evidence of either flattening or declining economic activity from the recent Beige Book Survey are a concern. While the futures market currently expects over 100 basis points (bps) of cuts this year, we expect the Fed to be more measured with three moves of 25 bps, followed by three more in 2025, aiming for a terminal rate of 3.75%-4%.

European economic outlook

Euro-area economy: An underwhelming recovery

______________________________________________________________________________________

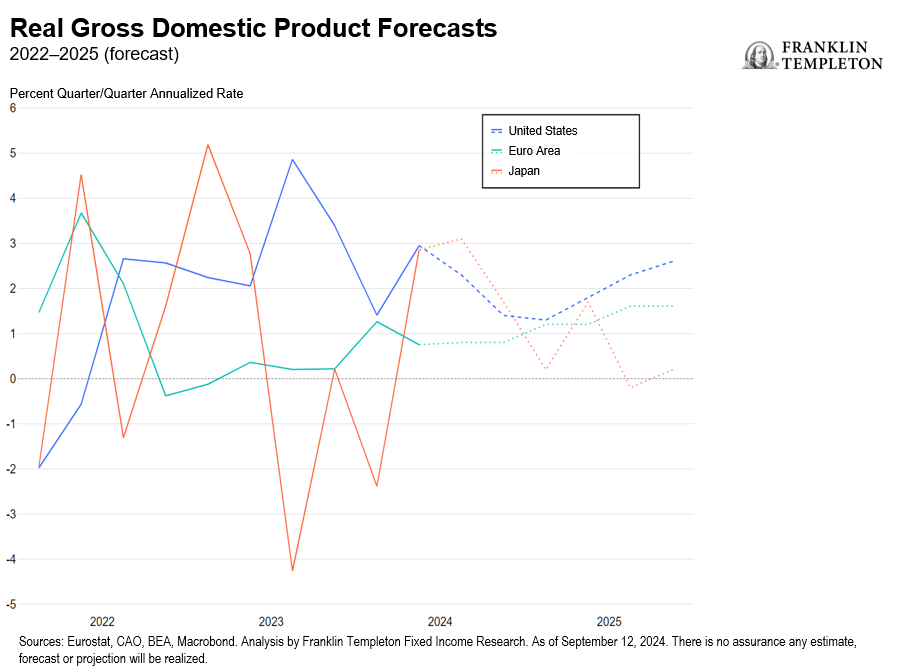

- The euro area’s economic recovery is not picking up pace. The positive growth momentum that the region began to witness in the first three months of this year—after a prolonged period of stagnation—did not extend into the second quarter. In the second quarter, gross domestic product (GDP) growth decelerated to half of what the European Central Bank (ECB) had expected in its June projections, while underlying details indicated that domestic demand had contracted during the period. Looking ahead to the third quarter, leading indicators do not point to a pickup in the pace of growth.

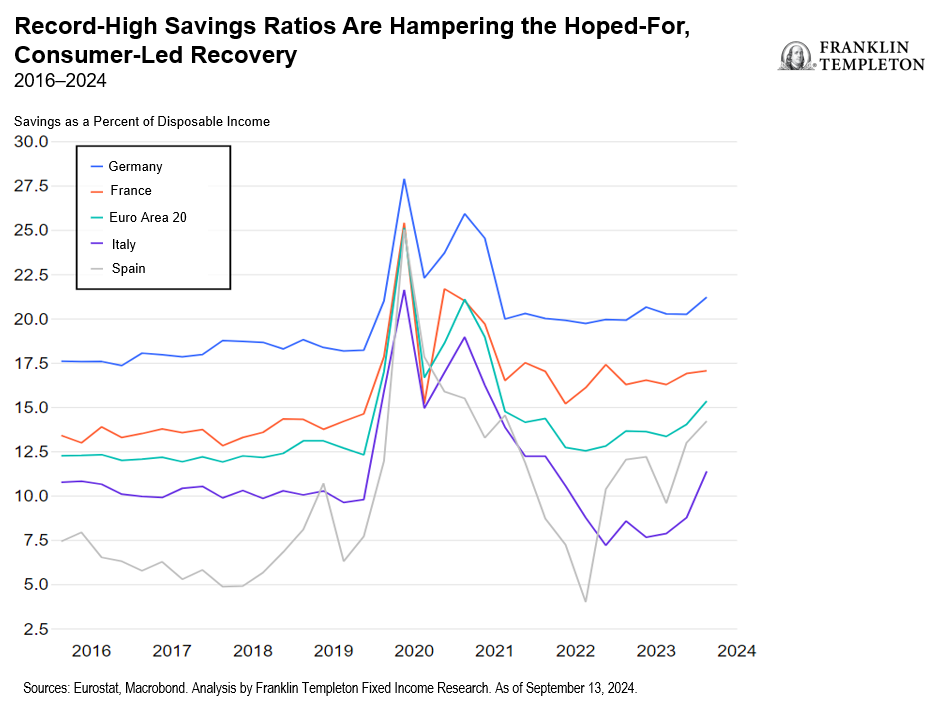

- The consumer-led recovery narrative seems increasingly challenged. Despite solid real income gains—driven by high wage growth and falling inflation—private spending remains subdued. In fact, the savings rate continues to increase and reached a new record high in the first quarter, significantly above pre-pandemic levels. However, subdued consumer confidence is driving the wish to rebuild and maintain a financial buffer. Additionally, the still-elevated deposit rates incentivize liquidity parking, especially after a long time of almost no remuneration on deposits. A normalization in savings behavior might take more time than previously anticipated, once again delaying the consumer-led pickup in growth.

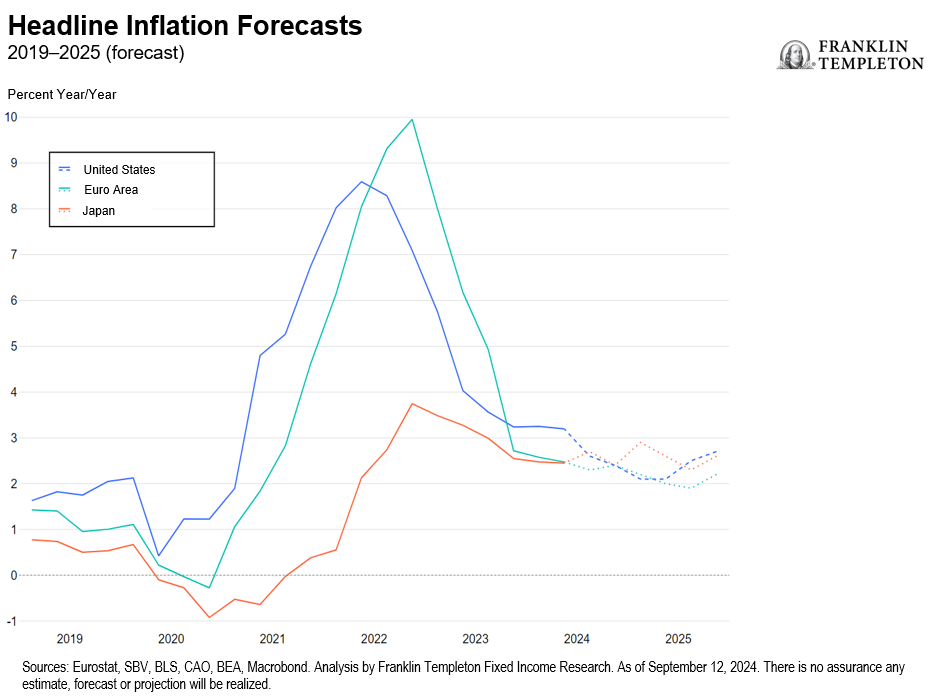

- We are increasingly confident in the disinflationary path. Headline inflation is sustainably moving lower and now hovers not far from the ECB’s target. Core inflation—excluding the more volatile energy and food prices—has remained stickier due to the services component. However, as the labor market slowly rebalances, the risk of further inflation persistence due to wage pressures is abating.

- The ECB continues to follow a gradual easing cycle, for now. September’s 25-bp cut was widely expected, as was the modest downward revision to the growth outlook. Policymakers are remaining data-dependent, and we don’t foresee a shift from their cautious stance for now nor a cut at the October meeting. The ECB remains constrained by still-elevated wage growth and services inflation, as well as medium-term considerations such as an uncertain path for profit margins and weak productivity growth. While the labor market is still in a historically healthy place, the consumer-led recovery baseline scenario is increasingly challenged, and growth remains below trend. If weakness persists into the year-end, the ECB might reconsider the speed of its monetary policy adjustments at its December meeting and move to back-to-back cuts from January or March. So far, the terminal policy rate has been strongly anchored within the neutral range (between 2% and 2.5%), in contrast with what can be observed in the United States. However, prolonged weakness might push the terminal rate somewhat below neutral, even without a recession.

Japan economic outlook

Japan’s economy: More normalization ahead

______________________________________________________________________________________

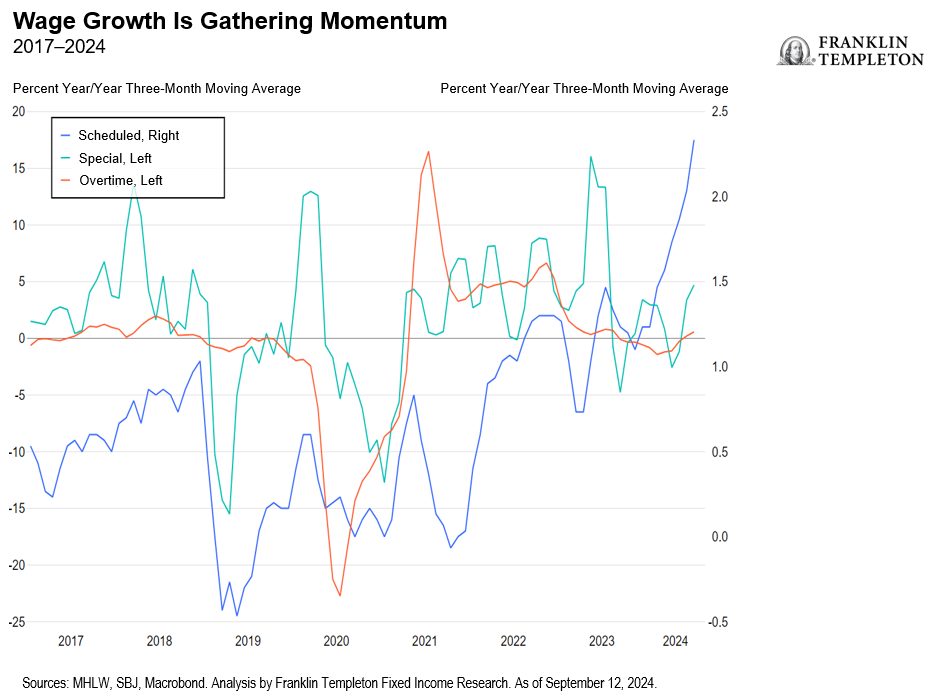

- GDP rebounded in the second quarter following a dismal first quarter reading. We continue to expect impetus to build in the second half of 2024, underlined by strong wage growth which will support private consumption and household spending. Labor cash earnings rose 3.6% year/year (y/y) in July with scheduled pay for the same base period rising 3%, some of the strongest numbers on record. Not only have this year’s annual wage negotiations added to this upside, an increase in the minimum wages by 5% from October will further cement this momentum, in our view. We forecast growth to slow to 0.1% y/y in 2024 but rebound to 1.2% in 2025.

- Inflation is again rearing its head as longstanding energy subsidies were rewound in June, pushing up energy prices. Inversely, the Tokyo area school fee waivers shaved off from core consumer price index (CPI). These transitory factors aside, inflation is still sticky, with import prices and inflationary expectations at elevated highs. This added to stronger wage growth, which should cement a case for a buildup in wage-price spiral, thereby resulting in stronger underlying services and overall inflation. Our forecasts for the main CPI variables including core and super core hover around 2% for the next two years.

- Recent Bank of Japan (BoJ) commentary has turned a corner, acknowledging it will be progressing on policy normalization if inflation and wages evolve in line with expectations. This also provides reassurance that transitory factors or relief measures which add to volatility in inflation will broadly be overlooked if growth holds up on expected lines. Given the strong underlying momentum in wages in addition to a tight labor market, we believe the BoJ will be prompted to raise rates one more time this year, in the fourth quarter and consistently so through 2025. The Ministry of Finance survey for the second quarter suggested record profit margins for both manufacturers and non-manufacturers, including strong capital expenditure plans, which should help cushion growth and the BoJ’s plans for rate hikes. We hold on to our aggressive call for a higher terminal rate of around 2%. Current market expectations are deeply underpriced, in our view.

- Japan’s ruling Liberal Democratic party will host internal elections on September 27 to elect a new leader after current Prime Minister Kishida chose to not return for another term. We do not expect major policy deviations as a result.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

IMPORTANT LEGAL INFORMATION

_________________________

1. Source: “The Budget and Economic Outlook: 2024-2034.” US Congressional Budget Office. As of February 2024. There is no assurance that any estimate, forecast or projection will be realized.